Layoffs are sweeping the USA, impacting workers at companies like Shopify, Tesla, and Peloton. At some point, you may need to lay off employees in your small business, too.

Although not an easy choice, laying off a worker or workers is sometimes necessary to promote growth and development or prevent small business bankruptcy. Read on to learn how to lay off employees (small business).

What is a layoff?

A layoff takes place when an employer terminates an employee due to problems that are not performance-related. Layoffs can be the result of downsizing, budget cuts, business reorganization, an attempt to boost cash flow, or the business no longer needing the position. Unlike firings, layoffs are not the result of poor employee performance, fraud, or misconduct.

Layoffs can be temporary or permanent. But, there is no guarantee that a temporary layoff won’t become permanent.

Generally, employees who are laid off through no fault of their own can file for unemployment insurance benefits. Keep in mind that your state may provide a mass-layoff number for employers to use during emergencies (e.g., coronavirus layoffs) or for special cases. This helps your employees receive unemployment insurance benefits more quickly and may prevent your employer account from being affected.

As an employer, deciding to lay off workers is not easy. So, how do companies lay off employees? When it comes to how to lay off an employee, what’s the right and wrong way to go about it?

Laying off employees: Small business

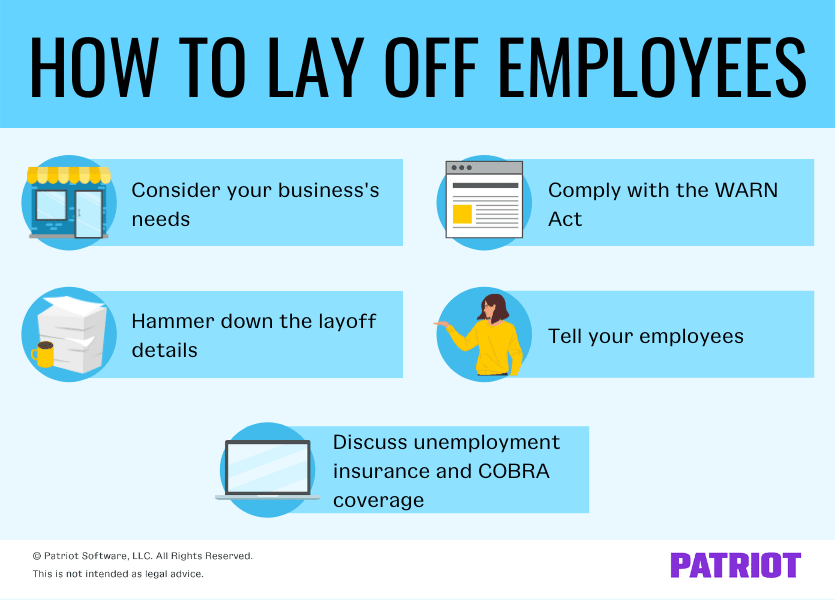

When laying off employees, you must follow both ethical and legal guidelines. Use the five tips below to help lighten the load of the layoff process.

1. Consider your business’s needs

Clearly, laying off employees is a big decision. As with anything, you should weigh the pros and cons before deciding.

Laying off employees isn’t just harmful to the people you’re laying off—it can also hurt your remaining staff, customers, investors, brand, and reputation. However, failing to lay off workers can sink your business into a hole of negative cash flow.

Consider some alternatives to laying off workers:

- Cut back employee hours

- Limit or cut out overtime

- Hold off on giving raises or bonuses

- Implement furlough

So, what is furlough? Furlough is mandatory time off work for employees without pay. Unlike a layoff, an employee on furlough still has their job. Implementing furlough may help you avoid layoffs and get your business’s finances back on track.

If you’re thinking about implementing a layoff, you can assess your business’s needs by creating or updating your budget. Your budget can help you project expenses, business revenue, and profit. Use your budget to see if there are other expense areas you can cut back on.

You know what’s best for your business. If layoffs in your small company are necessary, you need to think through the details.

2. Hammer down the layoff details

Before you tell your employees about the layoffs, you need to solidify some details. You don’t want to cause a panic by telling your employees what could happen after you figure out the details.

Here are a few things you need to determine:

- Whether the layoff is temporary or permanent

- Who you will lay off

- How you plan on notifying your employees

- What type of support you’ll offer to affected workers

- When the layoffs will take place

- What this means for your current staff

If at all possible, avoid doing multiple rounds of layoffs.

3. Comply with the WARN Act

If you want to know how to lay off employees legally, you need to familiarize yourself with the Worker Adjustment and Retraining Notification Act (WARN) of 1988.

The WARN Act requires that employers with 100 or more employees notify them about mass layoffs and plant closings at least 60 calendar days in advance. The notice must be in writing.

Mass layoffs are where 50 or more employees are laid off at one location.

Not all employers have to follow WARN. Only employers with 100 or more employees have to comply with WARN regulations.

The Worker Adjustment and Retraining Notification Act aims to protect soon-to-be laid off employees by giving them enough time to apply for other positions or seek additional training.

If you are governed by WARN, give your employees plenty of warning about upcoming layoffs. And, you must notify other relevant parties, like your local government’s chief elected official.

There are some exemptions to WARN. You do not need to provide 60 days notice if:

- You have fewer than 100 employees

- The employees haven’t worked for six months or more in the past 12 months

- The employees work less than 20 hours a week

- A plant being closed is a temporary facility

- The employees complete a project and knew when they were hired that project completion would result in mass layoffs

- Layoffs are the result of unforeseeable circumstances

- Layoffs are due to natural disasters

Failing to comply with the act can result in a penalty of up to $500 per day that you do not tell your employees.

For more information on WARN, consult the U.S. Department of Labor.

4. Tell your employees

Do you know how to tell employees about layoffs? More than likely, it’s not going to be easy.

Here are some do’s of how to lay off an employee:

- Do provide as much information as you can

- Do explain that the layoff isn’t the employee’s fault, if applicable

- Do offer to provide letters of recommendation

And, here are a few things you shouldn’t do when telling an employee about the layoff:

- Don’t overpromise that their jobs will come back

- Don’t beat around the bush

- Don’t forget to hand the employee a written notice

After telling your employee, ask them if they have any questions about the process. Your employee might be angry or emotional, so be prepared to stay calm and supportive as you field questions.

When it comes to telling an employee about a layoff, Ian Clark, Head of the Americas at Frank Recruitment Group, gives the following advice:

The most important thing is to treat your employees with dignity and provide as much support as you can. Nothing is more degrading to someone who’s worked hard for your business than simply being handed the paperwork and shown the door, so sit down with them in person, express your appreciation, and offer any resources that might make the transition easier.”

Once you tell the affected employees, notify your remaining staff about the layoffs. Tell them what this means for them, like job responsibility changes.

5. Discuss unemployment insurance and COBRA coverage

When you lay off employees, there are some things you must talk with your employees about, like unemployment insurance and COBRA continuation coverage.

Unemployment insurance

Employees who are laid off through no fault of their own may seek unemployment insurance benefits while they look for new employment. With unemployment benefits, employees can receive a portion of their paycheck.

When an employee seeks unemployment benefits, you will receive a notice from your state. And, your state unemployment tax rate will likely increase.

Before you lay off an employee, provide information on how they can go about claiming unemployment. Keep in mind that unemployment claim requirements vary by state.

COBRA coverage

The Consolidated Omnibus Budget Reconciliation Act (COBRA) protects qualifying employees who lose their health insurance.

Under COBRA, laid-off workers can elect to continue their health insurance coverage. Employees can receive coverage anywhere from 18-36 months.

You must provide COBRA coverage to your employees if you:

- Offer a private-sector group health plan

- Employ at least 20 full-time equivalent employees

Employees who are eligible to receive COBRA continuation coverage must have been covered by a group health plan on the day before they were laid off.

Although you can offer to pay a portion of the employee’s health plan, you don’t have to. You can require that the employee pay the full amount of their coverage, plus a 2% administrative cost.

Looking for an easy way to run payroll and keep payroll records? Check out Patriot Software’s online payroll. Our software uses a simple three-step process to get you on your way. Start your free trial today!

This is not intended as legal advice; for more information, please click here.