Hiring your first employee is exhilarating. Instead of remaining buried by your business responsibilities, you can bring employees on board to alleviate some of your stress. But for many, the endless information about becoming an employer can be overwhelming.

Every small business owner starts their employer journey by hiring their first employee. To get through the process, learn how to hire your first employee.

How to hire your first employee

Bringing on your first hire shouldn’t be a spur of the moment decision. It requires careful planning, significant preparation, and recurring payroll responsibilities once the employee is placed.

Take a look at your responsibilities when hiring first employee.

1. Register for accounts

As an employer, you will need several account numbers, registrations, and insurance policies. After registering, be sure to keep your account numbers and passwords in a secure place where they won’t get lost or stolen.

To legally operate your company, you need a business permit, registration, or license. If you don’t already have this, make sure you secure one before you bring on an employee. Each state enforces different registration rules. Check with your state business license office for your requirements.

You also need to apply for an EIN, which is an Employer Identification Number. Your EIN identifies your business when you report taxes and other information to the government. It is a unique nine-digit number that works similarly to a Social Security number.

Once you hire your first employee, you should sign up to make tax payments through the Electronic Federal Tax Payment System (EFTPS). EFTPS is a convenient way to pay employment taxes, and you can use it to pay business taxes as well.

You also need to sign up for an unemployment insurance account through your state department. Your state unemployment tax (SUTA) account is needed to make SUTA tax payments.

Another part of learning how to hire first employee is making sure you have a new hire reporting system account. You need to report new hires to your state’s new hire reporting program.

Last but not least, hiring your first employee means obtaining workers’ compensation insurance. This is a state-mandatory insurance that provides wages and medical benefits to employees if they are injured on the job. Rates are determined by your state and vary based on factors like industry, payroll, and past claims.

2. Make payroll decisions

The next step of hiring your first employee is to make decisions about your payroll program. The more carefully you plan now, the easier running payroll will be in the future.

First, determine how you will record and run payroll for your small business. Are you going to do payroll by hand, outsource payroll to a professional, or use payroll software? Consider things like cost and time before making your decision. Running payroll by hand is the most time consuming but least costly method while hiring a professional is the opposite. Running payroll with software is a good middle ground.

Next, consider what type of employee you need. Will they be a full-time or part-time worker? Will they be hourly or salary? What will their pay rate be? When deciding, think about whether they will be classified as exempt vs nonexempt employees from overtime wages.

Decide what the employee’s pay frequency will be. Will you pay them weekly, biweekly, semimonthly, or monthly? If you decide to use payroll software, make sure to look for providers that let you run as many payrolls as you want per month, like Patriot Software.

Lastly, hang up certain employment law posters where your employee can read them. Display required state and federal posters to stay compliant with the law.

3. Recruit and hire an employee

Now comes the actual hiring part. You don’t want your first hire to be a bad fit, so it’s important that you know how to hire your first employee.

Attract the right kinds of candidates by creating a clear and appealing job description. Nail down the position requirements and determine what qualifications (e.g., education, experience, etc.) you need to grow your business. You can include things like benefits to encourage candidates to apply.

Post your job description on platforms like job boards, social media, and your business website. You can even use email marketing to alert job seekers about the position. When job applications come in, weed out the unqualified candidates and determine which candidates you want to interview.

When you are ready to hire, extend the job offer to the candidate. If they accept, you can set a start date.

4. Collect and fill out paperwork

Before an employee begins working at your business, you need to collect paperwork from them. And, you also need to fill out paperwork. Do not procrastinate completing these forms.

Report new hires to the state using your new hire reporting system within a certain timeframe. Federal law says you must report new employees within 20 days of hiring them, but your state laws might be shorter. Make sure you know your state’s rules.

Each employee must fill out Form W-4, Employee’s Withholding Certificate, upon hire for federal tax withholding.

Many states have state income tax. If your employee works in a state with income tax, they need to also fill out a form for state tax withholding. These forms are the state’s equivalent to Form W-4.

To make sure employees are eligible to work in the United States, they need to fill out Form I-9, Employment Eligibility Verification. When you collect Form I-9, the employee must also bring in original documents proving their identity and employment eligibility. The final page of Form I-9 provides a list of acceptable documents employees can choose from.

Beginning May 1, 2020, employers are required to use a new version of Form I-9 for all new hires and for reverification. To stay compliant, use the October 2019 edition of Form I-9.

You might need to collect other documents such as an emergency contact form, employee handbook acknowledgment form, or a benefits form.

5. Understand your employment tax responsibilities

Before you hire your first employee, make sure you know what responsibilities you will have. As an employer, you are responsible for depositing and reporting employment taxes. You withhold some taxes from your employee’s paycheck. You pay other taxes out of your pocket.

Withholding and contributing taxes

Withhold federal income tax from your employee’s wages. The amount you withhold is based on the employee’s Form W-4 information. Use the IRS’s income tax withholding tables to determine the amount.

You may also have to withhold state and local income taxes from your employee’s pay. Check with your state for more information.

Withhold Social Security and Medicare taxes. Social Security taxes make up 6.2% of the employee’s pay and Medicare taxes make up 1.45%. There is also a Social Security wage base and additional Medicare tax rate you should familiarize yourself with.

Social Security and Medicare taxes are employer-employee taxes, meaning you must also contribute a matching employer portion. Pay 6.2% of the employee’s wages for Social Security and 1.45% for Medicare taxes.

There are also taxes that you alone must pay. Federal Unemployment Tax Act (FUTA) tax is an employer-only tax of 6% on the first $7,000 of employee wages per year. However, most employers receive a tax credit of up to 5.4%. With the maximum tax credit, you would only pay 0.6% on the employee’s wages up to $7,000.

State unemployment tax is another tax you must pay. However, some states require employees to pay this, too. You will need to check with your state for SUTA tax rates.

Depositing and reporting taxes

You are responsible for depositing and reporting taxes, too.

Depositing frequencies vary, but you will either deposit monthly or semiweekly for federal income, Social Security, and Medicare taxes. Your depositing schedule is determined by a four-quarter IRS lookback period.

Deposit your FUTA tax liability quarterly unless your tax liability is $500 or less during a quarter. You can carry your liability from quarter to quarter until it reaches more than $500.

You also need to familiarize yourself with tax forms. You must file the following reports to the correct government agency by their deadlines:

Report federal income, Social Security, and Medicare taxes on Form 941, Employer’s Quarterly Federal Tax Return, and file it quarterly. The IRS notifies some very small businesses that they can use Form 944, Employer’s Annual Federal Tax Return, to report these taxes annually. Use Form 941 unless the IRS tells you to use Form 944.

Use Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, to report FUTA tax payments annually.

You will also need to file Form W-2, Wage and Tax Statement, annually to report the employee’s total wages and withheld taxes. Send a copy to the employee, Social Security Administration, and applicable state or local tax departments. And, save a copy for your records. When you send Form W-2 to the SSA, you will also need to send them Form W-3, Transmittal of Wage and Tax Statements.

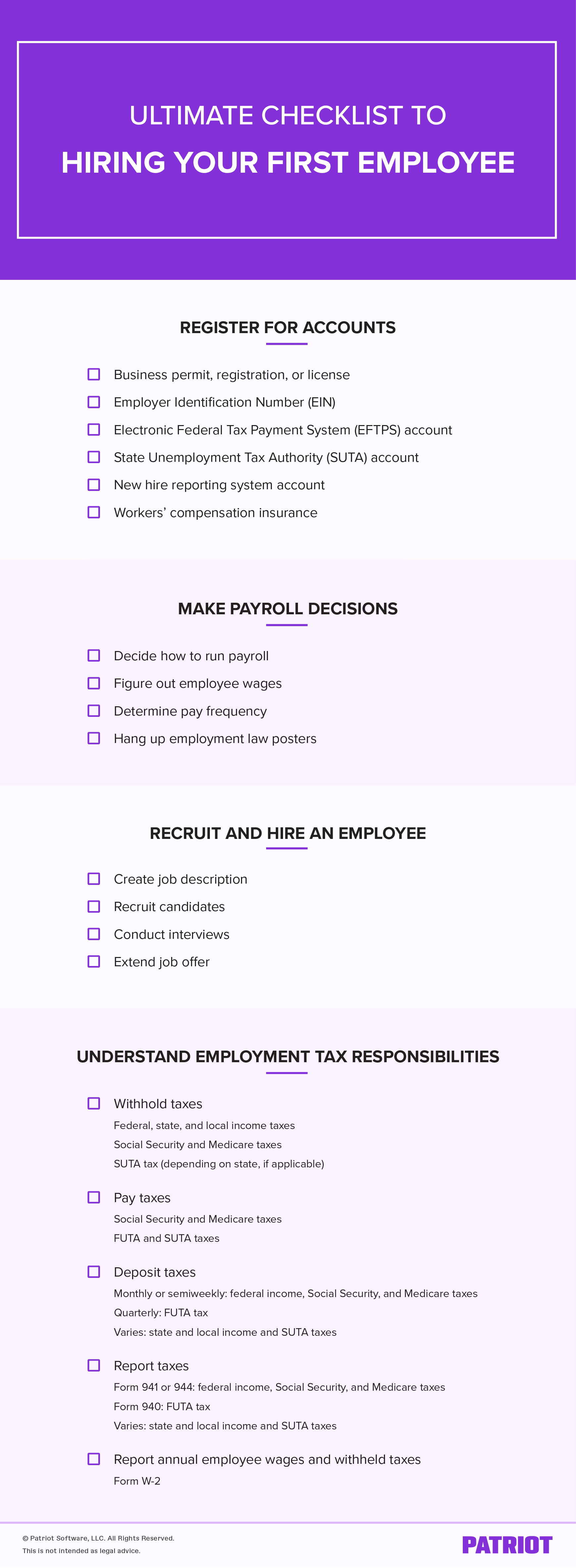

Hiring first employee: Ultimate checklist

Instead of scrambling when hiring your first employee, reference this checklist for first-time employers.

This is a comprehensive list to get you started with your first hire. Getting a handle on payroll tasks can give you a better understanding of our responsibilities as an employer.

You may have more payroll requirements based on your business’s industry, location, and size. Check with your state and local commerce departments to make sure you don’t miss any steps in your hiring and payroll processes.

This article has been updated from its original publication date of 1/22/2016.

This is not intended as legal advice; for more information, please click here.