Today’s Animal Spirits is brought to you by YCharts:

See here for YCharts research on which leading indicators best predict market declines.

On today’s show we discuss:

Listen Here:

Recommendations:

Charts:

Tweets:

Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless. Doing it while going well beyond one campaign promise ($10K of student loan relief) and breaking another (all proposals paid for) is even worse.

— Jason Furman (@jasonfurman) August 24, 2022

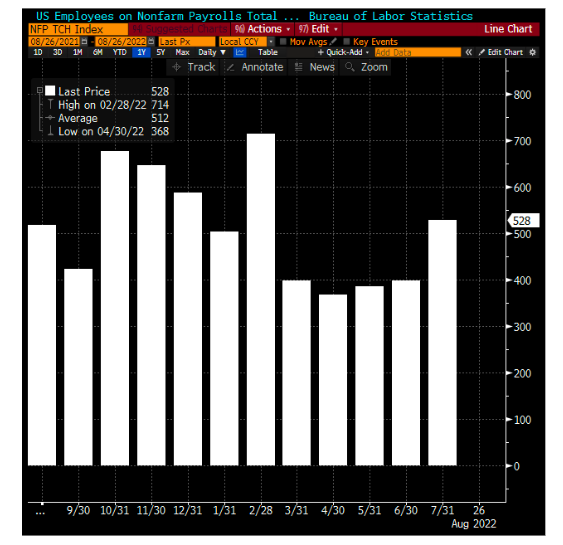

Powell can talk about the “pain” and “costs” of raising rates to bring down inflation, but the fact is the Fed has been hiking into a very strong labor market.

There’s little reason (yet) to believe that they’d stay the course if nonfarm payrolls start to come in softer. pic.twitter.com/ynwLv5WNtP

— Brian Chappatta (@BChappatta) August 26, 2022

6. In other news, US corporate profits reached a new all-time high in Q2: surpassing the $2 Trillion mark for the first time in history.

h/t @ReutersJamie pic.twitter.com/mvj5L09cCJ

— Callum Thomas (@Callum_Thomas) August 27, 2022

Profit margins not yet signaling recession … aggregate U.S. corporate profit margins rose to 15.5% in 2Q22, strongest since end of 1950 pic.twitter.com/WBDXHcDEKr

— Liz Ann Sonders (@LizAnnSonders) August 26, 2022

These scatter plot charts show just how bad of a year 2022 has been for stocks and bonds.

Read more at our open-content Think BIG page: https://t.co/6gatCEwSUX pic.twitter.com/wG1UTgBmT4

— Bespoke (@bespokeinvest) August 25, 2022

The shift to WFH is the largest shock to labor markets in decades. Pre-pandemic WFH was trending towards 5% of days by 2022. Now WFH is now stabilizing at 30%, a 6-fold jump.

In America alone this is saving about 200 million hours and 6 billion miles of commuting a week. pic.twitter.com/XK4WVWXq3f

— Nick Bloom (@I_Am_NickBloom) August 29, 2022

The Prices Paid component of all 5 regional Fed surveys declined in August, and all but one (Richmond) is at its lowest level since at least January 2021.

— Bespoke (@bespokeinvest) August 29, 2022

Lumber another 52wk lowhttps://t.co/bqBUgCcprI @justLBell pic.twitter.com/iccDiTPYZM

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) August 25, 2022

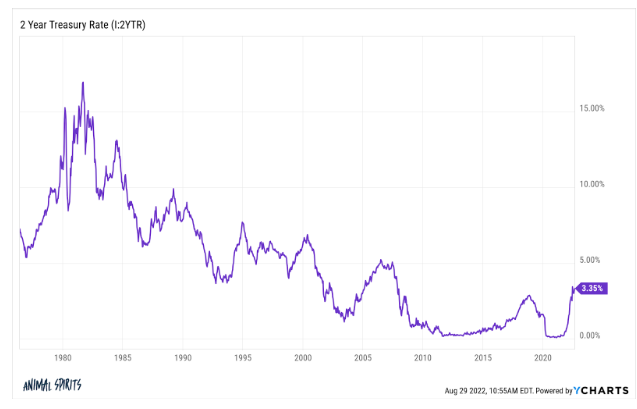

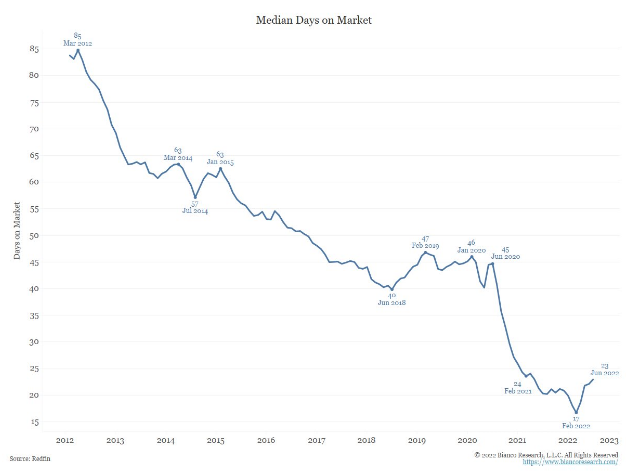

The average 30-year fixed mortgage rate jumps to 5.95%. pic.twitter.com/SpAwMWOvKx

— Lance Lambert (@NewsLambert) August 29, 2022

My guess is Kevin Durant is locked into a 3% mortgage rate and simply doesn’t want to buy a new house w/a higher rate so no trade

— Ben Carlson (@awealthofcs) August 23, 2022

Divorce is usually one the reasons people sell their homes (death, divorce, unemployment, etc)

I spoke with a divorce attorney (friend) yesterday and she told me couples are struggling with what to with their homes because they have 3% mortgage rates and plenty of equity.

1/— Bill McBride (@calculatedrisk) August 27, 2022

Investors are an important driver of US housing demand. While institutional investors and IBuyers get a lot of press they are a pretty small share of the overall market.

Individual and small investors (1-9 properties) are a much larger and faster growing share. pic.twitter.com/uqtsXZ6dEk

—

Len Kiefer

(@lenkiefer) August 23, 2022

HBO renews ‘House of the Dragon’ after more than 20 million watch first episode https://t.co/Hh9KvQhFhj

— CNBC (@CNBC) August 26, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: