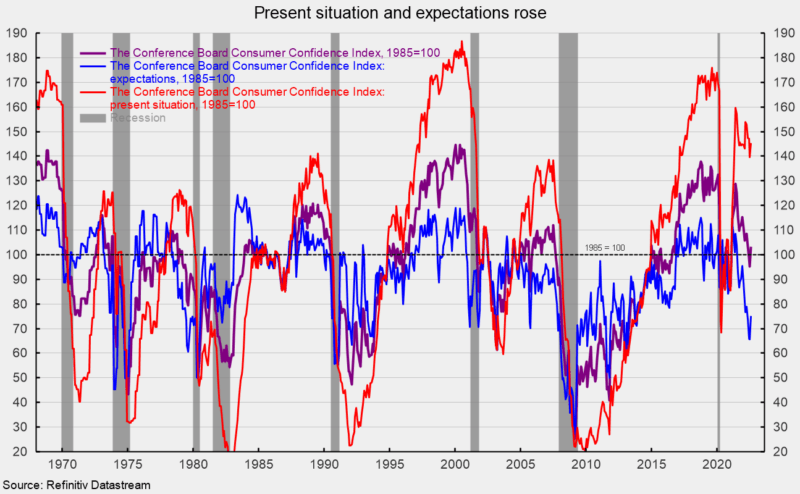

The Consumer Confidence Index from The Conference Board rose in August, the first increase following three consecutive monthly declines. The composite index increased by 7.9 points, or 8.3 percent to 103.2 (see first chart). From a year ago, the index is still down 10.4 percent. Both components gained in August.

The expectations component added 9.5 points, or 14.5 percent, to 75.1 (see first chart) while the present-situation component – one of AIER’s Roughly Coincident Indicators – rose 5.7 points to 145.4 (see first chart). The present situation index is down 2.4 percent over the past year while the expectations index is down 19.1 percent from a year ago. The present situation index remains consistent with economic expansion while the expectations index remains consistent with prior recessions (see first chart).

Within the expectations index, all three components improved versus July. The index for expectations for higher income gained 0.5 points to 15.8 while the index for expectations for lower income fell 1.0 points, leaving the net (expected higher income – expected lower income) up 1.5 points to 1.3.

The index for expectations for better business conditions rose 3.8 points to 17.5 while the index for expected worse conditions fell 3.9 points, leaving the net (expected business conditions better – expected business conditions worse) up 7.7 points, but still at -4.8.

The outlook for the jobs market improved in August as the expectations for more jobs index increased 2.3 points to 17.4 while the expectations for fewer jobs index fell by 1.8 points to 19.3, putting the net up 4.1 points to -1.9.

Current business conditions improved for the present situation index components, but current employment conditions weakened. The net reading for current business conditions (current business conditions good – current business conditions bad) was -4.0 in August, up from -7.9 in July. Current views for the labor market saw the jobs hard to get index decrease, falling 1.0 point to 11.4 while the jobs plentiful index fell 1.2 points to a still-strong 48.0 resulting in a 0.2-point drop in the net to 36.6.

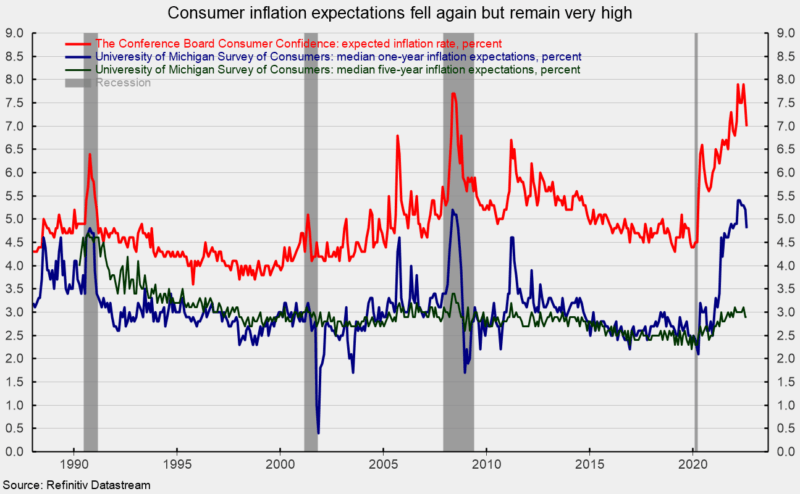

Inflation expectations eased down to 7.0 percent in August from 7.4 percent in July; expectations were 4.4 percent in January 2020 (see second chart). The sharp rise in expected inflation from The Conference Board survey is consistent with the University of Michigan survey results, though the magnitudes are different (see second chart). Inflation expectations remain extremely high as prices for many goods and services continue to rise at an elevated pace. The extreme outlook for inflation is a key driver of weaker consumer expectations.

The surge in prices for many consumer goods and services is largely a function of shortages of materials, a tight labor market, and logistical issues that prevent supply from meeting a post-lockdown-recession surge in demand. However, there has been significant progress in boosting production. Price pressures have been compounded by periodic lockdowns in China and surging energy prices due to the Russian invasion of Ukraine. Furthermore, the intensifying Fed tightening cycle raises the risk of a policy mistake and adds to the extreme level of risk and uncertainty in the overall economic outlook.