I heard a data point on this week’s TCAF that blew me away:

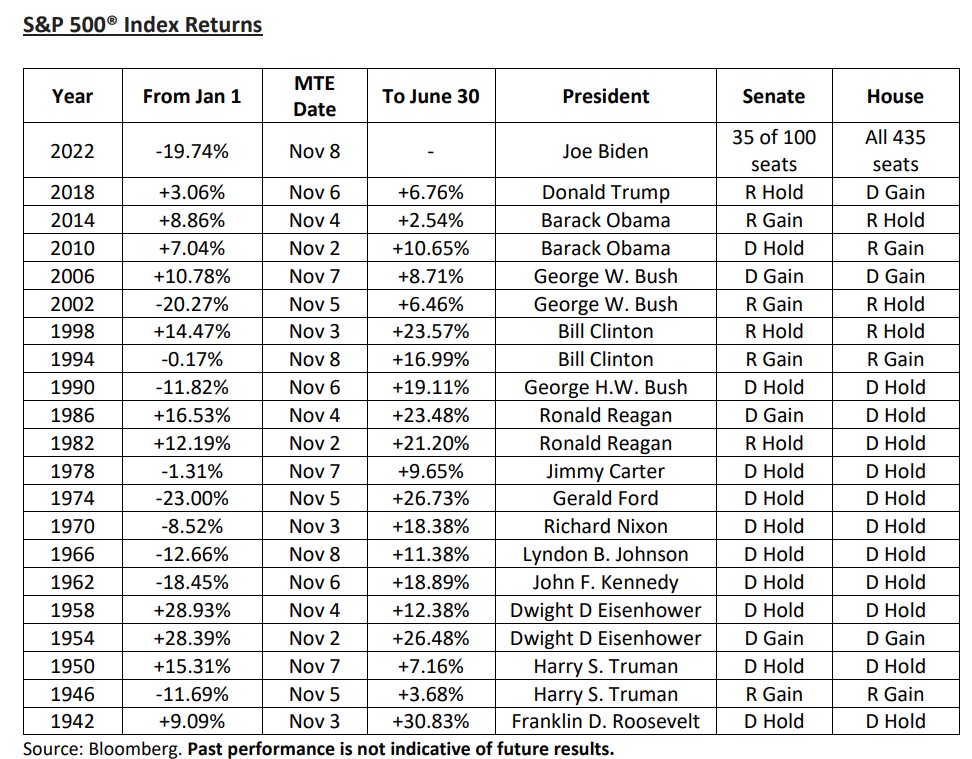

There have been 20 midterm elections since 1942. The S&P 500 was positive from then until the following July during all 20 of them.

It didn’t matter if a Democratic president held or lost the senate or the house. Same for Republicans. The market doesn’t care about political beliefs. What it responds to is uncertainty, and it hates it. That’s why stocks can rally on bad news if the bad news isn’t quite as bad as people feared it would be.

Like ketchup and steak, politics and investing should be kept far away from one another.

I hope you enjoy this episode of The Compound and Friends with Joe Terranova. Enjoy the rest of your weekend.