There are various types of financial goals like short-term, mid-term, or long-term goals. However, certain recurring financial goals will occur at specific intervals. How to plan for such recurring financial goals?

Types of recurring goals may be your yearly travel (maybe once in two to three years), kids’ school fees, or insurance premiums (if you opted for half yearly or yearly mode).

If you do not plan it well in advance, then you may face certain sudden pressure on such particular months. Hence, it is always better to plan in advance for such recurring goals.

Take, for example, in my case, I have recurring goals like my daughter’s school fee, insurance premiums, or my yearly blog maintenance cost.

Rather than feeling the heat of paying a big chunk in one go during particular months, I have planned it and accumulate it on monthly basis for such expenses.

How to plan for recurring financial goals?

Let me first list the example of such recurring financial goals for your better understanding.

- Kids School Fee

- Yearly or once in two to three years travel

- Insurance premiums

- Upgrading the electronic gadgets

- Revamping the house interior

There are two ways to plan for such recurring financial goals. Let me take an example – your kid is currently in the 1st standard and the current yearly fee is Rs.2,00,000. You need to fund such expenses say from her 1st standard to her 12th standard.

Method 1 –

Each year start a yearly RD immediately after you pay the fee. For example, if you have to pay in the month of April every year, then each year you must start an RD of a year for about Rs.16,666 (Rs.2,00,000/12). Once the RD matures, then you can immediately pay the fee and again start a fresh RD for next year’s fee.

The advantage of using this method is that it is simple and if you can’t accommodate Rs.16,666 in your monthly budget, then it is an indication that the expenses are beyond your reach. It will immediately show you the feasibility of the goal.

Method 2-

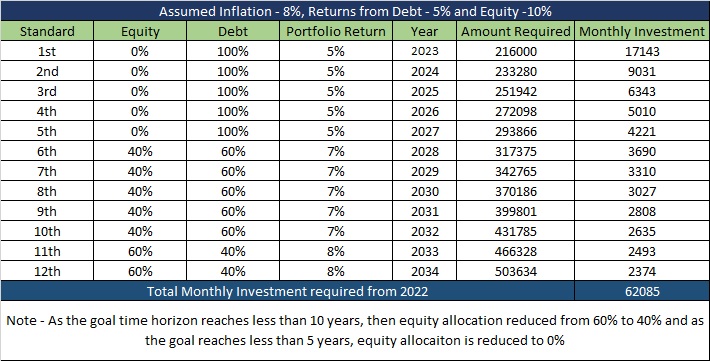

Here, you calculate each year’s future value with the inflation (assume around 8% in the educational fee example) and accordingly start investing all the investments in one go for the fee of 1st standard to 12 standard fees.

In one way it looks simple but in another way, it is complicated to manage those many yearly goals investment. The only advantage of this method is that you can start well in advance for the future goals and if possible can include the equity (for goals more than 5 years requirement). This way, you are reducing future stress. Sharing with you an example of such planning.

Looks fantastic in excel right? But for a layman to implement the same is the toughest task. The first thing is asset allocation is different for the group of the goals like 1st to 5th year it is 100% into debt. From 6th to 10th, it is 40:60 between equity to debt, and from 11th to 12th it is 60:40 between equity to debt. Hence, even though you create a unified portfolio, after few years, you may struggle of finding how much to withdraw from which portfolio. Otherwise, you have to create 12 different portfolios to manage this single goal. Again as equity is included, two more tasks will increase here – Yearly review and rebalancing of equity to debt and slowly coming out from equity well in advance of the goal.

More than all these points, whether you are capable of investing monthly Rs.62,085 from today without altering the other major mandatory goals of your life (like retirement goal or kid graduation and post graduation goals) is the question mark you have to ask for yourself.

It may be fantastic to say and calculate in excel. But for a common man who has to manage his professional life, and family life, and then this investment life turns out to be cumbersome.

Rather a simple yearly RD for such recurring goals is a fantastic way to manage. Just in a mad rush of including equity for long-term recurring goals and reducing the stress of monthly investment, we are taking MORE STRESS than simplifying it. After all, by including a certain % of the equity in the portfolio for such small required goals, the end result may not be such an exorbitant differentiating factor.

Hence, a simple yearly or based on choosing the frequency based on the occurrence of the goal and investing regularly for each such requirement is far better than planning for what is required after 5 years or 10 years and starting investing now itself.

As I told you, just to infuse equity and reduce the investment stress, you are creating a mess in your financial life. If you have the time and zeal to follow the second method, then you can do it. Otherwise, a simple first method is far better. Above that, how much you gain by including a certain % of equity matters a lot.

Which products to use for recurring financial goals?

Which products to use for such recurring financial goals depends on what type of method you are using. Hence, let me classify the products also based on the method you are adopting.

Method 1 –

If you are using method 1 and if your goal is less than three years, then a simple RD is far better. I know few may use Arbitrage Fund mainly for taxation purposes (as the taxation of the Arbitrage Fund is much lesser than RD). However, there may be a possibility of negative returns also if the volatility in the market increases (like 2008 or 2020 market crashes). Hence, Arbitrage Funds are suitable for those who are more concerned about the tax and ready to digest a certain degree of volatility. Otherwise, as I suggested a simple RD is a far better option.

However, if your goal is more than 3 years, then use Liquid Funds or Ultra Short Term Debt Funds. They will provide less volatility with better tax-adjusted returns than RDs.

If you are following method -2, then you have to choose certain debt and equity products in your portfolio. Hence, to choose the better products in this category, I suggest you to refer my earlier posts “Top 10 Best SIP Mutual Funds to invest in India in 2022” and “Top 10 Best Debt Mutual Funds to invest in India in 2022“.

I hope I gave you an idea of how to manage your recurring financial goals. If you still have questions or doubts, then you can comment here.