When I ask a group of financial advisors to share their thoughts on an ideal client, I often hear things like “willing to take my advice” or “appreciates our planning approach.” What I’m really after are indicators of an ideal client that would be identifiable from a marketing standpoint. After all, it’s a little harder to seek out those who “take advice” than it is to find those who are in a certain stage of life, have a certain occupation, etc.

The following are steps that any advisor can take to define your ideal client profile. This process starts by analyzing your top existing clients, which is a great starting point for replicating them.

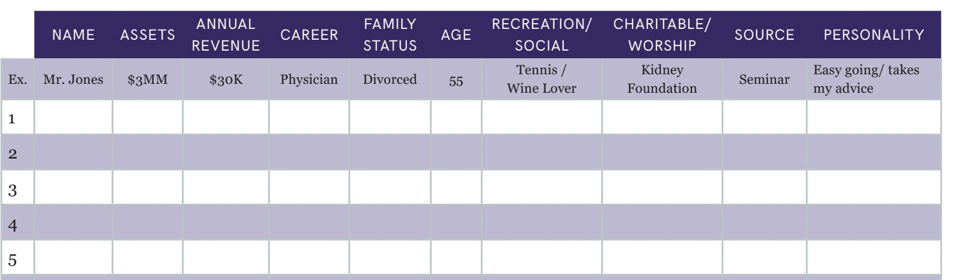

Start by examining your current client base and looking for areas of commonality. What are their ages? How did you get connected with them? What do they do for work? List your top clients and answer questions in each category listed below to the best of your ability.

Review your answers to the top client audit and list areas of commonality you discovered. Write each commonality under the appropriate header below. For example, you might notice you work with a number of physicians, divorcees, country club members, contacts from a place of worship, corporate executives, etc.

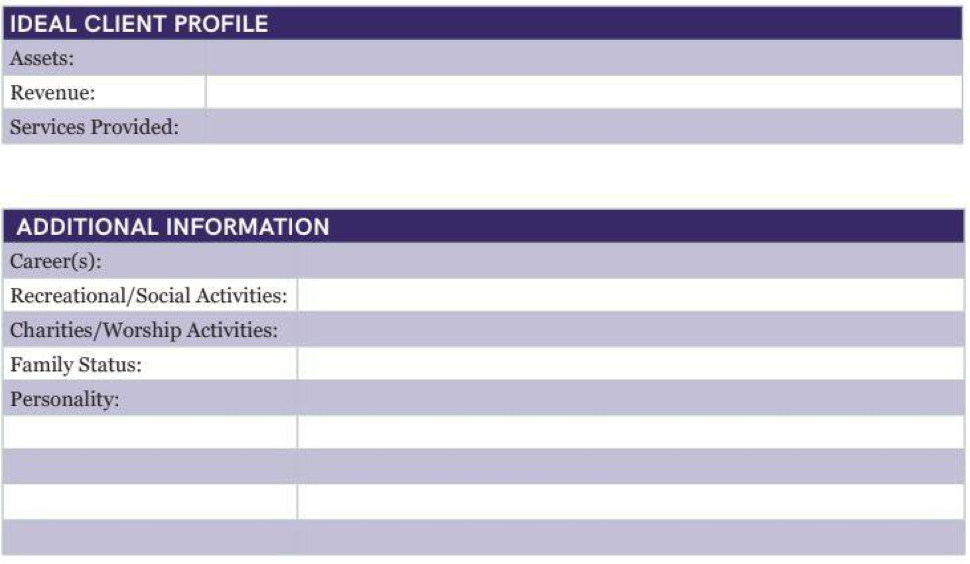

Once you’ve examined the patterns in Step 2, create the profile of your ideal client based on the information you’ve gathered. Determine what patterns and characteristics fit together to make each segment.

Start with assets and revenue figures, then fill in the additional information. The objective is to activate your marketing antenna. What’s that? Like when you start searching for a new car, once you narrow down your focus to a certain make and model, you start to see these types of cars everywhere. You know where they’re sold, all the available options, and who else drives one in your neighborhood. This is the type of antenna we’re looking to activate as it relates to ideal clients.

When you are done, your Ideal Client Profile should enable you to:

- Determine the places you need to spend more time marketing (i.e. your tennis club).

- Recognize prospective clients quickly after you meet them.

- Quickly qualify prospects, knowing that you have the right solutions for them and can provide valued service in a long-term financial advisory relationship.

This type of ideal client exercise helps shape all facets of your marketing. If you’re working through centers of influence, which of them work most closely with your ideal? If you’re hosting client events, which events would be enticing to your ideal? If you’re running digital ads, how can you target your ideal? Every marketing action you take and every budget dollar you spend should all be targeted at your ideal client.

Matt Oechsli is author of Building a Successful 21st Century Financial Practice: Attracting, Servicing & Retaining Affluent Clients. www.oechsli.com