Dominic Stone: So do you know what’s going to happen?

Eric Finch: No, it was a feeling. But I can guess.

– V for Vendetta (“Beginning of the End”)

During the runup to the financial crisis, your humble blogger pointed out that financial time moved faster than political time. Market players often had better and more comprehensive access to important information than officials did and had strong incentives to act on it.

By contrast, regulated entities were motivated to shuffle their feet and mumble until problems became undeniable…and then the regulators themselves would too often hope gunshot wounds would magically heal themselves, rather than risk having to answer embarrassing questions by going into emergency response mode.

Compounding these institutional and behavioral issues was the fact that decades of deregulation had produced a financial system that was tightly coupled. That means, in layperson-speak, that when a problem starts, it propagates thorough the system too quickly to be stopped. There aren’t enough natural or man-made firewalls to arrest the cascade.

With the Ukraine conflict, commentators have fixated on the timetable for prosecuting the war, trying to argue that the fact that Russia has not already “won” (whatever “won” means) implies Russia is losing, despite Russia and its allies having taken over 20% of Ukraine and continuing to gain ground with a mere peacetime expeditionary force. Russian officials have also made clear that they aren’t following a timetable. Some analysts have even argued that the seemingly slow pace is to Russia’s advantage. It does not merely allow them to continue the conflict without resorting to a general mobilization. It also appears to lead Ukraine to bring the war to the Russian front line, facilitating the destruction of the Ukraine army and equipment away from major cities, where civilian casualties would be greater. And the front line is not all that far from Russia, facilitating resupply.

However, there is also a big difference between when a war is won or lost versus when the vanquished is finally prostrated. For instance, Germany’s World War II fate was sealed in the Battle of Kursk, but it was nearly two full years more before Germany surrendered.

Some Western military experts have argued that Ukraine lost within weeks of the start of the Russian forces’ attack. For instance, Larry Johnson contended Ukraine was a goner as soon as Russia took out its radar, air force command and control, and most of its fixed wing aircraft. Ukraine could not mount a counter-offensive against a military using a combined arms operation when it lacked air support. Colonel Douglas Macgregor also stated publicly that Ukraine had lost a month into the conflict; the only open question to him was how long we kept the fighting going to try to weaken Russia.1

In other words, while officials, armchair generals, and the press have been paying at least intermittent attention to the calendar for the military campaign, they’ve not paid much heed to the timeline for the economic war.

We will be so bold as to posit that not only has the sanctions war against Russia backfired spectacularly, but the damage to the West, most of all Europe, is accelerating rapidly. And this is not the result of Russia taking active measures2 but the costs of the loss or reduction of key Russian resources compounding over time.

So due to the intensity of the energy shock, the economic timetable is moving faster than the military. Unless Europe engages in a major course correction, and we don’t see how this can happen, the European economic crisis looks set to become devastating before Ukraine is formally defeated.

Now that European leaders are returning from summer holidays, it appears only now to be dawning on them that Europe is entering a severe and almost certainly protracted economic crisis.

Mind you, they were worried enough in late July to Do Something in the form of agreeing to 15% voluntary energy use cuts starting August 1. The lack of any planning or implementation time, even before getting to the “voluntary” uselessness, confirmed that this measure was a handwave.

Emmanuel Macron rattled pundits last week by telling France it faced the “end of abundance,” as in they need to accept a permanent reduction in their standard of living. As Agence France-Presse translated it:

This overview that I’m giving – the end of abundance, the end of insouciance, the end of assumptions – it’s ultimately a tipping point that we are going through that can lead our citizens to feel a lot of anxiety.

Faced with this, we have duties, the first of which is to speak frankly and very clearly without doom-mongering.

Frankly, more doom-mongering is in order. Despite spot market electricity prices sending a dire warning of the consequences of reduced supplies of Russian gas, and citizen and business desperation over recent and expected near-term energy price increases, Macron depicts that as something voters should accept because Ukraine. And that’s before getting to the other stressor that Macron mentioned, food price increases due to droughts and fires.3

We’ll stick to the energy crisis for now. As we’ll explain, this shock will be so severe if nothing is done (and as we’ll explain, it’s hard to see anything meaningful enough being done), that the result will be not a recession, but a depression in Europe.

The 1970s oil embargo produced a rapid four-fold increase in US prices, which led to both a serious recession and inflation, the now-infamous stagflation. By contrast, at the end of last week, the one-year forward contacts for electricity in France and Germany were more than ten times higher than a year ago. And that was with the underlying inflation rate in EU countries already being high (9.8% year to year as of July for the European Union):

Electricity prices in Europe. Not some spot contract, but actual YEAR ahead prices.

Things are going to break next year.

I think the “Inflation has peaked” narrative dies soon.

Lots of short equity positions in my portfolio at the moment (big basket of 15 names).

https://t.co/rhMM9cWNmj

— Joeri (@joeriwestland) August 25, 2022

Spot prices are not yet quite as bad:

For those who like to blame our government for everything, our electricity spot price for tomorrow is lower than much of Europe. (Image source unknown, would like to see the rest of EU) https://t.co/Rbn7vzDKG9

— DJMidarezaki, Esq.

#NeverRishi (@DJMidarezaki) August 25, 2022

Note that most prices subsidies and limits on increases are for households. Even so, there’s already fear and anger over some pending residential price increases. UK homes will see an 80% rise in their combined energy and gas rate cap come October 1 with that rate set to increase again in January. Mind you, this follows a 57% increase earlier this year.

Businesses in normal times pay full freight. As a result, there will be large scale company failures.

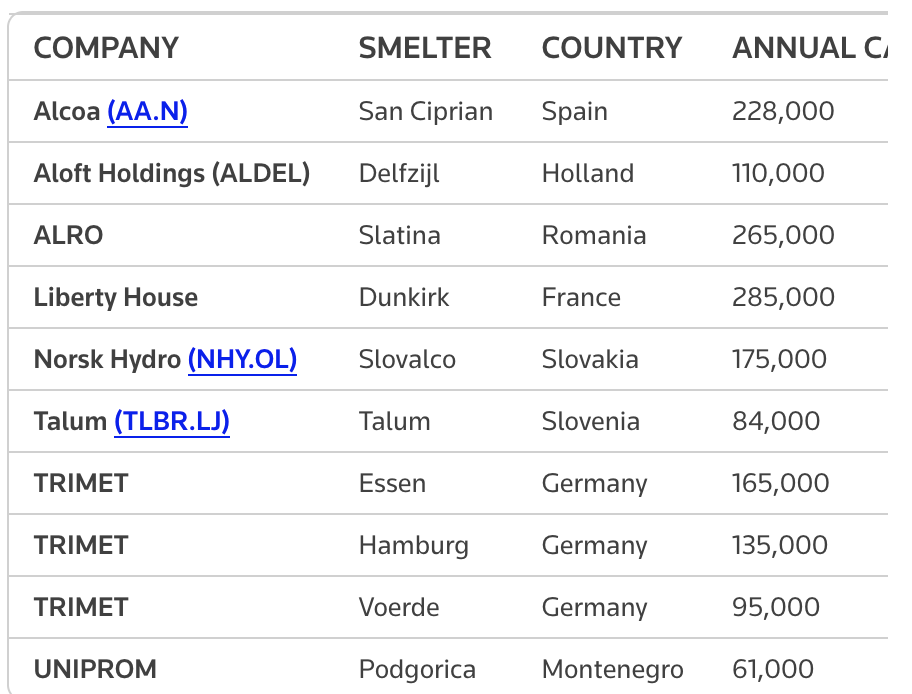

We are already seeing early signs of distress, like aluminum smelters cutting output or shuttering facilities. From Reuters on August 25 (visit original story to see full detail on chart):

Europe’s aluminium output capacity is around 4.5 million tonnes. Of that, about 1 million tonnes has been taken offline since 2021 and another 500,000 tonnes is under threat, analysts at Citi say.

Following is a list of smelters that have cut production.

Aluminum smelters are not the only early casualty. From France24:

Industries are also affected by the soaring energy prices.

Factories that produce ammonia — an ingredient to make fertiliser — announced the suspension of their operations in Poland, Italy, Hungary and Norway this week.

And while those losses can happen quickly, it takes a long time to rebuild.

In theory, Europe can cap or subsidize prices.4 But high prices serve as a rationing mechanism. Subsidizing prices means other forms of rationing will take place instead. Blackouts? Brownouts? Which businesses and homes will be preferred and which will be sacrificed?

Save the euro weakening against the dollar, the EU has not faced much pressure in recent months on the oil price front. But things could get worse there too, albeit not to the same degree as with gas and electricity. Many experts think that oil prices moderating wa s due in large degree to lower demand from China, first from off and on Covid lockdowns hitting production, and now from heat waves doing the same. If China’s demand perks up, so to will oil prices. And if they don’t, the Saudis are threatening to cut output.

With its notorious democratic deficit plus Europeans being more inclined to take to the streets when things get bad than Americans, it’s not hard to imagine that unions and consumers will protest…particularly since they’ve already planning to do just that. From the Guardian:

Britain is facing a wave of coordinated industrial action by striking unions this autumn in protest at the escalating cost of living crisis, the Observer can reveal.

A series of motions tabled by the country’s biggest unions ahead of the TUC congress next month demand that they work closely together to maximise their impact and “win” the fight for inflation-related pay rises.

The move, which includes the two biggest unions, Unison and Unite, comes amid growing anger at the government’s failure to agree a detailed package of help for families following Friday’s announcement that average gas and electricity bills are to rise by 80%.

While coordinated action would be short of a “general strike” floated by some union leaders, Unite’s motion would give the TUC the task of ensuring that walkouts are synchronised or deliberately staggered to deliver the greatest impact.

If UK corporate profit share as a percentage of GDP is anything like that of the US, companies have a fair bit of room to increase pay levels without raising prices or cutting output. But given deeply held neoliberal views and the lack of a government willing to browbeat CEOs into living with less (starting with cutting executive pay and bonuses), we’re likely instead to get whinging and more price gouging.

If labor actions become common across Europe, expect a new version of the early 1970s capitalist complaint about the US, that it’s become “ungovernable”.

But in all seriousness, businesses and households simply cannot swallow energy cost increases this high, particularly in winter.

The reality is the cutoff from Russian energy can’t be remedied with fiscal spending. Government intervention can make it less painful only at the margin. This is a real economy problem and it can only be solved in the real economy, either by getting a lot of that Russian energy back or by getting new energy sources. We know how well the latter is likely to go. The Prime Minister of Belgium was brave enough to say the quiet part out loud, that the energy crisis in Europe will last for ten years.

In theory, the EU could try to make up to Russia. But the time for that has passed. It isn’t just that too many key European players like Ursula von der Leyen and Robert Habeck are too deeply invested in Russia-hatred to retreat. Even if there were blood in the street come December, they wouldn’t be turfed out quickly enough.

It is also that Europe has burned its bridges with Russia beyond just the sanctions. Putin has repeatedly offered the EU the option of using Nord Stream 2. Even with Russia now using half its capacity, it could still fully substitute for former Nord Stream 1 deliveries. Putin did warn that option would not stay open for all that long, that Russia would start using the rest of the volume.

Even with Putin being more dovishly inclined than anyone else in the Russian leadership, it now seems politically untenable for him to agree to let Europe use Nord Stream 2 even if he were still inclined to agree. First is that most of those who have advocated turning on Nord Stream 2 have suggested doing so in a bad faith manner, just to fill up storage, and then renege on payments. Mind you, EU gas storage facilities are meant to be a supplement. They can’t hold a full year supply. So this idea would just be a stopgap…showing its advocates to be clueless on multiple levels.

But putting that wee EU problem aside, the Russian interest in opening up Nord Stream 2 would be to repair economic relations with Europe. But Europe’s posture is that it still thinks Russia should bow to European interests, as opposed to deal on the basis of mutual benefit.

Second, the outpouring of hatred from ordinary Europeans against Russia, as shown in cancellation of performances by Russian artists and athletes, and even the removal of Russian compositions from symphonies, has led many Russians to wish Europe good riddance.

Third, even as the loss of Russian energy is becoming more painful, European leaders are determined to keep punishing Russia even though none of the past blows have landed all that hard. They are now discussing a seventh round of sanctions. The Baltics have been pushing for the EU to follow Estonia and stop issuing Schengen visas to Russians. If Russians can no longer receive Schengen visas, they would have to get a visa for each visit, and I understand not a 90 day visa but one that specified the time of entry and departure.

However, the European Commission has said the EU cannot halt the issuance of Schengen visas but individual member states can. My impression is that the fact that this idea hasn’t been denounced by any prominent European (even if under the guise of undermining Schengen and therefore the EU) has not gone unnoticed in Russia.

So the outcome seems inevitable: many Europeans businesses will fail, leading to job losses, business loan defaults, loss of government revenues, foreclosures. And with governments thinking they’d maybe spent a bit too freely with Covid relief, their emergency energy fillups will be too little to make all that much difference.

At some point, the economic contraction will lead to a financial crisis. If the downdraft is rapid enough, it could be the result as much of (well warranted) loss of confidence as actual losses and defaults to date.

The reason the September-0ctober 2008 crisis was so cataclysmic was that it was a derivatives crisis. Derivatives generated considerable leverage of the worst real-economy subprime exposures and significantly concentrated those risks at systemically important institutions like AIG, Citigroup, and Eurobanks.

Yours truly does not have a good handle on where supposedly but not really hidden leverage sits now. Even though there has been an awful lot of speculation in crypto-land, so far, its wild ride down does not seem to have done much damage to the critical traditional payments infrastructure (as in the linkages to real economy banks don’t seem to be very significant).

However, a long standing concern is that after the crisis, derivatives were not tamed. The easy and obvious remedy would be to require adequate margining. But high enough margins make derivatives unattractive for most users….and those undermargined, as in ultimately government subsidized, derivatives are a big profit center for big financial firms. Can’t mess with that!

So they were largely moved over to central clearing houses. These clearing houses are not backstopped but are widely seen as too big to fail entities. So they are a possible flash point if the financial system goes wobbly.

In other words, Europe’s trajectory seems likely to lead to accelerating bad outcomes, first in the real economy and then soon in the financial economy.

And it seems entirely plausible that the unwind will become acute before Russia imposes terms on Ukraine or the conflict is frozen, Korean-War style.

And a final cheery note: if things do get that bad, it is hard to see the US (banking and supply chain ties) and China (big loss in demand from a key customer) emerging unscathed.

____

1 Some like Scott Ritter who do agree that Russia is winning the war, argue that it would still be a defeat for Russia if Russia did not decisively prevail. I’m not sure what this would look like, unless Ritter believes that Russia not capturing the western part of Ukraine would amount to a Russian loss, when regime change or “liberating” the non-ethnic Russian parts of Ukraine were never an objective. If Russia takes the Black Sea coast, whatever is left of Ukraine will be economically weak. And Medvedev let the cat out of the bag that Russia would very much like to see western Ukraine partitioned, but how that comes to pass is over my pay grade.

2 It was Europe that vowed it would be off Russian energy by winter, while not mentioning that that depended on completely filling up all gas storage and not cutting themselves off until sometime in the fall. That is already “customer from hell” behavior: “We’ll default on our agreement in the way most convenient for us and brag about it too.”

Recall also that some of the loss of EU supply was due to Ukraine cutting off transport through one line going through Lugansk (weeks after the separatists took territory near a key junction, thus showing that the Ukraine claim that the separatists might do something bad were trumped up. Why not wait until an incident to deprive Europe of needed gas? But no one, not even a European columnist, chided the sainted Ukrainians for taking an action detrimental to Europe.

Supply to Europe also fell due to Poland and Bulgaria refusing to pay for gas in the contracted currency at Gazprom bank.

Recall also that Germany stole the assets of Gazprom Germania, yet Russia retaliated narrowly, by sanctioning the entities involved in the heist (I have yet to see any discussion of that impact….is the Western press not willing to admit to any?)

As to the uproar over the reduction of shipments on Nord Stream 1, Putin offered repeatedly to let the EU use Nord Stream 2. So Russia cannot be accused of denying Europe supply. This is about putting institutional and personal egos ahead of serving the public good.

3 In France, it’s not unreasonable to link the energy crisis to climate change given how the water part of the equation complicates running nuclear reactors.

4 One assumes that this practice would lead to utilities having to sell power below cost…so they would either need subsidies or an eventual bailout. So this response would also impose fiscal costs on governments. And with the EU already suffering from inflation and having Maastrict budget rules, there will be a lot of reluctance to save people by busting budgets. The EU might resort to more Eurobond issuance, but that will be seen as inflationary and could further weaken the euro….which will lead to higher commodity and import prices. So there are no good finesses.