When the pandemic hit in early 2020, many businesses quickly and significantly expanded opportunities for their employees to work from home, resulting in a large increase in the share of work being done remotely. Now, more than two years later, how much work is being done from home? In this post, we update our analysis from last year on the extent of remote work in the region. As has been found by others, we find that some of the increase in remote work that began early in the pandemic is sticking. According to firms responding to our August regional business surveys, about 20 percent of all service work and 7 percent of manufacturing work is now being conducted remotely, well above shares before the pandemic, and firms expect little change in these shares a year from now. While responses were mixed, slightly more firms indicated that remote working had reduced rather than increased productivity. Interestingly, however, the rise in remote work has not led to widespread reductions in the amount of workspace being utilized by businesses in the region.

Remote Work Is Here to Stay

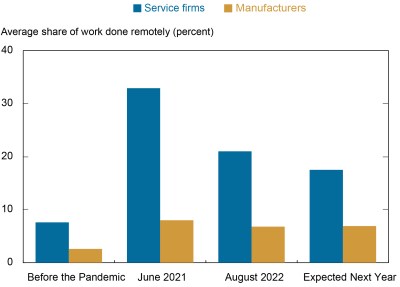

As the chart below shows, the amount of remote work in the region increased sharply with the pandemic. Indeed, last year at this time, our surveys suggested that about a third of all service work and just under 10 percent of manufacturing work in the region was being done remotely—a huge jump from 8 percent and 3 percent, respectively, before the pandemic. This month, supplementary questions to the Empire State Manufacturing Survey and Business Leaders Survey followed up by asking firms to estimate the share of their workers conducting at least some work remotely and how many days of the week these workers were typically offsite. We estimate the share of work being done remotely by multiplying the percentage of time remote workers telecommuted by the share of workers working remotely for each firm, and then averaging across all firms.

Remote Work Is Sticking in the Region

While the amount of remote work conducted among regional businesses has declined over the past year, it remains well above pre-pandemic levels. In our August service-sector survey, an average of about 30 percent of firms’ employees were working remotely for an average of 3.3 days per week, suggesting that about 20 percent of all work in the region’s service sector is being done remotely—almost three times the pre-pandemic share. By contrast, only about 9 percent of the average manufacturing firm’s employees were working remotely for an average of 2.8 days per week, suggesting that about 7 percent of all work in the region’s manufacturing sector is still being done remotely—more than double the share before the pandemic.

Looking ahead, this level of remote working is expected to decline only modestly, and only among service firms. Next year, service firms expect about 18 percent of work to be conducted remotely. Manufacturers already appear to have adjusted to a new normal of about 7 percent of manufacturing hours worked remotely. Of note, these figures are quite close to the incidence of remote work regional firms had expected “after the pandemic” when asked just over a year ago.

Within the service sector, there was a great deal of variation in the amount of remote work being done. For industries typically geared toward office work, such as professional and business services and financial services, the share of hours worked remotely was above 50 percent, on average. However, in industries typically relying on face-to-face contact with customers, such as restaurants, bars, retailers, and hotels, remote work accounted for less than 10 percent of work for the average firm.

Notably, firms were mixed about whether expanding remote work had increased productivity. Of those firms that had expanded remote work arrangements since the pandemic, 30 percent of service firms said that productivity had declined, while 21 percent said that it had risen. Among manufacturers, 28 percent indicated productivity had slipped compared to just 12 percent noting improvement. Here again, industries geared toward office work tended to perceive productivity changes more favorably than other firms.

Workplace Attendance Lowest on Mondays and Fridays

As might be expected, firms reported that workplace attendance does vary by day of the week, but not by much. Fridays and, to a lesser extent, Mondays are days where attendance is lowest. Tuesdays, Wednesdays, and Thursdays are the most popular days to come into the workplace and tend to be similar in terms of attendance. This pattern mirrors recent estimates for New York City office workers from the New York City Comptroller.

Has More Remote Work Led to Less Workspace?

A key question is whether the increase in remote work has reduced the amount of workspace needed by businesses. As such, respondents were asked whether they had changed the total square footage of their workplace directly in response to remote working. Interestingly, the rise in remote work has not led to widespread reductions in the amount of workspace being utilized by businesses in the region: just 16 percent of service firms and 7 percent of manufacturers have reduced their footprints. Overall, on average, respondents indicated that their workspace usage had declined by about 5 percent in the service sector and just 2 percent in the manufacturing sector. Thus, consistent with other research, while more remote work has resulted in a smaller footprint on net, the reduction has not been proportional to the rise in remote work. Somewhat encouragingly, as more remote workers are gradually returning to the workplace, businesses plan a slight increase in their footprints, in aggregate, in the next one to two years.

Jaison R. Abel is the head of Urban and Regional Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Bram is an economic research advisor in Urban and Regional Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Richard Deitz is an economic research advisor in Urban and Regional Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Jaison R. Abel, Jason Bram, and Richard Deitz, “Remote Work Is Sticking,” Federal Reserve Bank of New York Liberty Street Economics, August 18, 2022, https://libertystreeteconomics.newyorkfed.org/2022/08/remote-work-is-sticking/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).