If you have employees, you’re responsible for handling and paying Medicare tax. Like all things tax-related, Medicare tax can get complicated quickly. Read on to learn what is Medicare tax, what it funds, and how much it costs.

What is Medicare tax?

Medicare tax is a payroll tax employers and employees share. You must withhold a certain amount from an employee’s wages and make a matching contribution.

Medicare and Social Security taxes make up FICA (Federal Insurance Contributions Act) tax and benefit the public. Both Medicare and Social Security are employee and employer payroll taxes. In other words, you withhold the proper amount from an employee’s paycheck and make a matching contribution for both Medicare insurance and Social Security.

FICA tax has a flat rate of 15.3%. Here’s how it breaks down:

- 6.2% of employee gross wages go to Social Security tax

- Employers make a matching 6.2% Social Security contribution

- 1.45% of employee gross wages go to Medicare tax

- Employers make a matching 1.45% Medicare contribution

Medicare tax applies to a wide range of compensation, including regular wages, tips, commissions, bonuses, overtime, and some fringe benefits.

See IRS Publication 15 for more information on special classes of employment and types of payments that may be exempt from Medicare tax withholding.

What is covered in Medicare?

Medicare taxes fund Medicare health insurance, a federal program benefitting people 65 years or older and those younger than 65 with qualifying conditions.

There are four parts of Medicare coverage. Each part provides different services for Medicare recipients:

- Medicare Part A offers hospital insurance to cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

- Medicare Part B provides medical insurance that helps with outpatient care, home health care, and preventative services.

- Medicare Part C offers Medicare Advantage plans as a private alternative to Original Medicare.

- Medicare Part D helps reduce the cost of prescription drugs.

What is the Medicare tax rate?

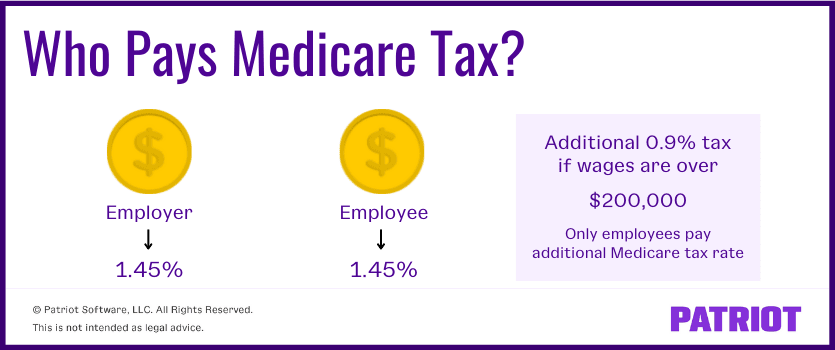

Again, the Medicare tax rate is 1.45% of an employee’s wages. Because Medicare is an employee and employer tax, you must withhold 1.45% from an employee’s wages and contribute a matching 1.45%.

Medicare makes up 2.9% of the FICA tax rate of 15.3%, and Social Security covers the rest.

So, what does Medicare tax look like in action? Let’s say an employee earns $1,000 in gross wages during a pay period. You would take out $14.50 from the employee’s paycheck for Medicare ($1,000 X 0.0145) and contribute a matching $14.50.

Keep in mind there are several differences between Social Security and Medicare taxes. An important difference is the Social Security wage base—a limit based on employee wages when you have to stop withholding. Medicare has no limit. You must continue withholding Medicare taxes regardless of what your employees earn.

In fact, if employees earn above a certain amount, they are subject to an additional Medicare tax.

Additional Medicare tax

An additional Medicare tax occurs when an employee earns more than a certain amount (depending on their filing status). You are not responsible for matching the additional Medicare tax rate.

The additional Medicare tax rate is 0.9%. Employees must pay this additional tax when they reach one of the following thresholds:

- Married filing jointly earning more than $250,000

- Married filing separately earning more than $125,000

- All other taxpayers (e.g., single, head of household, widow(er) with child) earning more than $200,000

You don’t have to worry about an employee’s filing status. Simply withhold the additional Medicare tax from wages that exceed $200,000.

For example, when a single employee earns more than $200,000, you must withhold 2.35% (1.45% + 0.9%) from their wages and match their 1.45% contribution. Again, you do not need to match the additional Medicare tax, paid solely by the employee.

What if employees owe more or less than you withhold?

You may have employees who owe more or less in additional Medicare tax than what you’ve withheld from their wages. There are several different reasons this may occur. For example, the employee may file separately, which means they owe additional Medicare tax on wages over $125,000. But, you won’t start withholding the tax until the employee’s wages are more than $200,000.

To correct the problem, your employees must take specific steps.

Your employee owes more

What if an employee owes more than the amount withheld because of their filing status, wages, compensation, or self-employment income?

If an employee is under the threshold based on the wages they earn with you but has other sources of income (e.g., self-employment), they may need to make estimated tax payments.

Your employee owes less

There’s a chance that an employee will appear to meet a requirement for additional Medicare tax, but in actuality, they do not.

If you withhold the Additional Medicare tax from an employee who doesn’t actually meet the threshold, they can claim a credit by using Form 1040 or 1040 SR.

For example, an employee meets the threshold of $200,000 to automatically qualify for Additional Medicare tax. But the employee is married, files jointly with their spouse, and their combined wages don’t meet the $250,000 threshold for married filing jointly. In this case, the employee cannot ask you to stop withholding Additional Medicare tax. The employee must claim a credit using their appropriate Form 1040 or 1040 SR.

For more information on additional Medicare tax, visit the IRS’s website.

Depositing and reporting taxes

To make Medicare tax deposits, follow your depositing schedule, which is either monthly or semi-weekly. Your schedule is determined by your reported tax liability using a four-quarter IRS lookback period.

Use the Electronic Federal Tax Payment System (EFTPS) to deposit Medicare taxes, Social Security, and federal income taxes. Make sure your payments are on time. Otherwise, the IRS can charge you penalties if you make late deposits.

Medicare taxes for the self-employed

What if you’re self-employed? Do you have to pay Medicare tax?

The short answer is yes. If you’re self-employed, you must pay self-employment tax. Think of self-employment tax as a FICA tax you pay on your own. Self-employment tax contributes to Medicare insurance and Social Security and is 15.3% of your wages—just like the FICA tax.

Of the 15.3% self-employment tax rate, Medicare tax makes up 2.9%. And, you must pay the additional Medicare tax when you earn above $200,000 (single), $250,000 (married filing jointly), or $125,000 (married filing separately).

For more information on self-employment tax, visit the IRS website.

Do you want an easier way to calculate and remit payroll taxes? When you run payroll with Patriot’s Full Service Payroll, we will calculate, withhold, and submit payroll taxes for you. Try it for free today!

This article has been updated from its original publish date of May 07, 2018

This is not intended as legal advice; for more information, please click here.