What is Tracking Difference Vs Tracking Error of ETF and Index Funds will provide us? Effective from 1st July, all Mutual Fund companies have to disclose the tracking difference, tracking error, and iNAV (for ETF) of ETF and Index Funds in India. Hence, it is important to understand the difference between tracking difference and tracking error.

Tracking Difference Vs Tracking Error of ETF and Index Funds

These two are one of the important data pointers to understand the fund performance. However, majority of Indian Mutual Fund companies ignored this to show on their factsheets. Hence, it turned difficult for the investors to judge the fund’s performance. Thanks to the regulator for making it mandatory for all AMCs to show both tracking difference and tracking error.

# Tracking Difference

Let us first try to understand the tracking difference concept. For this purpose, let us assume there are two funds with names as A and B. Let us say the benchmark is X.

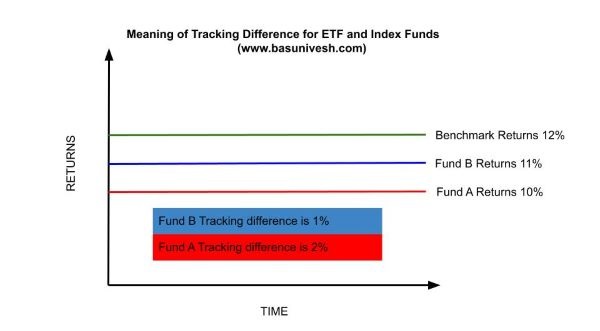

Assume that for 1 Yr period, fund A generated 10% returns, fund B generated 11% returns, and benchmark generated 12% returns. In that case, we can draw a graph like this.

You noticed that fund A returns are almost 2% less than the benchmark. Hence, choosing fund B makes sense. However, HOLD ON…..before judging the fund just with tracking difference will not give the actual picture of the fund. Instead, we have to look for tracking error (which is explained below).

Also, one important aspect you have to look for is to make sure that the index funds or ETF returns should always be less than the benchmark. Why? Eventhough in both the cases dividends are reinvested but in case of funds they have to bear the expenses. Hence, all ETF or Index funds must always be less than the index fund returns. If at any point of time, the fund is showing positive returns than the index, then it is a red flag for you to choose that fund.

# Tracking Error

It is nothing but a standard deviation of a fund with respect to the benchmark. It will gives you an exact indication of how much the volatile the fund is with respect to the benchmark.

The tracking error is the annualized standard deviation of the difference in daily returns between the underlying equity index and the NAV of the ETF/ Index Fund based on past one-year rolling data. As per the recent SEBI regualtion, such tracking error must be within 2% levels.

Tracking error gives you an indication of how much volatile the fund is with respect to the benchmark. Hence, relying simply on tracking difference will not gives you a right picture. Instead, you have to look for tracking error also.

It can be calcualted as below –

You noticed that in case of Tracking Difference, Fund B performance looked fantastic. However, if you look at the tracking error, the fund has a wide distribution with higher volatility than the benchmark. However, it is reverse to the Fund A.

Hence, if someone is looking for consistency in their funds must look at Fund A (tracking error). But if someone is just chasing the returns can look for Fund B (tracking difference).

The reasons for tracking error can be listed as below –

# Expense of the Fund – As the fund has to bear the expense whatever left out can be invested. Hence, if the fund having higher expenses left with lower amount of investable surplus leading to the higher tracking error.

# Cash holding – Higher the cash holding of the fund leading to higher the tracking error. Because it leads to less amount of money to be invested.

# Buying and selling – Due to execution of the buying and selling of underlying stocks, the error may happen.

# Corporate actions – Corporate actions like splits, bonus, mergers or amalgamations leads to such tracking errors. These corporate actions come into effect from the ex-date as announced by the Stock Exchanges. Usually, there is a time gap between the ex-date and the date on which the Fund is actually credited with that benefit and has the number of shares with itself. During this period, the Index is representing with the benefit but the Fund isn’t.

# Rounding off of quantity of shares – Assume that the fund has to buy ABC companies shares in around 1000.789. Practically, you can’t buy 0.789 shares. Hence, the fund may buy 1001 shares. Leading to the slight tracking error or difference in holding like how exactly is constructed.

Credit – Major credit for this knowledge sharings goes to Vangaurd AMC. They created wonderful online content to read Tracking Difference Vs Tracking Error of ETF and Index Funds.