This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Liz Truss has vowed Britain will “ride out the storm”, as the new UK prime minister began confronting an economic crisis with a massive energy bailout for families and businesses that could cost more than £150bn.

Truss dodged torrential rain outside 10 Downing Street to tell the country that she would create an “aspiration nation”, adding: “As strong as the storm may be, I know that the British people are stronger.”

Within minutes of entering Number 10, Truss set about forming a cabinet and finalising an energy relief package that will set the tone for her premiership and sharply increase government borrowing.

Truss’s allies suggested the household package would cost £90bn, with an estimated £40bn-£60bn for the business element, which is still being finalised, over two years.

The estimated scale of the package is bigger than any single Covid-19 support scheme. Ahmed Farman, an analyst at Jefferies, said it would amount to the “largest welfare programme in the UK’s recent history”.

-

Cabinet Truss remakes government, appointing Kwasi Kwarteng as chancellor of the exchequer, Suella Braverman as home secretary, Thérèse Coffey to the post of deputy prime minister and health secretary and James Cleverly as her successor as foreign secretary.

-

Economy Britain’s new leader risks setting up a policy clash with the Bank of England that economists think will lead to jump in interest rates before Christmas.

Thank you for reading FirstFT Europe/Africa — Gary

Five more stories in the news

1. EU’s windfall taxes to counter ‘astronomic’ energy bills Brussels is pushing for national windfall taxes on energy companies to counter what European Commission president Ursula von der Leyen described as “astronomic” electricity bills. The proposed levies would target fossil fuel producers and low-carbon power generators that have reaped extra profits thanks to artificially inflated electricity prices.

2. Revolut axes grad job offers during cost review British fintech group Revolut is in the middle of a major cost-cutting review codenamed “Project Prism” and has revoked job offers to graduates with just days of warning, as the company valued at $33bn tries to shield itself from the economic downturn.

3. European metals sector warns of ‘existential threat’ In a letter to EU leaders, the bloc’s nonferrous metals trade body Eurometaux has said the energy crisis poses an “existential threat” to the European industry’s future. Executives fear many smelters face permanent shutdown without emergency action from the EU.

4. China’s big banks feel pinch from failing loans China’s four biggest banks — the Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China — have been hit by a more than 50 per cent increase in overdue loans from the property sector over the past year, as the real estate market’s liquidity crunch spills into the financial sector.

5. Top Fed official warns rates must stay high In an interview with the Financial Times, Thomas Barkin, president of the Federal Reserve’s Richmond branch, has said the US central bank must lift interest rates to a level that restrains economic activity and keep them there until policymakers are “convinced” that rampant inflation is subsiding.

The day ahead

Economic data Germany releases July industrial production figures. Italy publishes retail sales data, while Halifax releases its monthly house price index in the UK. The US is to release consumer credit figures.

Results British residential property developer Barratt Developments and Italian luxury footwear company Tod’s publish their most recent figures. UK retailers Halfords and WHSmith will release trading updates.

Apple launch Apple holds its annual event to unveil its latest products, including a new series of iPhones. Late last week, the company officially overtook Android devices to account for more than half of smartphones used in the US.

US Federal Reserve Beige Book The Fed will publish its report of economic conditions today. Michael Barr, vice-chair of the US central bank, will also discuss how to make the financial system safer and fairer at the Brookings Institution, in his first public comments since taking the role.

What else we’re reading and listening to

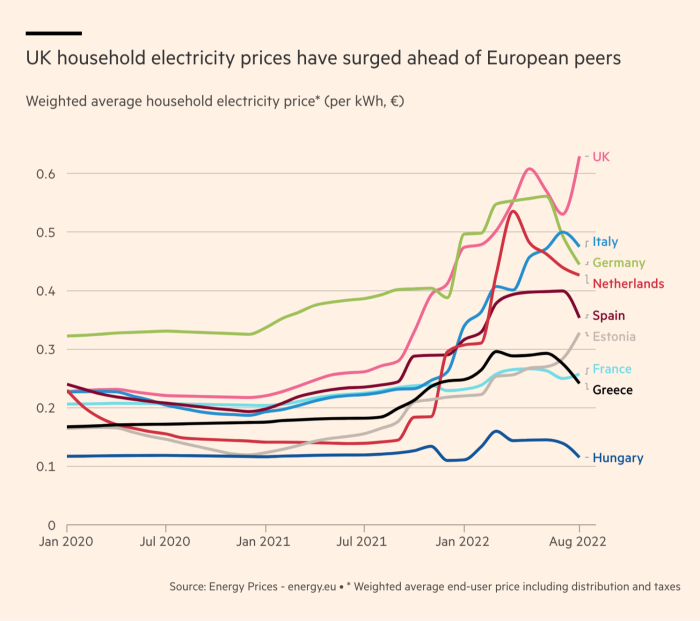

How do energy bills compare across Europe? The impact of reduced oil and gas flows from Russia on European households varies widely depending on the energy mix of each country. The average UK household electricity price is at least 30 per cent higher than in many of its European neighbours because of its greater reliance on natural gas for power generation.

Europe can — and must — win the energy war How Europe responds to this crisis will shape its immediate and longer-term future, writes Martin Wolf. It must resist Putin’s blackmail. It must adjust, co-operate and endure. That is the heart of the matter.

-

Related read: Without immediate political intervention, the energy crisis threatens to escalate into an avoidable health emergency that will widen inequality and shorten lives.

Russia’s melancholy oligarchs Increasingly angry at western governments for freezing their bank accounts and forcing them out of their Mediterranean mansions, many Russian oligarchs are resigned to returning home. Those in Moscow have quietly accepted their diminished status in a country at war.

The growing pains of a Blackstone-backed song rights machine Hipgnosis raised more than £1bn and snapped up song catalogues from the likes of Blondie and Neil Young, pledging to make popular music a dependable asset class. But the Hipgnosis Songs Fund has become an example of what can happen to exotic investments when the market turns.

A sceptic’s guide to crypto Even after the crypto markets crashed this year, there are still people who believe there is a future for digital assets and blockchain technology. FT columnist and avowed crypto sceptic Jemima Kelly is not so sure. In season 4 of Tech Tonic, she takes a trip deep into cryptoland to hear from critics, converts and hardcore believers.

Travel

Kill time and zombies at four of Tokyo’s most exciting game centres. From retro-tastic classics to mind-blowing VR adventures — via good old pinball machines — every gaming taste is catered on this FT Globetrotter list.

Recommended newsletters for you

Disrupted Times — Documenting the changes in business and the economy between Covid and conflict. Sign up here

Asset Management — Sign up here for the inside story of the movers and shakers behind a multitrillion-dollar industry