As a business owner, running errands is inevitable. But sometimes, you are too busy to make the run yourself. You might send an employee to pick up something or handle a task for you. If you find yourself counting on employees to use their personal cars for business, consider offering mileage reimbursement. So, what is mileage reimbursement?

What is mileage reimbursement?

Mileage reimbursement includes compensating employees for using their personal vehicles (e.g., cars or trucks) to run business errands. You might use mileage reimbursement to pay employees for doing things like:

- Driving to the bank for a business transaction

- Driving to meet customers

- Driving to pick up office supplies

- Other business-related errands

Typically, the federal mileage reimbursement rate changes each year. The standard mileage rate between January 1st and June 30th of 2022 was 58.5 cents per business mile driven. From July 1st to December 31st of 2022 the standard mileage rate is 62.5. But, there is no law stating employers must use either of these rates.

Most businesses use the standard mileage reimbursement rate. However, businesses or organizations may also need to use different rates, depending on the industry.

For example, standard mileage reimbursement rates for medical or moving purposes is 18 cents per mile driven for 2022. And, charity-related activity mileage reimbursement is 14 cents per mile driven.

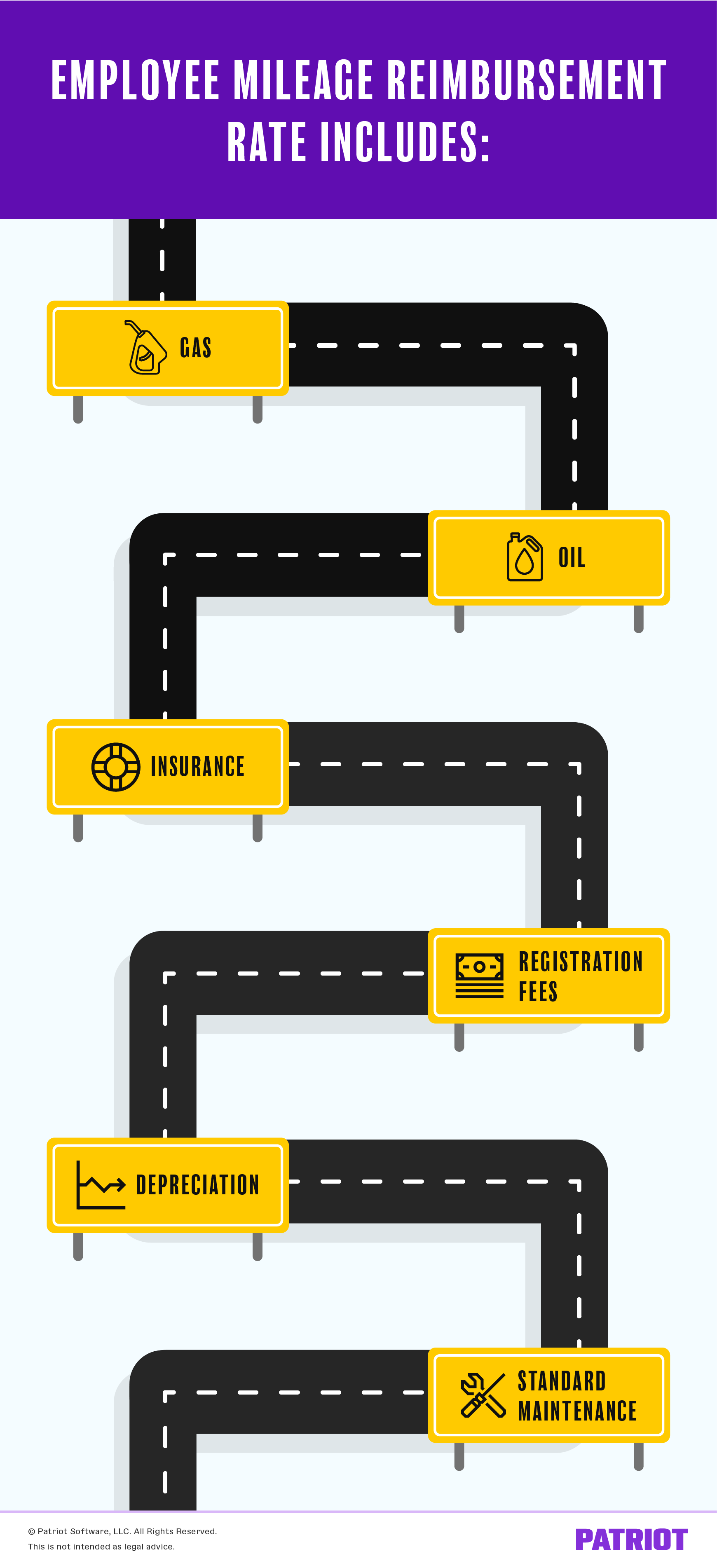

What does mileage reimbursement cover? Mileage rates are based on the fixed and variable costs of operating a vehicle.

The employee mileage reimbursement rate includes:

- Gas

- Oil

- Insurance

- Registration fees

- Depreciation

- Standard maintenance

Only provide mileage reimbursement if your employee uses their personal car for business purposes. If your employee uses a company car, do not reimburse them with federal mileage reimbursement.

Calculating standard mileage reimbursement example

Let’s look at an example of calculating standard mileage reimbursement.

Say your employee, Caitlin, is running some errands for your business. Caitlin drives 14 miles roundtrip to pick up supplies. Later, she drives 11 miles to meet a client and 11 miles to drive back to the office.

Caitlin drove 36 business miles. So, you reimburse her $21.06, because her trip took place in the first half of the year and her standard mileage rate was 58.5. (0.585 standard mileage rate x 36 business miles driven).

How does mileage reimbursement work?

To receive mileage reimbursement, employees must keep track of their business mileage. Employees can track business miles using paper or digital forms.

Employees can record business miles driven throughout the day using pen and paper. Many businesses provide employees with mileage reimbursement forms. That way, employees can fill out the form each time they complete a business-related errand.

Mileage reimbursement forms ask for details about the drive. Information on the form usually includes the date, business purpose, destination, origin, miles traveled, and total miles.

Forms typically have multiple lines or spaces so employees can add information about multiple trips. Some businesses may have employees turn in mileage forms once each month, while other companies require it once per year.

Companies might also allow employees to track business miles using an application or online spreadsheet. The information on digital forms would be the same as paper forms. And, utilizing digital mileage forms cuts out the possibility of employees losing the mileage information (e.g., misplacing or losing a paper form).

Determine how frequently you want employees turning in their mileage information. Keep the time frame consistent.

Add details such as deadlines, requirements, qualifications, and exemptions in a mileage expense reimbursement policy. Include your policy in your employee handbook.

How to reimburse for mileage

Paying employees mileage reimbursement can be done a few different ways.

Before you compensate employees for mileage, determine a few things:

- Are you paying mileage reimbursement with paper checks or direct deposit?

- Do you plan on adding mileage reimbursements along with regular wages or separately from payroll?

Some businesses pay mileage reimbursement along with an employee’s regular wages. That way, mileage and other wages are listed on one pay stub. Other companies may opt to reimburse employees with a separate check or direct deposit transaction.

Generally, you should refund employees two weeks after they submit their mileage report.

Are mileage reimbursements taxable?

Employees don’t have to pay taxes on mileage reimbursements with an accountable plan.

Mileage reimbursement benefits

Mileage reimbursements benefit both employers and employees. Check out the advantages for each below.

Employer advantages:

- Increased employee satisfaction

- Can receive business mileage deduction for reimbursing employees

- Employees more likely to run business-related errands

Mileage reimbursements help prevent disgruntled employees, improve employee satisfaction, and can positively affect employee engagement.

Employers can also receive a tax break for offering employees reimbursement for mileage. When it comes to calculating mileage for taxes, there are two methods, including the standard mileage rate and the actual expense method.

The way you calculate business mileage and your type of business determine which forms you file. You might need to file Form 1040, Schedule C (e.g., sole proprietors), and/or Form 4562 with the IRS to receive a business mileage deduction.

Check with the IRS for more information about the business mileage deduction.

Employee advantages:

- Compensation for mileage and using personal car for business purposes

- Less worry about mileage costs

Due to the Tax Cuts and Jobs Act of 2017, employees can no longer claim the business mileage deduction. However, self-employed workers can still deduct mileage expenses.

Mileage reimbursement laws

If you plan to offer employees mileage reimbursement, you must know which laws to follow.

Federal law does not require you to offer mileage reimbursement to employees. And, the IRS does not have any specific federal mileage reimbursement rules. However, you still need to follow minimum wage requirements if you don’t offer mileage reimbursement. Make sure you pay employees at least the minimum wage after deducting mileage expenses.

Some states, like California and Massachusetts, have mileage reimbursement requirements. Check with your state for more information about mileage reimbursement laws.

Need a way to reimburse employees for mileage? Patriot’s online payroll software is easy to use and lets you run payroll using a quick three-step process. And, we offer free, USA-based support. What are you waiting for? Get started with your free trial today!

This article has been updated from its original publication date of March 21, 2012.

This is not intended as legal advice; for more information, please click here.