Hiring salaried employees can eliminate some of the guesswork out of wage calculations. Typically, an employee earning a salary receives the same amount each pay period. But, what happens when an employee takes an unpaid day of work? In these situations, you must know how to prorate salary.

What is a prorated salary?

You pay salaried employees predetermined wages. When an employee doesn’t work their full hours, they earn less than their predetermined wages. Therefore, you must reduce what you pay them. A prorated salary is when you divide an employee’s wages proportionally to what they actually worked.

Prorating an employee’s salary only applies to salaried workers. Hourly workers don’t receive predetermined wages. Instead, hourly workers earn wages for the hours they work during a pay period, which can fluctuate. Because you pay hourly workers for the hours they work, you don’t need to do any additional calculations.

Calculate an employee’s prorated salary so you don’t pay them for days they didn’t work.

Reasons to provide a prorated paycheck

If you offer paid time off (PTO) to employees, do not prorate their salary when they use their time off. But, there are a number of reasons to calculate a prorated paycheck.

You might need to calculate prorated salary if:

- You don’t offer paid time off and an employee takes a day off

- The employee takes more days off than you provide in your PTO policy

- You need to implement furlough

- The employee starts in the middle of the workweek

- The employee is terminated in the middle of the workweek

Forgetting to prorate salary can be costly. Learn how to prorate salary to avoid unnecessary expenses.

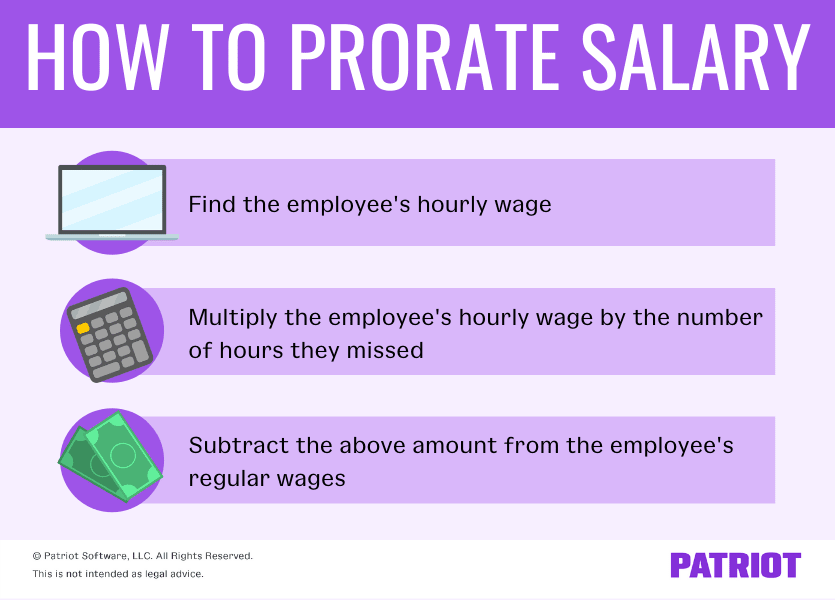

How to prorate salary

Regardless of what pay frequency you use (weekly, biweekly, semimonthly, or monthly), calculating prorated salary requires the same steps.

To prorate an employee’s salary, you can either calculate their hourly earnings or daily earnings. Find the employee’s hourly wage if they do not take full days off. Determine the employee’s wage if they take full days off.

Calculating prorated salary is relatively easy. However, there isn’t a standard prorated salary formula. Instead, there are a few steps in the process:

- Divide the employee’s salary by 52 weeks in the year

- Divide the employee’s weekly salary by the number of days they normally work OR number of hours they normally work

- Multiply the employee’s hourly or daily rate by the number of hours or days missed

- Subtract the number from Step 3 from the employee’s usual pay period amount

If you want to see this process in terms of formulas, take a look below. We’ll use hours to keep it simple, but you can easily sub in days instead:

- Annual Salary / 52 = Weekly Salary

- Weekly Salary / # of Hours Normally Worked = Hourly Wage

- Employee’s Hourly Wage X # of Hours Missed = Reduction Amount

- Usual Pay Period Amount – Reduction Amount = Prorated Salary

Still rocky on how to prorate salary? Take a look at the example below.

How to prorate salary example

Your employee, Alex, earns a salary of $50,000. She works 40 hours per week. You pay her $1,923.08 biweekly. During a pay period, Alex takes 15 unpaid hours off from work for personal reasons.

Use the steps above to calculate Alex’s prorated salary.

First divided Alex’s salary by 52 weeks in the year. You can also divide her biweekly pay by two to get her weekly salary. For consistency, we’ll divide her annual salary by 52.

$50,000 / 52 = $961.54

Next, divide Alex’s weekly salary by the number of hours she normally works, which is 40, to get her hourly wage.

$961.54 / 40 = $24.04

Now, multiply Alex’s hourly wage by the number of hours she missed during the pay period, which is 15.

$24.04 X 15 = $360.60

Lastly, subtract $360.60 from Alex’s regular biweekly wages.

$1,923.08 – $360.60 = $1,562.48

Alex’s prorated salary is $1,562.48.

What to do after finding prorated salary

Now that you know how to prorate salary, you can’t forget to adjust your payroll. The employee’s tax liability decreases when their gross wages decrease.

The amount you withhold in Social Security and Medicare (FICA) taxes is lower when you prorate salary. And depending on how many hours the employee missed, you likely need to adjust federal income tax withholding, too. If applicable, you may need to adjust state and local income tax withholding as well.

If you use payroll software, remember to enter the employee’s prorated salary into the system. Software automatically calculates the employee’s payroll tax liability based on their updated wages.

With Patriot’s online payroll, you don’t have to worry about manual wage or tax calculations. And if you have questions, our free support is only a call, chat, or email away. Ready to see why our customers rate us so highly? Start your free trial and find out today!

This article has been updated from its original publication date of May 13, 2019.

This is not intended as legal advice; for more information, please click here.