NAHB analysis of the 2021 Census Bureau Survey of Construction (SOC) data shows that, nationwide, the share of non-conventional financing for new home sales accounted for 28.8% of the market, while conventional financing dominated the market at 71.2%. In 2020, share of non-conventional financing was 34.4% of the market while conventional financing accounted for 65.6% of the market share.

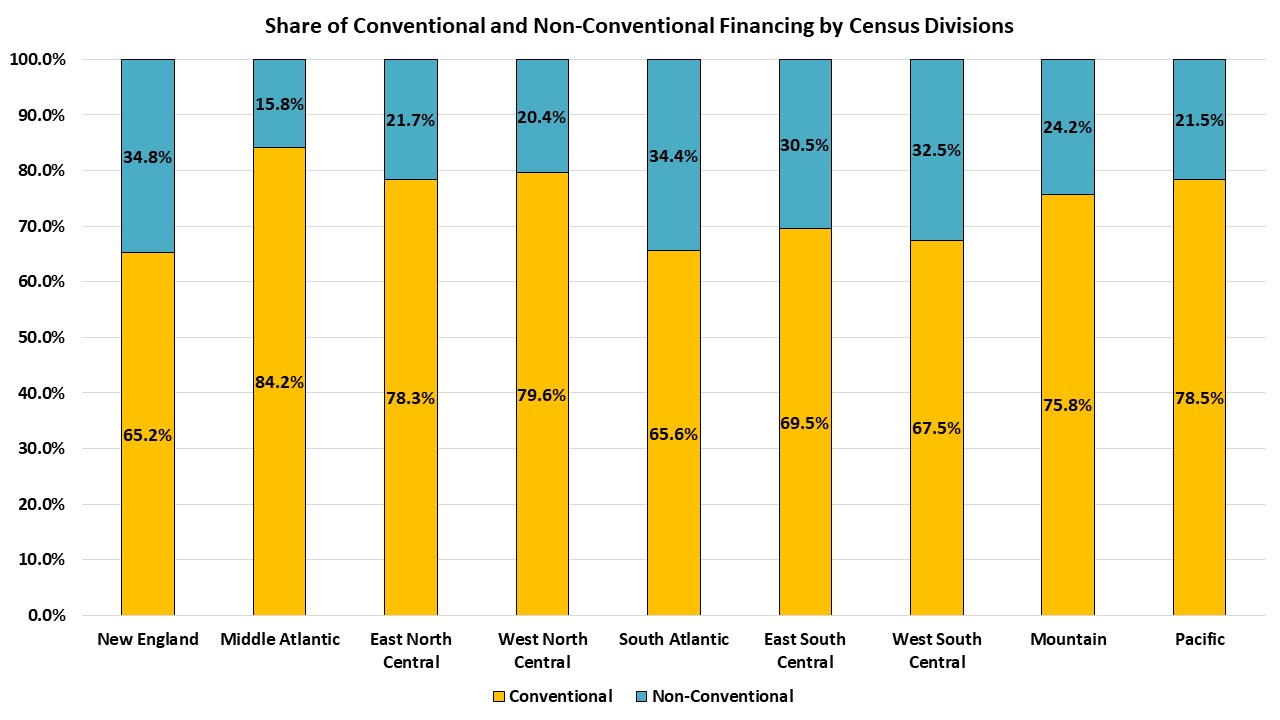

Non-conventional forms of financing, as opposed to conventional mortgage loans, include loans insured by the Federal Housing Administration (FHA), VA-backed loans, cash purchases and other types of financing such as the Rural Housing Service, Habitat for Humanity, loans from individuals, state or local government mortgage-backed bonds. The reliance on non-conventional forms of financing varied across the United States, with its share at 34.8% in New England but accounting for only 15.8% of new single-family home starts in the Middle Atlantic division.

Nationwide, FHA-backed loans and cash purchases tied for the majority share of non-conventional financing of new home purchases, accounting for 11% each. The share of VA-backed loans was at 5% market share in 2021 while Other Financing was 2% of market share.

FHA-backed loans accounted for the majority of all non-conventional financing in the South Atlantic (17.6%), West South Central (13.2%), and Pacific (8.9%) divisions. New England division reported the lowest FHA-backed loans at 0.5%, followed by Middle Atlantic (2.0%) and East South Central (2.8%).

Cash financing dominated non-conventional forms of financing in New England, where 31.2% of all homes started were purchased with cash. Cash purchases led non-conventional financing in East South Central (23.5%), East North Central (12.8%), West North Central (12.1%), and Middle Atlantic (11.5%). The lowest market share was reported in Mountain division where 5.8% of single-family starts were financed with cash.

VA-backed loans were most used in the Mountain division, which accounted for 9.0% of non-conventional forms of financing. In Middle Atlantic division, VA-backed loans were only 0.8% of market share, the lowest market share for this category.

Other financing such as the Rural Housing Service, Habitat for Humanity, loans from individuals, state or local government mortgage-backed bonds was highest in West South Central where it was 4.0% of market share, while West North Central division reported the lowest share at 0.5%.

Related