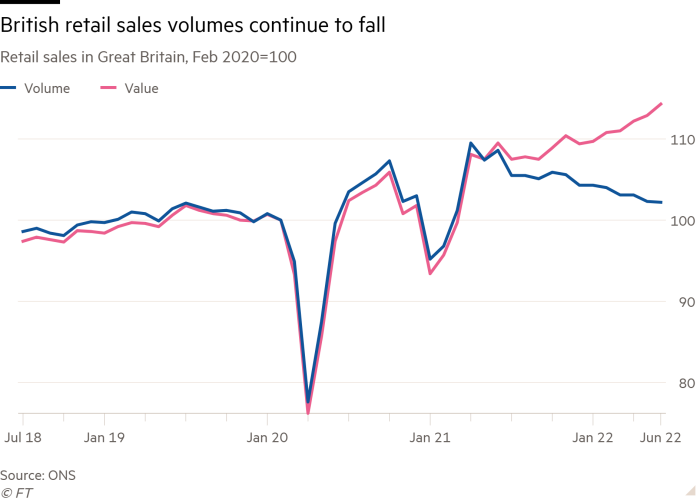

British shoppers spent more money buying fewer goods from retailers in June as rising inflation pushed them to tighten their belts.

The quantity of goods bought fell 0.1 per cent from the previous month — the second consecutive decline — but consumers ended up spending 1.3 per cent more than they did in May due to rising prices, according to official data.

The figures released on Friday by the Office for National Statistics underscored the impact on household finances of surging inflation, which hit a 40-year high in the UK of 9.4 per cent in June.

Heather Bovill, ONS deputy director for surveys and economic indicators, said that the broader trend for retail sales “is one of decline.”

She added that food sales picked up due to the Jubilee celebrations, but that was the only sector to report an increase.

Fuel sales fell sharply, with retailers reporting that record high prices at the pump hit demand.

Purchases of clothing and household goods dipped, with retailers suggesting that consumers were cutting back on spending due to higher prices and concerns around affordability.

Separate data published on Friday by research company GfK showed that UK consumer confidence remained at minus 41 in July, the lowest since records began in 1974.

Joe Staton, client strategy director at GfK, said that confidence was “severely depressed this month as the impact of soaring food and fuel prices and rising interest rates continues to darken the financial mood of the nation.”

Retail sales volumes are easing from their peak in the spring of last year as consumers have returned to spending in bars and restaurants, which are not included in the figures, instead of buying groceries.

Sales volumes were 5.8 per cent down from June last year.

Staton said that the next UK prime minister, either former chancellor Rishi Sunak or foreign secretary Liz Truss, will need to deliver “a much-needed shot in the economic arm of the country if they are to help improve consumer confidence.”