On 10th August 2022, the Ministry of Finance, Department of Financial Services notified that effective from 1st October 2022, taxpayers are not eligible to be part of the Atal Pension Yojana. However, there is confusion about what existing subscribers of Atal Pension Yojana have to do. Let us see the details about the notification.

Atal Pension Yojana or APY was primarily meant for the unorganized sector. It was launched with the intention to provide a retirement benefit to the such sectors. However, many individuals without bothering what should be the value of the benefit of this scheme, just blindly enrolled. Mainly because it is a Government scheme and the GUARANTEED tagline was there with this product. I tweeted the same few hours back.

You may refer to the complete feature of this product in my earlier post “Atal Pension Yojna (APY)-New Pension Scheme details and benefits“.

Now there is a huge confusion of what existing subscribers have to do after this new notification.

Tax Payers can’t join Atal Pension Yojana – What existing subscribers have to do?

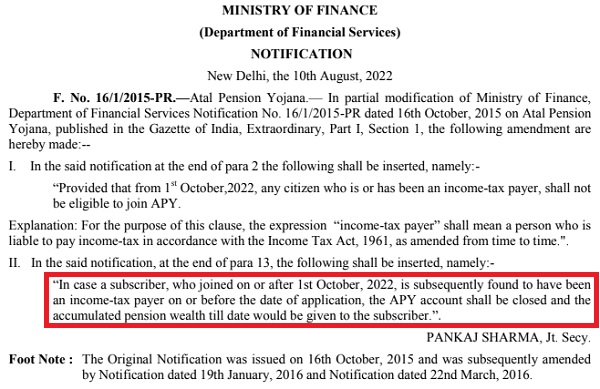

Let me share with you the image of the notification to clear all the doubts.

Notice the main wordings of this notification.

“Provided that from 1st October,2022, any citizen who is or has been an income-tax payer, shall not be eligible to join APY.”

“In case a subscriber, who joined on or after 1st October, 2022, is subsequently found to have been an income-tax payer on or before the date of application, the APY account shall be closed and the accumulated pension wealth till date would be given to the subscriber.”

It clearly indicates that the new ruling will be effective from 1st October 2022. The second important thing to note is that if a subscriber WHO JOINED ON OR AFTER 1ST OCTOBER, 2022 IS SUBSEQUENTLY FOUND TO HAVE BEEN AN INCOME-TAX PAYER on or before the date of application, the APY account shall be closed and the accumulated pension wealth till date would be given to the subscriber.

It means this new ruling is applicable for only those subscribers who will join on or after 1st October. It is completely silent on those who are already subscribers and also taxpayers.

Hence, it is clear from the notification that the existing Atal Pension Yojana subscribers can continue as usual. But many news items created so much confusion among existing subscribers that many thought of approaching the providers for the closure. However, as the notification is silent on existing subscribers and their tax status, one can continue as usual.

BUT…whether APY is a great retirement product? The pension that you get after 60 years of your age is kind of peanut. However, people are fans of financial products which have taglines like – TAX BENEFITS, GUARANTEED, and SAFE.

APY is meant for the unorganized sector. Let it must benefit them more than those who are working in the organized sector. Stay away from that mindset of searching GUARANTEED everywhere.