Variable-rate mortgages in Canada are now averaging about 4.20%, a full percentage point higher than they were a week ago.

That’s thanks to the Bank of Canada’s latest 100-bps rate hike, which was followed by an equal increase in the prime rate, upon which variable mortgages and lines of credit are priced.

The prime rate at most lenders is now 4.70%, a level not seen since 2008, and up from 2.45% at the start of the year.

“I think the big takeaway here is what it’s going to do to the variable-rate mortgage segment,” Steve Saretsky, a Realtor at Oakwyn Realty, told BNN Bloomberg in an interview. “At the end of the day, we’ve seen a huge cohort of people—more than 60% of purchasers over the last year and a half—going [into] variable-rate mortgages.”

Saretsky added that on top of the 100-basis-point rate hike, new variable-rate borrowers will have to qualify at a stress test rate of 200 bps above their contract rate as opposed to the minimum of 5.25% (something fixed-rate borrowers have had to do ever since fixed rates rose above the 3.25% threshold). Stress test rules for both insured and uninsured mortgages mean borrowers must prove they can afford payments based on their contract rate plus 2% or 5.25%, whichever is higher.

“Now they’re getting stress-tested effectively at about 6.20%, 6.25%,” Saretsky said. “That again will reduce purchasing power and that will feed through to the housing market.”

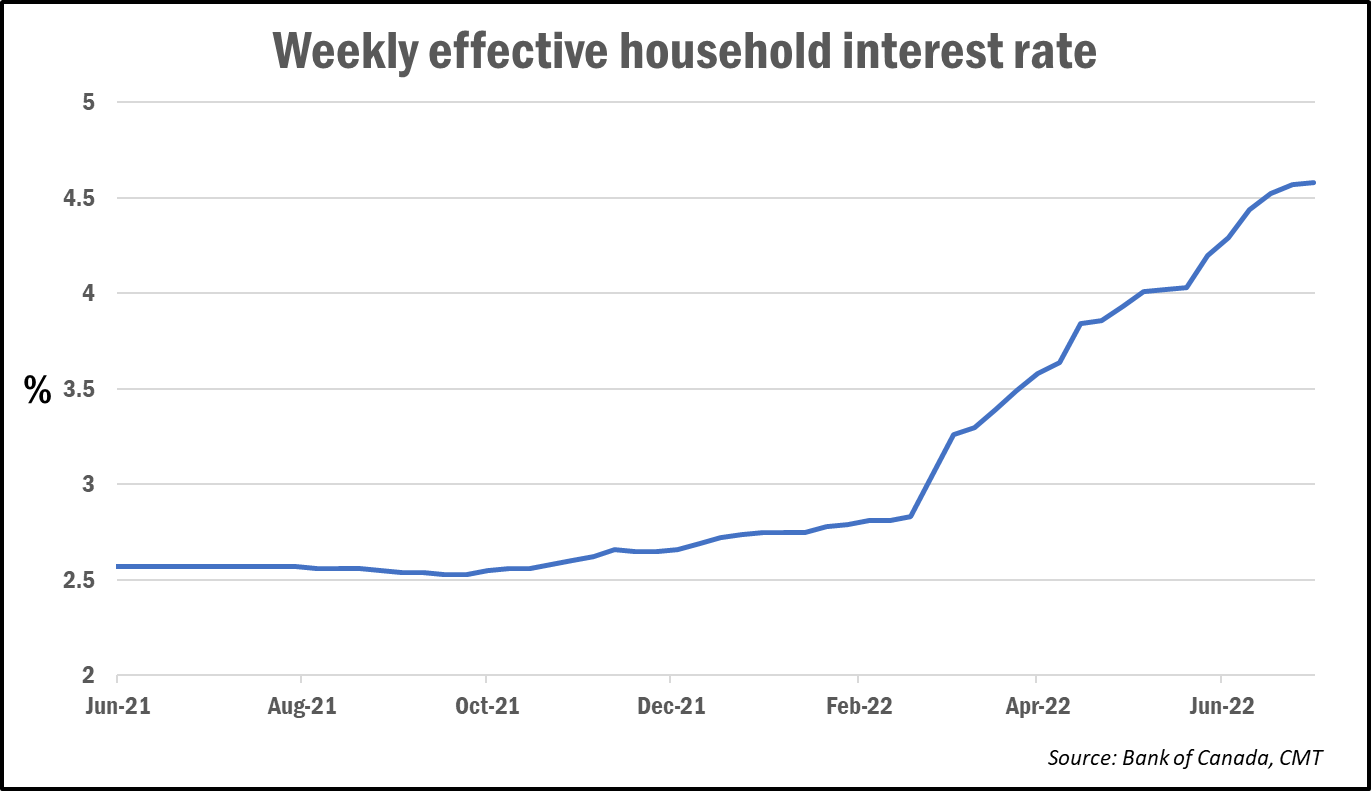

Looking at the bigger picture, overall carrying costs for Canadian consumers have surged since the start of the year.

The chart below shows the Bank of Canada’s measure of the “effective household interest rate.” This is a weighted average of both residential mortgage rates and consumer credit data.

Rate hikes could deliver a “total knockout” to the housing market

While home prices have been on the decline as rates have ratcheted higher, experts say the 100-bps hike delivered by the Bank of Canada last week could have serious ramifications for affordability and the housing market overall.

The Bank’s latest rate hike “might be a TKO [Total Knockout] for the housing market (at least for anyone that has any doubt a correction is underway),” wrote BMO economist Robert Kavcic.

By his calculations, the typical mortgage payment for the average-priced home in Ontario (as of Q1 2022) would “balloon” to about $4,700 per month from just over $3,000 as of early 2021. That assumes an average mortgage rate of 4.5%.

“Even after deflating mortgage payments to account for income growth over the decades, the ‘real’ mortgage payment will eclipse those seen at the height of the late-1980s market,” Kavcic said. “That is, of course, unless home prices continue to decline. And they are…”

Saretsky added that it’s too early for talk of a rebound in housing, which instead may be a “potential discussion for 2023.”

“For the back half of this year, I think we’re going to continue to see very weak sales volumes, and we are seeing a reduction in home values and I suspect that will continue,” he told BNN Bloomberg. “There’s really nowhere to hide right now if you’re a Canadian borrower.”