Yves here. I did caution on my chat on my first Roundtable, with Izabella Kaminska, hosted by Gonzalo Lira, that despite all the Twitter uproar, the economy was likely not yet in a recession per the NBER criteria, and it’s the NBER that makes the determination. But no one expected this jobs report. Note, however, despite the apparent strength, average real wages are lagging inflation. Lower end workers still lack bargaining power.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

It wasn’t the hottest growth in jobs ever, but it was big and exceeded the pre-pandemic average job growth. Employers added 528,000 workers to their payrolls in July, and 2.79 million over the past three months. Wages jumped, but less than raging inflation, and the number of unemployed people actively looking for work fell to the lowest since the year 2000, at the verge of the dotcom bust.

It was a shock-and-awe disappointment for the recession mongers out there that want a recession more than anything because, according to their thinking, it would “force” the Fed to pivot and start cutting rates – despite what the Fed actually says – and end this horrifying QT in a market that is addicted to QE and will suffocate under QT. They want the Fed to reverse the tightening though it has barely started (way too late), so that stocks can continue to get inflated to the moon.

Someday we’re going to get a recession – eventually there always is one. Knuckling under this raging inflation will likely require a recession, yet a shallow recession might not be enough to get the job done as this inflation is getting more and more entrenched.

But it’s just very tough to have an official recession with this type of labor market, with employment growing and wages growing sharply, and with unemployment falling.

The National Bureau of Economic Research (NBER) calls out recessions in the US, and the NBER’s definition has been the same for decades, and it hasn’t changed, and its definition includes labor market metrics, some of which we got today.

This strength in payrolls is supported by other data, such as the still historically high number of job openings that employers reported for June, along with massive churn and job hopping among very confident workers that are going for better-paying jobs, and amid aggressive hiring by employers to fill their jobs.

OK, cash-incinerating startups are now worried about running out of cash to incinerate, as obtaining new fuel to incinerate has become more difficult, and they’re trying to cut their cash-burn rates by reducing their payroll. Among them are Robinhood and other former high-flyers, some of which have become heroes in my Imploded Stocks column, that have lost oodles of money during their existence. But that’s a small – and very crazy – corner of the labor market, and the layoff numbers are minuscule compared to the overall labor market.

Overall, layoffs and discharges in June and in the prior months were at historic lows. And there are still large-scale staff shortages in the healthcare system, school systems, airlines, and many other industries.

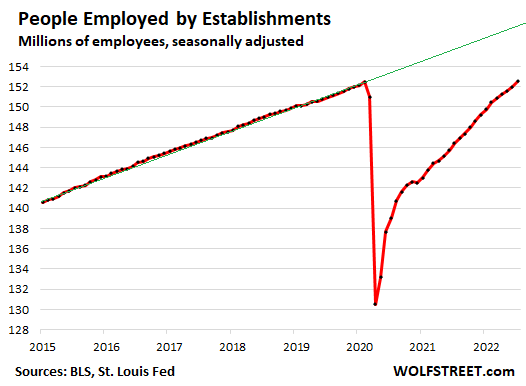

So the total number of workers on nonfarm payrolls rose by 528,000 in July to 152.54 million workers, a new record, finally and for the first time beating the pre-pandemic high, according to the Bureau of Labor Statistics’ survey of establishments today. And this number of workers on payrolls continues to catch up with the pre-pandemic trend (green line):

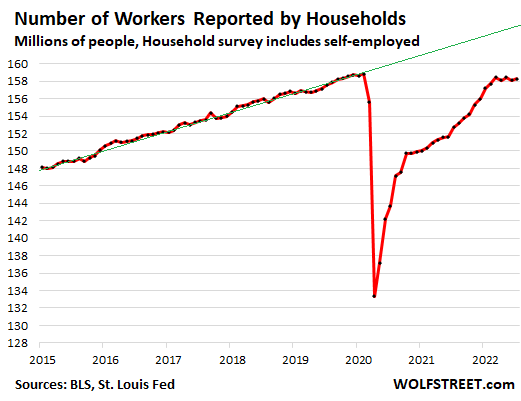

Workers, Including Self-Employed and Entrepreneurs

Households reported that the number of people with jobs, including the self-employed and entrepreneurs that are not captured in the employer data above, rose by 179,000 in July, and by 185,000 over the past three months to 158.3 million.

It is interesting that the number of people on the payrolls of employers is rising sharply, while households are reporting a much smaller increase in the number of working people, which include the self-employed and entrepreneurs. This could be in part due to self-employed people returning to regular employment with a company, to where employers are reporting the gain, but for households, the person just shifted from self-employed to being on a company’s payroll. And that would make sense amid the aggressive hiring by employers.

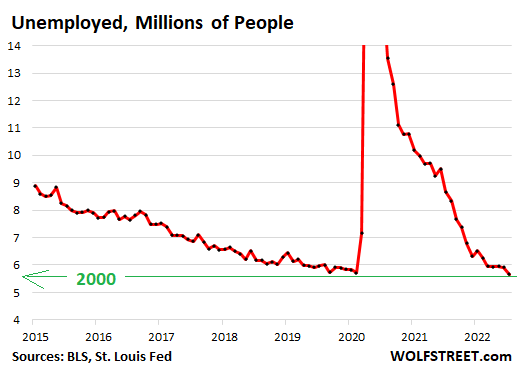

The Number of Unemployed People Lowest Since Dotcom

The number of unemployed people who are actively looking for work fell by 242,000 to 5.67 million, edging below the pre-pandemic low, and marking the lowest level since the year 2000.

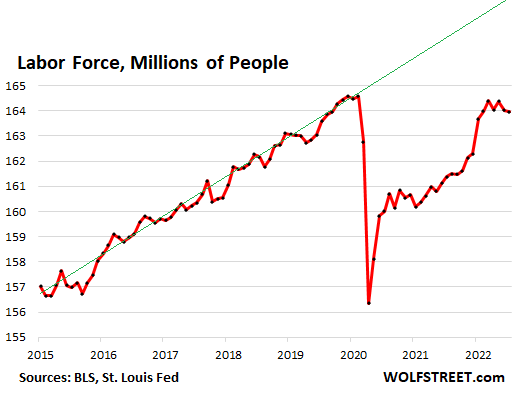

The Labor Force Is Stuck

The labor force – the people who are working or are actively looking for work – dipped by 63,000 in July, the second month in a row of declines, to 163.9 million, essentially where it had been in February.

There has been a lot of thinking about why the labor force has gotten stuck. All kinds of logical reasons are being cited that work together: The difficulty and expense in finding daycare; the need to care for elderly relatives; the excess mortality since 2020; health problems associated with covid; a massive wave of “retirements” by people who have enough already thanks to the massive inflation of asset prices; and as I phrased it, ageism, where older people who want to work stop looking for work because they cannot get anyone in their industry to take them seriously (particularly in tech), and when they stop looking for work, they come out of the labor force. And the list of reasons goes on.

Many folks, including the Fed, are now suggesting that the old normal labor force may never return, that there were permanent changes in the labor market that we’re just now trying to figure out.

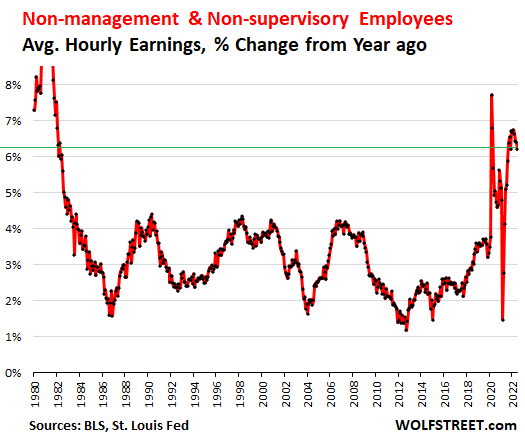

Wages of Non-Managers Surged, but Still Outrun by Raging Inflation

Average hourly earnings of non-management workers – coders, waiters, teachers, police officers, engineers, construction workers, etc. – jumped by 0.4% in July from June, and by 6.2% from a year ago to $27.45 per hour. This was the 10th year-over-year increase of over 6% in a row.

These year-over-year increases of over 6% – beyond the distortions in 2020 – were the biggest since early 1982. But they were still outrun by raging inflation, with CPI inflation at over 9%.

The Employment Population ratio, which tracks the percentage of people in the working-age population who are working, ticked up to 60% and has been roughly in the same range since March, but a full percentage point below the pre-pandemic range of 61%, which parallels the labor force getting stuck.

The unemployment rate, at its narrowest definition – the percentage of people who are in the labor force, but are not working – edged down to 3.5%, where it had been before the pandemic. If the labor market weakens, this rate will spike, as it has done every time before. But it remains grounded.