Low interest rates are great if you want to borrow money, but not too helpful when you are trying to save it.

At your typical bank, you’ll be lucky to get even .10% interest on money placed in a savings account. Even long-term CDs aren’t very lucrative.

Fortunately, there are some online banks that offer better-than-average interest rates. One of those is CIT Bank.

Summary

The CIT Bank Savings Builder account is a very fine option for people looking to get a little bit more return on their cash savings. Its interest rates for high-balance customers are among the best in the nation.

-

Long Term Savings Gains

4.5

Pros

- Competitive Interest Rates

- Long Term Savers

Cons

- No CIT Bank ATMs

- Minimums

What is CIT Bank?

Before you deposit money in any bank, it’s helpful to know about the company. CIT Bank is a subsidiary of CIT Group, a publicly-traded financial holding company based in Pasadena, CA.

CIT Group has a robust commercial financing segment, as well as a consumer banking segment that includes CIT Bank and OneWest Bank.

CIT is a shortened version of the company’s previous name, Commercial Investment Trust. The history of the company dates back to 1908.

After being acquired by Tyco in 2001, it was spun off and became a public company, CIT Group, in 2002.

CIT Group got in trouble in 2008 after being heavily involved in subprime mortgages. Financial problems led it to file for bankruptcy in 2009. After emerging from bankruptcy, CIT Group reformed and in 2015 acquired OneWest bank. And as of July 17, 2022, OneWest Bank branches and products have become First Citizens Bank branches and products.

In addition to offering the Savings Builder account, CIT Bank has a money market account, another high-yield savings account, certificates of deposit with terms ranging from six months to five years, and home loan products.

CIT Bank listed total deposits of $32 million with total assets of $42 million at the end of 2018, according to iBankNet.

CIT Bank Savings Builder Overview

CIT Bank Savings Builder offers one of the highest interest rates in the nation for those able to maintain a high balance or make regular deposits.

CIT Bank offers a competitive APY for those who can meet that criteria.

Thus, it’s a good option for two kinds of savers: those who have a lot of money saved already, and those who aren’t quite there yet but have the ability to regularly put away a decent sum every month.

If you can keep a minimum balance of $25,000 or make monthly deposits of at least $100, you can earn CIT Bank’s highest rate.

Even if you can’t meet either of those requirements, you can still earn an APY that’s up to three times higher than you would at most banks.

Let’s take a deep dive into the CIT Bank Savings Builder account to learn whether it’s a good option for you.

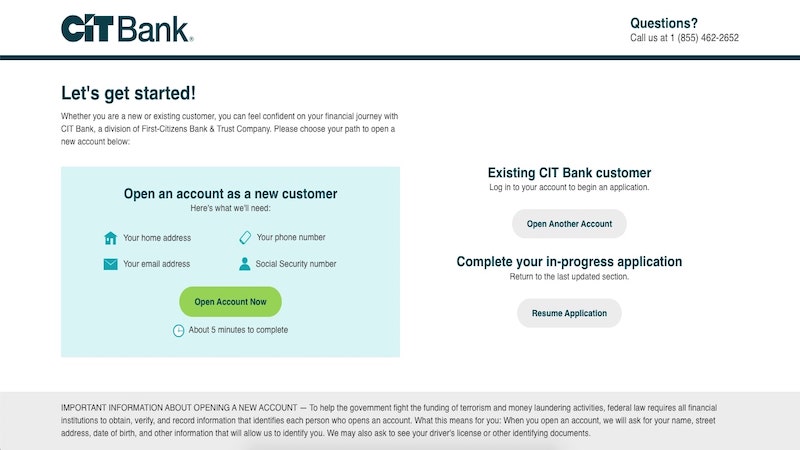

Opening a CIT Bank Savings Builder Account

Getting started is straightforward. Follow this link to the CIT Savings Builder Account and click on the green button that says, “Open an account.”

Then, click on the “I’m a new customer” button and you’ll see a list of required items to open an account.

They include:

- Valid email address

- Home address

- Phone number

- Social Security number

You also need to be a permanent resident or citizen to open an account. During the process, the bank will ask if you want to open an individual or joint account.

You’ll then be asked to enter the information listed above, as well as your citizenship status and (for security reasons) mother’s maiden name. Federal regulations also require you to provide your occupation and employer.

Once these details are entered, you’ll be asked to provide information on funding the account. The easiest way to do this is through an electronic transfer from another bank account.

However, you can also write a check or set up a wire transfer. Specific details on how to do this are on the FAQ section of the bank website.

Note: It is possible to open a Savings Builder account for a child using a custodial account. This means you can control the account until the child is 18, or as old as 25 if your state allows.

Under the Uniform Transfer to Minors Act, you can transfer as much money as you want into the account as a gift.

Important CIT Bank Features

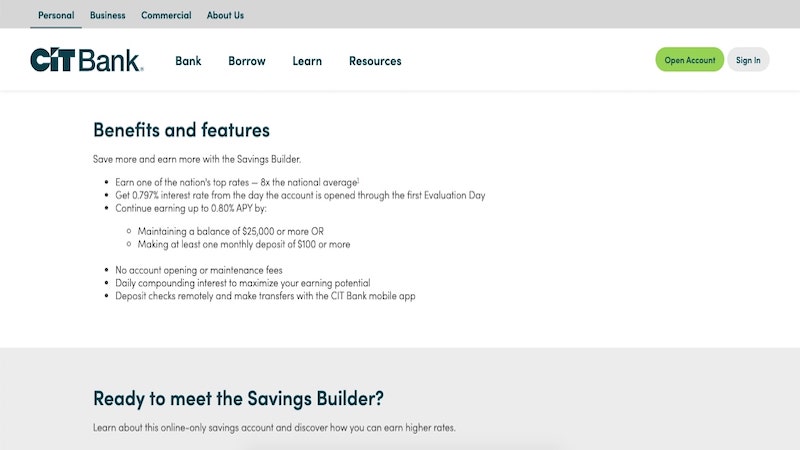

Here are some of the features of CIT Bank’s Savings Builder Account that make it really attractive.

Interest Rate

Let’s be honest: when you are shopping for a savings account, the thing that matters most is the interest rate.

You want to know how much passive income you can earn from your money.

The CIT Savings Builder account offers one of the highest interest rates for a savings account in the nation. They offer a competitive APY with a minimum balance of $25,000 or a $100 monthly deposit.

According to Bankrate.com, this is currently the best rate available for online savings accounts, though there may be money market accounts that pay slightly more.

The average interest rate nationally is just 0.10%, Bankrate says. CIT’s rate is significantly more than that.

The $25,000 minimum balance requirement for the Savings Builder account is high, but it can be waived if you deposit $100 per month into the account.

After an evaluation period, which ends on the fourth business day prior to the end of the month, the bank will determine whether you qualify for that rate moving forward.

If you do not meet the requirements for the highest interest rate, you will receive the base interest rate APY. Obviously, this is a noticeably lower rate, but still much higher than the national average.

Compounding

When analyzing bank interest rates, it’s best to look beyond just the number. You need to understand how the bank calculates interest rates and when it actually makes payments.

CIT Bank Savings Builder compounds interest daily.

What this means is that when calculating how much to pay you in interest, the bank will add the interest each day, as opposed to quarterly or monthly as other banks do.

This can help you earn more over time.

For example, let’s say you start with an account balance of $25,000 and the interest rate is .65% (a common rate for the CIT Savings Builder). For the first year, you’d earn $162.50.

That may not seem like much, but it means that the next time interest is calculated, it will be based on a balance of $25,137.50 and so on and so forth. It really will add up faster than typical banks.

Other banks will compound interest less frequently, doing so on a monthly or quarterly basis. In the short term, this does not make too much of a difference in your earnings.

But over a long time horizon, it can add up to noticeable savings.

Unlike many other bank accounts, the CIT Savings Builder account does not charge a monthly maintenance fee. There are also no fees for online transfers or incoming wire transfers.

Fees

The bank will charge the following fees:

- $10 fee for an outgoing wire transfer for account holders with balances of less than $25,000.

- $10 for excessive transactions. (Withdrawals and deposits are limited by law to six per month.)

CIT Online Banking and Mobile App

For any online-only bank, a quality online experience is paramount. It’s doubtful that you’ll have much to complain about with CIT Bank.

The bank’s website and dashboard interface are uncluttered and allow for easy viewing of your financial picture. Account transfers are also easy.

The CIT Bank free mobile app allows you to view accounts, transfer funds between CIT accounts, and even deposit checks. One big drawback, however, is that it’s not possible to use the app for transfers between a CIT account and an external one.

Security

Obviously, anytime you are banking online you want your funds to be secure. All CIT accounts are FDIC-insured up to $250,000. (Note: This $250,000 limit includes funds deposited with OneWest Bank.)

The company also has robust security protections in place.

In addition to requiring you to use a login and password to access your accounts, the bank does regular transaction monitoring and has 128-bit Secure Socket Layer encryption to ensure that your web connection is secure.

Some other financial institutions use a stronger 256-bit encryption.

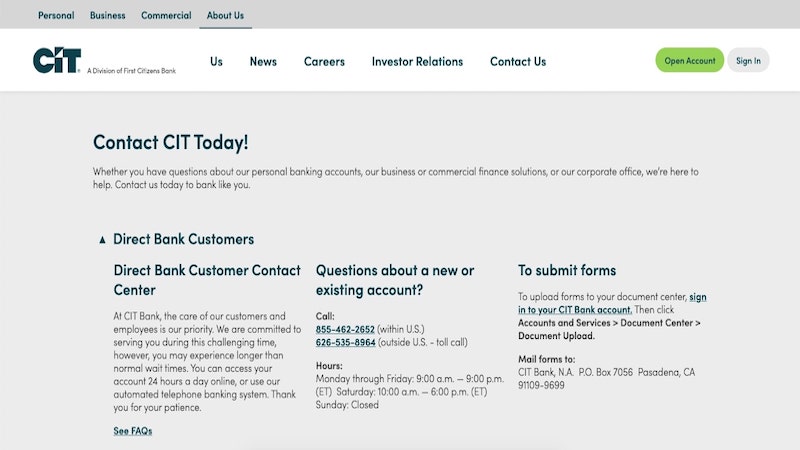

Customer Service

Because CIT Bank is an online bank, you won’t have the benefit of going into a branch to get customer service. But there are people available to help you via phone.

Here’s how to reach customer service:

Call: 855-462-2652 (within the U.S.)

626-535-8964 (from outside the U.S. — toll call)

Fax: 866-914-1578

Hours:

Monday through Friday: 9:00 a.m. — 9:00 p.m. (ET)

Saturday: 10:00 a.m. — 6:00 p.m. (ET)

Sunday: Closed

Drawbacks

The CIT Savings Builder account can help you save money, but there are some downsides you should be aware of.

First, as we mentioned, the highest interest rate is only available to those with account balances above $25,000, or those who can deposit $100 monthly.

Some people may find this threshold too high to meet. Other online banks offer interest rates that are nearly as good, without the minimum balance requirements.

The CIT Savings Builder account — and CIT Bank in general — does not offer the full suite of banking services you might get elsewhere. CIT Bank only offers one checking account, for example.

While the bank does offer some loan products, they are limited to home mortgages.

There are no retirement accounts or planning services, and no access to credit or debit cards. There are no bank branches, either. To be fair, it’s the lack of all these services that allows CIT to offer higher interest rates.

If you plan to bank with CIT, you need to be comfortable banking exclusively online through the bank’s website or mobile app, or through telephone banking.

Most likely, you’ll need an account with another bank in order to fund the CIT account and make withdrawals.

And remember that federal law limits deposits and withdrawals to a total of six per month. CIT Bank does not offer access to ATMs.

Alternatives

CIT Bank’s Savings Builder account is a good option for long-term savers, but there are competitors that may be worth a look.

Ally Bank is a popular online bank with better-than-average interest rates and no minimum account balances or fees. They also offers a free interest-bearing checking account and access to Allpoint ATMs.

Other online banks with similarly competitive rates and services include MySavingsDirect and PurePoint Financial.

Major financial institutions including Barclays, Citizens, Citi and Goldman Sachs have also recently introduced online banks with higher-than-average interest rates on savings accounts.

Summary

The CIT Bank Savings Builder account is a very fine option for people looking to get a little bit more return on their cash savings. Its interest rates for high-balance customers, in particular, are among the best in the nation.

If you can’t meet the minimum balance requirements for high rates, you may find a better fit with a competitor.

Also, consumers looking for a full banking experience including branches, ATMs, and loan products will likely find CIT lacking.

As a straightforward savings account for those with a lot to save, however, it’s tough to beat.