When employees incur travel-related business expenses, you might consider covering their costs. You can reimburse employees for expenses by giving them per diem pay. What is per diem pay?

Per Diem Meaning

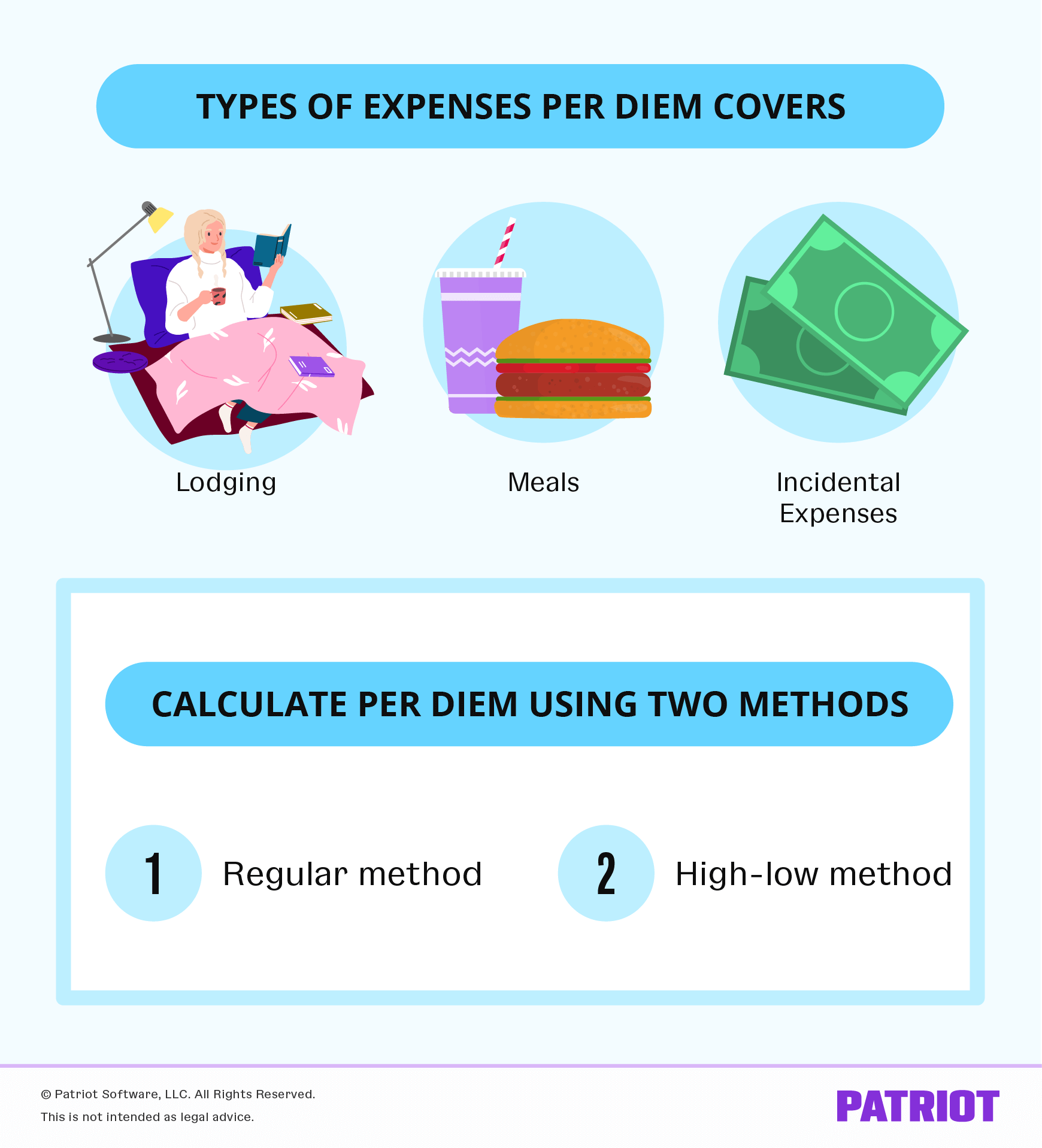

Per diem is a daily allowance you give employees to cover travel-related business expenses. Per diem means “for each day.” You give employees a fixed amount of money to cover daily living expenses, including lodging, meals, and incidental expenses. Per diem can also be limited to covering just meals and incidental expenses.

Employees appreciate per diem because it allows them to travel for business without spending out of their pockets. However, you are not required to provide per diem to employees.

What does per diem cover?

You cannot give employees per diem reimbursement to cover transportation expenses or mileage reimbursement. Per diem only covers three types of expenses:

- Lodging (e.g., hotel)

- Meals

- Incidental expenses (e.g., dry cleaning)

Employees receive full per diem if they need reimbursement for lodging as well as meals and incidental (M&IE) expenses. Let’s say an employee working in Ohio needs to travel to New York for the weekend. You would provide full per diem to cover the cost of lodging, meals, and incidentals.

You can pay employees a lesser per diem rate that only covers M&IE if they do not have to pay for lodging. For example, if an employee stays with family, you would only give them per diem for meals and incidentals.

How does per diem work?

Per diem is a substitute for using an actual expense reimbursement method. Instead of paying employees back the exact amount they spent on a trip (actual expense), you provide the per diem rate.

You can provide per diem in advance before the employee travels for business. Or, you can give per diem after.

Even though you give employees a fixed per diem rate instead of actual reimbursement, you still need to collect expense reports. The expense reports do not need to be as detailed as when you reimburse employees with the actual expense method.

Employees are required to file an expense report and give it to you within 60 days of using their per diem. The expense report should include the following information:

- Date, time, and place

- Amount of expenses

- Business purpose

So, how is per diem paid? Give employees the fixed per diem rate. You do not need to approve or deny an employee’s spending. In most cases, employees can keep any unused per diem money.

Federal per diem rates

There are two different ways you can determine per diem rates. You will use the high-low method or the standard per diem rate method to calculate rates.

Use the U.S. General Services Administration’s website to find out rates for specific localities.

The high-low per diem rate means the per diem rate is higher in certain cities than others. The high-low per diem rate will determine how much per diem is allowed. Large cities with a higher cost of living have high rates (e.g., New York City).

Because high-low per diem rates are based on the cost of living, lodging rates can change from month to month. In months where hotels charge more, the per diem rate is higher.

Use the regular or standard per diem rate if there is no specified rate for a city. The 2022 standard per diem rate is $155 ($96 for lodging and $59 for meals and incidental expenses). On the first and last day of an employee’s travel, you only need to pay 75% of the standard rate.

Check out the IRS’s Publication 1542 per diem rates for more information.

Is per diem taxable?

As an employer, you might be wondering, How does per diem work for taxes? Per diem is not taxable. Typically, you will not withhold payroll taxes on per diem payments.

Per diem is taxable if an employee does not provide or leaves information out of an expense report. It is also taxable if you give the employee a flat amount. The excess is taxable if you give an employee above the maximum per diem allowance.

Do not include per diem in an employee’s wages on Form W-2. You will only include per diem in an employee’s wages if the rate exceeds the IRS approved maximum rates or the employee does not provide an expense report.

Make sure you keep per diem records, like expense reports.

Get rid of the stress that comes with managing payroll. Patriot’s online payroll software lets you easily run payroll and pay employees via free direct deposit or checks. Try it for free today!

This article has been updated from its original publication date of October 23, 2017.

This is not intended as legal advice; for more information, please click here.