I was chatting with my friend Pete Dominick last week, and he asked about consumer sentiment. I tossed out a few reasons why I suspect it has gotten so negative:

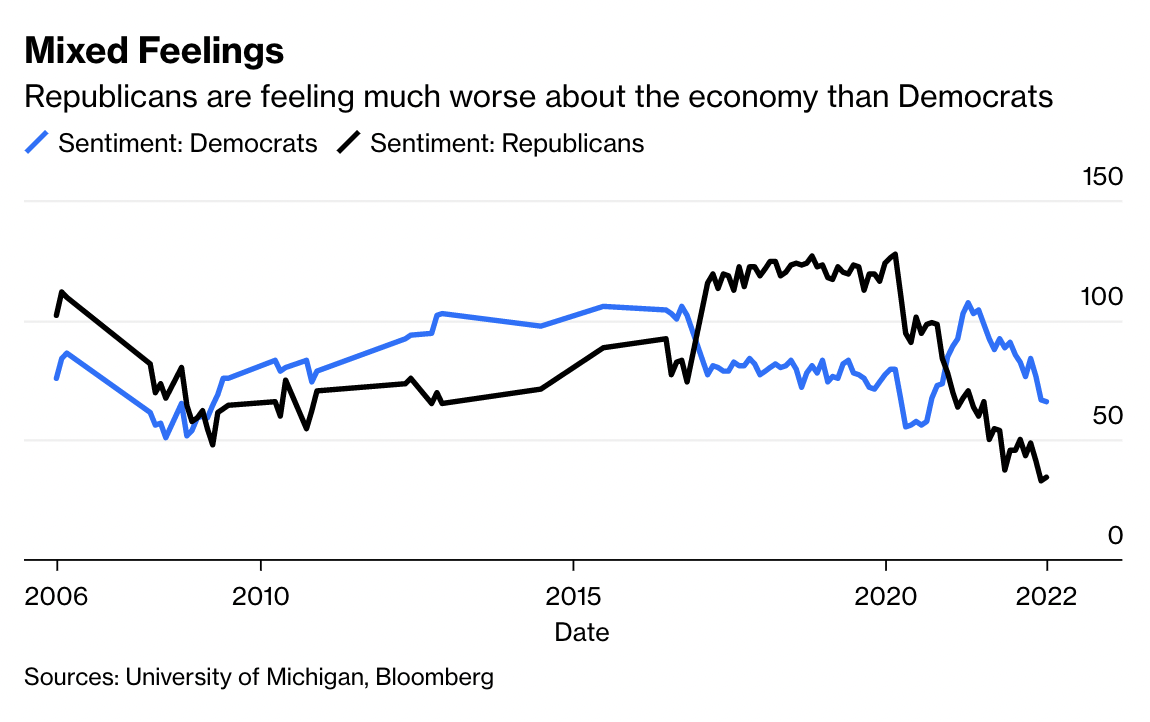

1. The past ~20 years have seen a much greater spillover from partisan beliefs into sentiment;

2. This is especially vivid around changes in White House party control;

3. Members of both major parties do this, but it is more intense among those who identify as “right-leaning;”

There was some pushback to this, especially #3. Lucky for me that Matt Winkler did the heavy lifting on this issue yesterday: “Blame Election Deniers for Faltering Consumer Sentiment.” He spared me the dive down that particular rabbit hole, observing:

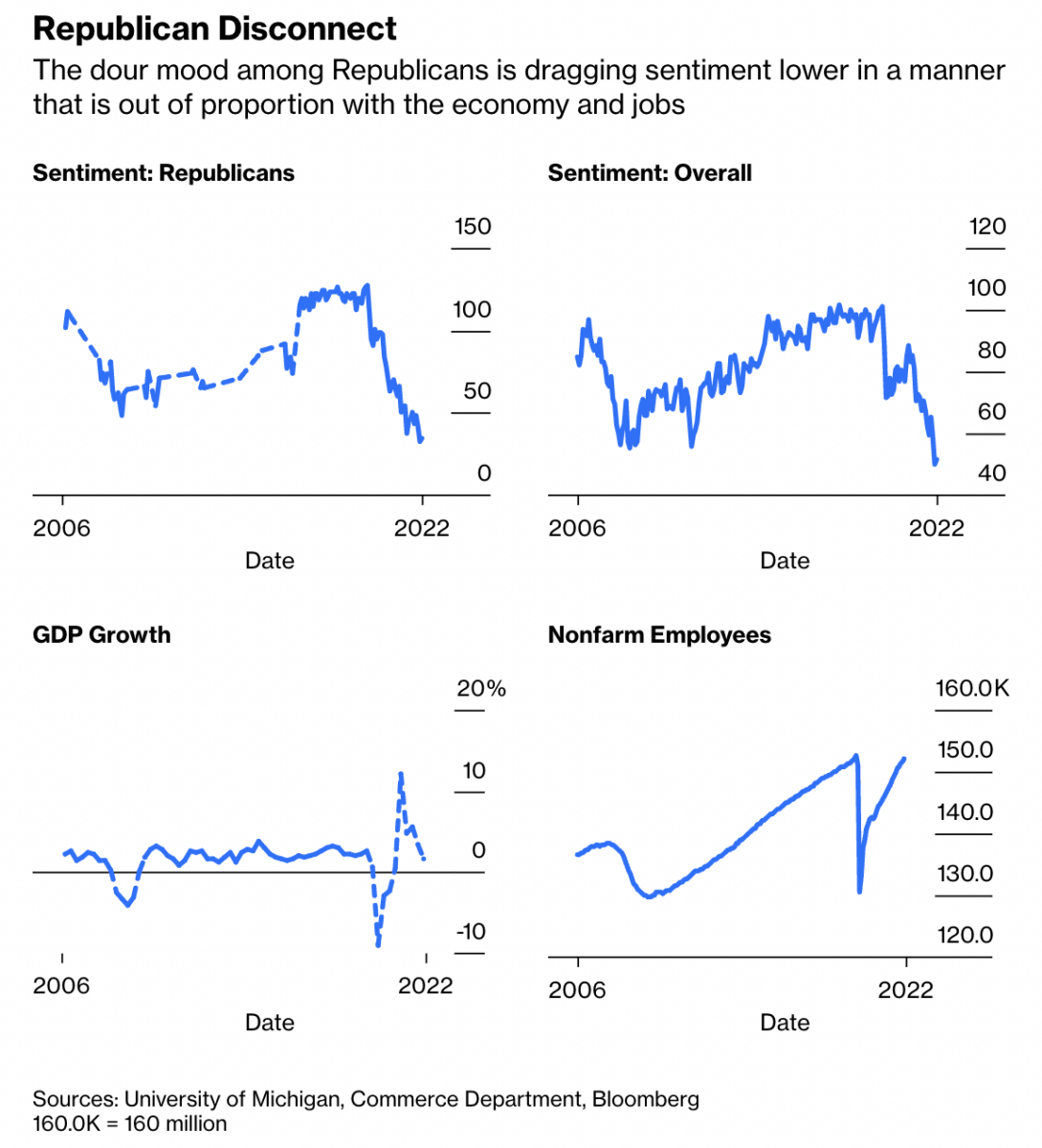

“With about 70% of Republicans believing incorrectly that Joe Biden lost the 2020 presidential election when he won it by more than seven million votes, it’s no wonder sentiment is similarly skewed against the 46th president, contributing to his low approval in public opinion polls.

Never mind that the deaths related to Covid-19 plunged 78% from the first to the second quarters, that 10 million new jobs have been created, that unemployment at 3.5% represents a 53-year-low, that corporate earnings rose to a record and that the confidence of chief executive officers remains above its long-term average. Not to mention that total household net worth soared by $18.1 trillion in 2021, the most under any president, while Congress in 2022 passed the biggest ever infrastructure bill and the first gun safety law in 30 years.”

There is a different conversation to be had about how terrible Democrats are at messaging (that is far outside of my expertise). Even with Inflation at 40-year highs, we should contextualize dour sentiment within a framework of the rest of the economy — Jobs, wages, etc.

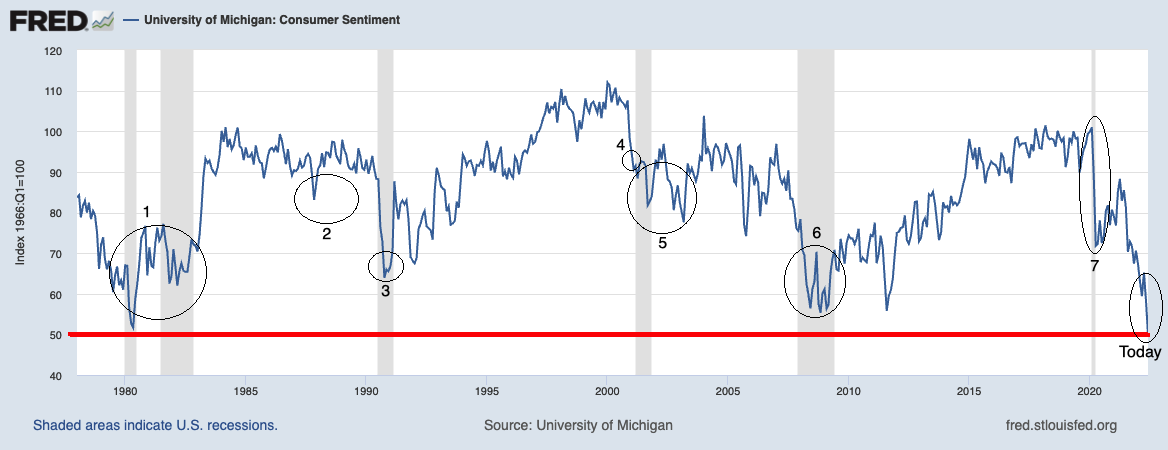

It is astounding that sentiment today is even worse than the levels it sees in the midst of the very worst modern financial crises and epic generational market crashes. Winkler’s point is this level of negativity makes little sense economically but is more consistent with partisanship (see chart at top). Generally speaking, I find sentiment data to only be useful when it is at extremes. This current spillover is potentially making even those readings less useful.

Before we go further, a Phil Gramm caveat: Ignore widespread displeasure among consumers at your own peril. Recall that on July 10, 2008, then-Senator Gramm called Americans a bunch of whiners. Literally:

“You’ve heard of mental depression; this is a mental recession. We may have a recession; we haven’t had one yet. We have sort of become a nation of whiners.You just hear this constant whining, complaining about a loss of competitiveness, America in decline…”

Akshully . . . The Recession was already in its 8th month, having begun in December 2007; housing had rolled over two years prior; mortgages were already resetting higher and defaulting in ever greater numbers. Gramm’s blithe dismissal of negative sentiment is a cautionary tale reminding us to tread lightly when dismissing widespread negativity.

Still, Winkler makes a compelling and data-driven case that the current sentiment levels are disconnected from the overall state of the economy relative to historic levels. Where as Gramm was representing his party’s views, Winkler questions the impact of partisanship within the consumer sentiment readings.

Consider this annotated chart of the University of Michigan Sentiment Index going back to 1978:

Does it make sense that current sentiment readings are worse than:

1. 1980-82 Double Dip Recession

2. 1987 Crash

3. 1990 Recession

4. 9/11 Terrorist Attacks

5. 2000-2003 Dotcom implosion

6. 2007-09 Great Financial Crisis

7. 2020 Pandemic Panic

Winkler states “Bipartisanship is sadly missing in consumer sentiment readings.” Considering that all of the events I referenced were far worse than the current state of the economy and overall markets, I tend to agree.

I have long pointed out the dangers of mixing Politics with Investing; we need to consider the real possibility that participants in the Consumer Sentiment Index are ignoring that advice.

Previously:

The Trouble with Consumer Sentiment (July 8, 2022)

Sentiment LOL (May 17, 2022)

Too Many Bears (May 3, 2022)

Overstating Negative Outcomes (April 11, 2022)

How News Looks When Its Old (October 29, 2021)

Source:

Blame Election Deniers for Faltering Consumer Sentiment

by Matthew A. Winkler

Bloomberg, August 8, 2022