Not every investor wants to self-manage their taxable and retirement portfolios. Managing your portfolio requires time to research investments and rebalance.

Vanguard Personal Advisor Services can give you peace of mind as you have financial advisor access and a managed portfolio when you can invest at least $50,000.

Here is a closer look at how the service works and what hands-on support you can expect.

Summary

Vanguard can manage your taxable and retirement accounts with at least $50,000 in managed assets. You also get unlimited financial advisor access and a personalized financial plan. The advisory fees and investment minimum is lower than most similar services.

-

Financial planning services

4.5

Pros

- Low advisory fee

- Unlimited advisor access

- Automatic rebalancing

Cons

- $50,000 minimum investment

- Takes several weeks to start

- Must transfer non-Vanguard assets

What is Vanguard Personal Advisor Services?

Vanguard Personal Advisor Services offers managed investment accounts and unlimited access to a fiduciary, non-commission financial advisor when you have a $50,000 minimum account balance.

You can upgrade to this service if you currently have self-directed accounts with the brokerage.

In addition to unlimited financial advisor access, you will receive a personalized investment plan for your taxable and retirement accounts. Vanguard rebalances your portfolio similar to a robo-advisor.

This service has an annual advisory fee of 0.30% which is competitive with other managed investing platforms. The annual fee and investment minimum are lower than other options offering human advisor services.

Who is Vanguard Personal Advisor For?

Consider Vanguard if you want a low-cost passive investment strategy primarily consisting of stock and bond index funds. Your model portfolio won’t be for short-term trades or investing in the latest trends and hot stock tips.

This service is ideal for people who want to invest in Vanguard funds with hands-on support. You will need $50,000 in investable assets to qualify.

The Vanguard advisor can help you plan for significant life events and also help you determine if you’re currently investing enough to achieve your financial goals.

Even if you are not a loyal Boglehead, the $50,000 minimum investment can be lower than other services that cater to investors with a high net worth to provide financial advisor access.

How it Works

Here is a step-by-step look at how to invest with Vanguard Personal Advisor.

Initial Account Setup

First, you create an account online or by phone.

Some of the basic details you will provide:

- Financial needs and goals

- Timelines to achieve your goals

- Non-Vanguard asset details

After launching your account and providing the above information, you can schedule a financial advisor meeting.

If you currently don’t invest with Vanguard, you must be willing to transfer your qualifying assets to Vanguard to open a managed portfolio.

You may need to sell some of your external assets. However, the service may let you keep certain investments if you’re not ready to sell for tax reasons. The initial portfolio consultation can help you determine if your existing portfolio is a good fit for this platform.

Meet with a Financial Advisor

You can speak with a financial advisor online to review your current portfolio and financial priorities. The advisor may ask additional questions to help customize your plan.

It will take several weeks for the financial advisor to build your customized plan to review in a follow-up session.

The advisor is a fiduciary and will make a financial plan and recommend assets that fit your best interest. Vanguard advisors are also non-commissioned and will not try to upsell you unnecessary services or fee-heavy funds to boost their salary.

Financial Plan

Your customized financial plan will recommend a personalized investment portfolio for various Vanguard stock and bond funds.

The advisor can also help create a roadmap for your other financial goals.

In particular, your plan can focus on your top financial priority.

Your primary financial priority might be the following:

- Short-term goals

- Can retire on time

- Living well in retirement

- Preserving wealth for your future generations

A computer algorithm recommends your model investment portfolio. You and the advisor can suggest minor adjustments to optimize your tax situation and avoid investments you don’t want to hold.

After you approve the initial plan, Vanguard conducts a quarterly review and rebalances when necessary. You can also request on-demand meetings with an advisor.

Supported Accounts

You must have at least $50,000 in managed assets at Vanguard to qualify for this service.

The platform can monitor the Vanguard and non-Vanguard accounts you self-monitor to see your whole financial situation.

Some of the supported accounts include:

- Individual accounts (mutual funds or brokerage)

- IRAs

- Trust accounts

- Employer-sponsored plans

If you only want Vanguard to manage your employer retirement accounts, the minimum balance requirement is $250,000.

Vanguard cannot manage these investment accounts:

- Ineligible 401k and 403b plans

- i401k accounts

- 529 accounts

- Custodial UGMA/UGTA accounts

- Investment accounts outside of Vanguard

Real-Time Tracking

You can view your account balances and financial plans online between financial advisor checkups.

Several other online planning tools are available for use too.

It’s also possible to schedule deposits and withdrawals. Your advisor can make sure the transaction completes smoothly and adjusts your portfolio accordingly.

Vanguard Personal Advisor Services Fee

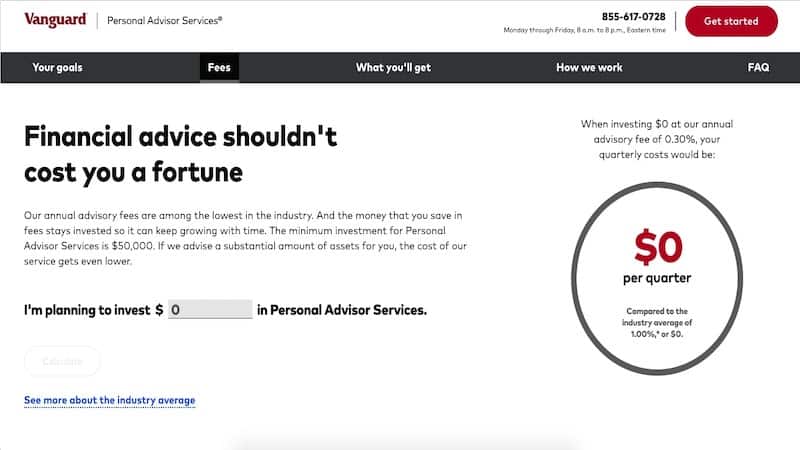

You will pay a 0.30% annual advisory fee that covers the advisor sessions and portfolio management. Investors with a substantial balance can pay lower fees.

This fee is similar to robo-advisors that don’t offer financial advisor access.

Competing services tend to charge between 0.40% and 1%. These other services are more likely to require at least $100,000 in managed assets to provide human advisor contact.

Investment Expense Ratios

In addition to the annual advisory fee, you will also pay mutual fund and ETF expense ratios as any brokerage passes onto the investor.

Vanguard funds typically have low fees that are competitive with other fund providers.

However, your advisor may recommend an actively managed mutual fund with a minimum 0.40% annual expense ratio.

While this fee isn’t excessive for an active fund, it can be higher than similar non-Vanguard ETFs other robo-advisors may recommend.

Investment Options

The service will recommend Vanguard ETFs and mutual funds for stocks and bonds. The funds may be passive index funds or actively managed funds.

Mutual funds and ETFs can make it easier to diversify your portfolio and minimize your investment costs and capital gains taxes.

Some of the investment themes include:

- US stocks and bonds

- Foreign stocks and bonds

- Socially responsible investing

- Target retirement funds

You should still use a self-managed brokerage account to invest in individual stocks. Your advisor can track this account.

Most of the funds are available to all Vanguard investors. The service also offers several Advice Select funds with active strategies only Personal Advisor clients can invest in.

Vanguard Total Market Index Funds

While this service can invest in various passive and active funds, the Vanguard Total Market stock and bond index funds are most of the portfolio for most investors.

The Total Market stock and bond index funds are the Vanguard funds with the most holdings and very low expense ratios.

So, instead of getting an S&P 500 index fund for domestic stocks, your model portfolio will likely recommend the Vanguard Total Stock Market Index Fund instead. This fund gives you exposure to mid-cap and small-cap equities too.

Your advisor can recommend the mutual fund or ETF version depending on whether you have a Vanguard mutual fund or brokerage account.

Vanguard Personal Advisor Features

Here are some of the best perks of using this investment service.

Financial Advisor Access

You have on-demand access to a financial advisor Monday through Friday from 8 am to 8 pm Eastern.

You can schedule an online or phone consultation to review your portfolio and financial goals.

Some of the goals an advisor can help you with include:

- Saving for retirement

- College

- Buying a home

- Starting a business

- Withdrawing retirement and Social Security funds

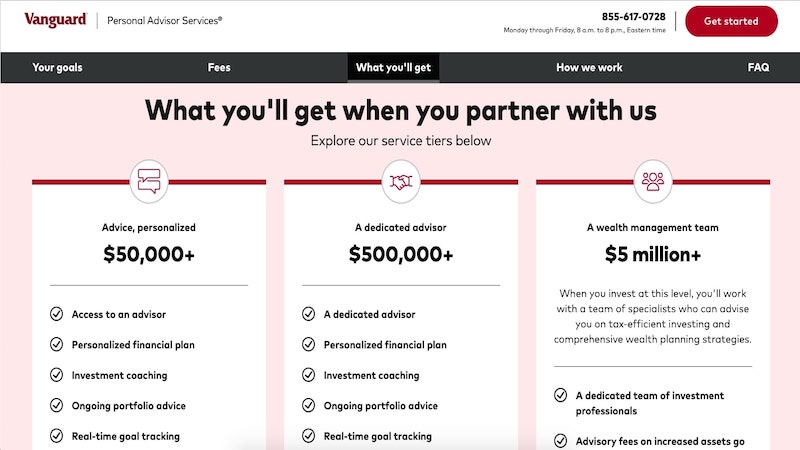

Portfolios smaller than $500,000 have access to an advisory team. You get a dedicated advisor once your balance exceeds $500,000.

There is no additional cost for these meetings.

Managed Portfolios

The Vanguard robo-advisor manages your investment portfolio and rebalances positions that drift at least 5% from their target allocation.

A human advisor won’t manually rebalance your portfolio but can provide a quarterly review. You can ask your advisor questions about your current holdings and the possibility of changing your investment strategy.

These factors can influence your personalized asset allocation:

- Investing goal

- Investment horizon

- Risk tolerance

- Current financial assets

Automatic Rebalancing

As Vanguard Personal Advisor Services is a robo-advisor service, the platform rebalances your portfolio when necessary to maintain your target asset allocation.

The brokerage will purchase under-allocated positions with your new funds. The service will only sell holdings when necessary to prevent taxable transactions.

Unfortunately, the brokerage currently doesn’t offer tax-loss harvesting for non-retirement accounts.

Automatic Deposits

You can schedule automatic deposits to invest new cash and have more opportunities to achieve your financial goals.

The service can recommend a minimum monthly deposit so you can meet your financial goals.

Tax-Optimized Investing

This service can also make it easier for you to invest with a tax-optimized strategy. You can find tax-friendly investments by yourself but an advisor can set up this portfolio sooner.

Retirement Simulator Tool

When building your initial plan and during the portfolio checkups, you can use the platform’s investment simulator to test the success probability of your investment strategy.

This simulator will apply bullish, bearish and neutral situations to estimate your long-term portfolio value.

Vanguard Personal Advisor Alternatives

These platforms may be a better fit for your investment strategy or financial planning needs.

Personal Capital

Personal Capital offers managed investment portfolios with a minimum $100,000 balance. Your personalized portfolio holds ETFs and balances above $200,000 can hold individual stocks.

You also have access to a financial advisory team but the advisory fees start at $0.89% on the first $1 million.

The service also offers a free net worth tracker and investment analysis tools to monitor your accounts at several brokerages.

Betterment

Two different robo-advisor investment plans are available with Betterment. The platform offers several investment strategies that can be a better fit for your investment goals.

The Digital plan has a 0.35% annual advisory fee and no minimum account balance. Unfortunately, you don’t get on-demand access to advisors but can purchase one-time advice packages.

With a minimum $100,000 investment balance, you qualify for the Premium plan and have unlimited phone and email access to the CFP team.

Blooom

Blooom can manage most IRA and workplace retirement plans, regardless of the brokerage. Consider this option if you want help managing your investments and a free portfolio analysis.

Three monthly plans are available and your account management and advisor options depend on which plan you choose. Your yearly fee is between $45 and $250.

You can also get financial advisor access by email or live chat. This feature may not be as hands-on as Vanguard and other alternatives.

For your managed account, you can have Blooom recommend a model portfolio. Then, you can either make the changes or pay to have Blooom place the trades on your behalf.

FAQs

Here are some answers to several questions you may have about Vanguard Personal Advisor Services.

You will pay a 0.30% annual advisory fee for your managed assets.

The fee can be lower for high account balances but Vanguard doesn’t list this amount or discounted rate on their website.

Like other robo-advisor services, you will also pay the expense ratios for mutual funds and ETFs.

You will need at least $50,000 to invest with Vanguard Personal Advisor Services.

Vanguard also offers a Digital Advisor program with a $3,000 minimum account balance. The advisory fee is lower and similar investment options. Unfortunately, you won’t get access to a financial advisor.

No, this service doesn’t provide tax-loss harvesting but can recommend investments with a lower tax burden.

Vanguard is one of the oldest and most popular online stock brokerages. Their fees and investment options are competitive with other reputable brokers.

Your advisor is a non-commissioned fiduciary that recommends investments with your best interest in mind.

In general, you can expect your personalized portfolio to invest in index funds with low expense ratios and broad diversification that meet your investment horizon and risk tolerance.

However, managed investment portfolios are not risk-free and subject to ordinary stock market losses.

Summary

Vanguard Personal Advisor Services has the lowest advisory fees and investment minimums for a managed account with unlimited financial advisor access.

Being able to start a smaller account balance lets you get hands-on help earlier in your investing career.