The U.S. economy definitively slowed in the first half of 2022 as the Federal Reserve tightened financial conditions. Real GDP fell for the second straight quarter, while the Fed raised interest rates by 75 basis points for the second consecutive month to reduce inflation pressure. Despite these negative elements, the job market remained solid amid inflation concerns and growing recession fears.

However, while an “official” recession will be called by the NBER, a housing downturn is clearly underway. The NBER definition of a recession requires a broad range of economic variables to show declines, including economic growth and labor market conditions. Such a call if often made quarters after the recession has begun. Nonetheless, during the second quarter of 2022 the housing component of GDP exerted the largest drag on headline GDP growth, excepting the second quarter of 2020, since the third quarter of 2010.

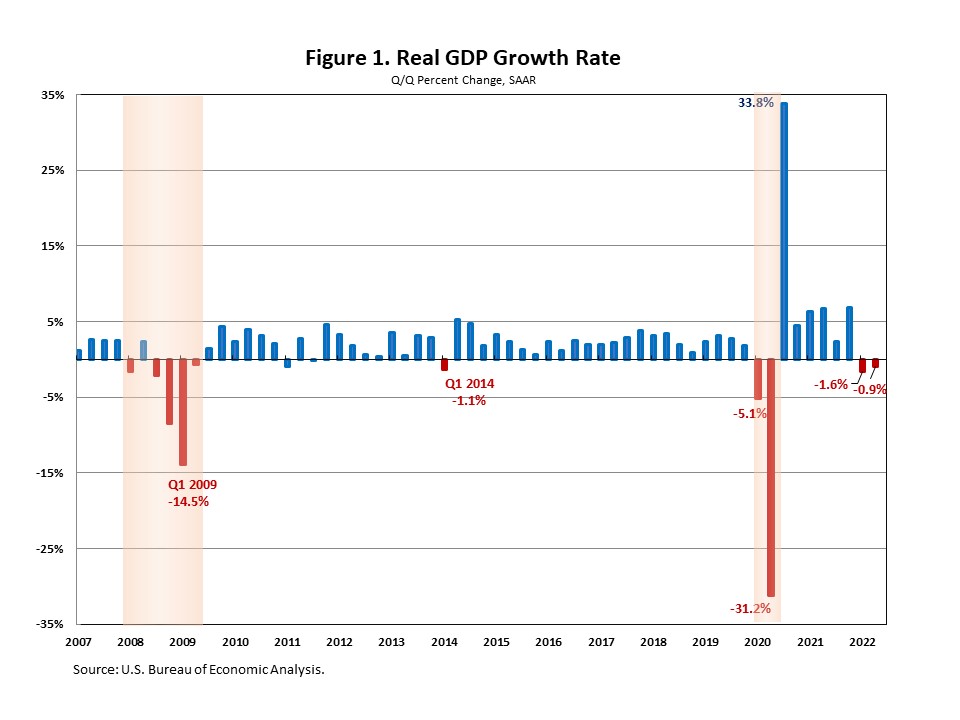

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) decreased at an annual rate of 0.9% in the second quarter, following a 1.6% decrease in the first quarter of 2022. It is the second consecutive quarter of negative growth. This quarter’s decrease reflected decreases in private inventory investment, residential fixed investment, federal government spending, and state and local government spending, partially offset by increases in exports and personal consumption expenditures (PCE).

In the second quarter, private inventory investment declined by $107 billion, subtracting 2.0 percentage points from GDP growth.

Both nonresidential fixed investment (-0.1%) and residential fixed investment (RFI) (-14.0%) dropped in the second quarter. The decrease in nonresidential fixed investment reflected decreases in structures and equipment, which were mostly offset by an increase in intellectual property products (+9.2%). Within residential fixed investment, single-family structures declined 4.2% at an annual rate, multifamily structures declined 5.6% and other structures (specifically brokers’ commissions) decreased 22.2%.

Meanwhile, federal government spending decreased 3.2% in the second quarter, reflecting a decrease in nondefense spending on consumption expenditures, while state and local government spending declined 1.2%, led by a decrease in investment in structures.

Imports, which are a subtraction in the calculation of GDP, increased due to an increase in services (+21.2%).

Consumer spending rose at an annual rate of 1.0% in the second quarter, compared to a 1.8% increase in the first quarter. Expenditures on services increased 4.1% at an annual rate, while goods spending decreased 4.4% at an annual rate, led by food and beverages (-11.7%).

Net exports rose by $70 billion in the second quarter, contributing 1.4 percentage points to GDP growth.

Related