Rising inflation headlines got you on edge? Or maybe you’re already feeling the rising costs on your budget.

You’re not alone. A lot of people are worried about inflation these days, and for good reason.

There are a couple of different ways you can try to protect yourself from inflation. One way is to invest in Series I Bonds. Another option is to invest in TIPS, which stands for Treasury Inflation-Protected Securities.

Both are solid options, but which one is the better inflation hedge? We’ll answer that question and more in this article.

Inflation Current Status

Inflation continues to soar, as the CPI just reported a 9.21% annualized inflation rate for the month of June. This is the highest inflation has been since 1981, according to CNBC, and it’s only going to continue to go up. And, according to JPMorgan, we could see inflation reach 10% by the summer of 2023.

With all of this in mind, it’s no wonder that people are scrambling to find ways to protect themselves from inflation. Let’s take a closer look at I Bonds vs TIPS to see which is the better inflation hedge…

What are Inflation-Indexed Bonds?

Inflation-indexed bonds are debt securities issued by the United States government that provide protection against inflation. The principal value of these bonds rises with inflation and falls with deflation, as measured by the Consumer Price Index (CPI).

The interest payments on these bonds are fixed, meaning that they do not change with fluctuations in inflation or deflation. Inflation-indexed bonds are sometimes referred to as “Real Return Bonds” or “TIPS”, which stands for Treasury Inflation-Protected Securities.

What are Series I Bonds?

I Bonds are a type of inflation-indexed bond that is issued by the U.S. government. The interest rate on I Bonds is composed of two parts:

A fixed-rate, which remains the same for the entire 30-year life of the bond

An inflation-adjusted rate changes every six months to keep pace with the CPI.

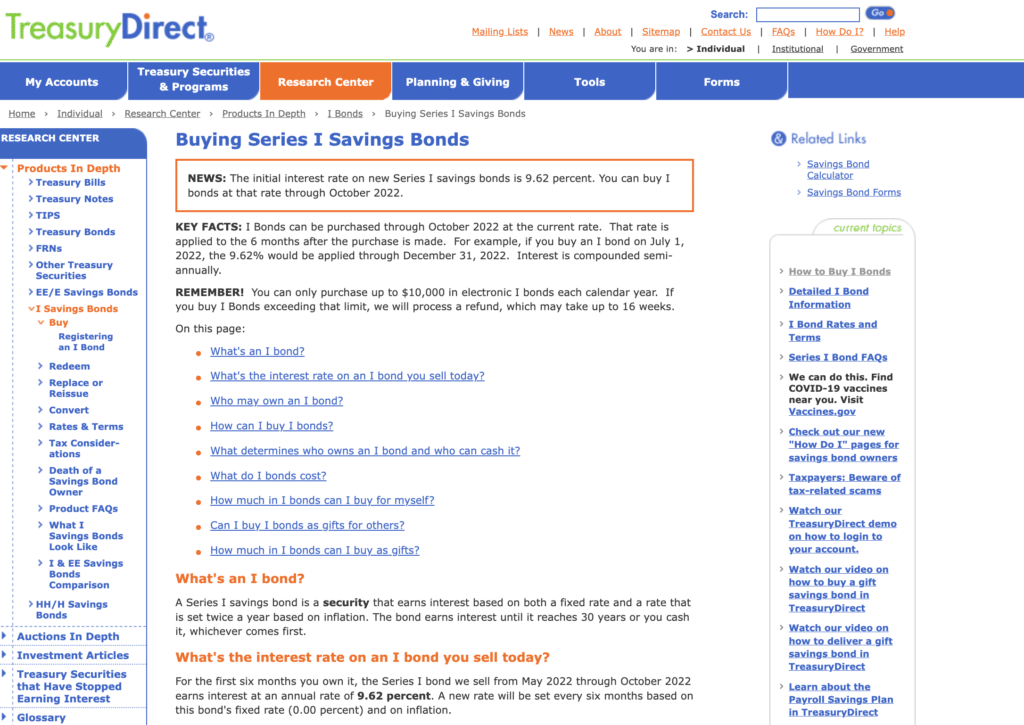

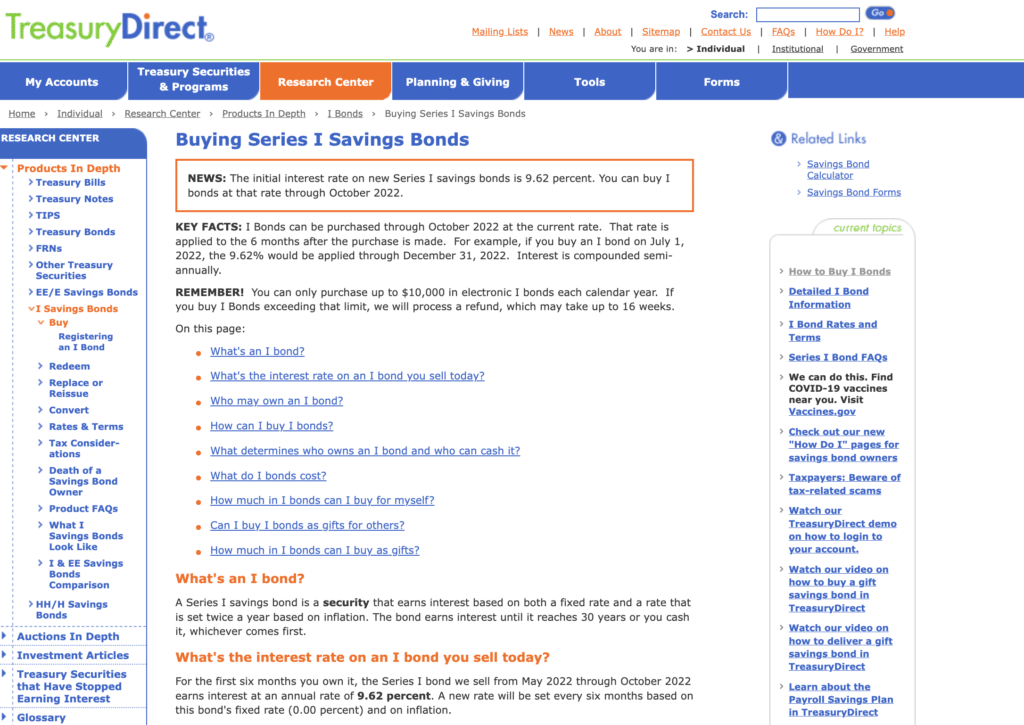

I Bonds can be purchased directly from the U.S. Treasury’s website, through a financial institution, or a payroll savings plan. I Bonds are also available in denominations of $50, $75, $100, $200, $500, $1,000, $5,000, and $10,000.

If you’re interested in adding them to your investment portfolio, be sure to check out our step-by-step tutorial on purchasing Series I Bonds.

I Bonds are limited to $10,000 per person, per year. However, there is a way to get around this limit by using a legal loophole that I discovered. More on this later…

How Series I Bonds and TIPS Are Similar

- Both I Bonds and TIPS are issued by the U.S. government. As safe as it gets when it comes to investing your money during these uncertain times, the U.S. government will not default on your I Bonds or TIPS or refuse to pay back your money.

- Both I Bonds and TIPS protect us, and help us hedge against inflation. Albeit in different ways which we’ll talk about it later on similarity.

- Both I Bonds and TIPS are adjusted for inflation based on the CPI-U consumer price index. The CPI-U measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services and is considered the most representative measure of inflation similarity.

- Both I Bonds and TIPS can be bought online. These bonds can be purchased on Treasurydirect.gov a website run by the U.S. treasury department that lets individual investors like you and me buy and redeem securities directly from the government at no cost similarity.

- Both I Bonds and TIPS are exempt from local and state taxes, but not federal taxes. Note: except under special circumstances, which we’ll cover shortly.

Those were the similarities. Now let’s talk about the differences between the two, because it’s the differences that have driven many to use I Bonds versus TIPS as an inflation hedge in their personal portfolio.

8 Differences of Series I Bonds vs TIPS

There are eight key differences between I Bonds versus TIPS. The method of purchase, the minimum holding period, the purchase limits the terms or maturities the way of adjusting for inflation, the method of taxation, the interest floor, and the return of principal.

Let’s dive into the differences…

1. How You Purchase Them

You can only buy and redeem I Bonds from Treasurydirect.gov, unlike TIPS. I Bonds are “non-marketable” or which means not available in the secondary market.

You can’t simply go to your brokerage firm, your bank, online brokerages such as Fidelity or Vanguard to buy and sell I Bonds like you can with stocks, mutual funds, index funds, and ETFs.

Bonus: Not sure if bonds are right for you? Read this to learn the difference between stocks and bonds for your investment portfolio.

TIPS are also available on Treasurydirect.gov, but unlike I Bonds they are marketable and also available in the secondary market. This means you can buy and sell them via your bank or broker, not just on the government’s website.

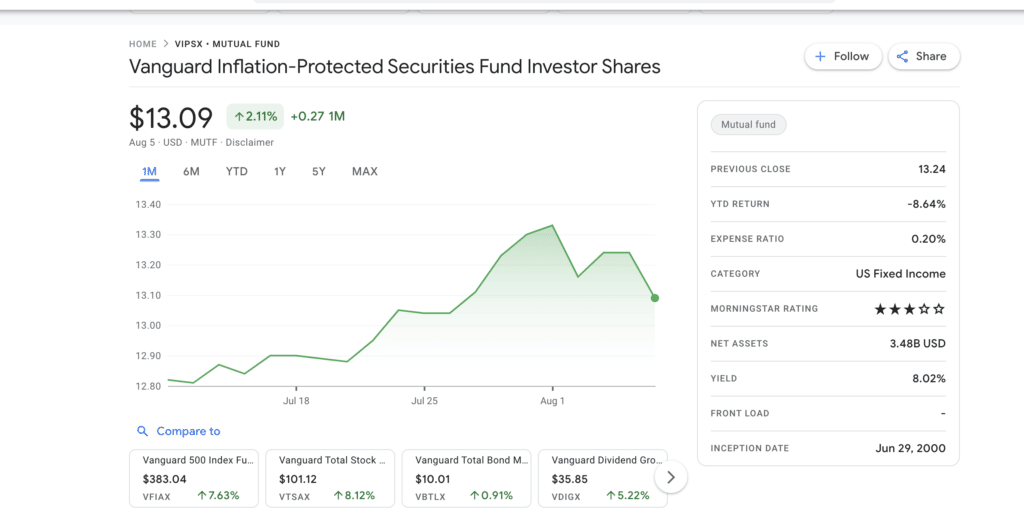

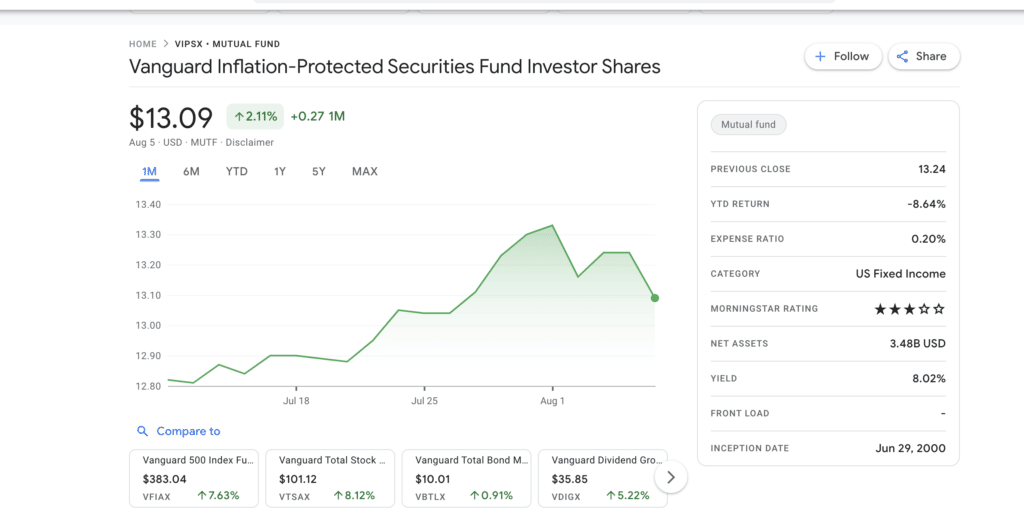

If you have a brokerage account with Fidelity right now, you can buy TIPS through an ETF from iShares. Even in retirement accounts held with Vanguard, TIPS can be purchased.

Vanguard’s Vanguard Inflation-Protected Securities Fund mutual fund, symbol VIPSX is in one of the largest in the industry.

In that sense, assuming you already have an existing brokerage or retirement account set up, TIPS are easier to buy than I Bonds.

This easier-to-buy factor is one of the reasons why many decide to purchase TIPS vs Series I Bonds. But setting up an account to purchase Series I Bonds is really not that difficult and should only take you 5-10 minutes. You can use our step-by-step tutorial to purchase Series I bonds to make it that much easier.

2. Minimum Holding Period of I Bonds Vs TIPS

The minimum holding period you have to hold I Bonds for at least 12 months. There is no way you can sell your I Bonds back to the government to cash out of them in the first year. In addition, there’s an early redemption penalty – You lose the last three months’ interest.

| Early Withdrawal Penalty – Investors that cash out their Series I savings bonds early (within the 1st year) will lose 3 months of interest. |

If you redeem within the first five years, kind of like if you were holding certificates of deposits, except that certificates of deposits CDs are paying rates like these. Whereas let’s assume I Bonds have an annualized yield of 7.12%. Perhaps you don’t see these last three months of interest loss for an early withdrawal as such a big deal, but the one-year minimum holding period, that’s something you should take into serious consideration with TIPS.

If you buy them from Treasury Direct, there is a minimum holding period, but only 45 days. And if you buy them, buy them as an ETF in your brokerage or retirement account, as many individual investors do. Doing so this way means there’s generally no minimum holding period.

3. Purchase Limits of Series I Savings Bonds vs TIPS

The purchase limit for Series I Bonds is $10,000 annually per social security or tax ID number.

You could also purchase up to an additional $5,000 of I Bonds each year with your tax refund.

The purchase limit via this method is either $5,000 or up to your tax refund amount. With TIPS the income limit is $5 million per individual or household per auction. Nothing to worry about here for the average individual investor. And if this is an issue, I think we can agree you’re doing okay income-wise!

4. Terms and Maturities

As I always say, everyone’s financial journey is different. So choosing the right term or maturity will largely depend on your long-term financial goals. I Bonds are only available for a 30-year term. Whereas TIPS are issued in five, 10, and 30-year terms.

This only matters if you intend to hold these securities to maturity, or if you have a personal perspective on the direction that inflation is headed and how long it might last difference.

5. How They Adjust For Inflation

I Bonds and TIPS are adjusted for inflation differently. I Bonds adjust inflation via their interest rate, whereas TIPS adjust via their principal amount. Here’s what I mean…

The I Bonds rate is a combination of two rates, a fixed rate that’s set at the time of purchase and doesn’t change over time. Plus a variable or inflation rate that changes every six months in May and November. You can find all the current and historical fixed and inflation rates on the TreasuryDirect site.

Hypothetical Series I Bond Rate Calculation.

If you were to buy an I Bonds in April 2023, you’d get the I Bonds fixed rate that was set in November 2022, which is 0%. Doesn’t sound very attractive until you add on the I Bonds variable rate.

Let’s say the inflation rate that was also set in November 2022, and that rate is at 3.56% for the six-month period, until it is reset again in May 2023, add the fixed rate of 0%, the semi-annual inflation rate of 3.56%.

That’s the I Bonds rate you would get for the next six months. But remember I Bonds rates change every six months in May and November. So this 3.56% inflation rate is just for six month period, meaning annualized it’s 7.12%.

What the treasury direct refers to as the composite rate. That’s what you should be using when you’re comparing returns on your I Bonds investments versus other investments, given that inflation has gone up steadily month over month.

6. Method of Taxation

Interest payments are typically taxed at redemption for I Bonds versus annually in the year of occurrence for TIPS. As I mentioned earlier, both I Bonds and TIPS are exempt from local and state taxes, but not from federal taxes.

With I Bonds though, most investors will delay reporting interest and paying federal taxes on these amounts until the year that they cash out or redeem their I Bonds. You can’t do this with TIPS as stated on the Treasury Direct website.

For TIPS, semi-annual interest payments and inflation adjustments that increase the principal are subject to federal tax in the year that they occur for this reason. Some people prefer not to hold TIPS in taxable accounts.

One more tax advantage that I Bonds have over TIPS is that in some instances, the interest on I Bonds may be exempt from federal income taxes. If you use the proceeds for qualified higher education expenses at an eligible institution, either for yourself, your spouse, or your dependence as always, there are certain exemptions and income limitations.

7. Interest Floor

The interest rate on I Bonds will never go below zero. There have been periods when the I Bonds variable rate, and the inflation rate have gone negative, like in May 2009 and May 2015.

No matter how negative the inflation rate goes, the combined interest rate or yield on your I Bonds will never go below zero.

That’s also the government’s promise with TIPS.

You might be asking yourself:

“Why would someone invest in TIPS if the yield is negative?”

Here’s why: that person has way more excess cash to invest in inflation, and protected securities than is permitted under the annual I Bonds purchase limits.

Even if he or she used the legal loophole that I’m getting to shortly and two, that person expects inflation to go up even higher than what the market expects.

8. Return of Principal

You will always get your original principal back with I Bonds. You will never get back less than what you paid. If you buy $10,000 of I Bonds today and redeem them at any point in the future, after the minimum holding period of 12 months, but before maturity, the government would pay you back your initial investment of $10,000, regardless of where the interest rates might be at the time with TIPS.

That’s not always the case. If you buy $10,000 of TIPS and you sell them before maturity says in the secondary market via your bank or fidelity, the price you get will depend on what the secondary market is willing to pay. And with TIPS like with all normal bonds, the price goes up when interest rates go down and the price goes down when interest rates go up.

If you buy $10,000 of five-year TIPS today and sell the next year, you’ll most likely lose money on the sale because interest rates are expected to go up. And when that happens, the price of my TIPS will go down.

Now, this only matters if you sell your TIPS before their maturity date if I hold my $10,000 of five-year TIPS to maturity. So for the full five years, I would be paid the inflation-adjusted principal or the original principal, whichever is greater, but just like I hate negative yields.

I hate losing principal.

The second reason for why we opted for I Bonds versus TIPS, leads nicely to how we’re using I Bonds versus TIPS as an inflation hedge in our personal portfolio and that legal loophole I mentioned earlier, that could help you increase your annual I Bond purchase limit. Like it helped us our retirement and other long-term savings. We’re still dollar-cost averaging those amounts into the market to buy equities. Because at the end of the day, we believe that’s still the best inflation hedge in the long run.

I Bonds and TIPS are designed to keep pace with inflation. They are not designed to make you rich.

That’s what the stock market is for. If you have the right long-term mindset towards investing, no matter which decade you started investing your average annual rate of return from the S&P 500 beat out the average annual rate of inflation every time, meaning the S&P 500 beat out the returns you would’ve gotten on an inflation index, government security like I Bonds and TIPS.

I Bonds vs Tips: What’s Better For an Inflation Hedge?

Series I Bonds are a great inflation hedge for your excess short to medium-term cash you do not need for the next year. Think of anything above and beyond your emergency fund. Most investors strategy is holding their I Bonds to maturity.

Like other investmetns the only reason you would want to sell if you really needed that cash for a specific purpose. Or if you were confident you could get better returns elsewhere for your short-term to medium-term cash savings.

With inflation being so high, TIPS doesn’t make as much sense; especially with the attractive yield of I Bonds. We know that when it’s time for you to redeem your I Bonds before maturity you’ll have made a nice 7.12% (or higher) interest rate. Plus, inflation doesn’t seem to be slowing down so you should earn more.

Now, if you have several $100,000 of excess cash sitting around, then this won’t work for you since the annual I Bonds purchase limit is simply too low. But if you’re like most investors, you’ll want to buy more than the annual I Bonds purchase limit.

Welcome to the legal loophole that I discovered a few weeks back.

Series I Bonds Loop Hole Strategy – Case Study Example

As mentioned previously, investors are limited to $10,000 of Series I Bonds purchased unless you take advantage of the special tax return that allows an additional $5,000 purchase.

First, you can purchase your $10,000 I bond limit for you and your spouse. Then you can purchase an additional $10,000 of I Bonds for your spouse as a gift from your treasury direct account.

This will be sitting in your treasury direct account immediately and you can gift it to them at a later time (most likely in a year or so) when you think inflation has peaked.

Here’s the great part: their $10,000 gift that’s sitting in your treasury direct account begins earning interest immediately.

Their I bonds gift earns interest immediately and it’s subject to the same conditions and restrictions as any normal bond. Here’s what I mean: his bond gift started earning 7.1, 2% interest from the date you purchased it, even though it’s sitting in your account in the gift box.

Their I Bonds gift also will have its rate adjusted for inflation six months from the date you purchased it, even though it’s sitting in your account in the gift box.

If you bought their I Bonds gift in May 2022, this rate adjustment would happen in September, 2022. And the minimum one-year holding period on their I Bonds gift also started from the date that you purchased it, even though it’s sitting in my account in the gift box.

This doesn’t mean you should run out and borrow other people’s names and social security numbers under the pretense of buying I Bond for them as gifts, and then take the money back for yourself.

Only the person named as the I Bonds gift recipient can cash out the Series I Bonds.

You don’t want to buy more I Bonds gifts than you should for someone and end up sitting on ridiculous amounts of I Bonds gifts. Only to find out that it’ll take you 20 years to deliver everything to your recipient.

Who knows where the yield on I Bonds will be in five years, forget about 20 or 30 years from now. Remember the delivery of the I Bonds gifts to the recipient is subject to the same legal limit of $10,000 per year. As if the recipient were buying I Bonds for himself or herself. Before they’re delivered, while the I Bonds gifts do earn interest in your treasury direct gift box, you can’t get to them or do anything with them, even if you need the cash.

The Bottom Line

The decision of whether to buy I Bonds or TIPS is a personal one. Consider your investment goals and objectives, time horizon, and risk tolerance before making a decision.

If you’re looking for a safe investment that will protect your purchasing power from inflation, I Bonds may be a good choice. If you’re looking for an investment that will provide you with a higher rate of return, TIPS may be a better choice.

Both I Bonds and TIPS are backed by the full faith and credit of the U.S. government, so you can feel confident that your investment is safe.