For the first half of this year, I have steadfastly refused to join Club Recessionista. I have not believed we were already in a recession, and I was hopeful that a moderate Fed gradually raising rates to throttle inflation could execute that soft landing.

No longer.

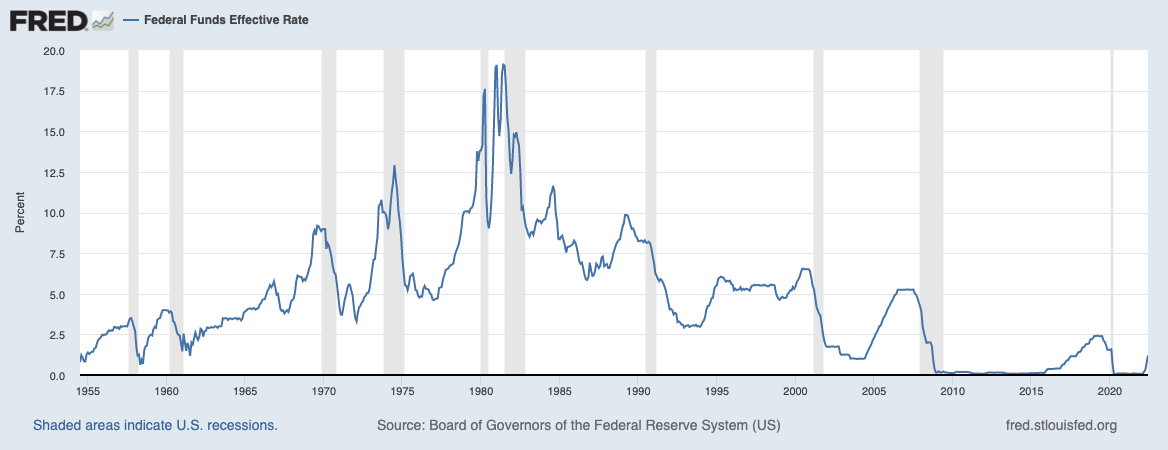

As I mentioned to Tom Keene last week, Nick Timiraos in the Wall Street Journal revealed the Fed’s intention to raise rates 75 basis points brought a reckoning to my hopes of a non-recessionary growth slow down.

A soft landing is now officially RIP.

What I have instead are questions about what the rest of 2022 looks like, and how deep into 2023 any damage persists. Here are five of those questions:

1. Will second-quarter earnings (released this month) disappoint or has the market already moderated expectations?

2. How much will the economy slow in Q3 and Q4?

3. How badly will third quarter earnings be hit?

4. Will the economic slowdown continue into 2023?

5. How much of this is priced into the stock market already?

Let’s dive into each of these:

1. Will second quarter earnings (released this month) disappoint or has the market already moderated expectations? Q2 earnings have disappointed, but at least so far seem to be in line with modestly reduced expectations. Companies have disappointed but have not been broadly punished for it.

Compare this with the response to Q1 earnings (April) when various firms were savagely punished for barely missing consensus expectations. General rule of thumb: Companies that disappoint but don’t sell off tend to have the bad news already in their prices.

This is more consistent with a mid-cycle slowdown than a full on end to the bull market

2. How much will the economy slow in Q3 and Q4? The trillion-dollar question. We have already seen a massive slowdown in home sales. There are other worrisome changes in consumer behavior: Two Wall Street Journal columns reported that a widespread switch towards cheaper store brands and less expensive names is already pressuring consumer food, beer and tobacco companies.

We don’t have much insight into the automobile market given the lack of availability; its a reaosnable assumption that higher financing costs will crimp consumer spending there too. Oother durable goods like appliances, furniture and even HELOC-financed additions/renovations can also be expected two moderate in the coming quarters.

3. How badly will third quarter earnings be hit? This could be the most difficult question to address of all as we are just three and half weeks into the 13-week quarter. Driving spending has been 2 years of pent up demand caused by the pandemic lockdowns; Americans are going on vacation, traveling, seeing movies in theaters, visiting family, etc. This is offset by higher prices and the worst consumer sentiment we’ve seen in decades.

Despite inflation and poor sentiment, consumers have – at least so far – continued to do what they do best: Spend like there’s no tomorrow.

But there is a tomorrow and my expectations are that if the Fed overtightens (as they appear on track to do) then the next 12 months will be less economically robust than the prior 12.

4. Will the economic slowdown continue into 2023? Too many variables to address this question with any degree of confidence. However, when we see the economists’ consensus expectations for Federal Reserve cuts in 2023, that informs us this group is expecting not merely a recession but one deep and long-lasting enough to mandate the FOMC has to respond aggressively.

5. How much of this is priced into the stock market already? There are so many variables in answering this question reverse engineering possible Q3 and Q4 earnings and coming up with some multiple seems to be a fool’s errand.

I will suggest the following: Down 20% on the S&P 500 is a fairly reasonable way to discount a mild recession. If we have a deeper recession or a more severe earnings decrease (from record highs) then we may need to work our way down to -28% to 32%.

It’s hard to extrapolate much worse than a modest economic contraction from where we are today. The economy, corporate revenues, earnings, and consumer spending are to some degree path dependent. Households are in good shape and corporate balance sheets are very healthy. This is why I have such a hard time imagining anything much worse than a medium (worse than a mild) recession.

Hence, my expectations are that we are now about 2/3 through the sell-off, and I could foresee revisiting the lows and surpassing them on poor Q3 earnings or even a weak September warning season.

Of course, all of this is just wargaming possible scenarios. We don’t make investments based on forecasts, and any number of random surprises could make the economy appreciably better or worse.

We go through these exercises so as to not be surprised about some of the possible outcomes if they come to pass.

See also:

Weak Earnings Reports Aren’t Fazing Investors After Brutal Year for Stocks (WSJ, July 24, 2022)

Previously:

Risk & Reward: Two Sides of Same Coin (July 20, 2022)

Rally

Too Late to Sell, Too Early to Buy… (June 16, 2022)

Capitulation Playbook (May 19, 2022)