One of these things is not like the others.

A 60/40 portfolio just experienced the worst eight-month stretch to start a year going back to the inception of the Barclay’s aggregate bond index in 1976.

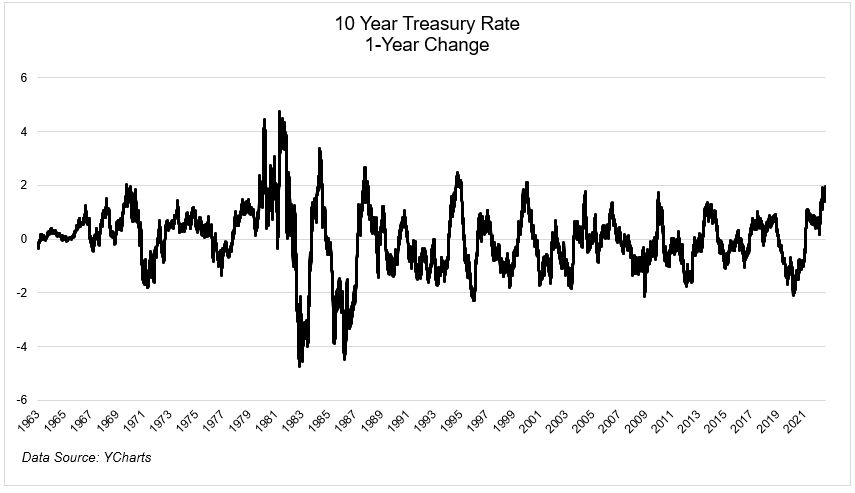

One year ago the 10-year rate was 1.32%. It’s 3.35% today. The last time it experienced a 12-month increase that large was in January 2000!

The vicious move in rates has left a mark on everyone’s portfolio in one way or another.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?