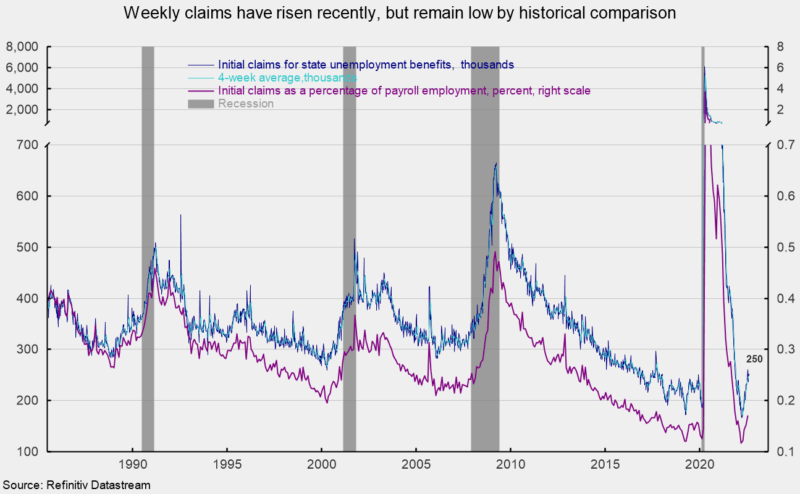

Initial claims for regular state unemployment insurance fell 2,000 for the week ending August 13th, coming in at 250,000. The previous week’s 252,000 was revised down from the initial tally of 262,000 (see first chart). When measured as a percentage of nonfarm payrolls, claims came in at 0.171 percent for the month of July, up from 0.152 in June and a record low of 0.117 in March, but still very low (see second chart).

The four-week average fell for the first time since April 2nd following eighteen consecutive weeks without a decrease. The average came in at 246,750, down 2,750 from the prior week. The large downward revision for the prior week’s data combined with the latest week indicates that the recent sustained upward trend may be flattening. Overall, the data continue to suggest a tight labor market. However, continued elevated rates of price increases, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine represent risks to the economic outlook.

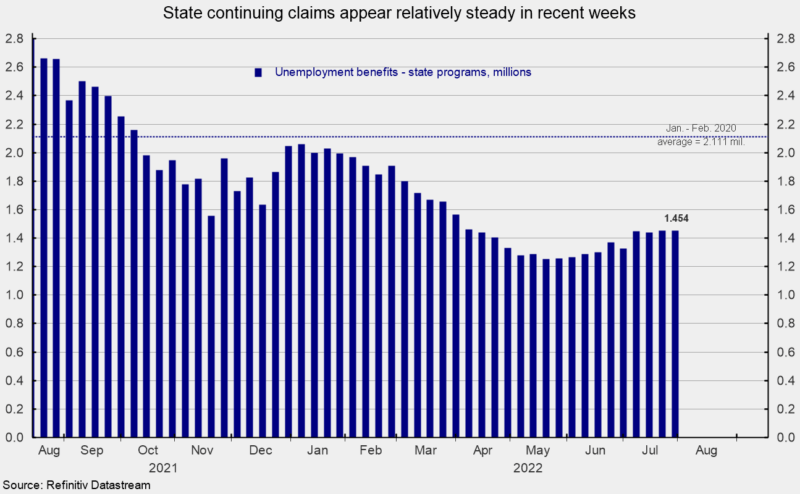

The number of ongoing claims for state unemployment programs totaled 1.454 million for the week ending July 30th, a rise of 3,289 from the prior week (see third chart). State continuing claims had been trending higher but now appear to be relatively flat over the last several weeks (see third chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.481 million for the week ended July 30th, an increase of 2,696 from the prior week. The latest result is the twenty-fifth week in a row below 2 million.

Initial claims remain at a very low level by historical comparison, but the recent upward trend was suggesting that, on the margin, the labor market has begun to loosen. That trend is now somewhat suspect.

Weekly initial claims for unemployment insurance is an AIER leading indicator and remained a favorable contributor in the July update. However, if the recent upward trend were to resume, it would likely turn to a neutral position in upcoming updates.

While the overall low level of claims combined with the high number of open jobs suggests the labor market remains solid, both measures are showing signs of softening. The tight labor market is a crucial component of the economy, providing support for consumer spending. However, persistently elevated rates of price increases already weigh on consumer attitudes, and if consumers lose confidence in the labor market, they may significantly reduce spending. The outlook remains highly uncertain.