Are you a trusted business advisor or a trusted technical advisor? Many CPAs think of themselves as the former, but they spend most of their time on compliance-related services, which are rapidly being commoditized. When asked why they continue to focus their efforts on these services, most respond that they don’t have the time (capacity) or don’t feel as comfortable providing advisory services that are performance- or strategic-based. Their experience and training have focused on after-the-fact accuracy, and the data/facts.

The changes necessary to move to advisory services generally happen over the long term. Therefore, many CPAs tend to talk about the need to change, but often do little to change. This procrastination is a big challenge for many firms. “Why should we change? Partner income is at or near an all-time high” is the comment I hear from many partners. Sorry, but partner income can be a meaningless metric when it comes to firms’ sustainable success and future-readiness. This answer generally may disclose a capability issue requiring additional skills like project management, marketing/messaging, data analytics, and sales.

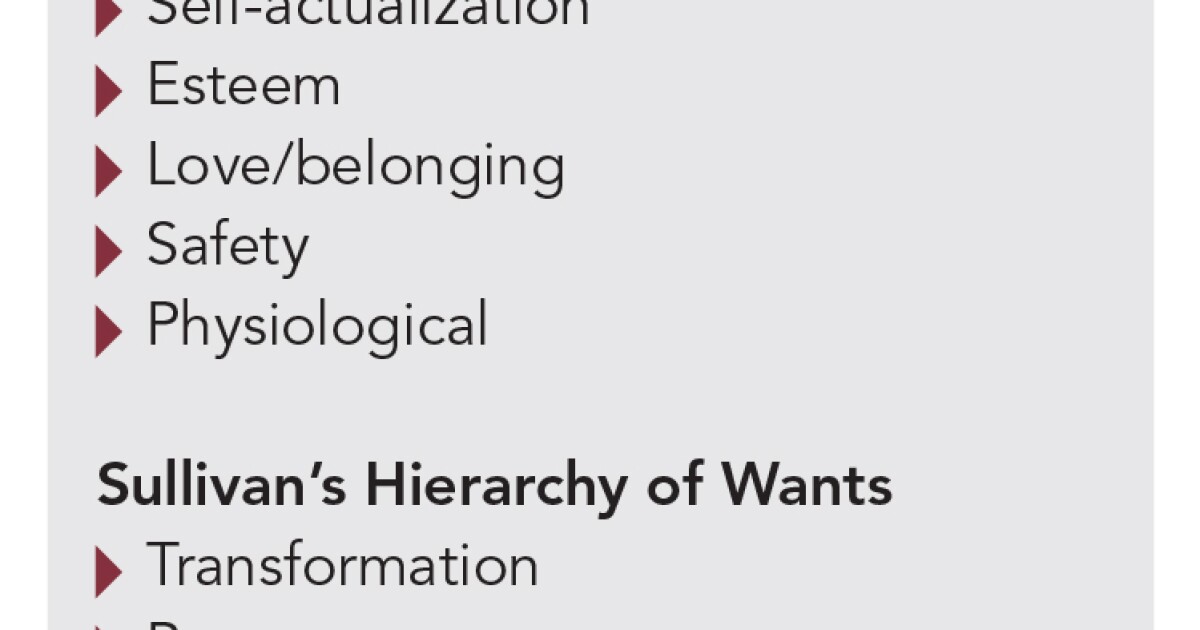

Why are advisory services so important? You have probably heard of Maslow’s hierarchy of needs but have you ever considered the hierarchy of wants? Dan Sullivan, founder of Strategic Coach, states, “The hierarchy of wants is what drives transformation and entrepreneurship.” Jean-Baptiste Say, a French economist from the early 1800s, defined an entrepreneur as someone who takes resources from a lower to a higher level of productivity.

The accompanying table (see “Needs vs. wants”) explains why clients are willing to pay higher fees for more valuable services. However, it doesn’t explain why moving from compliance to strategic-based services to the higher-valued services is such a challenge for our profession. People frequently ask me how to make progress toward the higher-valued services. Before I can respond, they provide their own answers. They tend to focus on capabilities and often the firm leader will say, “Our people just don’t have the experience and skills to offer advisory services.” Some, none, or all the above may be true, but to get to the next level you must change your mindset and focus on the future. Packaging and pricing services (transactional, compliance, advisory and consulting) also requires a change in mindsets, skill sets and toolsets. This brings us to the four Cs.

Capability

First, ask yourself if you truly want to provide higher-valued advisory services. Surprisingly, some accountants do not, and that is fine. However, most firms and many CPAs will quickly answer “Yes.” As we discuss further, they often admit they are currently including advisory services with compliance services and offering free or discounted advice because they don’t know how to charge other than by the hour. Clients, on the other hand, recognize that CPAs often give away the most valuable advice while charging higher rates for compliance work. To put it another way, CPAs focus mainly on capability and not the business model. They typically don’t focus on packaging, pricing and delivering a unique client experience.

Most CPAs are capable. In fact, too often they try to be rugged individualists and overplay their role when they should delegate or refer to others with different expertise. Advisory and consulting services are team sports. Perfection and accuracy are honorable compliance traits, but are not valued as highly as vision, relevance and real-time information by the client. Hindsight, insight and foresight create innovation, and that is what clients value.

Commitment

Sullivan states that to make a change, you must have commitment. In our profession, commitment is often confused with risk, boldness and even over-confidence. It is easier to wait for compliance work to come knocking on your door than to compete for advisory and consulting services, but waiting will not get you where you need to be. Firms are being forced to think differently. Mindset can be a challenge as many accountants direct their thinking toward the skill sets and toolsets.

Courage

Courage affects your ability to accept and manage risk. Many people are not capable of dealing with risk and demonstrating courage during difficult times. Leaders must show courage and confidence in challenging times. You’ve heard the old story about the entrepreneur who was asked how he slept last night and replied, “Just like a baby: I woke up every two hours and cried.” It’s a true story. Leadership is imperative in advisory and consulting services, but there are ways to test and predict who these leaders will be early in their careers.

Confidence

Confidence comes with success and accelerates the ability to learn and grow. Its importance cannot be overstated, and it should be part of your culture. Just remember that confidence is different from arrogance.

Focusing on the needs of clients will always create opportunities for firms. However, changes in services require firms to change their thinking, skill sets and processes to remain future-ready and successful. It will also require difficult management decisions regarding governance, talent, clients, technology and compensation. Technology and the cloud have created great opportunities in a real-time digital world. Clients use social media, online bill payment, banking and accounting, mobile devices, cloud storage for documents, data analytics and more. Most firms are also small businesses, just like their clients.

- Are you prepared for these changes internally?

- Do you have services that are no longer relevant or profitable?

- Are you ready to meet the needs of your clients?

- Who is responsible?

- What is your vision and plan?

- To whom have you communicated the vision and plan?

These questions can be addressed through the visioning and strategic planning process. Don’t procrastinate. Demonstrate commitment and develop your plan now! Think — plan — grow!