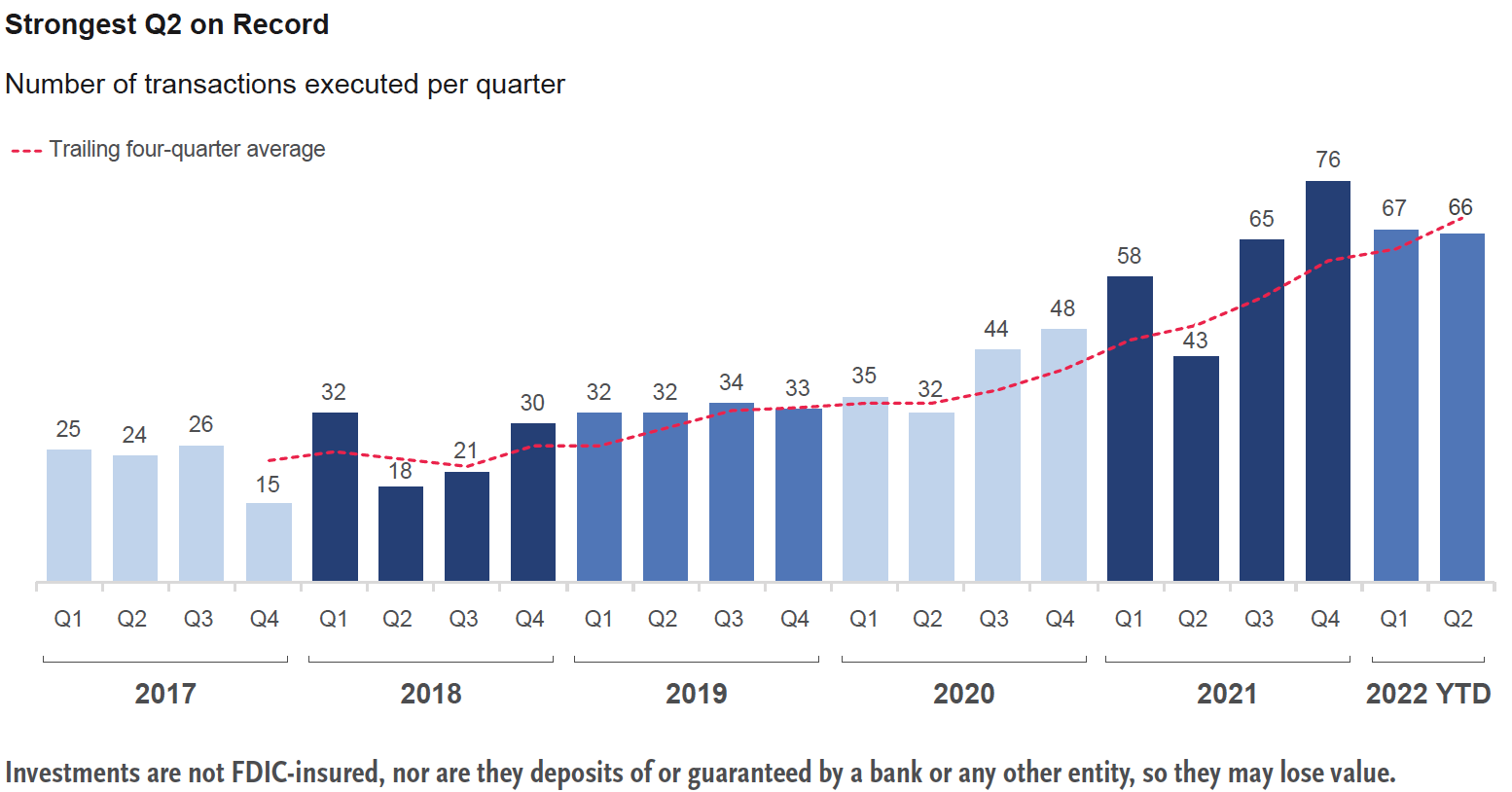

While 2022 is probably not going to see a quarter that rises to the Q4 2021 watermark, mergers and acquisitions activity among RIAs is still breaking records and on track to set another annually despite an expected slowdown in the second half of the year, according to the latest DeVoe & Company RIA Deal Book.

The first six months of 2022 saw a slight decline in M&A transactions compared to the previous two quarters, yet still represented the second-most active six months on record and a 31.7% increase over the first half of 2021 (which was about a 50% increase over same period during the previous two years).

After seeing 40% and 50% year-over-year growth in 2020 and 2021 activity, respectively, DeVoe expects to end 2022 with a 20% to 30% increase over last year’s record of 242 deals, a flatter trajectory identified as “healthier” for optimal M&A.

“[T]he industry has seemingly broken through to a ‘new normal’ of heightened transaction activity,” according to the investment bank. “Unfathomable just a few years ago, the transaction volume has steadily exceeded 60+ transactions per quarter for over a year—approximately twice the run rate of 2019.

“Contextually, the heightened activity is a bit surprising,” according to the report. “Given global political and economic instability, a looming U.S. recession and a declining stock market, advisors have their hands full. Historically, these challenges dominated advisors’ mindshare and calendar, deprioritizing complex strategic decisions like M&A. But recently RIA owners have clearly been making the time.”

DeVoe credited the RIA model for much of the sector’s resiliency in the face of falling markets, rising interest rates and other macroeconomic concerns, along with copious amounts of private equity dry powder and an increase in interested small and sub-sellers (RIAs sold to RIAs that have been acquired by a larger, consolidator firm) seeking to take advantage of recent high valuations and encouraged by the success of larger, notable deals within the industry.

“Despite the headwinds, the wealth management sector remains attractive to private equity and other financial services buyers,” wrote the report’s authors. “Key players are voting with their wallets that the RIA model is the best way to serve the investing public. This continued interest, complemented by the increasing interest of RIA firms to sell externally, will likely sustain strong M&A activity for years to come.”

Numbers released this month by Fidelity Investments seem to back up DeVoe’s claim that RIAs have surfaced as the most desirable wealth management advisory model. Fidelity Institutional Insights’ Quarterly M&A Review identified 119 RIA transactions during the first half of 2022 (excluding private equity and debt financing purchases, as well as a number of ‘other’ RIA-related transactions)—but only two deals involving independent broker-dealer firms.

Differences in classification and information-gathering result in variations between the totals reported by various industry scorekeepers—such as DeVoe, Fidelity and Echelon—but all tell a common story. RIA M&A is expected to remain disproportionately active within financial services, funded largely by significant private equity investments and joined by more small and mid-size sellers, but deal-making is showing signs of slowing to more sustainable levels after several years of unprecedented advance.

“Ultimately,” according to DeVoe, “the ‘best match’ is the most important aspect of a merger, and a ‘healthy’ amount of M&A optimizes the likelihood that these transactions will continue to yield successful outcomes.”