Software is a popular type of accounting system you can use to streamline your bookkeeping process. Depending on the software you choose, you can save your time and money and focus on what matters—running your business. But first, you need to know about accounting software setup. Lucky for you, our guide makes setting up accounting system as easy as pie.

Read on to learn more about our seven easy-to-follow steps for setting up accounting software.

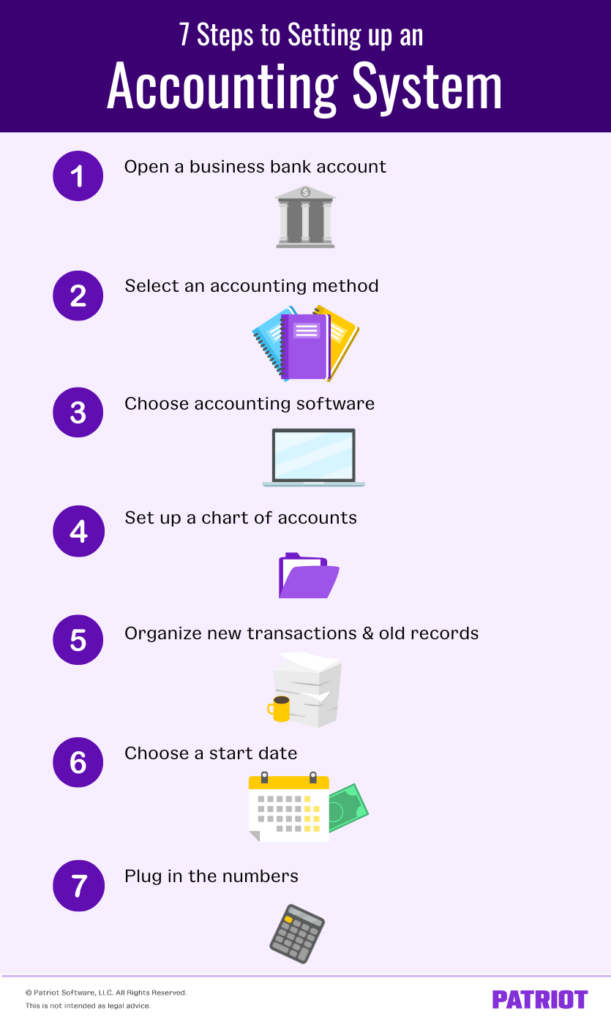

Setting up an accounting system in 7 steps

Accounting setup isn’t rocket science, but if you don’t know where to start it can feel overwhelming. Here are seven easy-to-follow steps on how to set up an accounting system.

1. Open up a bank account for your business

Before you choose and set up accounting software, you should think about opening up a separate business bank account. Some business structures must open a separate bank account (e.g., LLC, corporation, or limited partnership). Even if it isn’t a requirement for your business, the IRS does suggest that you do. It’s the simplest way to keep things organized.

Keep a separate account for your business to:

- Avoid spending your personal money on business needs

- Easily organize your records

- Forecast cash flow

- Make filing your business tax return easier

2. Select an accounting method

There are three accounting methods to choose from: Cash-basis, modified cash-basis, and accrual accounting.

Cash basis is the simplest method of accounting. Cash-basis accounting uses the single-entry method of accounting. With single-entry, you record each transaction as one entry as they happen. This accounting method is best for short-term transactions.

Modified cash-basis accounting is a happy medium between cash-basis and accrual accounting. Modified cash-basis uses the double-entry method of accounting. You can use cash-basis for short-term transactions and accrual accounting for long-term items such as long-term liabilities and accounts payable. In other words, you record transactions when money changes hands, and even when it hasn’t yet.

Accrual accounting can feel complicated to a beginner. Accrual uses the double-entry method of accounting. With accrual accounting, you record transactions when they take place, regardless of whether you’ve received any money yet. This is the best method to track funds over long periods.

3. Choose accounting software that fits your needs

First, you need to know how to choose the right accounting software for your business. After all, there are plenty of options to consider. So many in fact, it can feel a bit overwhelming. But, it’s easier than you think.

Before you choose software, let’s cover the basics. There are two types of accounting software to choose from: Cloud accounting and desktop software. Cloud accounting allows you to work from wherever you are, while desktop software generally keeps you tethered to the single computer or device you downloaded your software to.

Whichever type of accounting software you choose, there are a few other considerations you need to keep in mind. Make sure that your accounting software:

- Has payment options that fit your budget

- Is one that you know how to use

- Includes the features you need

- Offers flexibility and can change as your needs change

- Provides customer support that is there when you need it

4. Set up a chart of accounts

A chart of accounts (COA) is a way to keep track of all your business accounts. Think of it like a table of contents, it helps you understand all of your accounts at a glimpse. Your COA will break down your business transactions into five main accounts with as many sub-accounts as you need.

Here’s an example of how your five main accounts and sub-account could look:

- Asset

- Liability

- Accounts payable

- Sales tax collected

- Payroll tax liability

- Equity

- Income (revenue)

- Bank account interest

- Product sales

- Miscellaneous income

- Expense

- Advertising

- Equipment

- Insurance

- Supplies

- Payroll expense

5. Decide how to organize new transactions and old records

The IRS suggests that you keep detailed records of purchases, expenses, and assets, plus anything you want to deduct. Common sense demands it. If you’re looking for accounting software (and we know you are) consider organizing receipts electronically. When organized correctly, electronic receipts can make bookkeeping easier.

Whether you’re using electronic receipts or sticking to hardcopies, the same guidelines for organizing business receipts apply. Some general guidelines for organizing receipts include:

- Sorting receipts by type

- Organizing receipts chronologically

- Setting aside a specific place to store the receipts (e.g., a filing cabinet or a digital folder)

- Being consistent

6. Choose a start date to switch to your new software

A good time to make the switch is the end of an accounting period because you can use the closing balances from the last period as beginning balances. If you use 13-month accounting periods, the end of an accounting period will arrive quickly.

And since we are talking about schedules … if you want to keep things simple, make a schedule for bookkeeping tasks and set reminders so you don’t forget.

7. Plug in the numbers

You’re now ready to use your accounting software and get back to business. Stay organized, stay on time, and plug in the numbers. It’s as simple as that.

Interested in keeping your time and money? Sign up for Patriot Software today to get a free trial of our accounting software. We’ve designed our software with our customers in mind (you’ll see what we mean when you give us a try!).