Having a life insurance policy is critical to making sure your family is protected. A no medical exam life insurance policy is a great option if you are in the market for new life insurance.

Finding the right life insurance policy can be overwhelming. More so if you are older or have pre-existing medical conditions. It can be tough getting approved if you have a pre-existing condition.

The good news is some life insurance companies don’t require prospective clients to have a medical exam.

We’ve compiled a list of some of the more prominent no medical exam life insurance companies.

Top No Exam Life Insurance Companies

Here is a list of some of the bigger, more well-known life insurance companies. All of these companies specialize in no medical exam policies.

These companies don’t require up-front medical exams. However, some may ask some questions about your health at the time of application. Or they may require that you get medical exams in certain cases.

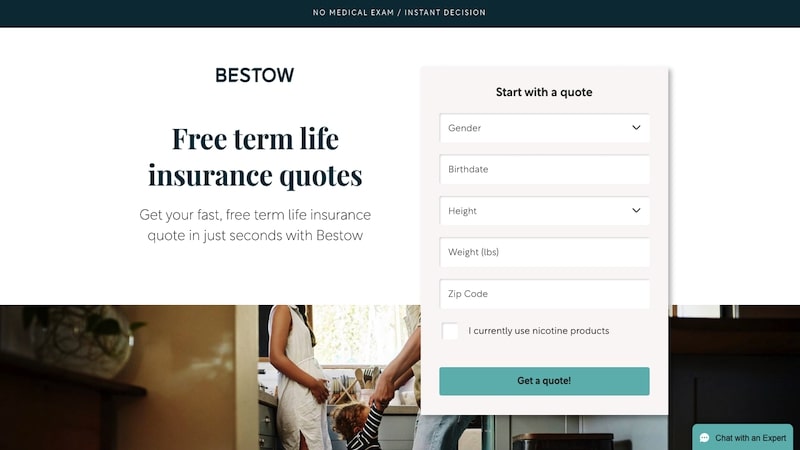

1. Bestow

Bestow was started by two dads who were discussing the challenges of obtaining solid life insurance policies – especially when the need is so great.

They felt many groups – including women – were under-served by life insurance companies, so they started Bestow.

Today, Bestow offers life insurance plans for as short as ten-year terms – and as long as 20-year terms.

Bonus: None of the Bestow plans require medical exams. This makes buying life insurance easier than ever.

Just fill out the application online and get a quote in minutes.

Pros

- Low premiums

- No medical exam required

- Quick approval process

- No commissioned representatives

Cons

- Health questions can seem intrusive

- Only offers term-life

- Coverage only to $1.5M

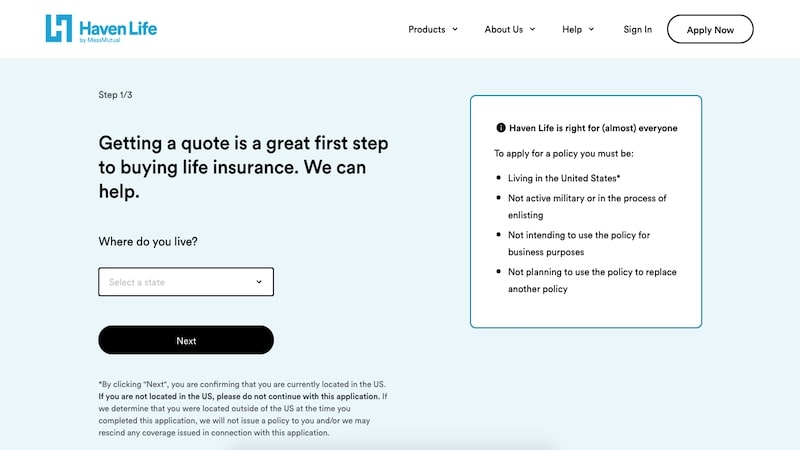

2. Haven Life

Haven Life offers a no medical exam policy called InstantTerm. InstantTerm applicants answer some questions about their health at the time of application.

After that, Haven analyzes that information to make an approval decision.

In some cases, a medical exam may be needed to finalize coverage. Again, the application does ask some medical questions. There is some medical analysis based on the information you provide.

Because of this, you generally won’t find too high of rates with Haven. Their rates are lower than you’ll find with many no medical exam companies.

Haven Life’s no medical exam insurance policy is issued by Massachusetts Mutual Life Insurance Company.

This company has earned the A.M. Best’s highest rating of A++.

Pros

- Easy application process

- Instant application decision

- Efficient payout

Cons

- Specific restrictions

- Available in US only

- Term life policies cannot convert to whole life coverage

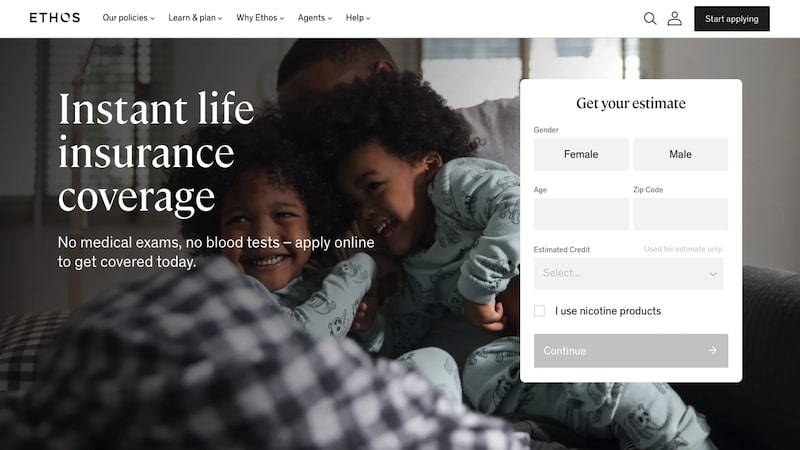

3. Ethos

Ethos looks to make getting life insurance simple for people and families. In fact, there’s no medical exam coverage policy is often approved in as little as ten minutes.

Roommates at Stanford Business School started Ethos. They’re licensed in all states except for New York.

Their goal was to provide simple and affordable insurance policies. They have traditional and no medical exam life insurance options.

Ethos life insurance policies get backed by insurance giant Assurity. This way you know you can count on them to deliver what they promise.

Plus they have a 4.5/5 Trust Pilot score.

Pros

- Easy to apply

- Competitive rates

- Claims promptly paid

- Offers accelerated death benefits

Cons

- Limited options

- Rates vary

- Rider only on accelerated death benefit

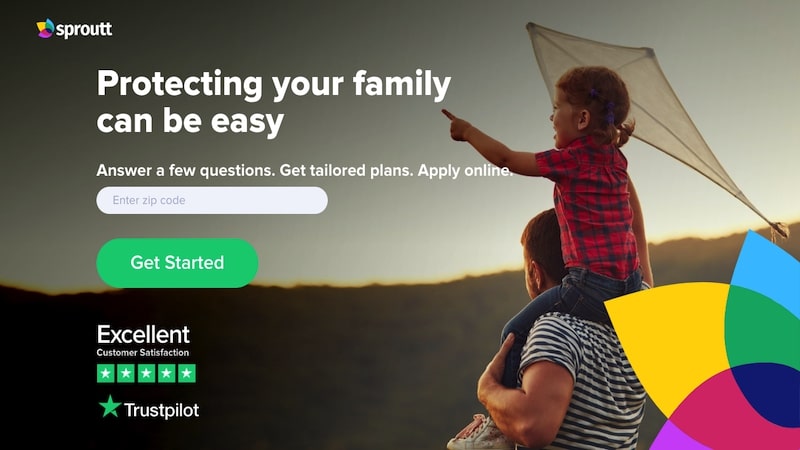

4. Sproutt

Sproutt is an independent insurance broker that can help you find the best no-exam life insurance for your needs. They accomplish this task by using an assessment tool called the Guided Artificial Intelligence Assessment (GAIA).

The GAIA helps determine ways you can live healthier by assessing your movement, sleep, balance, nutrition, and emotional health habits. By helping you to be aware of your lifestyle choices, and encouraging you toward a healthier lifestyle, Sproutt can save you money.

How? By being able to offer you the best in no-exam life insurance policies at the most competitive prices.

Pros

- Rates are competitive for healthy individuals

- Works with highly rated insurance companies to get best rates

- Easy to use online platform

Cons

- Limited products

- Rates higher for higher risk individuals

5. JRC Insurance Group

JRC Insurance makes comparing life insurance quotes easy. Their fee-free, online tool helps you compare 50 top-rate companies. Plus, their agents can help you narrow down choices even further. They’ll do this based on your specific needs.

In addition, if you have health issues the tool will compare your health profile to each company’s guidelines. This will help you see which ones you may still qualify for.

Pros

- Variety of products

- Help for high-risk individuals

- Quick quotes

Cons

- No live chat

- Customer support is limited

6. John Hancock

John Hancock has been in the insurance business for over 150 years. They offer ten, fifteen and twenty-year term life insurance policies.

With John Hancock you can get approved for up to $1 million in coverage. Of course, you have to qualify first. This is one of the highest benefit payouts in the no medical exam insurance industry.

There’s no medical exam required. However, they do ask a few health questions on the application.

Pros

- Large product options to choose from

- Discounts for healthy individuals

- Offers coverage for those with diabetes

- Up to $3M coverage

Cons

- Require medical questions

- Low customer satisfaction

7. Principal Financial Group

Many no medical exam companies only offer smaller policies up to $250,000. However, Principal Financial Group offers up to $1 million in coverage. This is for qualified applicants, of course.

They use their Principal Accelerated Underwriting program for applicants. This program helps you eliminate long waits. In addition, there are no scheduling conflicts with paramedical professionals.

They don’t require lengthy exams and blood tests for applicants. And you can get your approval results within 48 hours.

Principal Financial Group will check other factors such as driving history. This allows them to get the information they need to make an informed underwriting decision.

Pros

- Approval within 48 hours

- Supported by their underwriting company

- Best option for healthy individuals

Cons

- Up to $1M coverage

- Review your driving history

8. Assurity

Assurity offers term and whole life insurance policies. They’ve been in business for over 100 years.

Their Non-Med Term 350 policy offers life insurance policies up to $350,000. The policy covers people age 18-65 without any medical exam needed.

Note that you will need to answer questions on your current health condition. This is a requirement when you apply for their policies.

Pros

- Two-day turn around time

- Policy and rider options

- NonMed Term 350 is convertible

Cons

- Up to $350,000

- Complete questionnaire

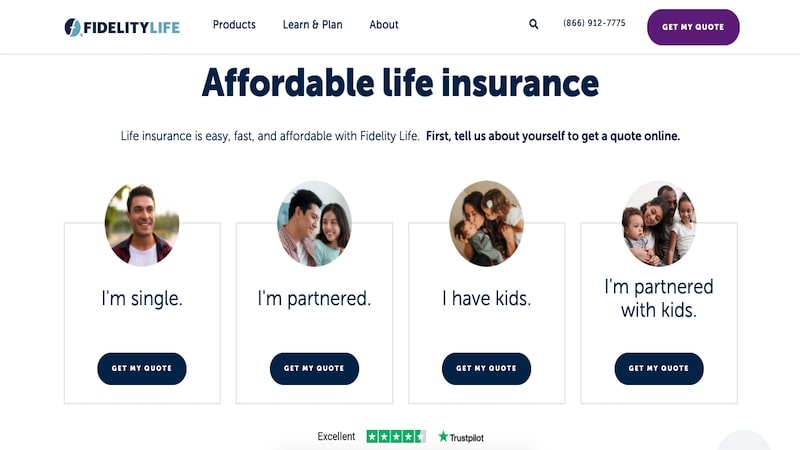

9. Fidelity Life

Fidelity Life opened in 1896. They offer a variety of policies based on your needs.

As far as no medical exam policies they offer a policy called the RAPIDecision Express.

Their RAPIDecision Express policy offers between $25,000 and $250,000 in term life insurance. You can get the policies in ten, fifteen, twenty or thirty year terms. There are no medical exams needed.

However, you will need to answer a few questions for policy approval.

Fidelity also offers small no medical exam whole life policies. They offer coverage up to $30,000. These policies, however, are meant to cover final expenses. They won’t cover your family’s expenses for the long term.

Pros

- Offer a 30 day guarantee

- Insurance riders available

- Guaranteed renewable up to age 95

Cons

- Up to $250,000

- Complete questionnaire

- Whole life has some restrictions

10. Transamerica

Transamerica has been writing life insurance policies for people since 1906.

They offer no medical exam life insurance policies up to $249,999. That’s not among the highest policy amounts we share here. However, Transamerica is well known for its excellent service.

They hold an A+ rating with A.M. Best. And they have a reputation for working hard to keep customers happy.

Transamerica serves over twenty million people. They offer life insurance and other financial products too.

Pros

- Quick turn around on quote

- Online comparison table

- Additional products

Cons

- Filing not intuitive

- Low customer service rating

How is ‘No Medical Exam Life Insurance’ Different?

I know we talked about this before, but it bears repeating. Many life insurance companies require applicants to obtain a physical exam. You must complete the exam before the life insurance policy gets approved.

The company’s underwriting team will take a thorough look at it.

The process of getting that physical exam for a life insurance policy has become pretty streamlined. However it still takes time on the part of the insurance company and the potential client.

In addition, exams can result in concrete reasons for policy denial.

It’s common for life insurance companies to schedule a paramedical professional to come to your home. They conduct a fairly non-intrusive medical exam as a part of your policy approval.

When the paramedical professional arrives at your home, they’ll take down basic personal information. They’ll record your name, address, social security number and birth date.

They’ll likely check your height and weight, and your blood pressure. In most cases, they’ll take a urine sample and blood sample too.

Other types of exams may happen based on the company’s exam policies.

After the paramedical professional finishes the exam, they send the information in for analysis. Any lab results are sent to the life insurance company you’ve applied to.

The results of the analysis can determine whether you’re approved. They also determine what your premium costs will be for the policy you wish to carry.

Healthy people can usually find a company that will charge a reasonable premium rate for a policy.

However, people who are elderly or are suffering from major health conditions can pay much higher premiums.

Oftentimes people in these higher risk groups get denied coverage altogether.

Getting a Life Insurance Policy is Now Easier

However, companies that don’t require a medical exam for potential clients are different. They can help eliminate the potential for getting denied coverage.

They often won’t deny you based on health conditions, age or other factors.

No medical exam life insurance policies come with beneficial time and convenience factors too.

A life insurance company not requiring a medical exam can get you approved for a policy faster. This is because they’re not waiting on paramedical professionals to connect with potential clients.

They’re also not waiting on medical results that may influence their underwriting experts. As such, no medical exam life insurance policies can be approved in as little as ten to fifteen minutes.

Of course, this depends on the application process and underwriting rules of the company you are applying to.

Have you been considering getting life insurance coverage? Are you concerned about being approved based on your age or pre-existing medical conditions?

If so, you may want to look further into no medical exam insurance companies.

Before you apply however, there is other information you should know. Here are some components about life insurance policies in general.

Important Components to a Life Insurance Policy

When you’re looking into getting life insurance you’ll want to consider three important factors. Check these factors before choosing a company to sign with.

Here’s the deal: not all insurance companies are the same. There are some main similarities from one to another.

However, they all have different rules, regulations, costs and business tactics.

As you shop for life insurance for yourself and your family, it’s important to focus first on three factors:

- Benefit amounts

- Premium costs

- Insurance company assessments

Benefit Amounts

Everyone considering a life insurance policy needs a different amount of coverage. They’ll want to take some time to figure out how much that amount is.

As you work to decide how much life insurance you need, consider current and future income needs.

For example, a single person with no plans to get married or have children can get a smaller policy. They won’t need as much life insurance coverage as a person who is married and has children.

A single person who plans on remaining single will likely only need a smaller policy. They’ll want something big enough to cover burial expenses.

However, a person who is married with a family will want to consider buying more coverage. They’ll want enough coverage for their family to be able to maintain their current lifestyle. And they’ll need money to pay for any extras they may need in the future.

There is a general rule in the personal finance world regarding coverage amounts. That rule says twenty times your annual expenses in coverage is a good target amount to start with.

Use that number when deciding how much life insurance coverage you need.

Determining Your Coverage Amount

For instance, let’s say the expenses for your family of five are $5000 per month. You’d start there, and add a twenty percent buffer for inflation and additional non-planned expenses.

This means your target income from your life insurance policy would be $6000 per month. Annually, that adds up to $72,000 per year for covering expenses.

Next, you’ll take that annual expense calculation of $72,000 and times it by twenty. That adds up to $1,440,000 in insurance benefits you would need in order to cover your family’s expenses over the next twenty years.

What if you have young children and want to include extra money to cover college, wedding or other expenses? If so, you may want to consider increasing your policy benefit amounts.

The 20x your annual expenses rule is just a suggestion, however. You may decide you need more or less coverage based on other factors.

Some of those factors may include:

- How much money you have in savings. Do you have a substantial amount of cash in your emergency fund and other non-retirement investments? If so, you may be able to get by with less life insurance coverage.

- How much debt you’re carrying. Do you have debt payments such as a mortgage payment, car payment or other consumer debt? You’ll want to make sure you have enough in life insurance benefits to cover those payments. If you have little or no debt, you may not need as much coverage.

Premium Costs

Premium costs on a life insurance policy are important because you’ll want to know:

- Whether the cost of the premiums fit into your current budget

- How competitive each company’s rate is compared to another

After all, why pay more than you need to for insurance or anything else? When shopping around for life insurance it can help to make a list of each company you talk with.

Record their premium costs for the amount of coverage you’ve determined you need based. Base that amount on the exercise in the previous paragraph.

It’s important to be aware that no medical exam life insurance policies are going to be expensive. They’ll cost more than those that require a medical exam.

You could pay two, three or even four times more in premiums for a no exam policy.

Does that information makes you cringe? If so, you may want to consider at least trying to get approved with a traditional life insurance company. Even if you have to get a medical exam first.

What if you don’t get approved for traditional life insurance policy coverage? You can move forward with a no medical exam company.

Just be sure to call several of the companies on your list as premiums will vary. One company’s premium costs may differ drastically from another company’s premium rates.

Insurance Company Assessments

After you’ve determined your needed benefit amounts, check with companies on their premium rates. This will help you narrow down your list. And you’ll have a clearer idea of which companies you want to further consider.

The next step is to research and assess each company’s reputation. You can start by checking out the Better Business Bureau’s reporting record for each company you’re considering.

The BBB shouldn’t be your main source of research. However, it can help you get an idea of the types and number of complaints filed against each company. It will also show you how each company handles complaints filed against it.

Does a company works to get consumer complaints resolved? Or do they ignore those complaints? The answer to that question will tell you something about their business ethics.

It will help you know whether they have a commitment to a high level of customer service and satisfaction.

There are also a few companies that exist for the purpose of rating insurance companies and their reputation. Four of the main companies that perform this function are Standard and Poor’s, Fitch, Moody’s and A.M. Best.

Make sure to visit your top picks. Then do your homework to assess which site is best for you. Then plan a meeting with each to review their policies and coverage.

Additionally, a certified financial planner may also be able to help you. They can help you decide more about what types of life insurance terms and policy amounts you need.

FAQ

With so much information regarding policies, we thought having a few top questions answered may be beneficial.

When you go to choose your life insurance policy, most require a medical exam to see if you have any underlying medical conditions that limit your eligibility.

A no medical exam is just that. You do not need an exam. They may ask you to honestly answer questions regarding your health and habits, yet that is about it.

Additionally, premiums may be higher, depending on the insurance carrier with a medical exam if there are underlying health issues.

Yes, you can apply. Again, the company may ask you to honestly answer questions regarding your health.

Start with considering how much you need for your coverage. We have provided the coverage amounts for each company above.

Additionally, make sure to do your homework and check each company you are review agains BBB and Trust Pilot. Having a company with a good reputation is important.

Comparison Table

| Coverage | Trustpilot Score | |

| Bestow | Up to $1.5 million | 4.6 out of 5 stars, 899 reviews |

| Haven Life | Up to $3 million | 4.8 out of 5 stars, 1,000+ reviews |

| Ethos | Up to $2 million | 4.5 out of 5 stars, 400+ reviews |

| Sproutt | Up to $5 million | 4.8 out of 5 stars, 400+ reviews |

| JRC Insurance Group | Up to $1 million | 4.9 out of 5 stars, 100+ reviews |

| John Hancock | Up to $65 million | 3.4 out of 5 stars, 70+ reviews |

| Principal Financial Group | Up to $1 million | 2.8 out of 5 stars, 3 reviews |

| Assurity | Up to $10 million | 4.1 out of 5 stars, 350+ reviews |

| Fidelity Life | Up to $2 million | 4.5 out of 5 stars, 700+ reviews |

| Transamerica | Up to $10 million | 1.3 out of 5 stars, 50 reviews |

Summary

Having adequate life insurance policies is a big deal. It’s important to work to be sure your family gets protected and provided for. You’ll want them to have enough money should something unexpected happen.

The subject isn’t fun to talk about. However, getting sufficient life insurance coverage is an important part of a successful financial plan.

Hopefully, our top picks for no medical exam life insurance companies review has helped.