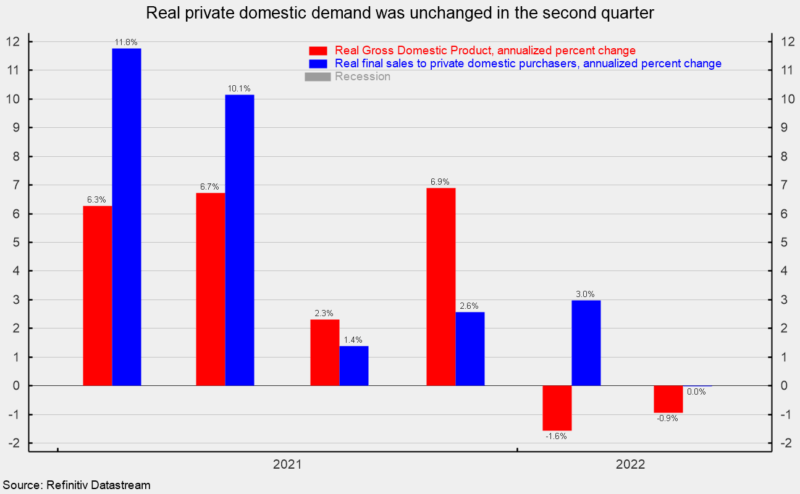

Real gross domestic product fell at a 0.9 percent annualized rate in the second quarter versus a 1.6 percent rate of decline in the first quarter (see first chart). Over the past four quarters, real gross domestic product is up 1.6 percent.

Real final sales to private domestic purchasers, a key measure of private domestic demand, has shown greater resilience. It was unchanged in the second quarter following a 3.0 percent pace of increase in the first quarter (see first chart). Over the last four quarters, real final sales to private domestic purchasers are up 1.7 percent. The data shown in the current report are based on incomplete information and will likely be revised in subsequent releases.

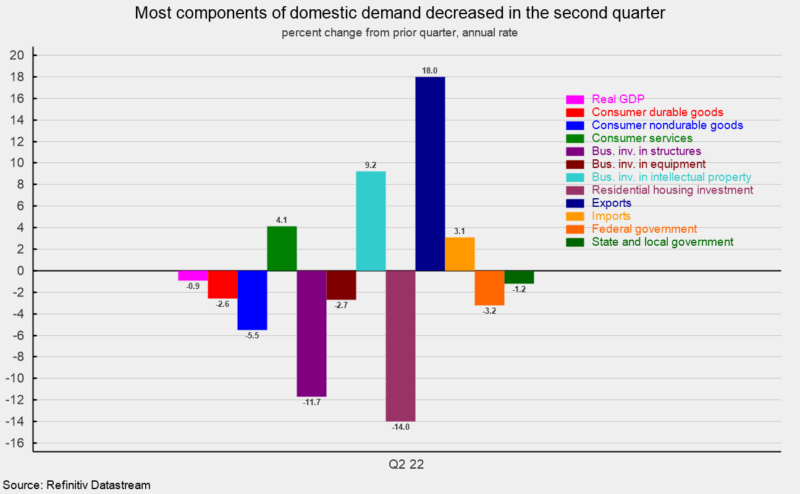

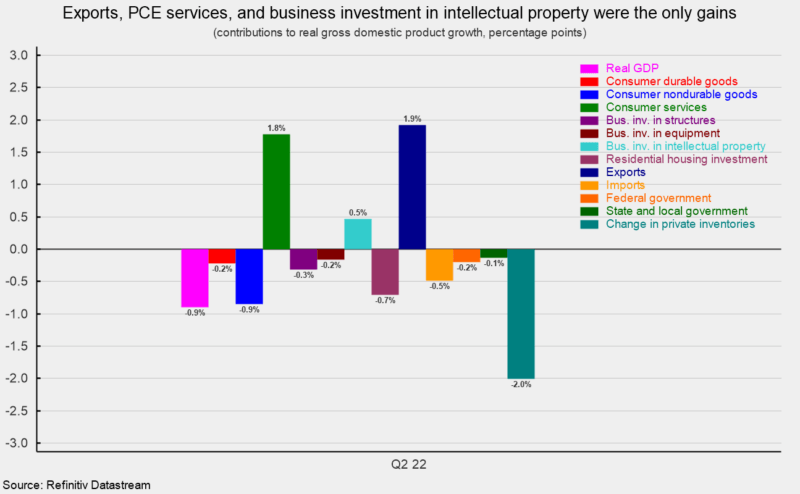

Declines were widespread in the second quarter. Among the components, real consumer spending overall rose at a 1.0 percent annualized rate, the slowest pace since the lockdown recession, and contributed a total of 0.7 percentage points to real GDP growth. Consumer services led the growth in overall consumer spending, posting a 4.1 percent annualized rate, adding 1.78 percentage points to total growth. Durable-goods spending fell at a 2.6 percent pace, subtracting 0.22 percentage points while nondurable-goods spending fell at a -5.5 percent pace, subtracting 0.85 percentage points (see second and third charts). Within consumer services, growth was broadly strong, led by food services and accommodation (13.5 percent), recreation (7.4 percent), and other services (6.6 percent growth rate).

Business fixed investment decreased at a 0.1 percent annualized rate in the second quarter of 2022, subtracting 0.01 percentage points from final growth. Intellectual-property investment rose at a 9.2 percent pace, adding 0.47 points to growth while business equipment investment fell at a -2.7 percent pace, subtracting 0.16 percentage points, and spending on business structures fell at an 11.8 percent rate, the fifth decline in a row, and subtracting 0.32 percentage points from final growth.

Residential investment, or housing, fell at a 14.0 percent annual rate in the second quarter compared to a 0.4 annualized gain in the prior quarter. The drop in the second quarter subtracted 0.71 percentage points (see second and third charts).

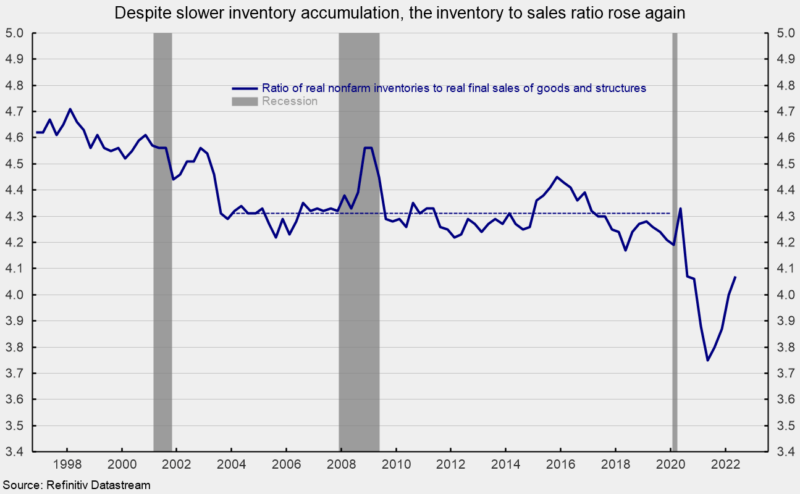

Businesses added to inventory at an $81.6 billion annual rate (in real terms) in the second quarter versus accumulation at a $188.5 billion rate in the second quarter. The slower accumulation reduced second-quarter growth by a very sizable 2.01 percentage points (see third chart). The inventory accumulation helped boost the real nonfarm inventory to real final sales of goods and structures ratio to 4.07 from 4.0 in the first quarter; the ratio hit a low of 3.75 in the second quarter of 2021. The latest result is still below the 4.3 average for the 16 years through 2019 but suggests further progress towards a more favorable supply/demand balance (see fourth chart).

Exports rose at an 18.0 percent pace while imports rose at a 3.1 percent rate. Since imports count as a negative in the calculation of gross domestic product, a gain in imports is a negative for GDP growth, subtracting 0.49 percentage points in the second quarter. The rise in exports added 1.92 percentage points. Net trade, as used in the calculation of gross domestic product, contributed 1.43 percentage points to overall growth. Government spending fell at a 1.9 percent annualized rate in the second quarter compared to a 2.9 percent pace of decline in the first quarter, subtracting 0.33 percentage points from growth.

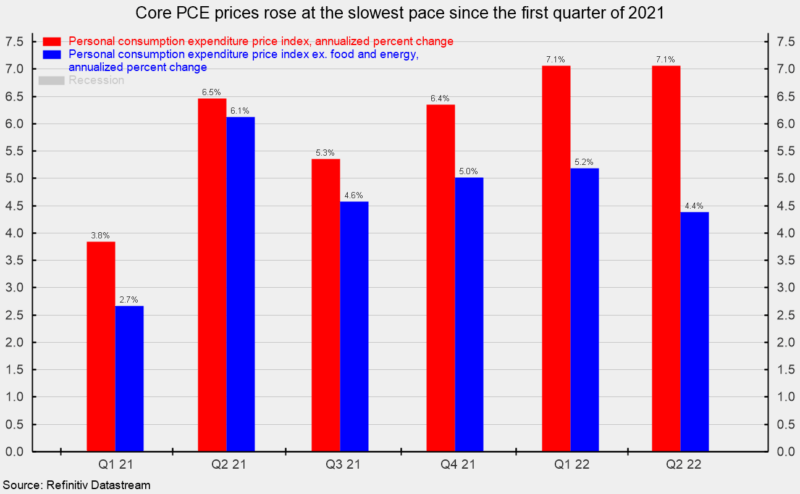

Consumer price measures showed another rise in the second quarter. The personal-consumption price index rose at a 7.1 percent annualized rate, matching the first quarter. From a year ago, the index is up 6.5 percent. However, excluding the volatile food and energy categories, the core PCE (personal consumption expenditures) index rose at a 4.4 percent pace versus a 5.2 percent increase in the first quarter and is the slowest pace of rise since the first quarter of 2021 (see fifth chart). From a year ago, the core PCE index is up 4.8 percent.

Lingering materials shortages, labor constraints, and logistical problems are sustaining upward pressure on prices, though some progress is being made. Upward price pressures have resulted in an intensifying Fed policy tightening cycle (the Fed Funds target rate is now 2.25 percent to 2.50 percent following the second 75-basis-point hike in eight weeks and matching the peak rate from the last tightening cycle), raising the risk of a policy mistake. In addition, fallout from the Russian invasion of Ukraine continues to impact capital and commodity markets, as well as global supply chains. Furthermore, 2022 is a Congressional election year. Intensely bitter partisanship and a deeply divided populace could lead to turmoil as confidence in election results come under constant attack. Contested results around the country could lead to additional economic disruptions and government paralysis, again testing the durability of democracy and the union itself. Caution is warranted.