Are you stuck underneath a mountain of student loan debt with high-interest rates? Do you think you could benefit from refinancing with a lower your interest rate, consolidating debt into a single loan, or both?

There are a growing number of companies that promise to do just that, using straightforward online platforms and a fast loan application process.

Splash Financial is one of these companies and contends it can help customers find a new, lower interest rate on student loans within three minutes.

Is Splash right for you? Can it save you money? Here’s a rundown of what Splash has to offer.

Summary

Splash Financial offers a simple way to potentially reduce your student loan debt by lowering your interest rate and consolidating debt to a single loan. It has a simple online platform and competitive rates.

Pros

- Easy to use

- Customer service

- Competitive rates

Cons

- Forbearance limitations

- Policies vary by lender

What is Splash Financial?

Splash Financial is a Cleveland-based company that offers student loan refinancing through an online platform. Notably, student loan refinancing is Splash’s only product. Splash allows those with student loans to apply online, potentially consolidating loans and receiving a lower rate.

Splash allows you to borrow as little as $5,000, and there is no maximum loan amount. As of October 2019, it advertised variable rates as low as 2.25% and fixed rates as low as 3.48%. Fixed rates could be as high as 7.27%, with variable rates that could top 7.41%.

Splash’s lending partners include Pentagon Federal Credit Union (also known as PenFed), U-Fi and Laurel Road.

Who is Splash Financial For?

Splash Financial may be a good fit for anyone with student loans, particularly those who have graduated from a four-year university. (If you have an associate degree, there are some restrictions.)

If you are looking to reduce your student loan debt by lowering your interest rate or consolidating your loans, Splash may be a good solution for you.

Students in medical and dental school can refinance student debt and pay just $100 while they are in residency and for the following six months. The entire loan term, including residency, fellowship, and 6-month grace period, can’t exceed 20 years.

If you have a federal student loan, you may save money with Splash, but the company notes that some benefits may not transfer when you refinance.

“If you work in the private sector, are in the military or taking advantage of a federal department of relief program, such as income based repayment or public service forgiveness, you may not want to refinance, as these benefits do not transfer to private refinance/consolidation loans,” Splash says.

Splash Financial Application Process

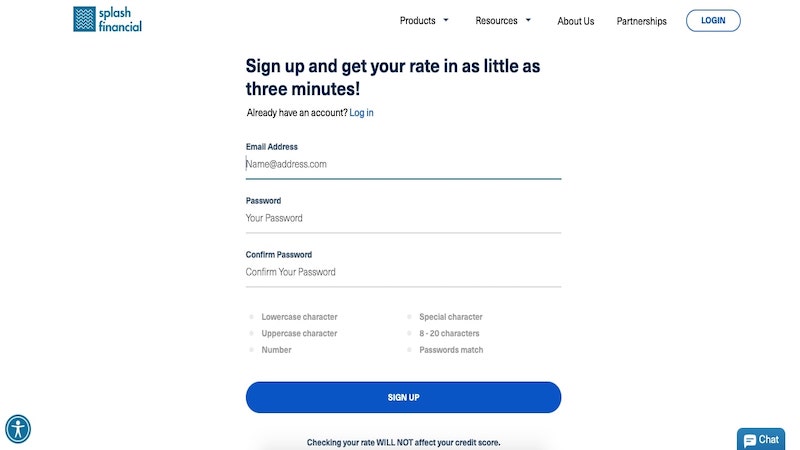

Splash Financial attempts to keep things as simple as possible when applying for the refinancing of your student loans.

You begin the process by going to the homepage of Splashfinancial.com and clicking on a large, orange, rectangular link that reads, “Get My Rate.”

Then you’ll be asked to enter your email address and create a password. After that, Splash will ask for your address, phone number and citizenship status.

On the next page, you’ll be asked what degrees you hold and from where, your annual earnings (not including that from your spouse), your employment status and whether you rent or own your home.

Finally, you’ll be asked to enter the amount of loan you are requesting to refinance.

The next step is to enter your social security number.

At this point, you’ll be provided with a list of loan terms, ranging from 5 years to 20 years, with the associated fixed interest rate. Additionally, you’ll be presented with similar variable interest rate options.

From my experience, the entire process lasted about five minutes.

Splash Financial Rates

Splash advertises variable rates as low as 2.25% and fixed rates as low as 3.48%. Splash notes that these rates may include a 0.25% discount for enrolling in autopay.

For purposes of illustration, I entered a request for a $50,000 loan refinancing. Splash responded with rates ranging from 3.90% to 4.85%, with terms ranging from five to 20 years. (The lowest rates were for the shortest terms.) There were also variable rates offered from 3.86% to 4.84%.

They only lock in your rate once your full application has been received. Until then, rates could change.

During the application process, Splash will perform what is known as a “soft pull” on your credit report. (This will not impact your credit.) This soft pull will be taken into account when determining your rate, along with what school you went to and your income.

You may be able to obtain a co-signer for a loan, but that depends on the lender. Keep in mind that if you have a co-signer, you will receive the loan proceeds, but you and the co-signer will be jointly liable for paying back the loan. Depending on the lender, you may be able to obtain a co-signer release after a certain amount of time.

Splash Financial Reviews

Splash Financial is a relatively new company, so there’s no firm consensus from customers about its products and services. However, it’s worth noting that it has four stars out of five from TrustPilot.com, based on five reviews.

A reviewer [trustpilot.com] named Matt said Splash helped him lower his rate from 6.9% to 4.94%. “Splash Financial made refinancing my student loan very easy,” he wrote.

Another reviewer named Bill said Splash was able to save him money. “Refinancing with Splash offered me the best possible rates for my wife and I,” he wrote. “I was extremely happy with the financial savings.”

Splash Financial gained accreditation from the Better Business Bureau and has an initial rating of A+.

In 2019, Splash was recognized by FitBux, an information portal for student loan repayment strategies, as the Best New Company in the student loan refinancing space. FitBux gave Splash high marks for its “technology, product availability, rate competitiveness, rate stability, quality of customer service, and ease of interaction.”

Splash itself reported that in a survey of 121 customers over six months, 95% of respondents said they are satisfied with their new loan.

Pros and Cons

Splash Financial has some good attributes as well as areas where potential customers may find the products or services lacking. Let’s break down the good and bad of Splash.

Pros

Here are the pros of Splash Financial.

Competitive Rates

It’s unlikely any prospective borrower would choose Splash unless the company could save them money by offering lower interest rates. On this point, Splash comes through with rates that are generally lower than traditional student loans and in the range of what competitors offer.

You may get lower interest rates elsewhere, depending on your financial situation, but Splash advertises rates that most borrowers would find attractive.

Simple Process

Splash’s website is very clean, and the application process is not too involved. Customers looking for student loan refinancing will not get confused by listings of other products and services—refinancing student loans is all that Splash does.

No Fees or Prepayment Penalties

You won’t pay a loan origination fee, as is required by many lenders. Additionally, if you pay off a loan early, there’s no charge for you.

No Maximum

With Splash, you can refinance loans as small as $5,000, but there is no limit to the amount you can refinance. This means that even if you are buried under hundreds of thousands of dollars in student loan debt, you may be able to refinance and reduce your overall costs.

Married Couples Can Consolidate Loans

Splash allows married couples to refinance their loans together. Additionally, a spouse can “take over” their partner’s loan. (This requires the applicants to fill out an affidavit to acknowledge the transfer.)

Cons

As always, there are some cons to consider too.

Limited Products

Splash does one thing—student loan refinancing. It does not offer private student loans. It can’t help you obtain a personal loan for home improvements or a car. And it can’t help you consolidate your credit card debt.

Some may see this as a positive, as the company may be able to focus its attention on perfecting its single product offering. But others may find that the company can’t address all of their borrowing needs.

Limited Loan Servicers

While Splash offers competitive interest rates, it does not shop around to find you the best rate that may be available. It does not serve as a clearinghouse for a wide range of loan providers. Instead, it partners with a handful of lenders—most prominently Pentagon Federal Credit Union.

Thus, you may find better rates if you do your homework and get multiple quotes. In this way, Splash differs from some key competitors, including Credible, which pulls rates from as many as ten lenders.

No Loan Forbearance Option

The Federal government and some online lenders have been known to allow borrowers to stop payments temporarily if they can demonstrate unexpected financial challenges. This is known as an Economic Hardship Deferral. It does not appear that Splash offers such a forbearance option.

Limited Acceptance for Those with Associate Degrees

Graduates with four-year degrees from most colleges will be eligible to receive refinancing loans from Splash. However, it gets more complicated for those with associate degrees.

Splash guidelines show that applicants pursuing an associate degree must be in the final term of the program and have an offer of employment in their field of study.

Those applicants who have already graduated with an associate degree must show that they have been employed for 12 months in the following fields: Cardiovascular Technologist (CVT), Dental Hygiene, Diagnostic Medical Sonography, EMT/Paramedics, Nuclear Technician, Nursing, Occupational Therapy Assistant, Pharmacy Technician, Physical Therapy Assistant, Radiation Therapy, Radiologic/MRI Technologist, Respiratory Therapy, Surgical Technologist.

Alternatives to Splash Financial

Splash Financial is not the only company offering student loan refinancing online. In fact, there are many competitors with similar products and platforms.

Main alternatives to Splash include:

Sofi

Sofi offers several different loan products, including student loan refinancing. Rates are comparable to Splash, and there are also no maximums on loan size.

You may get discounts on Sofi’s other loan products if you select them for student loan refinancing.

Credible

Credible operates more like a loan marketplace, with the potential to offer you rates from as many as ten lenders. It offers minimal fees and a fast application process. Plus, its product lineup includes not only includes student loan refinancing but private student loans, personal loans and mortgage refinancing.

Lendkey

Similar to Credible, Lendkey partners with hundreds of banks and credit unions to find you the best rates on student loan refinancing, as well as private student loans and home improvement loans. LendKey claims to have helped fund more than $3.1 billion in loans.

Common Bond

Common Bond offers private student loans for undergraduate and graduate school, as well as MBA programs, dental school and medical school. The company operates with a “Social Promise” that has led to $1 million donated to students in need and the construction of 470 schools.

Discover Student Loans

Backed by the same people who bring us the Discover credit card, Discover offers private student loans for everything from undergraduate to graduate schools, MBA programs, medical school, dental school, law school and even loans for the bar exam. It also offers consolidation loans and rewards for good grades.

iHelp

The Reunion Student Loan Finance Corporation administers loans from iHelp. Customers can access student loans for undergraduate and graduate school, as well as consolidation loans.

For more details on these companies and others, check out our article on the best student loan companies.

Summary

Splash Financial offers a simple way to potentially reduce your student loan debt by lowering your interest rate and consolidating debt to a single loan.

Its online platform is clean and straightforward, and customers may appreciate the fact that Splash does one thing—student loan refinancing.

The application process lasts less than five minutes. However, there is some stiff competition in this space, so prospective customers could find lower rates elsewhere.

Additionally, those customers with associate degrees may find themselves shutout of Splash’s products due to various restrictions.