A reader asks:

I have a house with a low interest rate (2.75%) I refinanced a year ago. My family has grown (3 kids) and might be time to get a bigger house. My problem is of course mortgage rates have skyrocketed (now could probably get a 5.75% rate). Is there anything I can do with this low rate asset? Or am I stuck selling my house at 2.75% and financing at the higher rate. How much would you value that change in rate (assuming both houses are $500k)? Is there a way to calculate that?

This is a choice millions of homeowners will likely face in the years ahead.

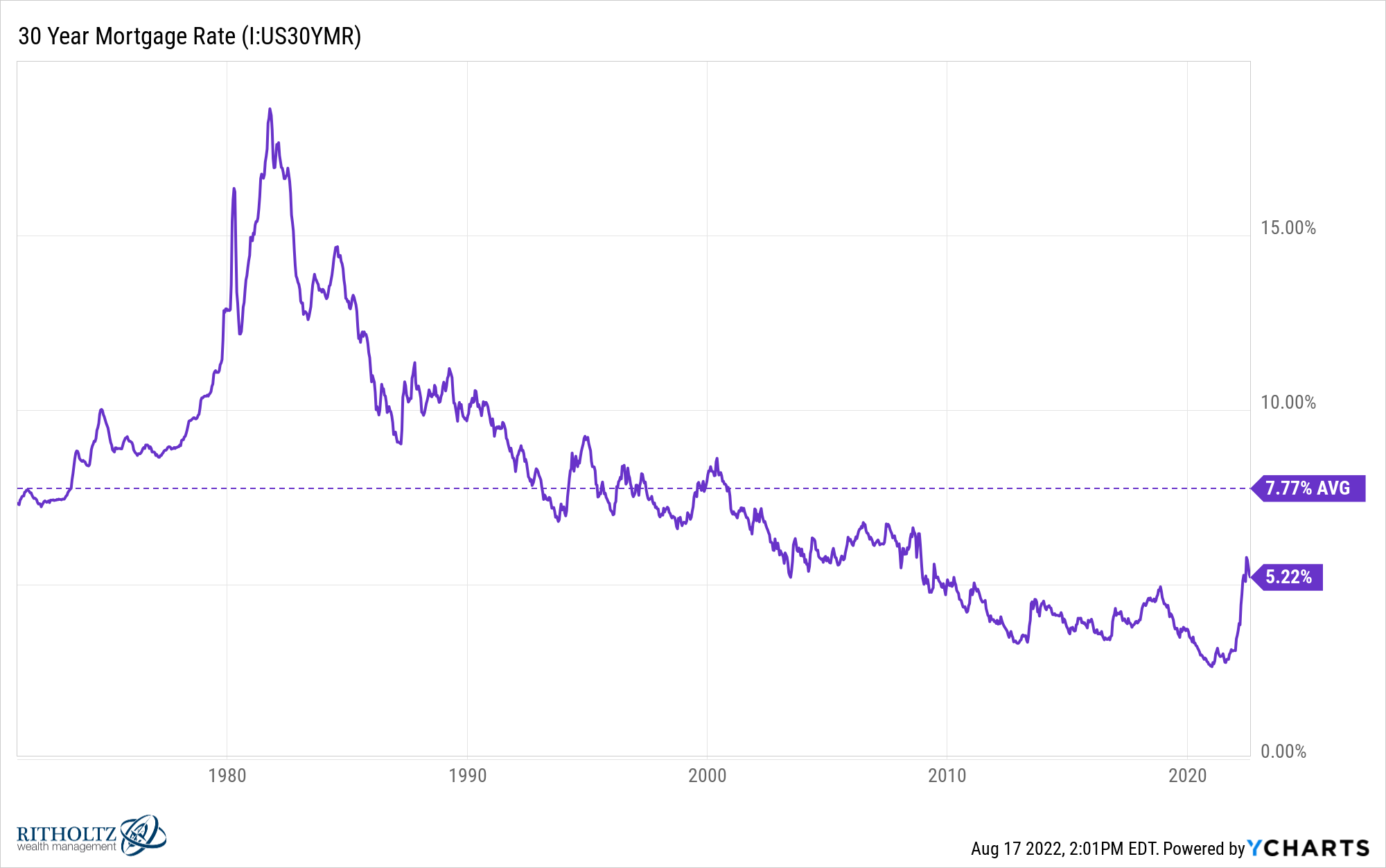

It’s possible we will see mortgage rates go much lower during the next recession but it’s not a foregone conclusion.

What if mortgage rates of 3% and lower during the pandemic were a historical anomaly?

It’s certainly possible.

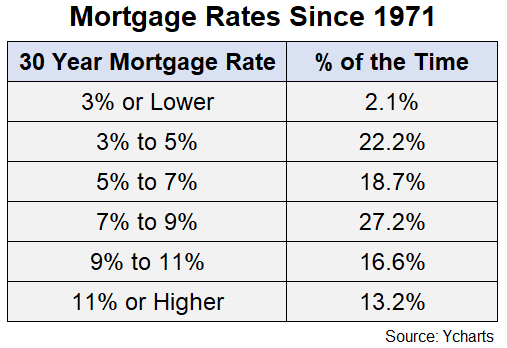

Even rates in the 3-5% range are low by historical standards.

Mortgage rates were 7% or higher nearly 60% of the time since 1971. Maybe the higher rates of the 70s, 80s and 90s were an aberration but it appears the past few years are the outlier.

I went through this same exercise when my twins were born and it became apparent our house couldn’t handle 3 kids.1

Mortgage rates were closer to 4% at the time (2017) but housing prices were much lower so that decision was easier to make.

I wish I had better news for you but you’re out of luck when it comes to your mortgage rate if you have to move. That asset would disappear.

It’s understandable why homeowners would be hesitant to give up that extraordinary mortgage rate.

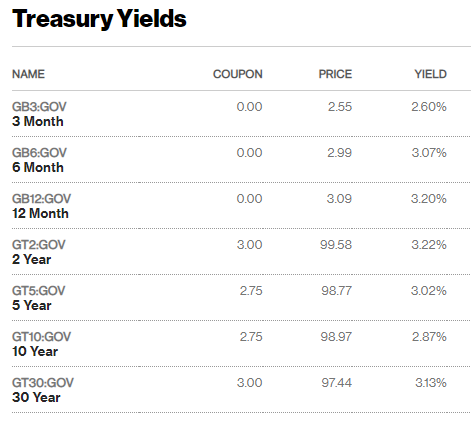

If you have a rate of 3% or lower locked in, you’re borrowing at a lower rate than the Federal Government right now:

Yields are higher than 3% for 6-month t-bills, 12-month t-bills, 2 year treasuries, 5 year treasuries and 30 year treasuries. The 10 year is close as well.

The most painful part about trading up is obviously the higher monthly payment.

Let’s assume you have a $500k house with a 20% down payment.

At 2.75% that’s a monthly payment of a little more than $1,630 a month.

Now if we were to look at that same house with a 5.75% mortgage rate, you’re now looking at a monthly payment of more than $2,330.

That’s $700 a month ($8,400 a year) in extra payments. And we haven’t even discussed the fact that a bigger house is almost certainly going to cost you more money today (which means higher taxes and upkeep as well).

There aren’t many good options:

- You could just suck it up and buy a bigger house. That higher monthly payment and rate are going to sting but it’s possible you’ll be able to refinance in the coming years if/when rates come back down during the next recession. There’s no guarantee you’ll see 2.75% again but you never know. It’s a roll of the dice.

- You could renovate your current home. Most homeowners are sitting on a decent amount of home equity right now. It’s not going to be cheap but maybe you could add a bedroom. Or you could have the kids suck it up and sleep in bunk beds. It’s hard to believe but many families back in the day would have 5-6 kids in 2-3 bedroom homes. I guess it depends how much more room you desire.

- You could look at other forms of financing. A couple of months ago you could have gotten lower rates on an adjustable rate mortgage but I checked those today and they’re actually higher than a 30 year fixed rate (5.7% vs. 5.5%). You could try for a 15 year fixed which is more like 4.8% right now. Or you could put more money down using the equity in your current house.

Unfortunately, all of these options are going to lead to higher costs one way or another.

This question illustrates why a home is the most emotional of all financial assets and there isn’t a close second place.

The spreadsheet would tell you to suck it up and stick it out with that succulent 2.75% mortgage rate. It’s the best inflation hedge possible and could be the lowest mortgage rate you see in your lifetime.

But financial decisions don’t exist strictly in Microsoft Excel.

This kind of decision has to be qualitative as well. Housing provides a psychic income stream you can’t find anywhere else.

Is it worth it to find a new house for your family?

Would the benefits of trading up in size outweigh the cost of trading up in borrowing rates?

I’m not going to sugarcoat it — it’s going to be painful to lose that sub-3% mortgage rate.

But sometimes we have to make painful financial decisions for the benefit of family and overall happiness.

We covered this question on this week’s Portfolio Rescue:

Barry Ritholtz joined me again to go over questions on Manhattan real estate, helping your grandmother with her portfolio, taking out a HELOC to buy stocks and more.

Here is the podcast version of this week’s show:

1We actually had our twins in May and moved into a new house in June. Things were a tad hectic in the Carlson household that year