Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Joe Biden and Xi Jinping will hold a telephone call today, according to a US official, as tensions escalate over the planned visit to Taiwan by Nancy Pelosi, the Speaker of the House of Representatives.

The planned call would be only the fifth conversation between the two leaders since Biden became US president 18 months ago. Biden and the Chinese president had been expected to discuss many contentious issues, from military challenges to technology competition. But those plans have been complicated by Pelosi’s intended visit to Taiwan in August.

The Financial Times reported last week that the 82-year-old Democrat planned to travel to Taiwan in a show of support as it comes under rising pressure from China, which claims sovereignty over the island. Beijing has privately issued harsh warnings suggesting a possible military response if Pelosi proceeds with the trip.

The White House is extremely concerned that her visit could spark a crisis across the Taiwan Strait. Biden has sent top officials, including national security adviser Jake Sullivan, to explain the risks. But that has been complicated by the fact that Congress is independent and he has no formal power to block her visit.

-

Opinion: US and China are entering a trap of their own making. The costs of miscalculation by either side would be lethal, and the risks are only growing, writes Edward Luce.

Five more stories in the news

1. Fed raises rates by 0.75 points for second month in a row At the end of its two-day policy meeting, the Federal Open Market Committee lifted the target range of the federal funds rate to 2.25 per cent to 2.50 per cent. The decision, which had unanimous support, extended a string of interest rate increases that began in March and have ratcheted up in size as the Federal Reserve’s battle to fight inflation intensifies.

2. South Korea probes crypto-linked forex transactions Regulators are investigating $3.1bn worth of “abnormal” foreign exchange transactions at two of the country’s biggest commercial banks for possible money laundering linked to crypto investments.

3. European gas price rise accelerates European gas prices have jumped after Russia followed through on its threat to make deepening cuts in gas supplies to the region. Prices rose as much as 13 per cent as flows on the Nord Stream 1 pipeline were cut to just a fifth of normal capacity.

4. Facebook parent Meta reports first decline in revenue Meta reported its first revenue decline in the second quarter, laying the blame at macroeconomic pressures and offering investors a gloomy outlook for the coming months. Meta, formerly known as Facebook, is the latest big online advertising player to wilt as advertisers pulled back on spending.

5. Singapore’s GIC warns of hard year ahead Singapore state fund is directing money towards real estate and other inflation-protecting assets as it prepares for several years of disruption from rising prices. In an interview with the Financial Times, GIC’s management said that soaring inflation could reverse gains it had made in recent years.

The day ahead

French president meets Saudi crown prince Emmanuel Macron will meet Mohammed bin Salman in Paris today amid Europe’s continued energy crisis. The trip is part of the crown price’s first trip to Europe since the killing of Jamal Khashoggi. (Politico EU)

Earnings The marathon of corporate earnings continues. We’ll have our eye on Amazon, Apple, Barclays, Nissan Motor, Panasonic, Pfizer and more. European supermajors in particular — BP, Shell and TotalEnergies — are expected to report bumper profits over the next week.

What else we’re reading and listening to

The white elephants stoking fury over Sri Lanka’s debt crisis The Rajapaksas lavished spending on vanity projects that are rotting away in the heat. Today, the unpaid debts and mounting maintenance costs reflect the problems faced by Ranil Wickremesinghe as the incoming president prepares to institute painful reforms.

-

Listen: In this week’s episode of Behind the Money, the FT’s Antoni Slodkowski shares what he’s seen after a week of reporting in Sri Lanka.

How bad will the global food crisis get? Food commodity prices are falling, but experts say global production and hunger rates might be even worse in 2023. The war in Ukraine is only one of a multitude of problems that could sustain higher hunger rates for many years to come.

Shrimsley: Truss is the right choice for this Conservative party Today’s Conservative party dislikes hard choices. And this is a problem for Rishi Sunak, because the former chancellor has decided to make facing up to them his key pitch to succeed Johnson. The cakeist candidate is Liz Truss and she is prepared to go full gateau if it gets her to the top.

To combat disease, look beyond the Kardashian of proteins If there were a celebrity hierarchy of proteins, P53 would be its Kim Kardashian. The protein scuppers tumour growth: a lack of P53 — for example — predisposes a person to cancer. While P53 is unquestionably important to health, it is also a beneficiary of the “street light effect”, in which a phenomenon that is already illuminated attracts further attention.

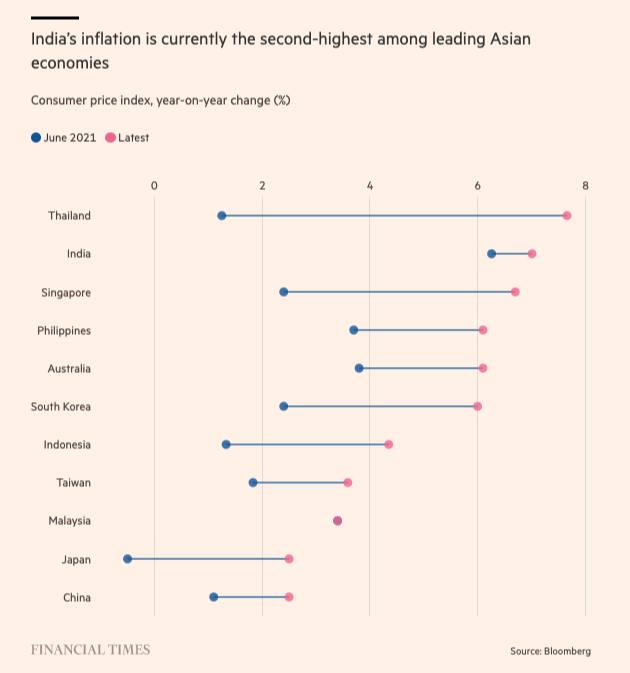

India’s roaring post-pandemic recovery at risk from inflation In a country that has traditionally maintained close ties with Moscow, Narendra Modi’s government has been buying Russian oil at a discount despite US and European sanctions over Vladimir Putin’s invasion of Ukraine. This has not been enough, however, to cushion the energy shock.

Books

Former Fed chair Ben Bernanke and historian Edward Chancellor offer conflicting perspectives on the crisis in central banking in two new books reviewed by Martin Wolf. “Chancellor has written an overheated and unbalanced polemic,” Martin writes. “Yet this does not altogether vindicate Bernanke’s managerialist perspective.”

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.