When it comes to private industry workers, 77% have access to paid sick leave and 77% have access to paid vacation time. But, what happens if you can’t afford to offer your employees paid time off (PTO)? Or, what if your employees use up all of their PTO and need to take time off from work? For either of these situations, you may consider offering unpaid time off.

Before offering employees unpaid time off, you need to know if you legally can. Some state laws might require you to offer paid time off. And if you offer unpaid time off, you need to create an unpaid time off policy for small business.

Read on to learn more about unpaid time off, including related laws, what to include in your policy, and how it affects payroll.

What is unpaid time off?

Unpaid time off (UTO) is time away from work an employee can take without pay. Employees can use UTO if they’re sick, want to take a vacation, or have other personal obligations. Workers can also take an unpaid leave of absence from work, which is an extended period of time away from work.

Employers can offer unpaid time off in addition to or instead of paid time off.

Paid time off is when employees earn their regular wages when they take off from work. Employers usually give employees a set number of paid time off hours that they can use in a calendar year. When the employee uses up all of their paid time off and needs to take time off from work, they might be able to use unpaid time.

Some employers decide not to give employees paid time off. Employers might provide UTO to hourly workers, part-time employees, or their entire staff.

Unpaid time off laws

Before deciding to offer employees UTO, familiarize yourself with paid sick leave laws by state.

There are 12 states, and Washington D.C., that require qualifying employers to offer employees a certain number of paid sick days.

The states that require employers offer paid sick leave are:

- Arizona

- California

- Colorado

- Connecticut

- Maine

- Maryland

- Massachusetts

- Michigan

- Nevada

- New Jersey

- New Mexico

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

- Washington D.C.

Additionally, there are several cities and counties with mandatory paid sick leave laws. Check with your locality for more information.

Creating your unpaid time off policy

If you decide to offer your employees UTO, you need to have a policy in place. Your time off without pay policy should specify information like:

- Whether you will also offer paid time off

- Which employees have access to paid (if applicable) and unpaid time off

- The number of unpaid days employees can take

- How employees can request time off

Whether you will also offer paid time off

Your policy should address whether you are offering unpaid time off after an employee uses their paid time or instead of paid time. If you offer paid time off, include a separate paid time off policy, too.

Which employees have access to UTO

Your unpaid time off policy should also specify which employees you’re offering unpaid time off to.

If you are offering paid time off to some employees and UTO to others (e.g., part-time vs. full-time employees), state it in your policy.

Number of days employees can take

When you offer unpaid time off to employees, you may decide to cap the number of days employees can take off in a calendar year. Or, you might let employees take off as many days as they want.

State whether you have a cap (e.g., 80 hours of UTO per year) or not in your policy.

How can employees request time off?

Although you don’t have to pay employees who don’t show up to work, you should have a system in place for taking time off.

Your policy should address how employees can request time off, how much heads-up they need to give you, and what happens if more than one person calls off.

For example, you might request that employees put their request in writing, provide one month’s notice for more than two days off at a time, and prioritize requests based on a first-come, first-served basis.

Unpaid time off and payroll

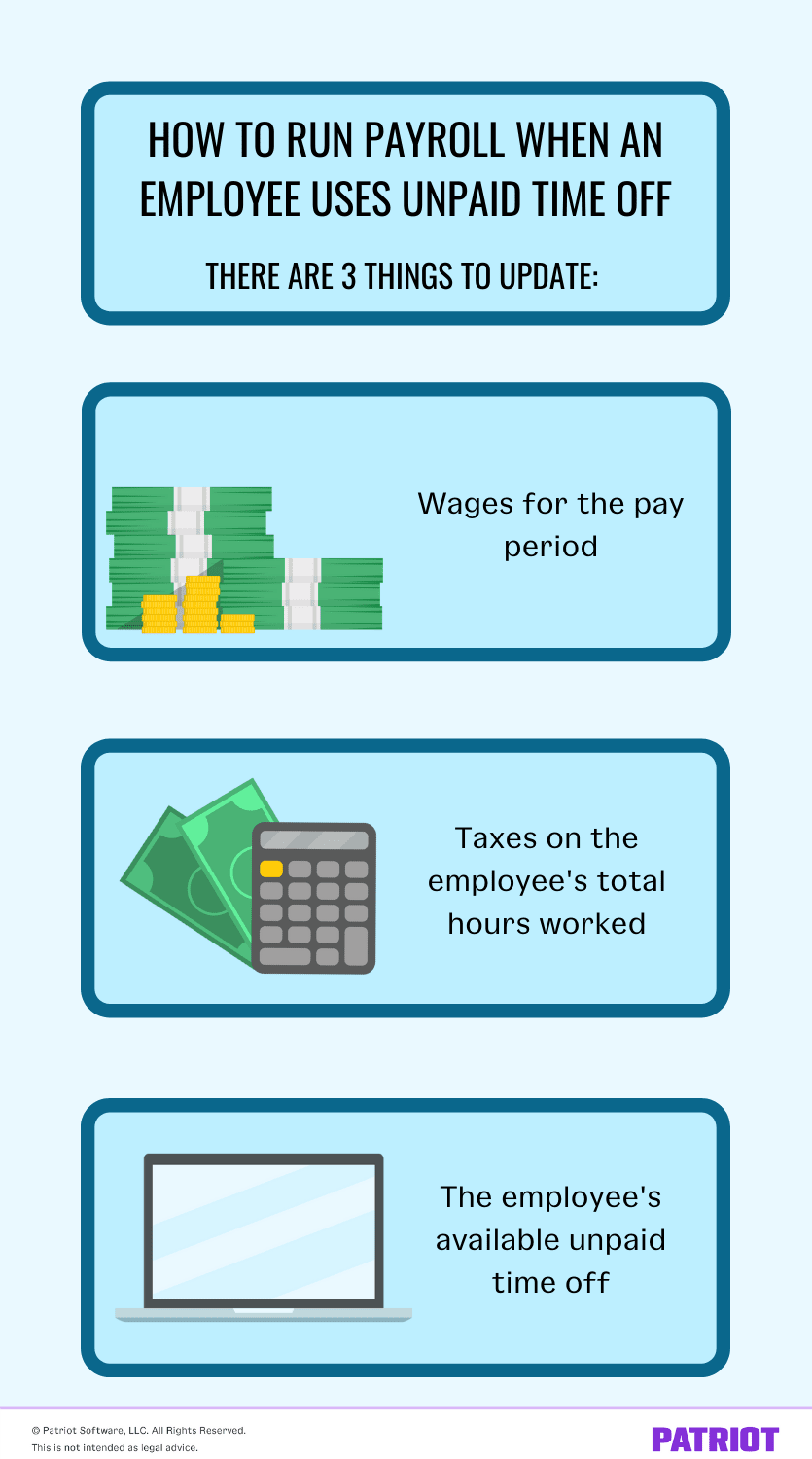

So, how do you run payroll when an employee uses UTO?

There are three things you need to update:

- Wages for the pay period

- Taxes on the employee’s total hours worked

- The employee’s available UTO (if you have a cap)

1. Wages for the pay period

The point of offering employees UTO is so they can take time off from work without getting paid. Your payroll should reflect their wages for fewer hours worked.

Multiply the employee’s hours worked by their hourly rate. Do not include the hours the employee used as unpaid time off.

If the employee is salaried, you may need to calculate their hourly rate. To do this, divide the employee’s gross wages in a pay period by the number of hours they normally work. Then, you can multiply their hourly rate by the number of hours worked.

Let’s say you have a salaried employee who normally earns $1,000 every week for working 40 hours. They use eight hours of unpaid time off and worked 32 hours during the week.

First, calculate the employee’s hourly rate by dividing their weekly gross wages by 40 ($1,000 / 40). The employee’s gross hourly rate is $25.

Now, multiply the employee’s hourly rate of $25 by their total hours worked, which is 32 ($25 X 32). The employee’s gross wages for the week are $800 rather than their normal $1,000.

2. Taxes

If you’re used to withholding the same amount for taxes from your employees’ wages, you need to make some changes when they take unpaid time off.

When an employee works fewer hours and earns lower wages, their tax liability decreases. Make sure to recalculate the payroll taxes you withhold based on their new wages.

3. Available unpaid time off hours

Did you decide to set a cap on the number of unpaid hours an employee can take off from work?

If so, make sure to subtract the number of used hours from the employee’s remaining available UTO hours.

Make things easy on yourself. If an employee takes unpaid time off, simply enter their hours worked into Patriot’s payroll software, and our software will calculate wages and taxes. Why not start your free trial today?

This article has been updated from its original publication date of December 16, 2019.

This is not intended as legal advice; for more information, please click here.