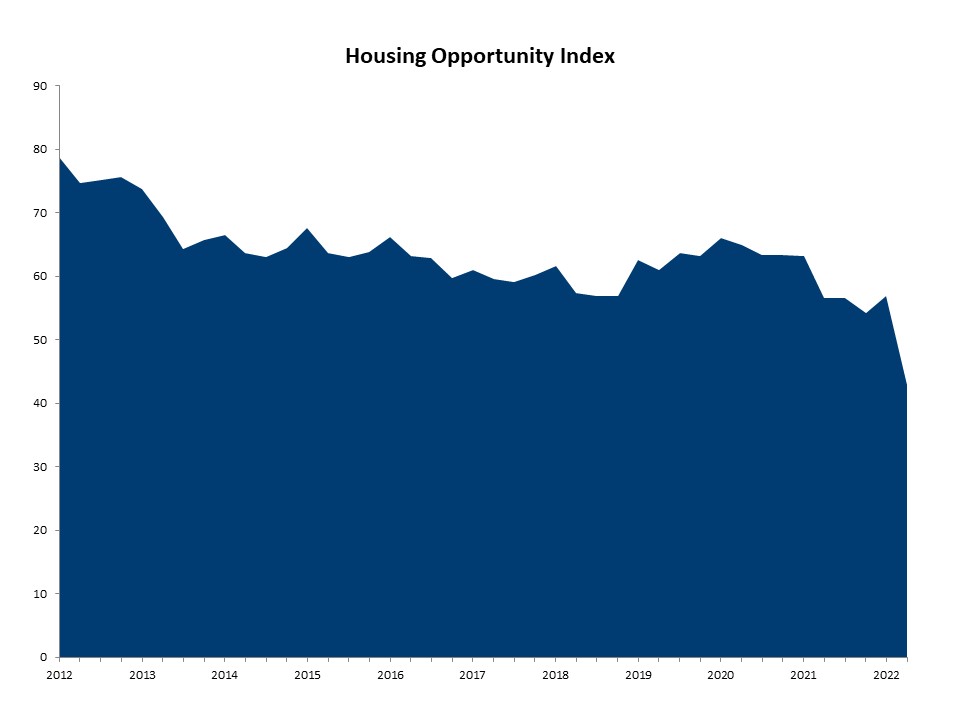

Rising mortgage rates, high inflation, low existing inventory and elevated home prices contributed to housing affordability falling to its lowest point since the Great Recession in the second quarter of 2022.

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI), just 42.8% of new and existing homes sold between the beginning of April and end of June were affordable to families earning the U.S. median income of $90,000. This is a sharp drop from the 56.9% of homes sold in the first quarter that were affordable to median-income earners.

The HOI shows that the national median home price jumped to an all-time high of $390,000 in the second quarter of 2022, surpassing the previous record-high of $365,000 set a quarter earlier. Meanwhile, average mortgage rates soared from 3.86% to 5.33% during this period.

The top five most affordable major housing markets in the second quarter of 2022 were:

- Lansing-East Lansing, Mich.

- Indianapolis-Carmel-Anderson, Ind.

- Toledo, Ohio

- Harrisburg- Carlisle, Pa.

- Scranton-Wilkes-Barre, Pa.

The top five least affordable major housing markets—all located in California were:

- Los Angeles-Long Beach-Glendale

- Anaheim-Santa Ana-Irvine

- San Diego-Chula Vista-Carlsbad

- San Francisco-San Mateo-Redwood City

- San Jose-Sunnyvale-Santa Clara

Meanwhile, Elmira, N.Y., was rated the nation’s most affordable small market, with 91.8% of homes sold in the second quarter being affordable to families earning the median income of $77,900.

The top five least affordable small housing markets were also in the Golden State. At the very bottom of the affordability chart was Salinas, Calif., where 5.3% of all new and existing homes sold in the second quarter were affordable to families earning the area’s median income of $90,100.

Visit nahb.org/hoi for tables, historic data and details.

Related