New orders for durable goods were essentially unchanged in July, following a 2.2 percent gain in June. Total durable-goods orders are up 11.8 percent from a year ago. The July gain puts the level of total durable-goods orders at $273.5 billion, the third highest on record.

New orders for nondefense capital goods excluding aircraft, or core capital goods, a proxy for business equipment investment, rose 0.4 percent in July after increasing 0.9 percent in June. Orders are up 9.4 percent from a year ago, with the level at $74.5 billion, a new record high.

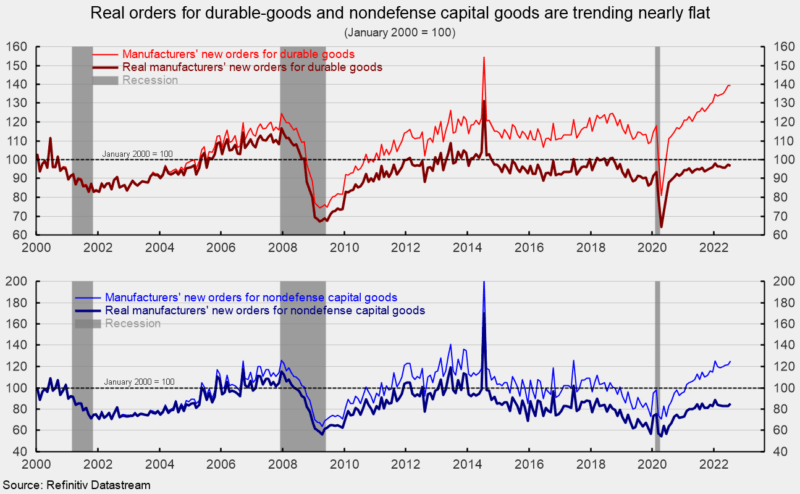

However, rapid price increases have had an impact on capital goods orders. In real terms, after adjusting for inflation, real new orders for durable goods fell 0.5 percent in July, while real new orders for nondefense capital goods – one of AIERs leading indicators – jumped 2.8 percent (see first chart). Despite the gain, real new orders for capital goods are trending nearly flat over the past year. Furthermore, real new orders for durable goods and real new orders for nondefense capital goods remain below their January 2000 level (see first chart again).

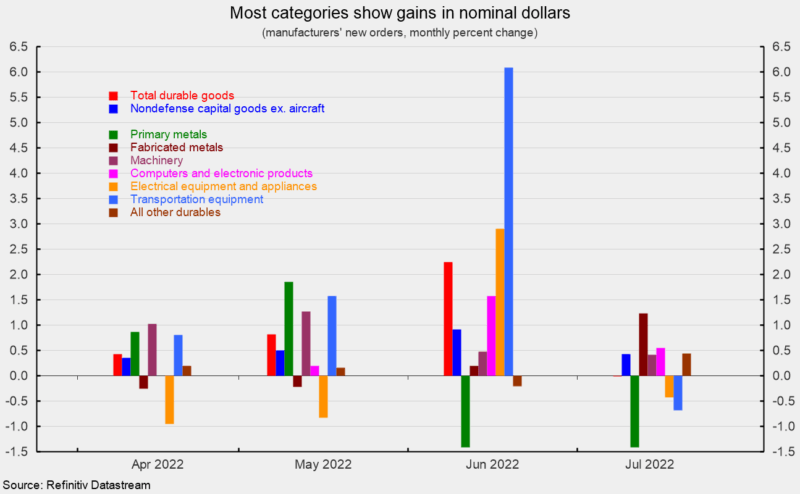

Four of the seven major categories shown in the durable-goods report posted a gain in July, in nominal terms. Among the individual categories, fabricated metals orders led with a 1.2 percent increase, followed by computers and electronic products with a 0.5 percent rise, machinery orders up 0.4 percent, and all other durables adding 0.4 percent.

On the downside for the major categories, primary metals orders dropped 1.4 percent, transportation equipment fell 0.7 percent, and electrical equipment and appliances decreased 0.4 percent (see second chart). Within the transportation equipment category, defense aircraft sank 49.8 percent following a 78.1 percent surge in June, nondefense aircraft jumped 14.5 percent, and motor vehicles and parts were up 0.2 percent. Every major category shows a gain in nominal dollars from a year ago.

Durable-goods orders have posted a strong recovery from the lockdown recession measured in nominal-dollars but after adjusting for price increases, real orders for durable goods are rising at a very slow trend growth rate. Nominal new orders for capital goods are also growing briskly but in real terms, the trend is nearly flat.

The outlook remains highly uncertain as sustained upward pressure on prices continues to distort activity and impact decision making. Despite substantial progress, labor and materials shortages continue to challenge businesses. Furthermore, the fallout from the Russian invasion of Ukraine and periodic lockdowns in China continue to disrupt global supply chains. Finally, the Federal Reserve has intensified the current interest rate tightening cycle, boosting the probability of a policy mistake. Caution is warranted.