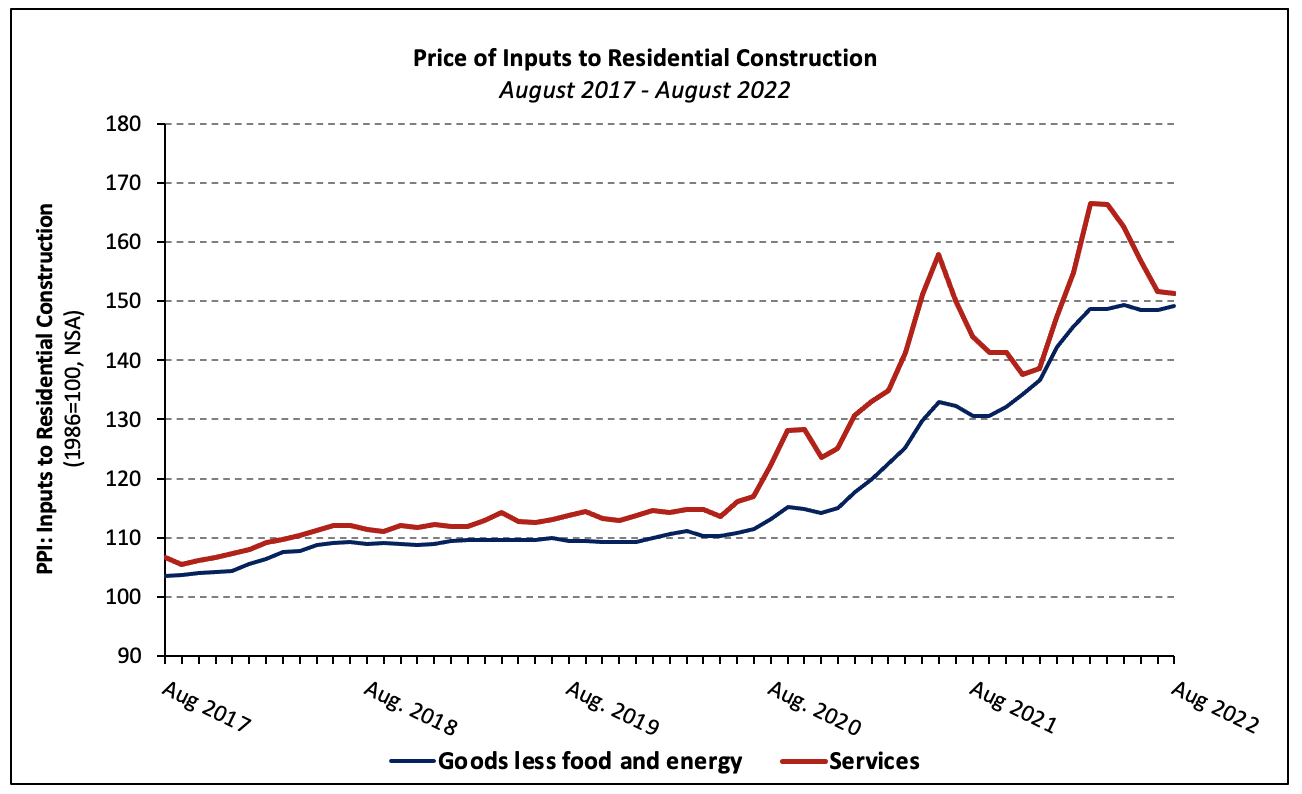

The prices of building materials rose 0.5% in August (not seasonally adjusted) even as softwood lumber prices decreased 5.2%, according to the latest Producer Price Index (PPI) report. Building materials prices have climbed 4.9% through the first eight months of 2022 and 14.3% over the past year. The PPI for goods inputs to residential construction, including energy, decreased 0.9% in August following a 1.5% decline in July. Between June and August, the prices of #2 diesel and unleaded gasoline decreased by 24.1% and 27.9%, respectively.

The price index of services inputs to residential construction was driven 0.2% lower in August—the fourth consecutive monthly decline—by decreases in the building materials wholesaling and retailing indices. The services PPI is 5.0% higher than it was 12 months prior and 32.0% higher than its pre-pandemic level.

Gypsum Building Materials

The PPI for gypsum building materials rose 3.3% in August—the seventh monthly increase in 2022. Prices have increased 11.0% YTD and 19.9% over the last 12 months. Since the start of 2021, the index has increased 38.9%.

Transformers and Transformer Parts

As the shortage of power and distribution transformers has become increasingly acute, the prices of transformers and parts thereof have increased substantially. The price of distribution transformers has increased 40.1% over the past 12 months and 60.7% since January 2021. Transformer parts (e.g., cores, bushings, windings/coils) prices have climbed 17.7%, on average, year-over-year, and 47.4% since the start of 2021.

Raw materials used to make transformers and their components include silicon steel (i.e., electrical steel) strip, sheet metal enclosures, epoxy adhesives, synthetic resins, and copper wire. The chart below shows price changes of these materials over the past year and since January 2020.

Concrete Products

The PPI for ready-mix concrete (RMC) gained 1.6% in August, its fifth consecutive increase and has 21st monthly gain over the past two years. The index has climbed 5.2% over the past three months—the second-largest three-month increase in the series’ 34-year history. The index has climbed 8.1%, year-to-date, the largest YTD August increase over the past three decades.

Prices increased in the South (3.0%), West (2.3%), and Northeast (0.2%) and decreased by 0.2% in the Midwest. where they gained 3.5%, not seasonally adjusted.

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) declined 5.2% in August. Softwood lumber prices have fallen four of the past five months by a total of 37.7%. its first increase in four months. Prices have fallen 32.7%, year-to-date, but remain 46.4% above pre-pandemic levels.

Steel Mill Products

Steel mill products prices decreased 5.7% in August following a 3.9% decline in July. over the two prior months. The index has fallen 13.8% thus far in 2022 and is 15.4% lower than the record high set in December 2021.

Transportation of Freight

The price of truck transportation of freight decreased 1.9% in August, although it is 8.4% higher than it stood at the start of the year. The indices for local and long-distance motor carrying prices declined 0.3% and 2.4%, respectively, over the month. Over the past eight months, the prices truck, rail, and ocean freight transportation have increased 7.2%, 8.4%, and 26.5%, respectively.

Related