Just because it’s full of big, intimidating words and phrases doesn’t mean managing your money has to be difficult. This is the first of an ongoing series of posts on the basics of banking, aimed at taking the mystery out of personal finance. We’ll focus on providing information, overviews and tips to help take the guess work and confusion out of how to handle your money.

There are plenty of things many of us take for granted living in America. Freedom of religion, freedom of the press … the list goes on.

Access to safe, secure banking isn’t something a typical citizen ponders. However, in some areas of the world, it’s not a given. First of all, other countries don’t feature a Federal Deposit Insurance Corporation (FDIC) like the United States. This government agency, along with the National Credit Union Administration (NCUA), regulates and insures banks and credit unions in the United States.

There are some fraud protections. For instance, Visa offers fraud protection, meaning you may not be held responsible for unauthorized charges made with your account or account information. … If someone steals your money out from under your mattress, though, you’ll never see it again.”

Phil Smith, Elevations Credit Union’s Boulder Baseline Regional Branch Manager

“Some of the stuff that draws people to banking is that it’s more secure than having cash,” said Elevations Credit Union’s Boulder Baseline Regional Branch Manager, Phil Smith. “Some of that security comes from our insurance level – the FDIC for banks and the NCUA for credit unions. Also, there are some fraud protections. For instance, Visa offers fraud protection, meaning you may not be held responsible for unauthorized charges made with your account or account information. In addition, you’re protected if your Visa credit or debit card is lost, stolen or fraudulently used.

“If someone steals your money out from under your mattress, though, you’ll never see it again.”

Different accounts are available

Banks and credit unions, including Elevations Credit Union, offer a variety of ways to keep your money safe. And, in some cases, will even pay a little in return in the form of interest or dividends. Checking and savings accounts are by far the most popular, while money markets and share certificate accounts are also available.

Checking accounts

A checking account is the most versatile of the options. Access to money in a checking account is easy, allowing the owner to write a check for goods and services or use a debit card that’s attached to the account.

A debit card works just like a credit card, but debits your checking account conveniently without having to write a check. One convenient aspect of a debit card is the user’s ability to have access to their cash at any number of automated teller machines (ATMs). As long as there are funds available in the account, the user is able to pull cash from an ATM.

Savings accounts

Savings accounts are similar to checking accounts, but are meant more as a vehicle to hold and store money “for a rainy day.” In general, checking accounts are transaction accounts people use to spend money, while savings accounts are meant for just that – saving.

Money markets & share certificates

Money markets and share certificates are a little more advanced, but in general they act as savings accounts over a longer term that offer higher interest rates.

Elevations and many other credit unions offer checking and savings accounts with no minimum deposit, no minimum balance and no monthly fees. This means no monthly fees are assessed, even if the account balance drops to a low level.

The advantages of building credit

While you’re keeping your money in a more secure, fully insured location, small, savings-secured loans, lines of credit or managing a credit card can also help increase the opportunity to obtain a loan when the need arises – and a good credit score can help make life easier in a multitude of ways.

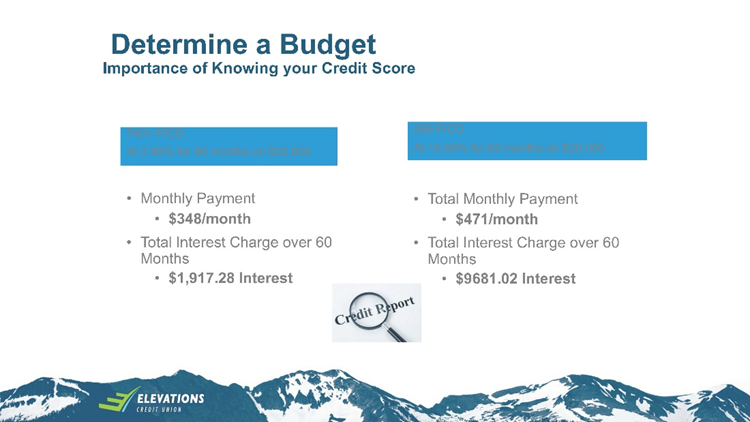

“The main thing a good credit score does is help get a loan approved,” Smith said. “But it can also help you get better rates. That can help significantly lower the amount of money you will pay over the life of a car loan or a home loan, for example.

“Also, places like apartment complexes and car insurance companies are checking credit now. A good credit score will help get better rates, and that’s on stuff more immediate than some large purchase in the future, like a car or house. Nowadays there are many situations where a good credit score can immediately impact your buying power.”

See the chart below for a quick example of how earning a good credit rating can save money over the course of a loan.

The convenience of having an account

As technology advances, checks and even cash are becoming less and less prevalent in society. The Covid-19 outbreak in 2020 pushed things along at a faster rate, too, as people became more nervous about cash transactions possibly spreading the disease.

Swiping a card, paying electronically or even having food or groceries delivered as well as [DM1] paying online has become more normal with every passing day. Having paychecks directly deposited into your accounts and having the ability to pay for items online has helped a lot of people feel much more comfortable during the worldwide pandemic.

Using a bank or credit union in the U.S. is not only the safest option, it’s also the most advantageous and most convenient way to manage your finances.

For more information on different types of accounts and the benefits they provide, reach out to a Financial Solutions Guide by calling 800.429.2676, dropping by one of our local branches or clicking the link below: