Are you an accounting professional hungry for new accolades, knowledge, and ways to stand out from the competition? If so, you might be interested in getting your certified management accountant certification. You can expand your financial planning and strategic financial management skills through this CMA certification.

So the question is: Is it worth it?

Read on to learn more about the CMA meaning, the benefits of getting certified, how to do it, and more.

What is a certified management accountant?

A certified management accountant is a professional with expertise in financial planning and strategic management knowledge. Professionals can obtain the CMA certificate after successfully taking an exam, similar to (but less rigorous than) the CPA. Individuals who receive the certified management accountant certification are known as CMAs.

CMA certifications signify that the professional has additional training and expertise in:

- Financial accounting

- Management

- Business strategy

- Financial statement analysis

- Ethical business practices

- Carrying out executive-level duties

The Institute of Management Accountants (IMA) issues the CMA certification to those who pass the exam. Many professionals who take the CMA exam are also CPAs. However, you do not have to be a CPA to obtain your CMA certification.

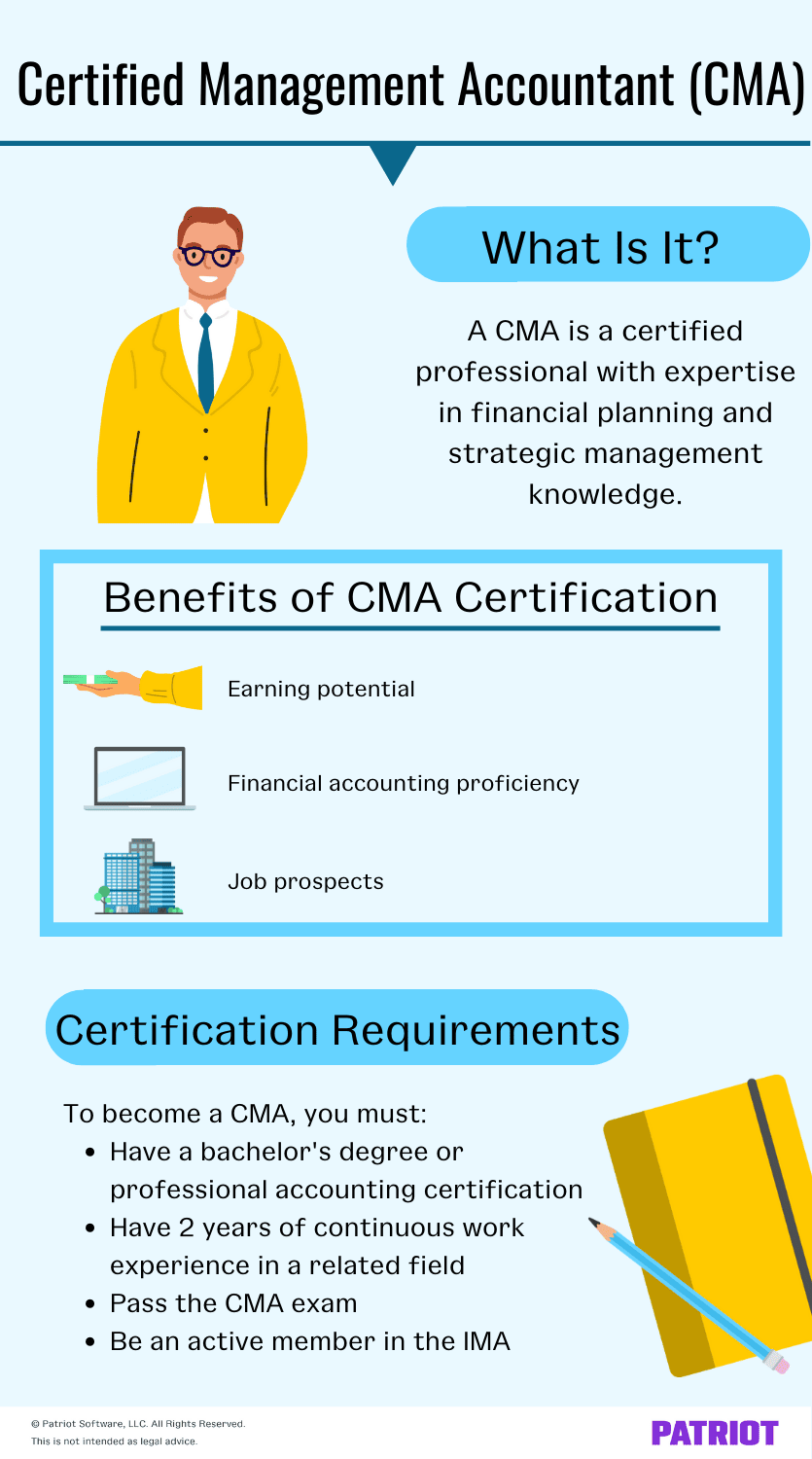

Benefits of CMA certification

So, what could becoming a CMA do for your career and accounting practice? Through a CMA certification, you can increase your:

- Credibility

- Earning potential (58% of CMAs globally enjoy a salary advantage)

- Financial accounting proficiency

- Job prospects

- Ability to stand out from the competition

Although there are advantages to obtaining the CMA certification, doing so is not a requirement for many finance-related jobs.

Certified management accountant certification requirements

Becoming a certified management accountant doesn’t happen overnight. You must meet the CMA requirements to enjoy the benefits that come with this credential.

To become a CMA, you must:

- Have a bachelor’s degree or professional accounting certification

- Have two years of continuous work experience in a related field

- Pass a rigorous exam (two parts covering 12 competencies)

- Be an active member in the IMA

What is the CMA exam like?

Let’s say you meet all the requirements of becoming a CMA except one: The rigorous exam. You may have questions about what it’s like, how long it takes, and how many people pass.

According to the IMA, here are some fast facts about the CMA exam:

- There’s a 50% pass rate globally

- The two-part test takes an average of 12-18 months to complete

- You have up to three years to finish both parts

- There’s a CMA entrance fee and an exam fee

- Consider spending 150-170 hours to study for each part

Take a look at the following chart to see the sections, along with how much of the exam each covers, in both parts of the certified management accountant exam:

| Part 1: Financial Planning, Performance, and Analytics | Part 2: Strategic Financial Management |

|---|---|

| External financial reporting decisions (15%) | Financial statement analysis (20%) |

| Planning, budgeting, and forecasting (20%) | Corporate finance (20%) |

| Performance management (20%) | Decision analysis (25%) |

| Cost management (15%) | Risk management (10%) |

| Internal controls (15%) | Investment decisions (10%) |

| Technology and analytics (15%) | Professional ethics (15%) |

How long is the CMA exam? Each exam part takes four hours to complete. There are 100 multiple-choice questions (three hours) and two 30-minute essays (one hour) per exam.

Check out the IMA’s website for more information about the CMA exam and to sign up.

What to do after receiving your CMA accounting certification

Received your CMA certification? Congratulations! However, the work doesn’t stop there. Now, it’s time to integrate your new credential into your accounting practice.

After you receive your CMA designation, you may need to:

- Adjust your accounting fees

- Add new services to your offerings

- Market your certification

1. Adjust your accounting fees

How much do accountants charge? Well, it depends. In addition to location, experience, and your clients’ sizes, accounting fees can also depend on credentials.

Clients may be willing to pay more for services from an accountant with an advanced degree, like a CMA. So when you receive your CMA, you may want to revisit your accounting fees—and increase what you charge.

2. Add new services to your offerings

What types of small business accounting services do you offer clients? After becoming a CMA, you may expand what you offer.

For example, you may have previously specialized in bookkeeping and payroll services. But when you receive your CMA, you may branch out into advising and consulting (e.g., business and management decisions).

3. Market your certification

You’ve increased your accounting fees and added new accounting services to your list of offerings. Now what?

Now, it’s time to market your new CMA certification and services.

You may use paid advertising, email marketing, or another marketing for accountants strategy to let current and potential clients know you’re a CMA.

This is not intended as legal advice; for more information, please click here.