Fidelity is a popular platform for investing in stocks and funds with taxable and retirement accounts. The platform offers just about every account type and investment option while charging minimal fees.

Should you switch to Fidelity and can this platform help you become a better investor?

This Fidelity Investments review takes a closer look at the brokerage features and unique investment options.

Summary

Fidelity has a wide variety of investment options and research tools for new and advanced investors. There are no trading fees or account minimums. You can also buy $1 fractional shares of stocks, ETFs and Fidelity mutual funds.

Pros

- Many investment options

- In-depth research tools

- Commission-free trades

Cons

- Mobile-only fractional investing

- No cryptocurrency trading

- No futures or forex trading

What is Fidelity Investments?

Fidelity is the largest online stock brokerage in the United States with approximately 25 million customers. It’s also is one of the oldest, along with Vanguard and Schwab.

As a result, you likely have several friends, relatives or co-workers that invest with Fidelity. The company also offers workplace retirement accounts, but this review will not cover those.

Investors can access more commission-free investment options and accounts than most free investing apps.

Some of the best features include:

- Fractional stocks and ETFs

- Fee-free index funds

- Active trader platform

- Fidelity Go robo-advisor

- Research reports

The platform fits the needs of most casual and active investors. As you no longer pay trading fees for stocks and ETFs, it’s an attractive option for experienced investors ready to change brokers. Therefore, getting more services while continuing to pay no trading fees or account fees.

In addition to the investment services, Fidelity also offers other financial products. Two examples include a cash management account and health savings account.

Who is Fidelity Investments For?

Fidelity can be an excellent fit for investors of any experience level and trading frequencies because of its many features and commission-free trading.

If you’re starting to invest, you might consider using Fidelity first instead of using a micro-investing app. This is because you have access to more investment options and research tools while paying $0 trade commissions.

Casual investors that want access to stocks, ETFs, mutual funds and in-depth research tools should consider this platform. In addition, you can open taxable and retirement accounts to have all of your investments at the same brokerage.

Short-term traders will also like Fidelity as they can use the Active Trader Pro desktop platform.

You can open the following accounts with Fidelity:

- Individual taxable

- Joint taxable

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Self-employed 401k

- 529 accounts

- Custodial accounts

Most investing platforms only offer taxable, traditional IRAs and Roth IRAs.

How Does Fidelity Work?

Fidelity lets you self-manage your investments or also enroll in a managed account.

Self-Directed Investment Accounts

You can open a taxable or retirement self-directed brokerage account with no minimum initial deposit. You also won’t pay any account service fees.

Most micro-investing apps only let you trade individual stocks and ETFs. Fidelity also enables you to trade mutual funds fee-free and read research reports from over 20 analyst firms.

Managed Investment Accounts

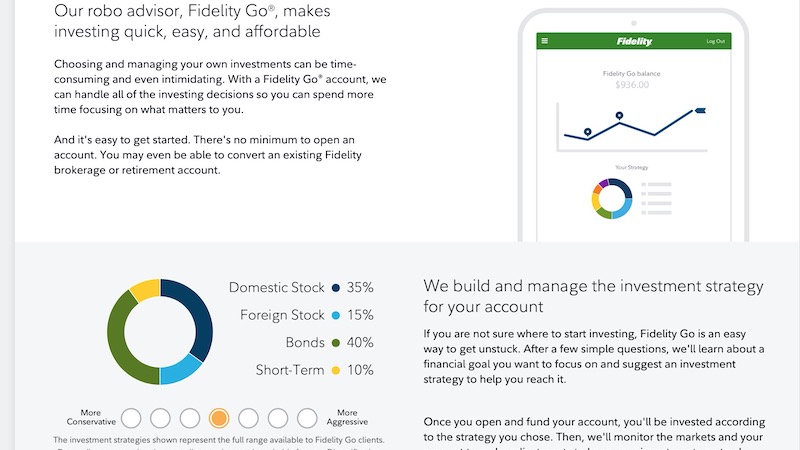

You may also prefer a managed account if you don’t have the time or desire to manage your investments.

Fidelity Go is the platform’s robo-advisor service that creates an asset allocation of stock and bond index funds using your risk tolerance and investing goals. The service automatically rebalances your portfolio when necessary.

The platform manages your first $10,000 for free.

Clients with a high net worth can hire an advisor for personalized financial advice.

Fidelity Fees

Most investors won’t pay fees to buy or sell investments with Fidelity. Self-directed accounts don’t charge account service fees.

There is also no investment minimum as you can get fractional shares of stocks, ETFs and Fidelity mutual funds in $1 increments.

Here are the current trading commissions.

| Investment Product | Trading Commission |

| Stocks and ETFs | $0 |

| Options | $0 plus $0.65 per contract |

| Fidelity mutual funds | $0 |

| Individual bonds | $1 |

| CDs | $1 |

| U.S. Treasuries | $0 |

One exception to the commission-free trading is for sell orders using the Active Trader Pro platform. You will pay between $0.01 and $0.03 per $1,000 in principal.

You can open a taxable or retirement account with a $0 balance.

Fidelity Go Fees

Your advisory fee for Fidelity Go depends on your account balance. This fee covers the trading and portfolio rebalancing costs.

The Fidelity Go advisory fees are below:

- Under $10,000: $0

- $10,000 to $49,999: $3 per month

- $50,000 and above: 0.35% per year

Fidelity Go requires a minimum $10 initial deposit to make your first trade.

Investment Options

The many investment options are one of the best reasons to join Fidelity.

Stocks and ETFs

You can buy or sell individual stocks and ETFs trading on the US stock exchanges. This platform also offers most ADR and OTC stocks of foreign companies trading on the New York Stock Exchange or Nasdaq.

It’s also possible to trade in over 25 countries and 16 currencies with taxable brokerage accounts.

Some of the available markets include:

- Canada

- Germany

- Hong Kong

- Japan

- United Kingdom

Most investors will be happy to only trade US securities but the international investing capabilities are a selling point for advanced investors.

Unfortunately, speculative traders cannot swap futures or forex. Fidelity currently doesn’t trade cryptocurrency like several micro-investing apps do.

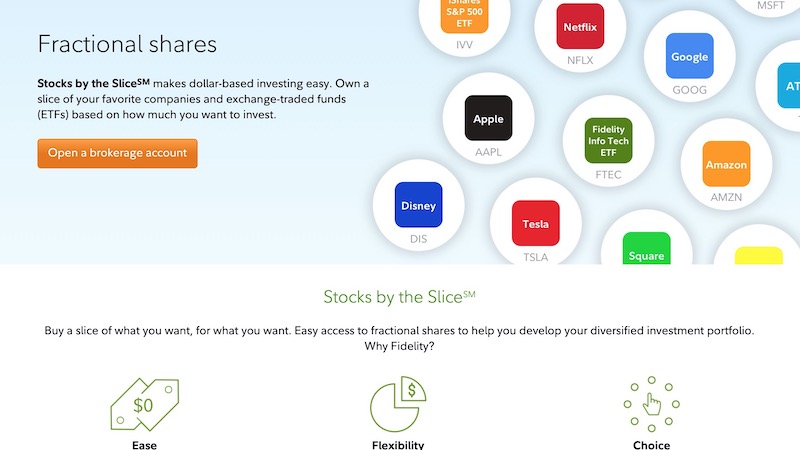

You can buy fractional shares of US-listed stocks and ETFs with a $1 minimum investment. However, you must use the Fidelity mobile app for this feature.

You can only buy whole shares of stocks and ETFs on the web and desktop platforms.

Another advantage of Fidelity is buying Fidelity mutual funds with a $1 initial or subsequent investment on the web or mobile platform.

Vanguard, for example, requires between $1,000 and $3,000 for most of its passive and active mutual funds.

Fidelity Mutual Funds

The brokerage has several popular active funds for most investment strategies. Index funds are available too if you want a passive investment approach.

Most Fidelity mutual funds only have a $1 investment minimum. Other brokerages require at least $100 for similar products.

You might compare these funds to the Fidelity and non-Fidelity sector ETFs if you’re using the web platform and cannot use the dollar-based investing for ETFs.

Most investors prefer ETFs to mutual funds as they have lower expense ratios, trading fees and investment minimums.

Only having to invest $1 makes these funds worth the alternative to ETFs.

ZERO Index Funds

Index fund investors will also like Fidelity as a way to avoid expense ratios on their stock funds.

The company also offers four zero expense ratio index mutual funds:

- Large Cap Index Fund (FNILX)

- Total Market Index Fund (FZROX)

- Extended Market Index Fund (FZIPX))

- International Index Fund (FZILX)

While stock index funds already have rock bottom fees, these fee-free funds are an effortless way to invest more money and have the same asset allocation as funds with an expense ratio.

There are several ways you can access your Fidelity account and research potential investments.

Web Platform

Most investors will use the web platform or mobile app to access their accounts. The platform is easy to navigate and the layout is similar to most full-service online stock brokerages.

Some of the desktop features include:

- Real-time quotes: You can look up real-time price quotes for stocks and funds.

- News headlines: View headlines for stocks and the markets

- Events: See recent and upcoming events that can impact the stock price

- Charts: Interactive technical charts with indicators and drawing tools

- Analyst reports: Read research reports and equity ratings from Fidelity and third-party analysts

One downside of the web platform is the inability to buy fractional stock and ETF shares. Only the mobile app supports dollar-based investing.

Thankfully, you can buy positions in Fidelity mutual funds with a $1 investment. These funds include index funds and active strategies similar to sector ETFs.

Active Trader Pro

Swing traders and day traders will benefit more from the Active Trader Pro desktop platform for trading stocks, ETFs and options. The software is available for PC and Mac computers.

This platform is free to use and provides better research tools and advanced trading tickets that short-term traders and options investors need.

However, you will pay an activity assessment fee between $0.01 and $0.03 per $1,000 of principal for sell orders.

Featured benefits include:

- Real-time alerts: Receive alerts when watchlist stocks meet certain technical levels or unusual events for over 45 indicators.

- Trade Armor: A trading simulator to manage potential profits and losses.

- Option trade builder: The platform will help you create options trades.

- Advanced trading ticket: You can create up to 50 orders at a time that can execute at different intervals.

The platform has a customizable layout that can help you optimize this feature to easily access your research and account monitoring tools.

Mobile App

The Fidelity mobile app works on Android and Apple devices. These apps offer complete functionality for trading and researching investments.

Some of the best mobile app features include:

- Dollar-based investing

- Customized news feed

- Research tools

- Phone-based customer support

- Notebook

- Tax forms

You must download the mobile app to use dollar-based investing with Fidelity. You can only buy stocks and ETFs in $1 slices when you initiate trades on the app. It’s possible to purchase whole shares too.

The Notebook feature is also an innovative way to record potential investing ideas. You can upload phone screenshots and type personal notes. The web platform has this tool too.

Charting Tools

The various platforms offer customizable charts that make it easy to research popular fundamental and technical indicators. Drawing tools are available and you can save charts too.

One unique feature is seeing the support and resistance lines on the price chart. However, customizing the chart on the web platform may require a pop-up window to zoom in on a specific time period.

You will need to use the Active Trader Pro platform to access the most indicators. Thankfully, the web and mobile charting tools are sufficient for most investors.

Research Reports

Fidelity offers more analyst research reports than most traditional and barebones investing apps. The service offers reports from over 20 firms.

These reports can make it easier to research potential investment ideas and view the opinions of professional investors. You can also use these reports to determine if the analysts are bullish, bearish, and neutral sentiment.

This feature can also help you save money if you no longer want to pay for stock research tools.

These reports can also provide opinions for the broad markets and industry sectors. Most apps don’t provide research reports unless you pay for a premium plan.

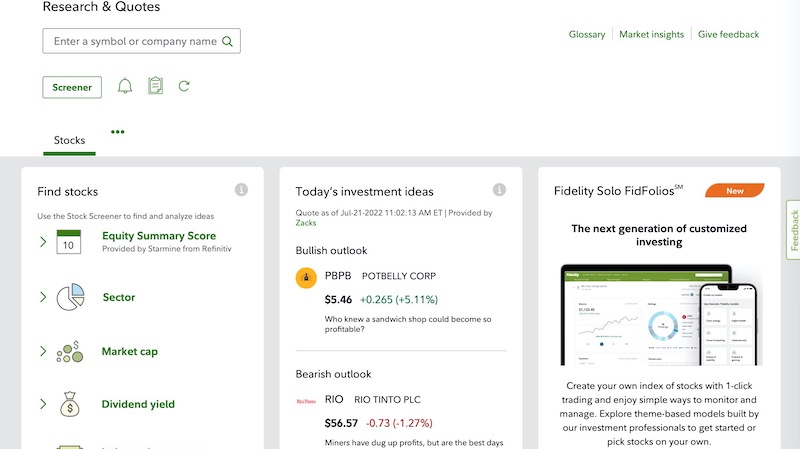

Stock Screener

This online broker also has a powerful stock screener to find stocks and funds.

Some of the filter options include:

- Investment strategy: Search by certain trends like mid-cap growth, head and shoulders technical patterns, high dividends

- Themes: Artificial intelligence, health care, mobile payments, natural foods, etc.

- Technicals: % off 50-day SMA, etc.

- Price performance

- Volume

Being able to screen stocks by strategy and theme adds an additional research tool to capitalize on investing trends.

The fundamental and technical research tools are comparable to other screeners.

Fidelity Investments Reviews

The online broker has many positive reviews from long-time investors that cherish the many account options, research tools and attentive customer service that many investing apps lack.

However, the negative reviews indicate there can be long wait times to speak with a customer service rep. Additionally, it can be challenging for beneficiaries to quickly close the account of a deceased loved one.

“Have been with Fidelity for over forty years. All the personnel we dealt with were very knowledgeable, kind and treated us kindly. I have recommended Fidelity time and time again to those who are willing to listen.” — Rose S.

“What I do like about Fidelity is that I know my money is safe with them and they have live customer service although sometimes you have to wait a lot to talk to a representatives. The HEAT MAP is probably the best feature!” — BakuTraders

“My employer uses Fidelity for their retirement plans. I have been attempting to rollover funds from Transamerica for the past few months and I always get my paperwork and check returned to me.” — Bobin C.

“As a client of Fidelity for over 20 years I have found their web site has numerous issues and when you try to contact them by phone you are greeted by the go to automated reply. We are experiencing extra volume.” — George M.

Alternatives to Fidelity Investments

These online brokerages can also be worth considering as they offer free investment accounts and many features for active and passive investors.

Vanguard

Index fund investors may prefer Vanguard which caters to passive investors. The platform offers many low-fee mutual funds and ETFs but the investment minimums can be higher.

Most stocks and ETFs trade commission-free but fractional investing isn’t available. Its research tools are sufficient but short-term traders will find the platform frustrating to use.

You might prefer this platform if your employer offers a workplace retirement plan through this brokerage.

Trustpilot score: 2.8 out of 5

Charles Schwab

Schwab rivals Fidelity with commission-free stocks and funds along with easy-to-reach customer service. However, it doesn’t offer fee-free index funds.

It’s also possible to buy fractional stocks slices of S&P 500 companies with a minimum $5 investment. Many index mutual funds also have a low minimum investment.

The platform offers interactive charts and third-party analyst reports that can make it easier for all investors to research potential investments.

Trustpilot score: 2.1 out of 5

TD Ameritrade

TD Ameritrade can be an excellent fit for novice and experienced investors. Its standard web and mobile platform has many in-depth charting and research tools.

Active traders may prefer Ameritrade’s thinkorswim platform to Fidelity’s Active Trader Pro as it can have more research tools and economic data for options and complex trading strategies. A paper trading feature is also available.

New investors may appreciate the educational library with many learning resources.

Stocks and ETFs can trade commission-free but the broker doesn’t offer fractional investing.

Read our TD Ameritrade review for more.

Trustpilot score: 1.4 out of 5

Ally Invest

Ally Invest may not have as many investment options as Fidelity but you can access commission-free stocks and ETFs. You can also create fee-free Robo Portfolios if you prefer automated investing.

The research tools are on the better side of average for analyzing stocks, ETFs and options.

Unfortunately, the platform doesn’t offer fractional investing.

Read our Ally Invest review for more.

Trustpilot score: 1.2 out of 5

FAQs

Here are several questions about Fidelity Investments.

Yes, Fidelity is beginner-friendly as it offers an online learning library and podcasts to learn the basics about investing and how the different investment products work.

Unfortunately, many basic apps don’t provide educational resources.

The platform also offers managed investment accounts and in-depth research tools that can make it easier to avoid high-risk investments.

One potential downside is that Fidelity has an above-average selection of investments like mutual funds with high expense ratios or a complex investing strategy. The expansive selection can be overwhelming if you’re not sure what to invest in.

Fidelity can be safer than other investing apps because of its research tools, managed robo-advisor accounts and customer service options.

The platform offers the typical FDIC and SIPC coverage amounts:

-FDIC Insurance: Up to $250,000 in cash management accounts and qualifying retirement accounts

-SIPC Insurance: Up to $500,000 in securities, including up to $250,000 for uninvested cash in a brokerage account.

These financial insurance products do not reimburse ordinary market losses.

You can open taxable and retirement accounts with $0. A Fidelity Go managed account is also free to set up but requires at least $10 to start investing.

Summary

Fidelity is an excellent brokerage for most investors because of its numerous investment options, research tools and free trade commissions. The service offers more features than competing brokerages.

It’s worth trying the platform and seeing if you like the layout and tools. One frustration is having to download the mobile app to make fractional trades. However, once up and running, you are good to go.