By Žymantas Budrys, PhD researcher at DSE Alma Mater Studiorum – Bologna University, Mario Porqueddu, Senior Economist, Prices and Costs Division at European Central Bank, and Andrej Sokol, Senior Economist at Bank of England. Originally published at VoxEU.

Workers and employers bargain over the surplus income generated by an employment relationship. This column uses information about key events in Germany relevant for wage negotiations, like labour strikes and the introduction of a minimum wage, to pinpoint changes in bargaining power between workers and employers. It finds that such wage bargaining ‘shocks’ are important drivers of unemployment and inflation and that their effect on wages is almost fully reflected in prices. Furthermore, they reduce the vacancy rate and increase firms’ profits and the labour share of income in the short run, but not in the long run.

>Workers and employers bargain over the surplus income generated by an employment relationship, most notably in terms of wages. Wage-setting reflects broader macroeconomic developments, but it is also affected by shifts in bargaining power that are not directly observed. We propose a novel approach to identify exogenous variation (compared with other factors such as demand and supply shocks) in bargaining power from the data, using information about key events relevant for wage negotiations. We then study its effects on the macroeconomy.

In Germany, the country we focus on, a number of historical events arguably constitute positive wage bargaining shocks that improve workers’ bargaining power, such as the introduction of a statutory minimum wage in 2015 and a number of labour disputes led by the prominent union IG Metall. Minimum wage policy acts as a direct shift of bargaining power in favour of workers, and collective bargaining rounds that involve the threat of, or actual, strikes also boost workers’ bargaining power.

We find that positive wage bargaining shocks propagate to the economy through higher unemployment and lower output. The effects on unemployment are very persistent, whereas the effects on output are comparatively short-lived, mostly fading within three years. We also find that, for Germany, bargaining shocks explain around a quarter of changes in inflation and unemployment at longer horizons. Furthermore, the so-called pass-through of higher wages to prices following a wage bargaining shock is close to total. It thus provides a rationale for monetary policymakers to closely monitor factors influencing wage bargaining outcomes.

Identifying wage bargaining shocks

Bargaining power is unobserved and is an ‘umbrella’ term for various factors – ranging from personal preferences to the extent of unionisation and the sequencing of bargaining steps – that determine how the surplus of a work relationship is split between parties. In a canonical search and matching framework (Pissarides 2000), bargaining power is controlled by a parameter that seeks to capture all factors determined outside the model. In such a model, an increase in bargaining power allows workers to obtain higher wages, but vacancies drop as firms are less willing to hire owing to increased costs, leading to a gradual increase in unemployment.

Crucially, such an outcome for unemployment very much depends on the specifics of the assumed model. A different bargaining framework, a more complex modelling set-up, or different parameter values can completely alter the conclusions – and with them any policy recommendations. We therefore seek to rely as little as possible on theory in our identification of wage bargaining shocks, and instead exploit information available from recent historical events. We employ a structural vector autoregression (SVAR) model that relies on sign restrictions (also used in previous studies of wage bargaining shocks, e.g. Foroni et al. 2018, Conti and Nobili 2019, Galí and Gambetti 2019), but also on minimum wage policy shifts and labour strikes for identification.

Minimum wage introduction

At the beginning of 2013 German political parties declared a shared intention to introduce a binding minimum wage, and legislation in that sense came into force in August 2014. Compared with wage floors in other European countries, the initial minimum wage rate of €8.50, adjusted for purchasing power, was the third largest. Moreover, around 10.7% of the workforce (four million employees) had wage rates below the new threshold and were eligible for the minimum wage rate.

Major industrial actions

We also treat major industrial disputes as wage bargaining shocks. We apply stringent criteria to select strikes suitable for our identification purposes. We focus on strikes where (1) a union is viewed as the winner of a negotiation round, and (2) anecdotal evidence suggests that wage increases would have been much less favourable to workers in the absence of a strike (threat). Moreover, we only consider cases where (3) the strike is an ‘economic strike’, meaning that it is focused on wage increases or better working conditions. We also choose (4) significant and costly strikes: in Germany, the legislative framework governing strikes encourages unions to call warning strikes that are typically short and induce only minor production losses for the firm; instead, we focus on full-day strikes. Finally, we only consider (5) major labour market conflicts involving IG Metall, the union for the metal and electricity industry.

1

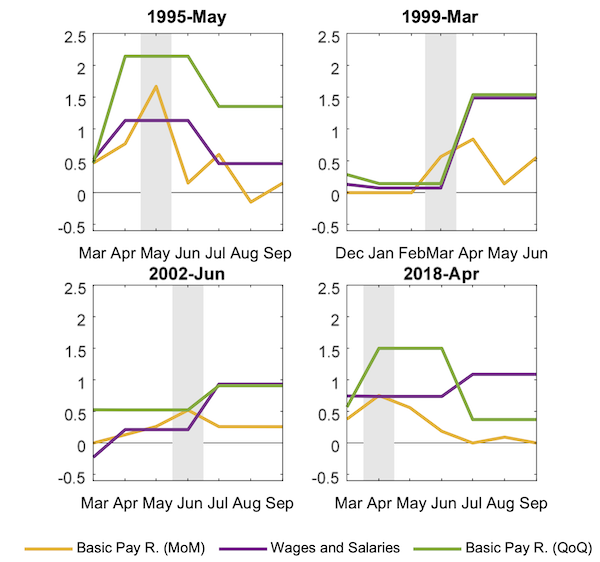

We identify three events that fully match our criteria. These occurred in the second quarter of 1995, the third quarter of 2002, and the second quarter of 2018. We also include another event, in the second quarter of 1999. Unlike the others, this fourth event did not result in a full-day strike, but instead ended with a compromise reached two hours after the deadline to authorise a strike. We observe non-negligible wage increases after IG Metall industrial disputes, as shown in Figure 1.

Figure 1 Nominal wages around selected IG Metall industrial strikes

Notes: The grey area shows the month of the actual wage increase, agreed between IG Metall and the association of employers. Basic Pay Rates (BPR) is an indicator compiled on a monthly basis by the Deutsche Bundesbank that summarises developments in wages under collective agreements covering over half of the German workforce (Deutsche Bundesbank 2020); BPR (MoM) is its monthly growth rate and BPR (QoQ) is its quarterly growth rate. The Wages and Salaries series is the quarterly growth rate of wages and salaries per employee based on national accounts.

However, strikes are not completely independent events. In fact, calls for strikes and most negotiated wage increases typically reflect unions’ reactions to improving economic conditions. For example, historical sources emphasise that IG Metall reacted to past and expected developments in wages, workers’ low purchasing power, a better economic situation, and rising profitability (Gesamt Metall 2018). But strikes are not entirely predictable either. For one thing, while the incidence of strikes may coincide and correlate with favourable economic conditions, industrial action is still pretty rare. It is subject to legal barriers and usually viewed as a last resort in wage negotiations, owing to the potential unemployment and reputational costs for all social partners involved.

To establish exogeneity, we investigate the predictability of the full-day strikes using an event study of the stock market performance of firms whose employees are represented by IG Metall, following the approach of Neumann (1980), Becker and Olson (1986), and Kramer and Vasconcellos (1996), among others.

2

Strikes are harmful and costly for firms. Future profitability may suffer for a number of reasons, such as lost or delayed production owing to stoppages or the expectation of a higher wage bill owing to increased wage demands. Thus, strikes may reduce the valuation of a company, and if capital markets are efficient and strikes were not anticipated, the lower valuation should be reflected in the firm’s stock price. We find that, on average, stock returns fall by around 0.7-0.95% over the four days up to and including the strike, thus corroborating our identification assumptions.

Wage bargaining shocks and the macroeconomy

We estimate and identify an SVAR model that includes five macroeconomic variables: the GDP deflator, real wages and salaries per hour, the unemployment rate, hours worked per employee, and real GDP per capita. For estimation, we rely on standard Bayesian techniques (see Litterman 1986, Kadiyala and Karlsson 1997, Bańbura et al. 2010, among others), supplemented with a long-run prior (Giannone et al. 2019). The latter is particularly useful for German data, where reunification and a number of structural reforms in the early 2000s induced some trending behaviour for otherwise rather stable variables, notably unemployment and average hours worked.

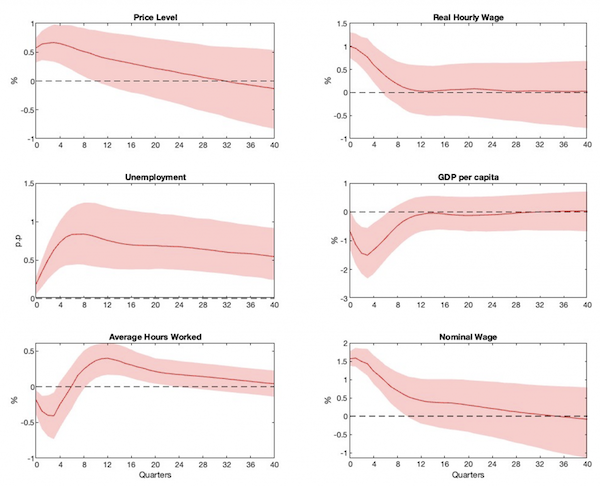

Figure 2 shows the impulse responses (i.e. how variables react) to a positive wage bargaining shock that improves workers’ bargaining power. The increase in real wages, which is around 0.2 percentage points on impact, lasts for about two years following the initial shock. The pattern mostly reflects the dynamics of nominal wages, only partially offset by a slower-moving response of domestic prices. Indeed, the unexpected increase in the wage bill raises the price level by 0.15 percentage points on impact, which then remains above its steady state level for three to four years.

3

Average working hours fall by about 0.1 percentage points within two quarters after the shock, but then experience a long-lasting reversal that peaks at 0.1 percentage points above the steady state after around three years, while the unemployment rate gradually increases following the shock, reaching a peak of 0.15 percentage points after around two years, and with an even more gradual return to the steady state. Output per capita falls on impact and reaches a trough of around −0.4 percentage points after three quarters, then reverses the decline and returns to the steady state within three years.

The pattern of impulse responses indicates that German firms first react to increased labour costs by adjusting prices and reducing average hours worked. With time, firms then also adjust the size of their workforce and unemployment increases as a result, while those still in employment end up working longer hours. This is consistent with existing evidence about the relative importance of the adjustment in average worked hours in the euro area compared with the United States (see Ohanian and Raffo 2011, Bulligan et al. 2019).

Wage bargaining shocks are an important driver of the business cycle in Germany. A breakdown of forecast error variance shows that around 16% of the contemporaneous variation in real wages is explained by the shock, and it still explains approximately 6% at the ten-year horizon. The shock is an important driver of GDP deflator inflation, explaining almost a quarter of its variation. In the long run, the shock also accounts for a fifth of the variation in the unemployment rate. Focusing on an interesting historical episode, we also find that following the announcement and introduction of a minimum wage in 2014-15 (the same event also used for our narrative identification), wage bargaining shocks led to a persistent increase of around 0.25% in hourly real wages, or roughly 0.5% in nominal terms, lasting until early 2016).

4

Figure 2 Impulse responses to a positive wage bargaining shock

Notes: The figure shows impulse responses to a positive wage bargaining shock for the baseline model. Bands show 68% credible sets of the posterior distribution.

Conclusions

We revisit the identification of wage bargaining shocks in an SVAR model using narrative information for Germany. We propose to use historical events, namely the introduction of a minimum wage as well as a number of industrial disputes, which are both economically relevant for aggregate wage dynamics and plausibly exogenous due to exogenous variation in bargaining power. Our findings suggest that wage bargaining shocks are an important source of macroeconomic fluctuations, and our model’s quantification of the impact of the minimum wage introduction in Germany is in line with and complements existing micro-econometric evidence. Given the similarities between wage bargaining institutions in many economies (such as the existence of some form of national minimum wage, widespread union coverage and a relatively high degree of regulation of the wage-setting process (e.g. Du Caju et al. 2009), our methods and findings are of broader applicability and relevance.

Authors’ Note: This column first appeared as a Research Bulletin of the European Central Bank. The authors gratefully acknowledge the comments of Alexandra Buist and Alexander Popov. The views expressed here are those of the author and do not necessarily represent the views of Bloomberg LP, the European Central Bank, or the Eurosystem.

Footnotes

- IG Metall is generally viewed as a trend-setter for wage bargaining activity in Germany, owing to its significance in terms of union coverage (the number of workers covered by collective bargaining) and historical dominance. The union is the largest in Germany and in fact the largest in Europe, representing around 3.5 million employees (see Eurofound 1999).

- We also estimate a set of wage Phillips curves to investigate whether wage dynamics can be adequately explained by macroeconomic developments for the quarters in which industrial disputes occur. In our baseline specification, we find that quarterly wage growth is on average 0.7 percentage points in excess of what macroeconomics factors would warrant for those quarters, suggesting that our selected events do indeed coincide with positive surprise effects related to an increase of bargaining power and are economically relevant for wage dynamics.

- Note that the impulse response of the price level is inferred from the cumulative response of inflation.

- This corroborates existing estimates of the resulting increase in the nominal wage bill, which range between 0.4% and 0.55% (Deutsche Bundesbank 2018, Mindestlohnkommission 2018, Caliendo et al. 2019).