What are the new EPF Taxation and TDS Rules if your contribution per year is more than Rs.2.5 lakh? How do calculate it and what are the rules? Let us try to understand these new rules with some examples.

In terms of TDS on EPF, there are two situations where TDS will be applicable.

# EPF Withdrawal Taxation and TDS Rules

I have explained the same in the below image. Earlier the limit of such TDS was for more than Rs.30,000 and above withdrawal amount. In Budget 2016, the limit was raised to Rs.50,000.

You may refer to the detailed post on this “EPF Withdrawal Taxation-New TDS (Tax Deducted at Source) Rules“.

New EPF Taxation and TDS Rules – Contributions above Rs. 2.5 lac

As per the circular, the effective date for TDS in case of final claim settlement shall be:

i) 01.04.2022 or final settlement/ transfer – whichever is later, and

ii) in all other cases, TDS shall be on the date of credit of interest.

Applicability of TDS –

TDS is applicable in case of

a) PF final settlement,

b) transfer claims,

c) on transfer from Exempted establishments to EPFO and vice versa,

d) on transfer from one Trust on another,

e) past accumulations transfer, at the time of annual accounts processing, on back period accounting after accounts for year 2021-22 are processed.

The TDS will also be applicable in death cases as in the case of a live member. It will be applicable to all EPF members including members of Exempted Establishments/Exempted Trusts. It will also be applicable in case of International Workers.

This is the new EPF Taxation and TDS Rules rules that came into effect on 1st April 2022 if your contributions to EPF are more than Rs.2.5 lakh a year. Hence, any contribution you done from FY 2021-22 will be taxable and tax is deducted as per this new rule.

The Government has changed the rules for the calculation of interest on EPF accounts. It has set a threshold limit for contribution in EPF Rs. 2.50 Lakhs and GPF Rs. 5.00 Lakhs (as there is no contribution from the employer) on which interest received will not be taxable. Any interest on the contribution made during the FY 2021-22 in excess of the amount of Rs. 2.50 Lakhs (EPF) and Rs. 5.00 Lakhs (GPF) will be taxable as “Income from Other Sources “in the hand of the employee or person contributing to those funds.

The CBDT has notified Rule 9D to calculate the taxable portion of interest pertaining to the contribution made to a statutory or a recognized provident fund in excess of the threshold limit of Rs. 2.5 lakh or 5.0 lakhs as the case may be. It provides that separate accounts within the provident fund account shall be maintained during the previous year 2021-22 and onwards for the taxable and non-taxable contribution made by the person.

Only the interest accrued in the Taxable contribution account would be taxable in the hands of the employee under the income head ‘Income from Other Sources”. The interest accrued in the Non-taxable contribution account shall continue to be tax exempt.

As per the accounting system of EPFO,

Interest is credited on annual basis. However, Member accounts are maintained monthly as per Para 60(2) (a) of EPF Scheme, 1952. I have written a detailed post on this at “How EPF (Employees’ Provident Fund) interest is calculated?“.

To manage this new rule’s applicability, the same method is further divided into two components.

# Taxable

# Non-Taxable

The applicable TDS rates for this new rule are as below –

i) 10% if PF account is linked with valid PAN,

ii) 20% if PF account is not linked with valid PAN (i.e., TDS rate would be double)

iii) 30% under Section 195 subject to provisions of DTAA; in case of non-resident.

The threshold limit in the case of GPF is Rs.5 lakh and for EPF it is Rs.2.5 lakh.

Let us take few examples here.

Scenario 1 – Taxation for FY 2021-22 contributions

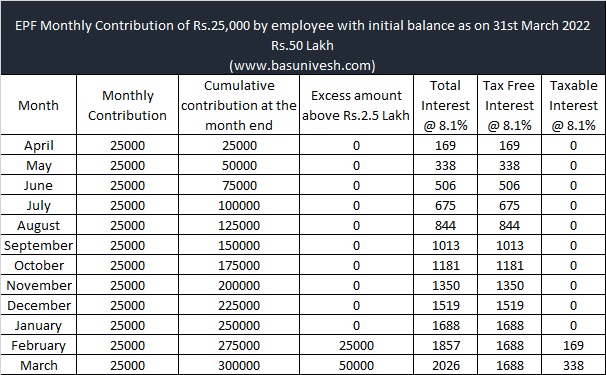

Mr. X’s monthly contribution towards EPF from 1st April 2021 is Rs.25,000. He has an earlier balance of Rs.50,00,000. EPF interest rate considered is at 8.1%. Then the monthly contribution, taxable, and tax-free interest table look like below for FY 2021-22.

The above chart is only with respect to the monthly contribution done during a year. However, as I mentioned above, he has an earlier balance of Rs.50 lakh also. Hence, the taxable and non-taxable list looks like the below.

a) Tax-Free account

Opening balance – Rs.50,00,000

Interest on opening balance – Rs.4,05,000

The contribution made up to the threshold limit for FY 2022-23 – Rs.2,50,000.

Interest earned on the threshold limit – 12,659

TDS @10% in case PAN is available and linked with Aadhaar – NIL

TDS @20% in case PAN is not available and not linked with Aadhaar – NIL

TDS @ 30% for NRIs – NIL

Year-end balance (as on 31st March 2022) of tax-free account is Rs.50,00,000 (initial balance) + Rs.4,05,000 (interest on Rs.50,00,000 balance) + Rs.2,50,000 (contribution of last year below the threshold limit) + Rs.12,659 (interest on such contribution of below Rs.2,50,000) = Rs.56,67,659

b) Taxable account

Opening balance as on 1st April 2021 – NIL

Interest accrued on opening balance – NIL

Cumulative excess amount above Rs.2.50,000 – Rs.50,000

Interest earned on such excess amount during FY 2021-22 – Rs.507.

TDS @10% in case PAN is available and linked with Aadhaar – Rs.50.07

TDS @20% in case PAN is not available and not linked with Aadhaar – Rs.101.4

TDS @ 30% for NRIs – Rs.152.1

Total year end balance (as on 31st March 2022) in such taxable account is Rs.50,000 (contribution above Rs.2,50,000) + Rs.507 (interest on such contribution above Rs.2,50,000) = Rs.50,507.

Scenario 2 – Taxation for FY 2022-23 contributions

From here onwards there are two accounts to be managed. One is a taxable account and another is a tax-free account. Let us first discuss tax-free account details.

The monthly contribution table and interest earned on such monthly contribution will remain the same as the above table of scenario 1 for FY 2022-23. Because our contribution is same and interest rate is also same. However, the tax-free account and taxable account details will vary. Hence, I am not again sharing the above table. Rather, I will explain the taxation from FY 2022-23.

a) Tax-Free account

Opening balance as on 1st April 2022- Rs.56,67,659

Interest on opening balance – Rs.4,59,080

The contribution made up to the threshold limit for FY 2022-23 – Rs.2,50,000.

Interest earned on the threshold limit – 12,659

TDS @10% in case PAN is available and linked with Aadhaar – NIL

TDS @20% in case PAN is not available and not linked with Aadhaar – NIL

TDS @ 30% for NRIs – NIL

Year end balance (as on 31st March 2023) – Rs.56,67,659 (Initial balance) + Rs.4,59,080 (interest on such initial balance) + Yearly contribution below the threshold limit Rs.2,50,000 + Interest on such contribution of below threshold limit Rs. 12,659 = Rs.63,89,398.

b) Taxable account

Opening balance as on 1st April 2022 – Rs.50,507

Interest accrued on opening balance – Rs.4,091

Cumulative excess amount above Rs.2.50,000 – Rs.50,000

Interest earned on such excess amount during FY 2022-23 – Rs.507.

Total taxable interest earned during FY 2022-23 – Rs.4,091 (from the initial balance) + Rs.507 (on the monthly contribution in excess of Rs.2,50,000) = Rs.4,598.

TDS @10% in case PAN is available and linked with Aadhaar – Rs.459.8

TDS @20% in case PAN is not available and not linked with Aadhaar – Rs.919

TDS @ 30% for NRIs – Rs.1,379.

Year end balance (as on 31st March 2023) -Rs.50,507 (Initial balance) + Rs.4091 (Interest on year end balance) + Rs.50,000 (Contribution above Rs.2,50,000 in a year) + Rs.507 (Interest earned on contribution beyond threshold limit) = Rs.1,05,105.

Conclusion – I hope that the above examples will give you clarity. However, I have one doubt which I am unable to find from the notification of EPFO regarding Rule 9D (Dated 31st August 2021) is whether the future partial withdrawals are considered as part of the taxable EPF amount or from tax-free EPF amount. If anyone of you found the clarity on this aspect either from EPFO or from CBDT, then please do share the same by commenting to this post.