Bestinvest’s bi-annual Spot the Dog report, which names and shames poorly performing funds, has revealed that investors are paying £115m in fees a year to invest in 31 ‘dog’ funds.

The firm, part of Evelyn Partners, estimates that the 31-strong pack of dog funds is earning almost £115 million in annual fees based on their current size and annual ongoing costs.

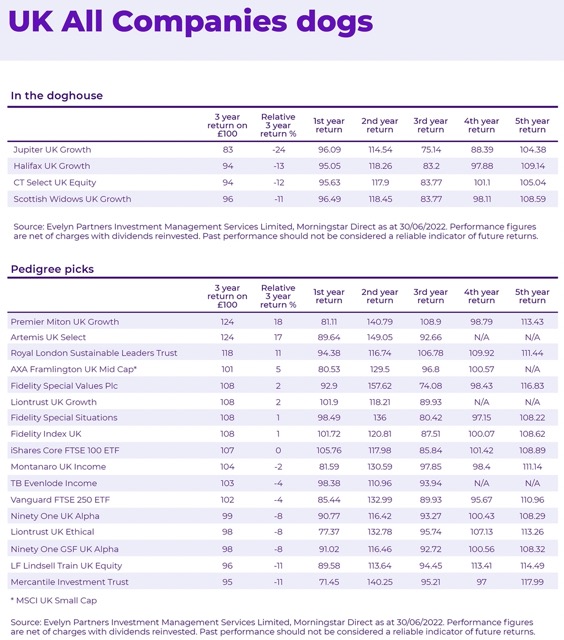

The dog funds include several large funds widely held by investors: Halifax UK Growth, Halifax UK Equity Income and Scottish Widows UK Growth. Each of these funds has over £1bn invested and collectively hold £6.7bn for investors.

UK funds are some of the worst performers on the list.

Bestinvest says that several poorly performing funds have been on the dog list for a long time so underperformance seems “entrenched and questions must be asked over their approach.”

Jason Hollands, managing director of Bestinvest, said: “While short-term periods of weakness can be forgiven, as a manager may have a run of bad luck or their style may be temporarily out of fashion, there can be more concerning factors at work: important changes in the management team; a fund becoming too big, which might constrain its flexibility or a manager straying from a previously successful approach.

“We have been producing Spot the Dog for nearly three decades in order to raise awareness of the poor performance of many investment funds and to encourage investors to regularly check on how their investments are doing and take action if necessary. While there can be reasons to persevere a little longer with a poor performer – such as a change of manager or outlook – in other cases it may make sense to switch to a different fund with a stronger team and track record.”

Bestinvest says that despite the poor performance of the worst funds and a very difficult start to 2022, a number of funds have improved relative to their benchmarks and “left the kennel,” according to the firm’s latest Spot the Dog report.

Despite the improvements, Bestinvest has identified 31 funds that meet the criteria to be labelled a dog fund although this is fewer than half the 86 funds revealed in the last report, and the amount of assets held in dismal performers has dropped substantially from £45.4 billion to £10.7 billion.

The relatively small number of dogs this time round reflects two aspects of the Bestinvest ‘dog fund’ selection process. One is that performance is measured relative to a benchmark index – so the fund must have underperformed compared to the market it invests in by 5% or more over a three-year period. A second filter is that the fund must also have underperformed in three successive 12-month periods on the trot.

Bestinvest says that while there are plenty of poor performers over the last three years, a change in fortune for funds investing in undervalued companies, and dividend paying shares, means that many of the funds that dominated the list in recent editions have escaped this time due to much stronger relative performance in the last several months.

Sectors like energy, commodities, consumer staples and healthcare have had a much better run of performance compared to ‘growth’ sectors like technology, communications services and consumer discretionary companies that previously delivered stellar returns. Many of growth-orientated funds that have suffered in this most recent year are kept out of the list by their strong performance in the previous two years.

Among the worst performers, the FTF Martin Currie Global Unconstrained fund has the ‘accolade’ of being the worst relative performer, with the fund lagging its index by -34% over the three-year period, turning £100 into £94 over the three years.

When it comes to absolute losses, two funds in the list vied for the trophy. The Schroder European Sustainable Equity fund left investors with £82 for every £100 invested over the three years, undershooting the index by -27%, narrowly edging the Jupiter UK Growth fund which reduced £100 to £83 over the same period.

UK-focused funds are some of the worst performers, with funds in the UK All Companies and UK Equity Income sectors contributing £7.6 billion, or more than 70%, to the £10.8 billion total of assets in the doghouse.

Source: Bestinvest

The number of global equity income funds appearing on the list has dropped from 14 last time around to zero. Their income-earning mandates dictate low weightings towards growth stocks (which typically do not pay a dividend) and the US market more widely.

In terms of fund groups, Schroders’ own-brand funds are mostly absent from the list this time but the FTSE 100-listed asset manager is the investment adviser on this edition’s biggest funds from HBOS and Scottish Widows: the Halifax UK Growth, Halifax UK Equity Income and Scottish Widows UK Growth funds.

Jupiter has three dog funds in the list, with £774.7 million under management, lower than the six funds that appeared last time, but the funds are all different to those that appeared in the last review.