Jenny and her husband Will live in the Upper Midwest along the shores of Lake Michigan with their two children, Sam (age 16) and Alex (age 10), and their one old cat. Will is 56 and the couple always planned for him to retire at 60 and to pay for Sam and Alex’s college educations. However, now that the date is nearing, Jenny’s not sure this is actually feasible. She’d like our help checking her calculations and determining how they should allocate their resources as they–hopefully–approach retirement and paying for college. I’m doing a deep dive today into one of the most commonly asked questions:

When can I retire and not run out of money?

I’ll walk you through how to model different retirement scenarios–based on the variables of your assets, your spending, and your desired retirement age–and how to determine whether or not you’ll run out of money before you die. Today I’m employing the ultra-comprehensive, detailed FIRECalc modeling system for “when can I safely retire?” Woohoo!

What’s a Reader Case Study?

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

Case Studies address financial and life dilemmas that readers of Frugalwoods send in requesting advice. Then, we (that’d be me and YOU, dear reader) read through their situation and provide advice, encouragement, insight and feedback in the comments section.

For an example, check out the last case study. Case Studies are updated by participants (at the end of the post) several months after the Case is featured. Visit this page for links to all updated Case Studies.

The Goal Of Reader Case Studies

Reader Case Studies intend to highlight a diverse range of financial situations, ages, ethnicities, locations, goals, careers, incomes, family compositions and more!

The Case Study series began in 2016 and, to date, there’ve been 81 Case Studies. I’ve featured folks with annual incomes ranging from $17k to $200k+ and net worths ranging from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured gay, straight, queer, bisexual and polyamorous people. I’ve featured women, non-binary folks and men. I’ve featured transgender and cisgender people. I’ve had cat people and dog people. I’ve featured folks from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured people with PhDs and people with high school diplomas. I’ve featured people in their early 20’s and people in their late 60’s. I’ve featured folks who live on farms and folks who live in New York City.

The goal is diversity and only YOU can help me achieve that by emailing me your story! If you haven’t seen your circumstances reflected in a Case Study, I encourage you to apply to be a Case Study participant by emailing your brief story to me at mrs@frugalwoods.com.

Reader Case Study Guidelines

I probably don’t need to say the following because you folks are the kindest, most polite commenters on the internet, but please note that Frugalwoods is a judgement-free zone where we endeavor to help one another, not condemn.

There’s no room for rudeness here. The goal is to create a supportive environment where we all acknowledge we’re human, we’re flawed, but we choose to be here together, workshopping our money and our lives with positive, proactive suggestions and ideas.

A disclaimer that I am not a trained financial professional and I encourage people not to make serious financial decisions based solely on what one person on the internet advises.

I encourage everyone to do their own research to determine the best course of action for their finances. I am not a financial advisor and I am not your financial advisor.

With that I’ll let Jenny, today’s Case Study subject, take it from here!

Jenny’s Story

Hello! I’m Jenny (age 50), married to Will (age 56). Will is a software engineer and I’m a stay-at-home mom. We have two kids, Sam (age 16) and Alex (age 10), who are homeschooled. We also have a lazy old cat who refuses to be schooled in any way. We reside in the Upper Midwest along the shores of Lake Michigan. We live pretty simply, enjoying time together going for hikes, collecting beach glass, gardening, playing board games, reading books, etc.

Our biggest expenses by far involve our health, due to both chronic (non-debilitating) as well as immediate medical issues. Food is our biggest line item and, despite cooking 100% at home and making almost everything from scratch, it’s a crazy high amount. Part of that is due to our insistence on buying only organic, grass-fed/finished, pastured, etc. We also spend a lot on supplements (after tracking for the last few months I’m honestly shocked by just how much!). And lately, the medical bills have been sky-high; the deductible on our health insurance is over $6,000 and we’re using our HSA as an investment vehicle so we haven’t been touching it.

What feels most pressing right now? What brings you to submit a Case Study?

As the one handling our finances, I’ve been telling Will for a while that I think he might be able to retire when he turns 60. Now that the date is drawing near, I’m freaking out a bit. I don’t see how he can stop working in just a few years.

My original target for “enough to retire on” was:

- $1,000,000 in Will’s IRA

- $100,000 in Will’s inherited IRA

- $100,000 in Will’s HSA

- $100,000 in our Roth IRAs (combined)

- $100,000 in cash

However, we recently had to stop investing in our Roth IRAs due to ongoing medical expenses, and we don’t have any cash saved at all. I realize this last part is a problem, but somehow I just can’t seem to save an emergency fund.

In addition, our net worth has dropped since the beginning of the year, thanks to the swings in the stock market. While I knew the good stock market times wouldn’t last forever, it’s another thing to see it actually happening. I’m not one to freak out (I mostly just stop checking our investments), but with Will getting closer to retirement age, it’s something that concerns me.

College for Two Kids

Complicating the picture of when Will can retire is the fact that both of our kids will be college-aged in just a few years. We’d like to make sure they get through whatever advanced education they want/need with no debt. We obviously don’t have much saved to that end, so we’ll need to cash-flow it, even if it means Will works a bit longer. I’m also concerned about what we’ll do for health insurance as a family once he retires.

Finally, I should add that I’ve been making calculations based on current investment balances and contributions, using 7% as a base interest rate and adjusting each year with the new balances. I have also looked into what Social Security might offer us, though I’m not counting on it. The Open Social Security website indicates that our best strategy would be for me to file for my retirement benefit when I turn 62 and 1 month, for Will to file when he turns 70, and then for me to file for my spousal benefit at that time. The first full year that Will is 70 would result in us receiving almost $54,000 a year. But again, I’m not counting on Social Security to be available, at least not in full.

What’s the best part of your current lifestyle/routine?

The best part of our current lifestyle is having so much time together as a family. We’re all homebodies and enjoy just hanging out together.

The best part of our current lifestyle is having so much time together as a family. We’re all homebodies and enjoy just hanging out together.

What’s the worst part of your current lifestyle/routine?

The worst part of our current lifestyle is not having Will home all the time. His company allows him to work remotely a few days a week, but the rest of the time he needs to be in the office, which is a 45-minute commute from home. We’d prefer for him to work from home full-time, and even better, not have him beholden to a job at all. Alas, an income is still required to pay for the necessary goods and services.

Where Jenny Wants To Be in Ten Years:

Finances:

- I would like for Will and I to have enough money saved to live off comfortably and to help our kids pay for their higher education if necessary.

Lifestyle:

- Will would be retired and we’d be continuing to live pretty much the way we have been, without Will having to work.

Career:

Jenny’s Finances

Income

| Item | Amount | Notes |

| Will’s net income | $6,491 | Will’s net salary, minus health insurance, taxes and the following deductions:

HSA: $8,300 per year (Will contributes $6,350 & his employer contributes $1,950) |

| Required Minimum Distribution from Will’s inherited IRA | $237 | This amount changes yearly (taken as a lump sum each December). |

| Monthly subtotal: | $6,728 | |

| Annual total: | $80,736 |

Debts: $0

Mortgage: None. Our house is paid off and valued at around $350k

Assets

| Item | Amount | Notes | Interest/type of securities held/Stock ticker | Name of bank/brokerage | Expense Ratio |

| Will’s 401K | $658,675 | VINIX | Fidelity | 0.035% | |

| House (paid off) | $350,000 | Estimate based on comp. sales. | |||

| Will’s Inherited IRA | $102,670 | Required RMD every year. | VBTLX & VTSAX equally | Vanguard | 0.05% & 0.04% |

| Health Savings Account | $55,750 | In the bank Will’s company uses. | VINIX | local bank | 0.035% |

| Jenny’s Roth IRA | $17,421 | VTSAX | Vanguard | 0.04% | |

| Will’s Roth IRA | $9,408 | VTSAX | Vanguard | 0.04% | |

| 529 (Sam) | $5,412 | In our state 529 program. | TISPX | 0.05% | |

| 529 (Alex) | $5,412 | In our state 529 program. | TISPX | 0.05% | |

| checking | $1,000 | Wells Fargo | |||

| savings | $500 | Capital One | 1% | ||

| Total: | $1,206,248 |

Vehicles

| Vehicle make, model, year | Valued at | Mileage | Paid off? |

| Toyota Sienna 2006 | $7,500 | 141,000 | yes |

| Honda Civic 2007 | $6,000 | 164,000 | yes |

| Total: | $13,500 |

Expenses

In filling out the financial spreadsheet I realized that I haven’t accounted for many expenses, mainly the maintenance and repair on our vehicles and house. Somehow we always find a way to pay for the things that come up irregularly without going into debt, but obviously living on the edge like this is not good. I think part of me knows that if we absolutely had to we could withdraw funds from the inherited IRA (and pay taxes on it) or the HSA (for medical expenses). Obviously, though, this goes against using those accounts to save for retirement!

| Item | Amount | Notes |

| groceries | $2,400 | |

| medical bills | $850 | |

| supplements | $681 | |

| misc. household expenses | $650 | health & hygiene, cleaning supplies, furnace filters, light bulbs, printer ink, etc. |

| property taxes | $544 | |

| kids’ activities/classes | $400 | |

| gas/electric bill | $200 | |

| gifts/holiday expenses | $162 | gifts, Halloween costumes/candy, Xmas tree, Xmas cards, memorial donations, etc. |

| water bill | $117 | |

| gasoline | $85 | |

| auto insurance | $76 | Erie Insurance |

| alcohol | $65 | |

| internet | $60 | |

| life insurance | $58 | Cincinnati Life |

| clothing | $50 | |

| pet supplies | $50 | cat litter/food/vet visits |

| homeowner’s insurance | $37 | Erie Insurance |

| books | $30 | We utilize the library as much as possible but buy a book if the library doesn’t have it or we want to own it. |

| virtual exercise classes | $25 | |

| New York Times subscription | $20 | |

| cell service (Tello) | $14 | |

| Netflix | $9 | |

| landline (Ooma) | $6 | Kids don’t have their own cell phones so we need this for when they’re home alone. |

| umbrella insurance | $6 | Erie Insurance |

| Monthly subtotal: | $6,595 | |

| Annual total: | $79,140 |

Credit Cards: none

Jenny’s Questions for You:

1) Are we on track for Will to retire in four years?

2) What options do we have for helping our kids with the costs of higher education?

3) If Will is able to retire before the kids are old enough to have their own health insurance, how do we make sure they’re covered?

4) How do we save an emergency fund? I used to be so good with money, but lately I feel as though we’re drowning in expenses.

5) Am I focusing too much on retirement savings at the expense of our finances today?

Liz Frugalwoods’ Recommendations

I’m delighted to have Jenny as a Case Study today because I think her family finds themselves in a situation familiar to many: Barreling towards retirement age and college tuition at the same time. I’m thankful to all of our Case Study subjects for their honesty and transparency since these deep dives help not just the subject, but plenty of readers too! Many thanks to Jenny for joining us :).

Most of Jenny’s questions are inter-dependent, so forgive me for addressing things slightly out of order today. Let’s dive in!

Jenny’s Question #1: Are we on track for Will to retire in four years?

It depends. There are a number of factors at play here and the theme I’ll return to over and over today is the need for prioritization and organization. Jenny and Will need to identify their highest priorities and then focus their financial energies towards those ends.

The big prioritization question is:

Do they want to pay for their kids’ college or do they want Will to retire at 60?

If they’re going to pay for their kids’ college, they’ll need to change their spending and allocations.

Priority 1: Paying for College?

Their oldest will be off to college in about two years and they have $5,412 in his 529 (a college investment plan). This is great! Any savings are great! Any investments are great! The downside is that this won’t be nearly enough to cover four years of tuition, room, board, books, etc.

Jenny mentioned cash flowing the kids’ college education, but that’s impossible at their current spending level. Will’s annual take-home pay is $80,736 and they spend almost all of that ($79,140). In light of this, if they want to pay for their oldest’s college in full, they’ll have to:

- Dramatically decrease their spending (and/or dramatically increase their income)

- Select a college with affordable tuition

- Seek out scholarships and other financial aid

- Stop contributing to their retirement accounts

As you all know, I’m not a fan of parents not contributing to their retirement because I think it leaves parents in a precarious position. I almost never advise people to stop investing in their retirement–particularly when you have an employer-matching 401k as Will does–and it makes me uncomfortable to even write it out.

In past Case Studies, I’ve encouraged parents to think about it like this:

Would your kid rather have you pay for their college and then potentially have you rely on them financially in your old age? Or, would your kid rather take out student loans and NOT be financially responsible for you in your old age?

Will and Jenny’s position isn’t quite this diametric, but they really need to be honest about how much money they have to work with, given the fact that their oldest is fast approaching college age and their youngest is close behind.

Remember: It’s not selfish to invest for your retirement–it’s fiscally responsible.

Expenses

A major hurdle to all of Will & Jenny’s financial goals is their spending. Jenny and Will are breaking even every month, which is a perilous position to put yourself in–especially if you don’t have to.

This isn’t a criticism of their spending, but rather an invitation for them to re-assess their longterm goals as a family and as a couple.

Unless they dramatically increase their income, this level of spending is not tenable.

I applaud Jenny for her honestly about their challenges with tracking their expenses. It takes a great deal of courage to face this and to articulate it. Nobody wants to admit fault–especially not on the internet!–so I want Jenny to understand how proud I am of her for taking this step and how difficult that is to do.

Since this seems to be a persistent issue for Jenny and Will, I encourage them to do three things right away:

- Sign-up for Personal Capital, which is a free, online, expense tracking system (affiliate link). I use and recommend Personal Capital, but there are other services out there if you prefer something different. The key is to find something that works for you and stick with it.

- Take my free Uber Frugal Month Challenge together. You can sign-up at any time and start with Day 1 of the challenge. This 31-day program guides you through the steps it takes to understand your goals, your money and the emotions around your finances.

- Review the below spreadsheets together and determine where they can start saving ASAP (Jenny, I’ll email this to you so you can edit as you and Will discuss).

As Jenny noted, it’s their top four expenses that are killing their budget. These “Big Four” total $4,581. Jenny and Will don’t have a mortgage, which should enable them to live on less, but these four are absolutely draining them. Let’s look at them first:

| Item | Amount | Notes | Mrs. FW’s Notes |

| groceries | $2,400 | I understand and share the desire/need to eat healthfully, but am hard-pressed to see how it needs to cost $2,400 per month. I live in a different part of the country and my kids are younger, but we spend around $600-$800 per month for a mostly organic, grass-fed, tons of fresh produce, minimal meat diet for our family of four.

Again, if this is Will & Jenny’s absolute highest priority, they will need to cut in other areas to support this amount. If Jenny’s open to considering reducing this amount, I recommend she start by reading: Our Complete Guide To Frugal, Healthy Eating. |

|

| medical bills | $850 | I’m confused as to why money is going into the HSA, but not being used to foot these bills? Let’s talk more about the HSA in a moment because this isn’t making sense to me (even in light of the tax advantages of investing in an HSA). | |

| supplements | $681 | I’m not a health professional, so I cannot discuss the efficacy/need for supplements, but WOW is this a huge amount. It’s $8,172 per year! Again, not criticizing the choice, just highlighting that this is an outsized amount of money. Is there an opportunity for reduction here? | |

| misc. household expenses | $650 | health & hygiene, cleaning supplies, furnace filters, light bulbs, printer ink, etc. | This amount also blows me away. I’m not clear on how this bill can be so high alongside the astronomical groceries and supplements? This is a category to really dig into to investigate the itemization, since it’s equaling $7,800 per year. |

| TOTAL: | $4,581 |

Everything else in their monthly expenses pales in comparison and totals a mere $2,014. While Will & Jenny can, and should, trim around the edges of these expenses, it’s the Big Four that are making the difference. Here’s my “trim around the edges” advice:

| Item | Amount | Notes | Mrs. FW’s Notes | Suggested New Amount |

| property taxes | $544 | Fixed cost | 544 | |

| kids’ activities/classes | $400 | Reduce/eliminate | 200 | |

| gas/electric bill | $200 | Explore opportunities for using less | 175 | |

| gifts/holiday expenses | $162 | gifts, Halloween costumes/candy, Xmas tree, Xmas cards, memorial donations, etc. | Reduce | 100 |

| water bill | $117 | Explore opportunities for using less | 100 | |

| gasoline | $85 | Fixed cost | 85 | |

| auto insurance | $76 | Erie Insurance | Shop around to see if there’s a better rate. | 76 |

| alcohol | $65 | Reduce/eliminate | 45 | |

| internet | $60 | Fixed cost | 60 | |

| life insurance | $58 | Cincinnati Life | Fixed cost | 58 |

| clothing | $50 | Reduce/eliminate | 25 | |

| pet supplies | $50 | cat litter/food/vet visits | Fixed cost | 50 |

| homeowner’s insurance | $37 | Erie Insurance | Shop around to see if there’s a better rate. | 37 |

| books | $30 | We utilize the library as much as possible but buy a book if the library doesn’t have it or we want to own it. | Eliminate | 0 |

| virtual exercise classes | $25 | Eliminate | 0 | |

| New York Times subscription | $20 | Eliminate | 0 | |

| cell service (Tello) | $14 | Fixed cost. Well done on using an MVNO!!! | 14 | |

| Netflix | $9 | Eliminate | 0 | |

| landline (Ooma) | $6 | Kids don’t have their own cell phones so we need this for when they’re home alone. | Fixed cost | 6 |

| umbrella insurance | $6 | Erie Insurance | Fixed cost | 6 |

| Monthly subtotal: | $2,014 | Monthly subtotal: | $1,581 | |

| Annual total: | $24,168 | Annual total: | $18,972 |

Even if Jenny & Will trim all of their expenses in this category, they’re only going to save $5,196 per year. Which isn’t nothing! I’m not saying they shouldn’t save this–they should–but the eye-opener are the Big Four expenses totaling $54,972 per year.

Let me reiterate: I do not care what Will & Jenny spend their money on. I’m not judging WHAT people spend on, I’m looking at the bottom line of HOW MUCH they spend versus their income. Jenny asked for my advice and, in this case, some radical expense reduction is what needs to happen.

Let’s circle back to the retirement question:

Jenny and Will have $788,174 in all of their retirement accounts combined. Let’s see how this stacks up against the retirement rule of thumb:

Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67 (Fidelity).

Since Will’s 56, let’s go with 7x: $80,736 x 7 = $565,152, which indicates they are ahead of schedule. However, the issue is that if Will stops contributing to retirement in order to pay for their children’s college AND/OR to retire at 60, this amount won’t be enough to see them through old age. Time for some serious math!

How To Model When You Can Safely Retire (hint: use an online calculator!)

I ran several different mathematical models for Jenny and Will using the online FIRECalc retirement calculator (don’t worry, I didn’t try to do my own math

1) I start at the “Start Here” tab and input:

- Spending: $79,140

- Portfolio: $788,174

- Full Years: 30

Their portfolio is only their retirement investments ($788,174) because we can’t include any of their other assets:

- They have to live in their house:

- A paid-off house is a wonderful thing, but it’s not a liquid asset. If you sell your house (and don’t buy another), then you’ll have that money in cash. But until then, it’s a place to live, not a liquid asset.

- The 529s are earmarked for their kids’ college

- The HSA is earmarked for medical expenses

- Their cash totals just $1,500

The variable here that Jenny and Will can most easily influence is their spending.

2) Next, I go to the “Other Income/Spending” tab and input:

- Social Security: $54,000 (this is the amount Jenny indicated they’ll receive)

- Starting in: 2036 (when Will turns 70, which is when Jenny indicated he’d elect to receive SS)

3) Next, I went to the “Not Retired” tab and input:

- What year will you retire?: 2026 (when Will is 60)

- How much will you add to your portfolio until then, per year? $37,350

- $37,350 = Will’s annual contribution to his 401k ($27,000) + his employer’s contribution ($4,000) + the amount they currently contribute to their HSA ($6,350).

- Note: they’d have to stop contributing to their HSA in order to include the $6,350

- If they decided to contribute more to their IRAs, they would add that amount here

4) Next, I go to the “Spending Models” tab and leave it alone, per the instructions:

If you leave this section alone, FIRECalc assumes you will continue to spend the same amount (after adjustments for inflation) every year for 30 years.

5) Next, I go to the “Your Portfolio” tab and input:

- How much are you paying in investing fees (expense ratio)? 0.04%

- For more on what expense ratios are and why they’re so important, check out this Case Study

- I selected “Total Market” since Will & Jenny are invested in low-fee, total market index funds

- Percentage of your portfolio that is in equities: 100%

- Note: Will & Jenny are currently invested 100% in stocks (aka equities). They should research whether or not they want to diversify their their portfolio to include some lower-risk, lower-reward bonds.

6) Next, I go to the “Portfolio Changes” tab:

This is the place to input major lump sum changes (either additions or subtractions) to your portfolio. The most relevant for Jenny and Will is college tuition. Other examples: an inheritance (addition), the sale of a home (addition), the purchase of a home (subtraction).

I had to make estimations since I don’t know how much college tuition will cost for Jenny & Will’s kids. I made the wild guess that it’ll be $125,000 for each of their boys to attend four years of traditional college (a grand total of $250k for both kids). They can adjust this number when they have real data from their sons’ prospective universities.

To model paying for college:

- I selected “Subtract a lump sum” of $125,000 in 2026 for their first child:

- I picked 2026 because it should be roughly the mid-point of their 16-year-old’s college education

- Then for the second child, I selected: “Subtract a lump sum” of $125,000 in 2032:

- I picked 2032 because it should be roughly the mid-point of their 10-year-old’s college education

7) And finally…. we get RESULTS! I go to the “Investigate” tab:

Retirement Scenario #1: Retiring at 60

I want to model Will & Jenny’s likelihood of success for several different possible retirement scenarios. Here’s the link Jenny and Will should use for modeling each of these scenarios.

We’ll start with the assumptions Jenny set forth (and the variables I input as noted above):

- Will retires at age 60

- They pay for both of their children’s college educations

- Their annual spending and savings rates do not change

To model this, I click on the first box, which says “The success rate of your portfolio and withdrawal plans…” Then I click “Submit.”

Unfortunately, it is not good news.

The FIRECalc results state:

- Because you indicated a future retirement date (2026), the withdrawals won’t start until that year.

- Your contributions will continue until then.

- The tested period is 4 years of preretirement plus 26 years of retirement, or 30 years.

- FIRECalc looked at the 122 possible 30 year periods in the available data, starting with a portfolio of $788,174 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 122 cycles:

- The lowest and highest portfolio balance at the end of your retirement was $-2,339,890 to $7,662,214, with an average at the end of $2,002,135. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

- For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 22 cycles failed, for a success rate of 82.0%.

In plain English, FIRECalc is telling us that if Will retires at age 60 and they pay for both of their kids’ educations and the stock market performs according to an amalgamation of 122 different historical stock market scenarios (per the market’s performance since 1871), their likelihood of NOT running out of money in retirement is only 82%. That means they have an 18% chance of going broke before they die.

This is too risky for me personally. If it were me, I would not feel comfortable pursuing a path that only has an 82% chance of success. Everyone has to determine their own risk tolerance, but I cannot advise taking this path.

Retirement Scenario #2: Delaying Retirement Age

Ok, since scenario #1 fails 18% of the time, I’m going to change some of the variables I noted above to increase Will & Jenny’s likelihood of success.

Under the “Investigate” tab, I’m going to now click the box under “Investigate delaying retirement” and input 10 years:

What happens if you retire in any of several years between now and 10 years from now?

This is exactly what it sounds like: if Will were to delay his retirement date, how likely is it that they’d run out of money?

Here are our new variables:

- Will delays retirement

- They pay for both of their children’s college educations

- Their annual spending and savings rates do not change

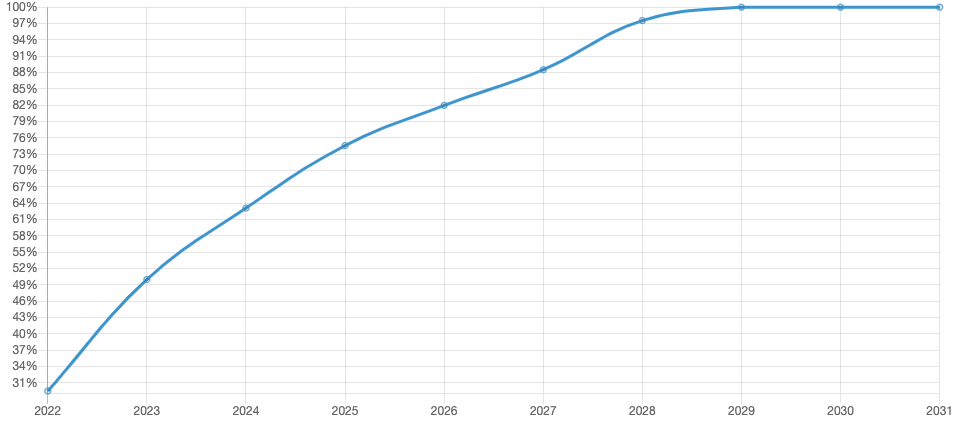

What we’re seeing here: if Will were to work until the year 2029, they’d have a 100% chance of success! This is great news as it would enable them to pay for both of their kids to go to college and ensure they wouldn’t run out of money in retirement. The downside is that Will would have to work until age 63. But that doesn’t seem like too bad of a trade-off to me!

The assumptions here are:

- They do not change their spending

- College does indeed cost $125k per child

- They stop contributing to their HSA and instead invest that money in retirement

- The stock market continues to perform as it has in the past

- They continue with Will’s current 401k contributions (and his employer continues to contribute as well)

- Their Social Security estimate of $54k annually is correct

Retirement Scenario #3: Retiring at 60, Decreasing Annual Spending

Let’s run another scenario. If the #1 priority is for Will to retire at age 60, they’ll need to change other variables in order to achieve success.

The most obvious variable they can change:

- Their annual spending

Back to the “Investigate” tab and this time, I go to the “Given a success rate, determine spending level for a set portfolio, or portfolio for a set spending level” section and select “Spending Level”:

Search for settings that will get a success rate of as close to 99% as possible (usually within 1%) by changing…

Spending Level or Starting portfolio value

Results:

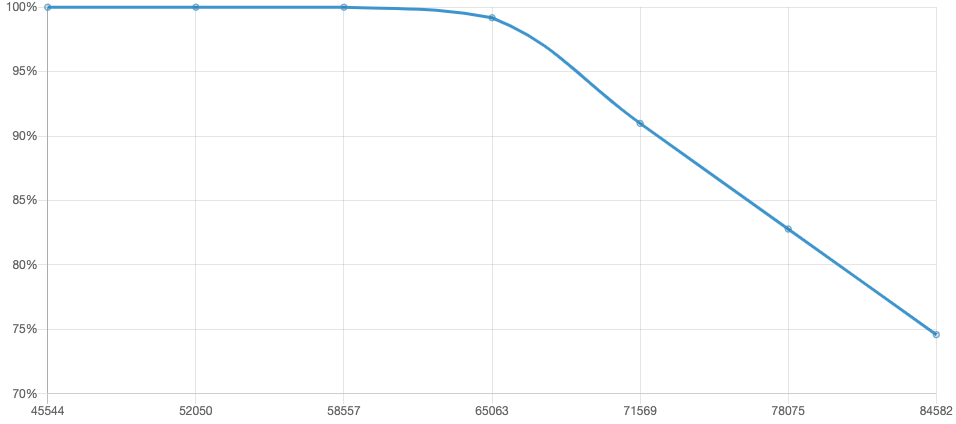

A spending level of $65,063 provided a success rate of 99.2% (122 total cycles, of which 1 failed). This spending level is 8.25% of your starting portfolio. (Your spending is assumed to come from any Social Security and pensions you entered, as well as from the portfolio.)

Here’s the graph:

Scenario #3 is also good news! If Jenny and Will are able to reduce their annual spending to $65,063, they’d have a 99.2% chance of not running out of money in retirement. At $58,557 per year, they’d have a 100% success rate.

Reducing their spending would enable them to reach their goals of:

- Will retiring at age 60

- Paying for their children’s college educations

- Not running out of money in retirement

Jenny’s Question #4: How do we save an emergency fund? I used to be so good with money, but lately I feel as though we’re drowning in expenses.

I agree with Jenny that this should be a top priority. They only have $1,500 in savings, which is a dangerous position. If Will were to unexpectedly lose his job, they’d only be able to cover a tiny fraction of their monthly spending.

I agree with Jenny that this should be a top priority. They only have $1,500 in savings, which is a dangerous position. If Will were to unexpectedly lose his job, they’d only be able to cover a tiny fraction of their monthly spending.

The standard emergency fund advice is to have three to six months worth of your expenses saved in an easily-accessible checking or savings account. At their current rate of spending, that’d be $19,785 ($6,595 x 3) to $39,570 ($6,595 x 6). However, I really encourage Jenny and Will to try and reduce their monthly spending. Then, they’ll be able to target saving a smaller emergency fund.

Other Notes

1) I question the HSA decision.

I know that some folks espouse the idea of hacking an HSA because of the tax advantages, which I get. But, it’s a complicated, potentially risky thing because it has to be used for qualified medical expenses:

- you have to be certain you’re going to spend this much in qualified medical expenses

- you have to save all of your medical expenses receipts for decades

- you have to hope that the laws governing HSAs don’t change

It’s not so much that this is a “bad” financial decision, it’s just kind of a quirky, secondary one that should take a back-seat to standard priorities, such as:

- Saving up an emergency fund

- Saving for retirement

- Saving for college

If a person has maxed out ALL other possible tax-advantaged accounts, has no debt, has an emergency fund, has a robust taxable investment account, a fully-funded retirement, etc, then the HSA hack is probably a fine thing to do. What concerns me in Jenny and Will’s case is how much money is sitting in this HSA while their other financial priorities suffer.

2) Look into getting a high-yield savings account.

For the awesome emergency fund Will and Jenny are going to save up, they should leverage their savings by choosing a high-yield account such as the American Express Personal Savings account, which–as of this writing–earns 1.15% in interest (affiliate link).

Summary:

Have a conversation about the family’s long-term financial priorities:

Have a conversation about the family’s long-term financial priorities:

- Is spending on the Big Four the #1 priority?

- Is paying for the kids’ college the #1 priority?

- Is Will retiring at 60 the #1 priority?

- Based on the outcome of that conversation, adjust your spending and savings to align with these priorities, in their order of importance.

- Utilize the FIRECalc to model different scenarios.

- Re-assess the use of the HSA as an investment vehicle. Consider instead spending it on your existing medical expenses and funnel the money you would put in the HSA into an emergency fund.

- Encourage oldest kid to begin researching college options, scholarships and financial aid possibilities.

- Sign-up for Personal Capital or some other free expense tracking service (affiliate link).

- Take the free Uber Frugal Month Challenge to help identify your financial goals and areas for improvement.

- Save up an emergency fund calibrated on your monthly spending. Look into putting this into a high-yield account, such as the American Express Personal Savings account (affiliate link).

- Take a deep breath and be thankful to yourself for embarking on this difficult process. I know these are hard choices to make, but you should feel confident in your ability to forge a solid financial future. Very well done!

Ok Frugalwoods nation, what advice do you have for Jenny? We’ll both reply to comments, so please feel free to ask questions!

Would you like your own case study to appear here on Frugalwoods? Email me (mrs@frugalwoods.com) your brief story and we’ll talk.

Never Miss A Story

Sign up to get new Frugalwoods stories in your email inbox.