As an employer, you are responsible for withholding various taxes from employees’ wages. After you subtract all of the taxes and other deductions, money left over is considered take-home pay. Read on to learn more about what is take-home pay and how to calculate it.

What is take home pay?

Take-home pay consists of the income an individual receives after taxes, benefits, and other contributions are deducted. Take-home pay may also be called net pay. An employee’s take-home pay is the difference between their gross pay and deductions.

Mandatory deductions typically include federal income tax, Social Security tax, Medicare tax, and state and local income taxes.

Depending on the type of small business employee benefits, individuals may also have additional deductions taken from each paycheck. Other deductions that impact take-home pay include:

- 401(k) or other retirement contributions

- Medical, dental, or health insurance premiums

- HSA account contributions

- FSA account contributions

- Wage garnishments

Take-home pay vs. gross pay

While take-home pay is net pay after taxes and other deductions, gross pay is the total income an individual earns before taxes and deductions.

For example, you make $20 per hour and work 80 hours per pay period. Your gross pay is $1,600 ($20 x 80 hours). To get take-home pay, you must subtract taxes and deductions.

Calculating take-home pay

If you want to know how much money an employee earns each paycheck after deductions, calculate take-home income.

To calculate take-home pay, factor in federal, state, and local taxes. And, deduct other contributions and deductions.

You can calculate take-home pay by hand, use software, or utilize online take-home pay calculators. Employers usually provide pay stubs that list gross pay, deductions, and take-home pay.

A few things you should have handy to calculate an employee’s take-home earnings include:

- Gross pay amount

- Number of personal exemptions on Form W-4

- Tax filing status (e.g., Single)

- Other payroll deductions (e.g., retirement plan contributions)

If an employee is hourly, calculate gross pay by multiplying hours worked by the number of hours per pay period. If they are salaried, divide annual salary by the number of pay periods per year. For example, calculate a biweekly employee’s gross pay by dividing their annual salary by 26.

An individual’s number of personal exemptions and tax filing status vary, depending on Form W-4. Form W-4 affects how much federal income tax you withhold from an employee’s wages.

Gather information about payroll deductions and contributions, such as types of deductions and how much to withhold each pay period.

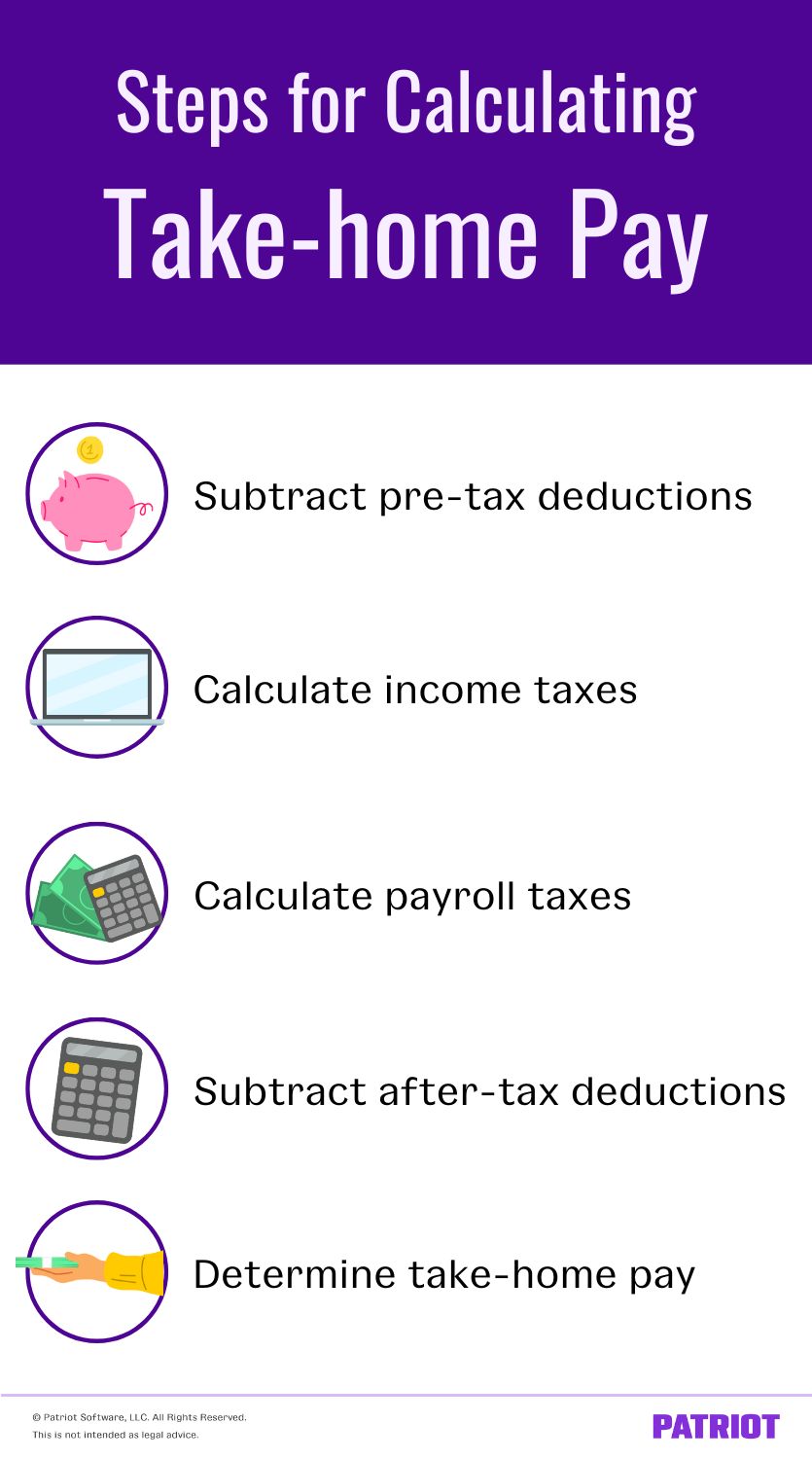

Steps for calculating take-home pay

Use the steps below to calculate an employee’s take-home pay.

1. Subtract pre-tax deductions

First, calculate taxable income by subtracting pre-tax deductions.

After subtracting pre-tax deductions, use the total to determine the tax bracket for federal income tax withholding.

2. Calculate income taxes

There are several types of income taxes, including federal, state, and local income taxes. The amount of federal tax withheld depends on an individual’s tax filing status and bracket. And, each state has its own set of tax brackets.

Once you review income taxes and brackets, add any federal, state, and local income taxes together and deduct them from gross pay (minus any pre-tax deductions).

3. Calculate payroll taxes

Calculate Social Security and Medicare taxes. Then, deduct them from total wages.

To calculate Social Security tax, multiply the employee’s gross wages (minus any pre-tax deductions) by 6.2%. Subtract 6.2% from wages unless the employee earned above the Social Security wage base.

Calculate Medicare tax by multiplying gross wages (minus any pre-tax deductions) by 1.45%. Deduct the total amount of Medicare taxes from the employee’s gross pay.

4. Subtract after-tax payroll deductions

Subtract any other relevant post-tax deductions from gross pay, such as Roth contributions.

5. Determine take-home pay

Determine take-home pay by adding together taxable income, income taxes, and other deductions. Then, subtract the total from your gross amount.

Need an easy way to calculate take-home pay for employees? Let Patriot’s payroll software calculate taxes and deductions for you. We guarantee accuracy. Try it for free today!

This article is updated from its original publication date of 1/31/2012.

This is not intended as legal advice; for more information, please click here.