Getting free banking access and cash back on purchases can be difficult when you’re trying to build credit or you have bad credit. It can also be challenging if you’re a foreigner moving to the United States.

Sable can be an excellent banking option if you want to earn up to 2% cash back on purchases and need a free way to improve your credit score.

This Sable review will help you learn more about how this banking app works, its top features, fees and more.

Summary

Sable provides a free banking account, rewards debit card and unsecured credit card. Your purchases can earn up to 2% cash back. No credit check is necessary and you can build your credit score.

Pros

- No account service fees

- Rewards debit card

- No credit check

Cons

- Cash doesn’t earn interest

- No mobile check deposit

- Possible ATM owner fees

What is Sable?

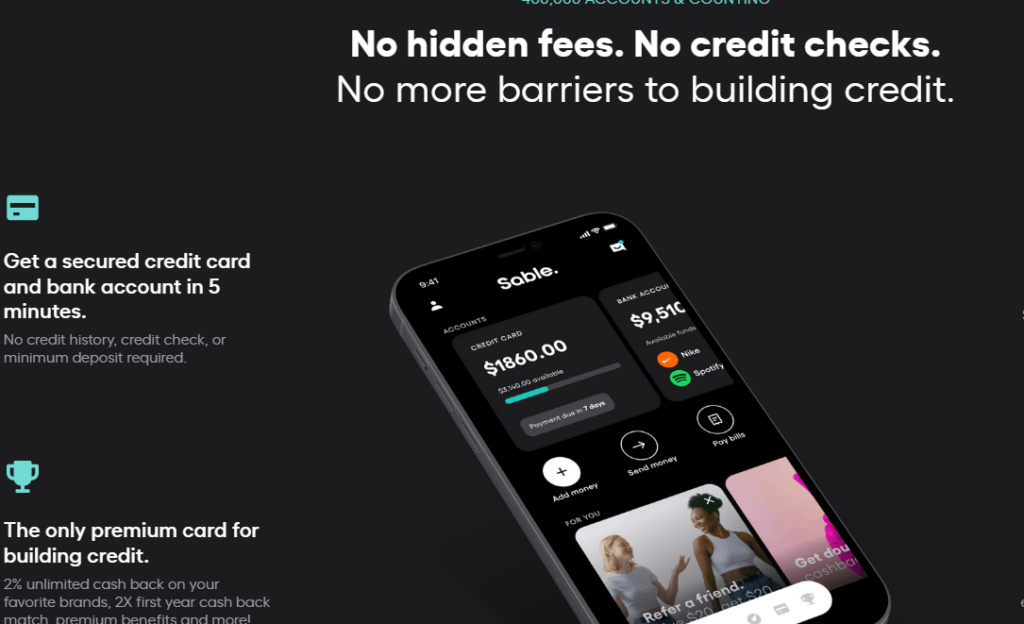

Sable is a free online banking service that offers a rewards debit card and a secured credit card.

It’s even possible to upgrade to an unsecured credit card when your creditworthiness improves and you are a member for at least four months. However, the qualifying process varies by person.

You can open these accounts without a hard credit check, Social Security number or minimum deposit. The minimum age to join is 18 years.

This account is one of the best ways for non-U.S. citizens to build a credit score with the United States credit bureaus.

Current U.S. citizens who want a rewards debit card or the opportunity to build credit without an annual fee should consider Sable as well.

Review the Sable terms and conditions to learn more.

How Does Sable Work?

You can join Sable for free by downloading the Android or iOS app.

Then, you must provide these details:

- Your legal name

- Street address

- Birthday

- Social Security number (passport or U.S. visa for non-citizens)

U.S. citizens and foreigners who are at least 18 years old can apply. Once the platform verifies your identity, you can begin sending and receiving funds within the United States as well as abroad.

If you request a secured credit card, the bank reports your monthly payments to the credit bureaus (Experian, Equifax and TransUnion).

On-time payments can increase your score, but late payments can have a negative impact.

Online Banking Account

Sable uses your information to provide a free online bank account with up to $250,000 in FDIC Insurance.*

You can fund this account by linking an existing account. Alternately, you can use direct deposit, wire transfer or cash deposits.

Your funds won’t earn interest, but you can easily pay bills and cover your debit card purchases.

In addition to your banking details, you can request:

- A debit card only

- Both a debit card and a secured credit card

You will receive an instant virtual card to start making purchases and earning cash rewards. Your physical card will arrive in approximately ten days.

It’s possible to use your bank account and payment cards for these activities:

- Earning up to 2% cash back on purchases (1% for debit cards)

- Receiving direct deposits

- Linking to digital wallets (i.e., Venmo, PayPal, Apple Pay, Zelle, etc.)

- Paying bills

- Sending money overseas

This account doesn’t offer paper checks. However, you can enter the payee’s details in your app to mail paper checks for free.

It’s also possible to quickly pay for expenses using your payment card.

Build Credit History

Making on-time credit card payments can gradually increase your credit score as you demonstrate that you can responsibly handle credit.

Your payment history reports monthly on your credit report if you have a Social Security number (SSN).

If you’re still waiting to receive a SSN, this credit building app reports your payment activity with your name and address. Then, your payment history appears on your reports once you’re issued an SSN.

No Credit Check

This service can be an excellent checking account for bad credit since you won’t undergo any type of credit check to open a deposit account or credit account.

These types of credit inquiries can remain on your credit history for several years and create a negative drop. As a result, you might be able to see your score increase sooner with Sable.

No Minimum Deposit

You won’t need to make a minimum initial deposit or maintain a minimum balance to use your bank account or debit card.

If you request a Sable ONE Secured Credit Card, you must make a refundable security deposit.

Your deposit balance is your maximum spending limit, and you can receive a refund when you graduate to an unsecured card or close this card.

How Much Does Sable Cost?

There are no monthly or annual service fees to use Sable’s banking account or payment cards. You can also pay bills for free when you need Sable to mail a check to the recipient.

However, there are several miscellaneous fees you might pay:

| Description | Fee |

| Foreign Transaction Fee | 2% on debit and credit purchases |

| Incoming Domestic Wire Transfer | $3 to $15 |

| Outgoing Domestic Wire Transfer | $5 |

| Incoming International Wire Transfer | $15 |

| Outgoing International Money Transfer | Included in transfer amount |

| Late Fee | $0 (interest charges still apply on the unpaid balance) |

| ATM Withdrawals | $0 from Sable (third-party fees may apply) |

You may also encounter third-party fees for cash deposits to your debit card. Participating retailers include CVS, Walmart, Walgreens, Dollar General and Kroger.

Key Features

These banking and cash rewards benefits help make Sable an excellent banking app.

Sable Rewards Program

It’s possible to earn rewards when you use your Sable credit or debit card.

You can earn up to 2% cash back at these merchants with a Sable credit card:

- Amazon

- Hulu

- Netflix

- Spotify

- Uber

- UberEats

- Whole Foods

Your remaining credit card purchases earn 1% back at other retailers. Sable Points can be redeemed as a monthly statement credit.

Purchases at the above retailers only earn 1% with the debit card, and your remaining spend doesn’t earn cash back. You can transfer your rewards to your banking account.

Your first $20,000 in qualifying purchases per year are eligible for cash rewards.

In addition to the ongoing rewards program, you earn double cash back for your first year. For example, you receive 4% instead of 2% and 2% instead of 1%.

You’ll receive your cashback match at the end of your first membership year.

Along with earning purchase rewards from Sable, you can also use cash back sites to save more money on online purchases.

Virtual Cards

You will receive virtual debit card and credit card details immediately upon opening your account.

In addition to instantly being able to use your bank account, your virtual card number has different card details than your physical card.

So, you can use your virtual card for online shopping and your physical card for in-store purchases. If one of your cards becomes compromised, you can continue using the other until your replacement card arrives.

You can lock or unlock your virtual and physical cards on-demand as an added security feature. Disabling a card prevents accidental and fraudulent purchases.

Secured Credit Card

The Sable Secured Credit Card doesn’t have an annual fee. It works at most local and online retailers.

Your purchases earn up to 2% cash back, and your payments report to the major credit bureaus to increase your credit score.

The credit limit for this card can be between $10 and $10,000, and you get to decide how high to make your spending limit. To increase your credit limit, you make a refundable security deposit.

You will need to pay your balance each month before the due date from your Sable Banking Account. There are no late fees, but interest charges apply on your unpaid balance.

It’s possible to upgrade to an unsecured Stable ONE Credit Card that has similar benefits. This card doesn’t require a security deposit. When you qualify for the card, Sable refunds your security deposit.

You might be eligible for an upgrade after four months depending on several factors, including your spending behavior and repayment history. Enrolling in direct deposit can also make it easier to qualify.

Premium Benefits

When you use your Sable credit card or debit card for certain purchases, you might be eligible for additional benefits.

Premium benefits with Sable include:

- Cell Phone Protection: Coverage when your cell phone is stolen/damaged

- Car Rental Insurance: Pays for damage/theft for qualifying car rentals

- Satisfaction Guarantee: Refunds for items returned within 60 days of purchase

- Price Protection: Receive a partial refund for recent purchases that go on sale

- Purchase Assurance: Reimbursement for new purchases that are stolen/damaged

- Extended Warranty: Doubles the manufacturer’s or store warranty

- Zero liability: You’re not responsible for unauthorized purchases

Review the Sable terms and conditions to learn more about qualifying transactions and coverage benefits.

International Money Transfers

You can send money to over 55 countries using the Sable app. The platform partners with Wise and calculates the exchange rate before you send.

There are no additional fees to use this service since the app deducts the transfer fees from the balance.

If another money transfer service is offering a better rate, Sable can match the price difference with its Cheapest International Money Transfer Guarantee.

You’re eligible for this guarantee with qualifying debit card or credit card spending. You can also get the guarantee by receiving qualifying direct deposits.

Along with sending and receiving international remittances, you can transfer funds to other Sable members and to accounts in the United States. This service works with payment apps like Venmo, Zelle and Cash App.

Credit Score Updates

You can track your credit score progress in real-time, just like a credit monitoring service. The app sends credit card payment updates to the credit bureaus monthly.

It’s also possible to receive a $25 credit-building bonus if you can get your credit score above 700 within the first 12 months of joining. You can learn more about this opportunity when you join.

Sable Reviews

When determining if a financial service is right for you, knowing what current customers have to say can help.

Here’s how Sable ranks among the various rating platforms:

| Platform | Rating | Number of Reviews |

| Trustpilot | 2.1 out of 5 | 55 |

| Google Play | 4.7 out of 5 | 2,700+ |

| Apple App Store | 4.8 out of 5 | 2,800+ |

These are a few reviews from Sable customers:

“I moved to Austin last year from Canada. I couldn’t find any major bank or mobile bank that would help give me a credit card or a bank account even when I had a credit history in Canada. In just one year, Sable helped build my U.S. credit score to 740!” –Terry

“They rejected my application and refuse to tell me why. The application literally only asks for your name, passport and phone, so I cannot understand what could possibly be wrong. Terrible experience.” – Ivan Cheresky

“I like that I can build my credit limit over time with the extra cash I may have. It’s also great that they report limit and utilization unlike some other credit cards apps.” –Ngrossi96

“Awesome. Only wish we had access to a free ATM, other than that I’m extremely happy with Sable One!” – Sergio A.

Is Sable Worth it?

Sable may be worth it for you if you need or want to work on building up your credit and/or credit score.

You might also find Sable worthwhile if you like the idea of having a free checking account and a rewards debit card.

Alternatives to Sable

Here are a couple of Sable alternatives that you may want to consider as well.

Current

Current is an online banking fintech that offers free checking, savings pods and a rewards debit card.

There is no charge to have a Current account, and the savings pods earn interest.

Current also offers faster Direct Deposit, Tap to Pay, Spending Insights, budgeting tools and more.

Learn more here by reading our Current Review.

Chime

Chime also offers a free checking account and savings account that you can manage entirely online.

Chime’s debit card doesn’t have a rewards program, but it is free to use at in-network ATMs.

The banking fintech also offers a fee-free Credit Builder Secured Visa card that you can get to help you build or improve your credit.

Other benefits include fee-free overdrafts and early Direct Deposit.

Learn more by reading our Chime Review.

FAQ

If you are still trying to decide if Sable is a good solution for you, here are some additional details.

Yes. Sable will report your secured credit card or unsecured credit card payments to Experian, Equifax and TransUnion each month.

There are several ways to receive funds, including direct deposit, linking to U.S. bank accounts, payment apps like Venmo or Zelle, money transfer apps or wire transfers and depositing cash at participating stores.

Mobile check deposits should start sometime this year. Until then, you must deposit physical checks into another bank account or payment app first.

Yes, Sable is legit. The bank offers up to $250,000 in FDIC Insurance through Coastal Community Bank for your banking accounts.

Your debit and credit card purchases are eligible for zero liability protection for fraudulent transactions. The banking app even lets you lock your spending cards as an additional security measure.

To prevent data breaches, the app also supports fingerprint ID to prevent unauthorized logins. Plus, it uses the third-party app Plaid to connect to your external bank accounts to transfer funds.

You can call customer support or access an agent by live chat from 9 a.m. to 6 p.m. Eastern. Email support and online FAQs are available 24/7 as well.

Summary

Sable offers several exciting banking features that make it easy to access your money and earn cash back at your favorite brands.

Being able to build a credit history while avoiding common bank fees is another reason why the platform is worth considering.

In addition, the flexible membership requirements make Sable appealing when other banks are less likely to accept you.

*Banking services provided by Coastal Community Bank, Member FDIC, pursuant to license by Mastercard International Inc.