Executive Summary

Registered Investment Advisers (RIAs) are generally required to enter into an advisory agreement with their clients prior to being hired for advisory services. And while there is no standard ‘template’ language applicable to all advisory agreements, there are a number of best practices that RIAs can follow in drafting and reviewing their agreements to ensure they can pass legal and regulatory muster.

In this guest post, Chris Stanley, investment management attorney and Founding Principal of Beach Street Legal, lays out the statutory requirements for RIA advisory agreements and some of the essential elements for advisory agreements to include when describing the RIA’s services and fees.

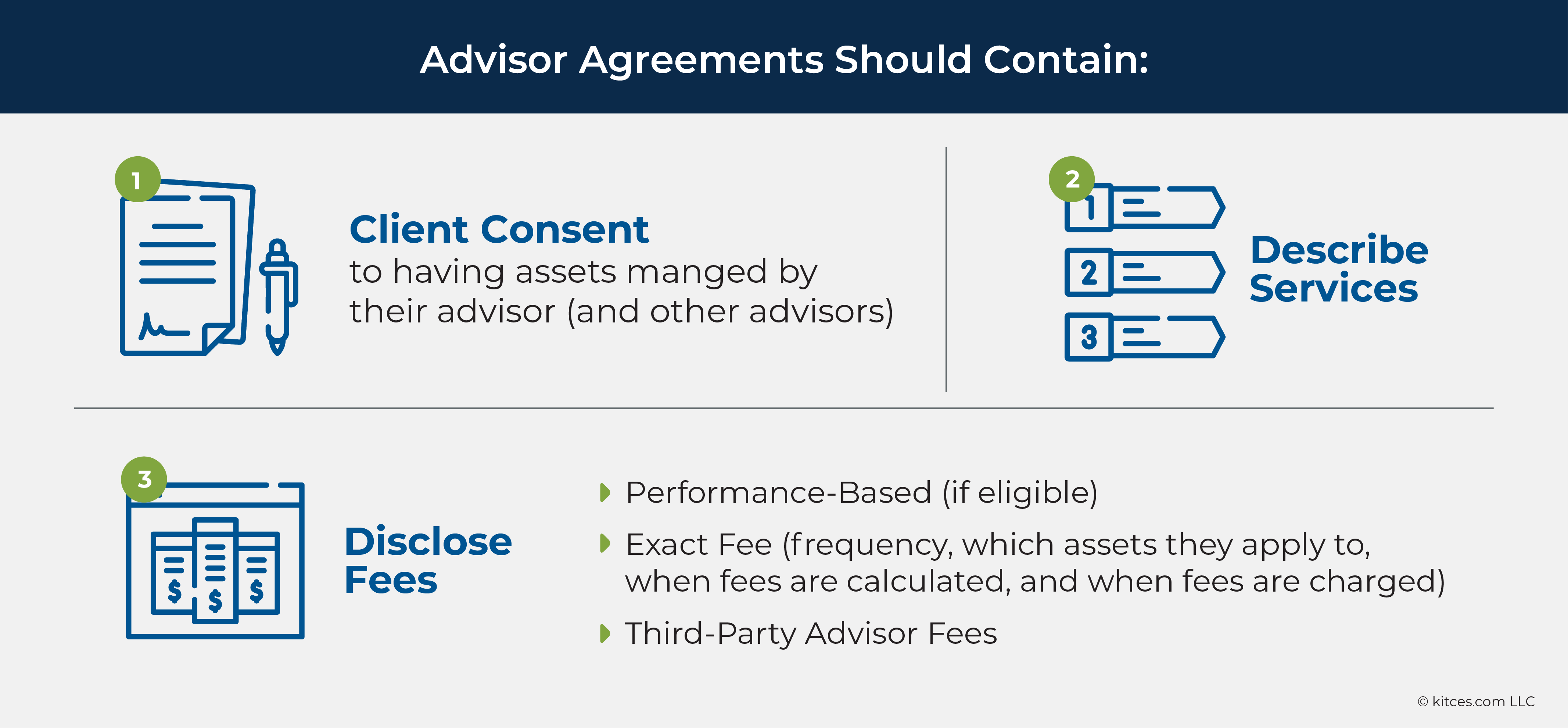

Advisory agreements for SEC-registered RIAs are governed by Section 205 of the Investment Advisers Act of 1940. In terms of specific advisory agreement language, the Advisers Act focuses essentially on three items:

- First, the law restricts RIAs from charging performance-based fees unless the client is a “qualified client” (in most cases, a client with at least $1.1 million under the management of the adviser, or with a total net worth of at least $2.2 million);

- Second, advisory agreements are required to give clients the opportunity to consent to their advisory agreement being ‘assigned’ to another adviser (including when an RIA changes ownership by merging with or being acquired by another firm); and

- Third, advisory agreements of RIAs organized as partnerships are simply required to contain a clause informing the client of any change in the membership of that partnership “within a reasonable time after such change”.

But even though the specific requirements of the Advisers Act are relatively narrow in scope, a well-crafted advisory agreement will contain additional elements, including descriptions of the RIA’s services and fees.

When describing the RIA’s services, advisory agreements should lay out the specific services – such as discretionary or nondiscretionary asset management, and the scope and duration of any financial planning services – to be included in the arrangement.

When it comes to fees charged to clients, advisory agreements should include – at minimum – the exact amount of the fee (either as a dollar amount or percentage of assets under management), when the fee will be charged, how the fee will be prorated at the beginning and end of the agreement, how the client can pay the fee, and which of the client’s accounts may be billed. For AUM-based fees, agreements should also include breakpoints for multi-tiered fee schedules (and whether breakpoints are applied on a ‘cliff’ or ‘blended’ basis) and how AUM is calculated (and whether it is based on assets at a single point in time or averaged over a specific period, and if it includes cash and/or margin balances). Any fees for third-party advisers or subadvisers should also be described in the agreement. While these constitute only two core elements of advisory agreements, there are numerous other essential components for RIAs to include (so many, in fact, that covering them all will require another separate article!).

The key point, however, is that a good advisory agreement requires a solid grasp of the Federal and state statutory requirements, and clearly lays out the RIA’s services and fees. For established firms, understanding these points more deeply will allow RIA owners to review their existing agreements – to ensure not only that they comply with existing regulations, but that they also include the elements constituting a valid agreement between RIA and client!

As unbelievable as it may be, the Investment Advisers Act of 1940 and the rules thereunder don’t require client advisory agreements to be in writing.

Seriously.

Technically speaking, an oral understanding that is never memorialized to a written instrument may be deemed a valid means by which a client can retain an SEC-registered investment adviser to render advice and other services in exchange for compensation. My son’s T-ball league requires that I sign a written agreement waiving every conceivable right I have (and some I didn’t know I had) before he even steps out onto the diamond, yet the fiduciary act of managing someone’s life savings is not deemed statutorily worthy of the same written memorialization.

I cannot emphasize the following enough, though: I do not advocate or endorse oral agreements in lieu of written agreements. This is partially due to my personal marital experience of never remembering what I agreed to do with or for my wife during casual conversations (don’t worry, she remembers everything), but also because it invites revisionist history of what was actually agreed to between client and adviser, and a resultant battle of he-said, she-said, that never ends well.

In addition, from a practical perspective, professional malpractice insurance carriers, custodians, potential succession partners, and most clients would likely shy away from an adviser that isn’t prepared to sign on the dotted line. It also should be noted that most, if not all, state securities regulators require that client advisory agreements be in writing, so state-registered advisers can simply ignore everything written above.

Whether oral or written, though, Section 205 of the Advisers Act imposes specific requirements and restrictions upon client advisory agreements, most of which are dedicated to the logistics of charging performance fees. Still, in order to comply with Section 205, there are many contractual best practices and drafting techniques that advisers (even those not charging performance fees) can use in the course of updating or replacing their existing advisory agreement(s).

Importantly, state securities regulators often impose different or additional requirements and restrictions with respect to advisory agreements used with their respective state’s constituents. Any state-registered adviser that has the misfortune of enduring multiple different state registrations has likely experienced this first-hand during the registration approval process. While each state’s whims will not be reviewed in this article, sections in which state rules and regulations will likely vary will be flagged.

Lastly, the contractual best practices and drafting techniques offered here are topics squarely within an attorney’s bailiwick. While they are meant to help advisers better understand and comply with advisory agreement requirements, they should not be construed as legal advice.

Editor’s Note: Because of the sheer volume of information related to advisory agreement requirements, this article has been divided into 2 parts. Part 1 will focus only on the statutory requirements of Section 205 of the Advisers Act, as well as the ‘core’ elements of any advisory agreement: a description of the adviser’s services and fees. Part 2 will address the additional considerations that should be made in any advisory agreement. Each part is intended to be read in conjunction with the other, so as to provide a holistic view of a robust and complete advisory agreement.

Section 205 Of The Advisers Act On Investment Advisory Agreements

Relative to the Advisers Act as a whole, Section 205 is fairly short and is the sole section dedicated to “investment advisory contracts”. It focuses on essentially three items:

- charging performance-based fees;

- client consent to the assignment of the agreement; and

- partnership change notifications.

Section 205(f) is also the section of the Advisers Act that reserves the SEC’s authority to restrict an adviser’s use of mandatory pre-dispute arbitration clauses (i.e., that require clients to agree to settle disputes through arbitration before any disputes even arise) – an authority that has yet to be exercised.

Charging Performance-Based Fees

The primary takeaway from Section 205 regarding performance-based fees is that an advisory agreement cannot include a performance-based fee schedule unless the client signing the agreement is a “qualified client”, as such term is defined in Rule 205-3(d)(1).

A qualified client includes a natural person or company that:

- Has at least $1.1 million under the management of the adviser immediately after entering into the advisory agreement;

- Has a net worth of at least $2.2 million immediately prior to entering into the advisory agreement; or

- Is a “qualified purchaser” as defined in section 2(a)(51)(A) of the Investment Company Act of 1940 at the time the client enters into the advisory agreement.

Qualified clients also include executive officers, directors, trustees, general partners, or those serving in a similar capacity to the adviser, as well as certain employees of the adviser.

Notably, the Dodd-Frank Act requires the SEC to adjust the dollar amount thresholds in the rules set forth by Section 205 every 5 years. The SEC’s most recent inflationary adjustment to these dollar thresholds was released in June 2021.

For a more fulsome explanation of the restrictions imposed on advisers that charge fees “on the basis of a share of capital gains upon or capital appreciation of the funds or any portion of the funds of the client” (i.e., performance-based fees), refer to this article and the rulemaking history described therein.

The dollar thresholds triggering “qualified client” status may differ in certain states, as the automatic inflationary adjustments made by the SEC do not automatically apply to the states. In other words, state securities rules may include a different definition of what constitutes a qualified client, and/or still be using ‘prior’ thresholds not in line with more recent SEC adjustments. This poses a potentially awkward scenario in that a particular client may be charged a performance fee while an adviser is state registered, but not if the adviser later transitions to SEC registration.

Client Consent To Assignment

Section 205(a)(2) prohibits advisers from entering into an investment advisory agreement with a client that “fails to provide, in substance, that no assignment of such contract shall be made by the investment adviser without the consent of the other party to the contract.” In other words, an advisory agreement must, without exception, afford the client the opportunity to consent to his or her advisory agreement being “assigned” to another adviser.

An “assignment” of an agreement occurs when one party transfers its rights and obligations under the agreement to a third party not previously a signatory to the agreement. The new third-party assignee essentially stands in the shoes of the assigning party to the agreement going forward, and the assigning party is no longer considered a party to the agreement. In the context of an adviser-client relationship, an adviser that assigns its rights and obligations to another adviser is no longer the client’s adviser… such that Section 205(a)(2) requires the client to acquiesce to such a change.

Notably, an assignment to a new “adviser” in this context is in reference to the investment adviser (as a firm), not necessarily to a new investment adviser representative within the firm. Still, though, Section 202(a)(1) broadly defines an assignment to include “any direct or indirect transfer or hypothecation of an investment advisory contract by the assignor or of a controlling block of the assignor’s outstanding voting securities by a security holder of the assignor […]”. There are a few more sentences specific to partnerships in the definition, but the general concept of the “assignment” definition is that there are essentially two situations in which an assignment is deemed to have occurred:

- When advisory agreements are transferred to another adviser or pledged as collateral; or

- The equity ownership structure of an adviser changes such that a “controlling block” of the adviser’s outstanding voting securities changes hands.

Both scenarios described above would trigger the need for client consent.

Transferring Advisory Agreements To Another Adviser

A transfer of an advisory agreement from one adviser to another most commonly arises in the context of a sale, merger, or acquisition of one adviser by another (which is also often the case upon the execution of a succession plan).

If Adviser X (the ‘buyer’) is to purchase substantially all of the assets of Adviser Y (the ‘seller’) – including the contractual right to become the investment adviser to the seller’s clients going forward – the seller’s clients must either sign a new advisory agreement with the buyer, or otherwise consent (either affirmatively or passively) to the assignment of their existing advisory agreement with the seller to the buyer.

Controlling Block Of Outstanding Voting Securities

With respect to the second scenario contemplated by the Section 202(a)(1) definition of assignment, the logical next question is: what constitutes a “controlling block?” Unfortunately, the Advisers Act does not define what a “controlling block” is, but based on various sources, including the Adviser Act itself, Form ADV, SEC rulings and no-action letters, and the Investment Company Act of 1940 (a law applicable to mutual funds and separate from the Investment Advisers Act of 1940), we can reasonably conclude that such control is having at least 25% ownership or otherwise being able to control management of the company.

Thus, the logistics of client consent to assignment need to be considered both in adviser sale/merger/acquisition scenarios and in adviser change-of-control scenarios. To come full circle, the existing advisory agreement signed by the client must provide that the adviser can’t assign the advisory agreement without the consent of the client.

Importantly, Section 205(a)(2) does not contain the word “written” before the word “consent,” and does not define what constitutes consent. Must the client affirmatively take some sort of action to provide consent to an assignment, or is the client’s failure to object to an assignment within a reasonable period of time sufficient?

If the existing advisory agreement does require the client’s written consent to an assignment, the assignment cannot occur until the client physically signs something granting his or her approval (i.e., “positive” consent). If the existing advisory agreement does not require written consent, an assignment may automatically occur if the client fails to object within the stated period of time after being notified (i.e., “negative” or “passive” consent). If the existing advisory agreement does not address the assignment consent issue, though, it does not meet the requirements of the Advisers Act.

The important takeaway for SEC-registered advisers, however, is that negative/passive consent is generally permissible in the context of an assignment, so long as the advisory agreement is drafted appropriately. The SEC affirmed this view through a series of no-action letters from the 1980s, which were later reaffirmed in further no-action letters from the 1990s (see, e.g., American Century Co., Inc. / J.P. Morgan and Co. (Dec. 23, 1997).

Many states prohibit negative/passive consent assignment clauses and require clients to affirmatively consent to any assignment. Texas Board Rule 116.12(c), for example, states that “The advisory contract must contain a provision that prohibits the assignment of the contract by the adviser without the written consent of the client.”

Negative/passive ‘consent to assignment’ clauses should afford the client a reasonable amount of time to object after receiving written notice of the assignment (which ideally would be delivered at least 30 days in advance of the planned assignment). The clause should also make it clear to the client that a failure to object to an assignment within X number of days will be treated as de facto consent to the assignment.

Partnership Change Notifications

The third Section 205 provision with respect to advisory agreements is specific to advisers organized as partnerships and simply requires that advisory agreements contain a clause requiring the adviser to notify the client of any change in the membership of such partnership “within a reasonable time after such change.”

Disclosing Services And Fees In Advisory Agreements

With an understanding of the requirements set forth by Section 205 of the Investment Advisers Act, advisers can now supplement those requirements with additional best practices and techniques when creating or reviewing advisory agreements. Two key considerations include providing a good description of the firm’s services and fees. (Established advisory firms may wish to pull out a copy of their own advisory agreement and read through the sections of their own agreement as they explore the sections discussed below.)

Describing The Firm’s Services

The first keystone component of an advisory agreement (or any agreement) is a complete and accurate description of the services to be provided by the adviser in exchange for the fee paid by the client. The exact nature of services will naturally vary on an adviser-by-adviser basis, but good advisory agreements should account for at least the following services:

If rendering asset management services:

- For discretionary management services, include a specific limited power of attorney granting the adviser the discretionary authority to buy, sell, or otherwise transact in securities or other investment products in one or more of the client’s designated account(s) without necessarily consulting the client in advance or seeking the client’s pre-approval for each transaction. For non-discretionary management services, state that the adviser must obtain the client’s pre-approval before affecting any transactions in the client’s account(s).

- Clarify whether the adviser’s discretionary authority extends to the retention and termination of third-party advisers or subadvisers on behalf of the client.

- Consider provisions that discourage or restrict the client’s unilateral self-direction of transactions if they will interfere or contradict with the implementation of the adviser’s strategy (e.g., that the client shall refrain from executing any transactions or otherwise self-directing any accounts designated to be under the management of the adviser due to the conflicts that may arise).

- Consider identifying the account(s) subject to the adviser’s management by owner, title, and account number (if available) in a table or exhibit, noting that the client may later add or remove accounts subject to the adviser’s management so long as such additions and removals are made in writing (or pursuant to a separate custodial LPOA form). This is particularly important if some accounts are to be managed on a discretionary basis and others are to be managed on a non-discretionary basis (or if some of the client’s accounts will be unmanaged).

- Identify any client-imposed restrictions that the adviser has agreed to (e.g., not investing in certain companies or industries).

If rendering financial planning services:

- Describe whether the rendering of financial planning services is for a fixed/limited duration (e.g., if the adviser is simply engaged to prepare a one-time financial plan, after which the agreement will terminate) or whether the financial planning relationship will continue indefinitely until terminated. For ongoing financial planning service engagements, either describe what financial planning services will be rendered on an ongoing basis or consider preparing a separate financial planning services calendar. Advisers can either limit financial planning topics to an identifiable list (if the adviser and/or client want to be very prescriptive in the scope of the relationship) or generally describe that the adviser will render advice with respect to financial planning topics as the client may direct from time to time (if the adviser and/or client want to keep the scope of potential financial planning topics open-ended).

- Clarify that the adviser is not responsible for the actual implementation of the adviser’s financial planning recommendations and that the client may independently elect to act or not act on the adviser’s recommendations at their sole and absolute discretion. Even though the adviser may assume responsibility for discretionary management of a client’s investment portfolio, the client remains ultimately responsible for actually implementing any separate financial planning recommendations that the adviser cannot implement on behalf of the client.

Just as important as a description of the services to be provided by the adviser is a description of the services not to be provided by the adviser. While it is impossible to identify by exclusion everything the adviser won’t be doing, it is best practice to clarify that the adviser is not responsible for the following activities if not separately agreed to:

- Rendering legal, accounting, or tax advice (unless the adviser is also a CPA, EA, or has otherwise specifically agreed to render accounting and/or tax advice).

- Advising on or voting proxies for securities owned by the client (unless the adviser has adopted proxy voting policies and procedures and will vote such proxies on the client’s behalf).

- Advising on or making elections related to legal proceedings, such as class actions, in which the client may be eligible to participate.

To the extent that the client is a retirement plan (such as a 401(k) plan), it will be important to distinguish what plan-specific services will be provided and whether the adviser is acting as a non-discretionary investment adviser (under Section 3(21)(A)(ii) of ERISA) or a discretionary investment manager (under Section 3(38) of ERISA), and what specific plan and/or participant related services are being provided by the adviser.

The nuances of ERISA-specific plan agreements are beyond the scope of this article, but suffice to say that plan agreements should generally be relegated to a separate agreement and should not be combined with a natural-person business owner’s standard advisory agreement, as discussed above.

Advisory Fees

The second keystone component of an advisory agreement, and the one most likely to be scrutinized by SEC exam staff, is the description of the adviser’s fees to be charged to the client. Advisory fees have justifiably received a lot of regulatory attention recently, and advisers should consider reviewing the November 2021 SEC Risk Alert which describes how advisers continue to drop the ball in this respect, from miscalculating fees to failing to include accurate (or sometimes any) disclosures, to lapses in fee-billing policies and procedures and reporting.

At a minimum, an advisory agreement should describe the following with respect to an adviser’s fees:

- The exact fee amount itself (e.g., an asset-based fee equal to X%, a flat fee equal to $X, and/or an hourly rate equal to $X per hour).

- The frequency with which the fee is charged to the client (e.g., quarterly or monthly).

- Whether the fee is charged in advance or in arrears of the applicable billing period (e.g., monthly in advance or quarterly in arrears).

- How the fee will be prorated for partial billing periods, both upon the inception and termination of the advisory relationship.

- How the fee will be payable by the client (e.g., via automatic deduction from the client’s investment account(s) upon the adviser’s instruction to the qualified custodian, or via check, ACH, credit card, etc., upon presentation of an invoice to the client).

- If all fees are to be charged to a specific account and not prorated across all accounts under the adviser’s management, the identity of the account(s) that are the ‘bill to’ accounts. Fees can only be payable from a qualified account(s) specifically for services rendered to such qualified account(s) (e.g., fees associated with a client’s taxable brokerage account should not be payable by the client’s IRA).

Asset-Based Fees

Specifically, with respect to asset-based fees, advisory agreements should include the following:

- Whether fees apply to all client assets designated to be under the adviser’s management and whether the client will be entitled to specific asset breakpoints above which the fee will (typically) decrease.

- For multi-tiered asset-based fee schedules, whether the asset breakpoints are applied on a ‘cliff’ basis or a ‘blended’ (also referred to as ‘tiered’) basis.

- If the fee starts at 1.00% per annum but then decreases to 0.70% per annum if the client maintains a threshold amount of assets under the adviser’s management, clarify whether the 0.70% fee amount applies to all client assets back to dollar zero (i.e., a cliff schedule), or only to the band of assets above a certain threshold, with assets below that certain threshold charged at 1.00% (i.e., a blended or tiered schedule).

- Whether fees are calculated upon assets measured at a single point in time (such as the last business day of the calendar quarter) or calculated upon assets averaged over a specific period of time (such as the average daily balance during the prior calendar quarter).

- If fees are calculated upon assets measured at a single point in time, identify whether fees will be prorated at all for any intra-billing period deposits or withdrawals made by the client.

For example, if fees are payable quarterly in advance based on the value of the client’s assets under the adviser’s management as of the last business day in the prior calendar quarter, will the client be issued any prorated fee refund if the client withdraws the vast majority of his or her assets on the first day of the new quarter? In other words, if the billable account value is $1 million on day one of the billing period but the client immediately withdraws $900,000 on day two of the billing period (such that the adviser is only managing $100,000, not $1 million, during 99% of the billing period), is the client afforded any prorated refund?

Conversely, if fees are payable quarterly in arrears based on the value of the client’s assets under the adviser’s management as of the last business day of the quarter, will the client be charged any prorated fee if the client withdraws the vast majority of his or her assets on the day before the adviser bills? In other words, if the adviser manages $1 million of client assets for 99% of the billing period but the client withdraws $900,000 on the last day before the billable value calculation date (such that the billable value is only $100,000 and not $1 million), is the adviser afforded any prorated fee?

- Charging asset-based fees calculated from an average daily balance in arrears can help to avoid either of the potentially awkward scenarios described above and the need/desire to calculate prorated refunds or fees.

- Whether cash and/or outstanding margin balances are included in the assets upon which the fee calculation is applied.

Flat Or Subscription Fees

To the extent an adviser charges for investment management services on a flat-fee basis, be aware that both certain states and the SEC may consider the asset-based fee equivalent of the actual flat fee being charged for purposes of determining whether the fee is reasonable or not.

For example, if an adviser manages a client’s $50,000 account and charges an annual flat fee of $5,000 for a combination of financial planning and investment management, a regulator may take the position that the adviser is charging the equivalent of a 10% per annum asset-based fee, which, if viewed in isolation, is well beyond what is informally considered to be unreasonable (generally, an asset-based fee in excess of 2% per annum).

Nerd Note:

The 2% asset-based fee threshold traces its roots back to various no-action letters from the 1970s, like Equitable Communications Co., SEC Staff No-Action Letter, 1975 WL 11422 (pub. avail. Feb. 26, 1975); Consultant Publications, Inc., SEC Staff No-Action Letter, 1975 WL 12078 (pub. avail. Jan. 29, 1975); Financial Counseling Corporation, SEC Staff No-Action Letter (Dec. 7, 1974); and John G. Kinnard & Co., Inc., SEC Staff No-Action Letter (Nov. 30, 1973).

In these letters, the SEC’s Division of Investment Management took the position that an asset-based fee greater than 2% of a client’s assets under the adviser’s management is excessive and would violate Section 206 of the Advisers Act (Prohibited Transactions By Investment Advisers) unless the adviser discloses that its fee is higher than that normally charged in the industry.

Setting aside the dubious reasoning underlying the citation of advisory fee practices from nearly a half-century prior, one potential way to combat such logic is to charge separate flat fees purely for investment management (with the asset-based equivalent remaining under 2% of a client’s assets under management), and separate flat fees for financial planning (while adhering to a financial planning service calendar).

Fees Involving Third-Party Advisers Or Subadvisers

To the extent the adviser may retain a third-party adviser or subadviser to manage all or a portion of a client’s assets, and the client will not separately sign an agreement directly with such third-party adviser or subadviser that discloses the additional fees to be charged to the client, it is prudent to include such third-party adviser or subadviser’s fees in the adviser’s agreement.

Advisory agreements should also generally describe the other fees the client is likely to incur from third parties in the course of the advisory relationship (e.g., product fees and expenses like internal expense ratios, brokerage commissions, or transaction charges for non-wrap program clients, custodial/platform fees, etc.).

Several states take a rather ‘creative’ position with respect to what constitutes an ‘unreasonable’ fee and may either explicitly or implicitly prohibit certain types of fee arrangements, especially with respect to flat or hourly fees for financial planning. At least two states have even been known to cap the hourly rate an adviser may charge.

Many states require that advisers present clients with an itemized invoice or statement at the same time they send fee deduction instructions to the qualified custodian. Such itemization, to use California as an example, is expected to include the formula used to calculate the fee, the value of the assets under management on which the fee is based, and the time period covered by the fee.

Ultimately, the foundation of a good advisory agreement consists of many components, including a complete and accurate description of the firm’s services and advisory fees. While these are only two essential components, there are also many other equally important elements to include and best practices to follow that should be accounted for in any advisory agreement, which will be addressed in Part 2 of this article.